檢è¦/éå - å å¹ç§æ大å¸

檢è¦/éå - å å¹ç§æ大å¸

檢è¦/éå - å å¹ç§æ大å¸

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

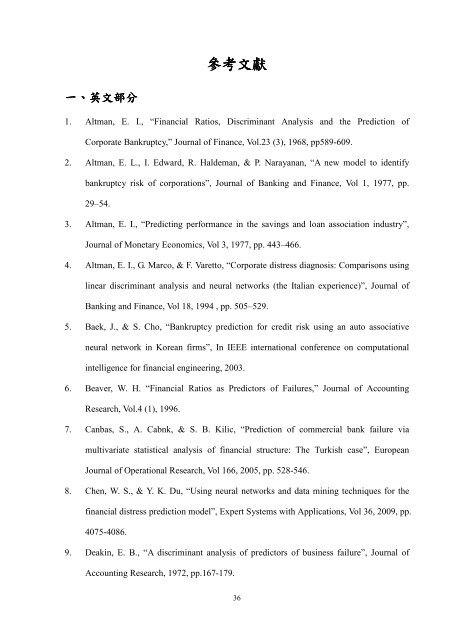

參 考 文尠 獻一 、 英秺 文尠 部 分1. Altman, E. I., “Financial Ratios, Discriminant Analysis and the Prediction ofCorporate Bankruptcy,” Journal of Finance, Vol.23 (3), 1968, pp589-609.2. Altman, E. L., I. Edward, R. Haldeman, & P. Narayanan, “A new model to identifybankruptcy risk of corporations”, Journal of Banking and Finance, Vol 1, 1977, pp.29–54.3. Altman, E. I., “Predicting performance in the savings and loan association industry”,Journal of Monetary Economics, Vol 3, 1977, pp. 443–466.4. Altman, E. I., G. Marco, & F. Varetto, “Corporate distress diagnosis: Comparisons usinglinear discriminant analysis and neural networks (the Italian experience)”, Journal ofBanking and Finance, Vol 18, 1994 , pp. 505–529.5. Baek, J., & S. Cho, “Bankruptcy prediction for credit risk using an auto associativeneural network in Korean firms”, In IEEE international conference on computationalintelligence for financial engineering, 2003.6. Beaver, W. H. “Financial Ratios as Predictors of Failures,” Journal of AccountingResearch, Vol.4 (1), 1996.7. Canbas, S., A. Cabnk, & S. B. Kilic, “Prediction of commercial bank failure viamultivariate statistical analysis of financial structure: The Turkish case”, EuropeanJournal of Operational Research, Vol 166, 2005, pp. 528-546.8. Chen, W. S., & Y. K. Du, “Using neural networks and data mining techniques for thefinancial distress prediction model”, Expert Systems with Applications, Vol 36, 2009, pp.4075-4086.9. Deakin, E. B., “A discriminant analysis of predictors of business failure”, Journal ofAccounting Research, 1972, pp.167-179.36