sowych, z których to teorii korzystają gracze giełdowi tacy jak hedgies, obracający, bez żadnej kontroli ze strony nadzoru bankowego, ogromnymi kwotami, kumulując w ten sposób ryzyko rynkowe, traktując świat jako „grę w ruletkę” i zwiększając niepewność co do losów globalnej gospodarki. 87 Literatura BERNSTEIN P.L., 1996: Przeciw bogom: niezwykłe dzieje ryzyka, WIG Press, Warszawa. DRABIK E., 2006: Analiza empiryczna zdarzeń występujących na Warszawskiej Giełdzie Towarowej SA w latch 2002–2004. [w:] pod red. Zeliaś A. Przestrzenno-czasowe modelowanie i prognozowanie zjawisk gospodarczych, Wydawnictwo Akademii Ekonomicznej w Krakowie, Kraków, s. 219–238. ELSNER J., 1998: Emotions and Economic Theory, Journal of Economic Literature, XXXVI, pp. 47–74. KAHNEMAN D., TVERSKY A., 1979: Prospect theory: an analysis of decision under risk, Econometrica, Vol. 47, No. 2, pp. 263–292. LOWE J., 1997: Mówi Warren Buffet, Wydawnictwo K.E. Liber, Warszawa. LEFÉVRE E., 2000:, Wspomnienia gracza giełdowego, Dom Wydawniczy ABC, Warszawa. SAMUELSON W.F., 1998: Ekonomia menedżerska, Marks S.G., red. nauk., przekł. Ryszard Rapacki, tł. [z ang.] Bogusław Czarny i in., Polskie Wydawnictwo Ekonomiczne, Warszawa. Praca zbiorowa pod red. T. Tyszki, 2004: Psychologia ekonomiczna, Gdańskie Wydawnictwo Psychologiczne, Gdańsk. TRĘBSKI K., 2004: Powrót łajdaka, 11. stycznia, Wprost, s. 45. TYSZKA T., 1970: Subiektywna interpretacja prawdopodobieństwa i zagadnienie wyborów w warunkach niepewności, Przegląd Psychologiczny, 20, 19–40, Warszawa. TYSZKA T., ZALEŚKIEWICZ T., 2001: Racjonalność decyzji, Polskie Wydawnictwo Ekonomiczne, Warszawa. VALEZ M.A., 2006: Handlarze pieniędzmi, Przekrój, październik, s. 34–36. ZALEŚKIEWICZ T., 2003: Psychologia inwestora giełdowego, Gdańskie Wydawnictwo Psychologiczne, Gdańsk. ZALEŚKIEWICZ T., 2005: Ekonomia w mózgu, Charaktery, marzec 2005, s. 44–47. ZIELIŃSKI M., 2006: Analiza anomalii związanych z aukcyjnym charakterem handlu na WGT SA w <strong>Warszawie</strong>, praca magisterska napisana pod kierunkiem E. Drabik, <strong>SGGW</strong>, Warszawa.

88 Data transformation processes and taking decisions in the circumstances of uncertainty, on the example of WGT SA Abstract The purpose of this paper is to discuss all the possible problems which participants of the market may come across, as well as the analysis of how common is one of them, namely the one called a curse of the winner on the auctions on WGT SA. An attempt has also been made to explain why “psychological traps”, typical of acting in the situation of hazard, are not dangerous for such players as Warren Buffet, who was able to diminish the level of hazard connected with playing on the stock exchange, thanks to his experience and great skills. Uncertainty on the market occurs only when you have more than one possible outcome of your decision. The more possible outcomes you have, the higher is the level of uncertainly. The latter one is an inseparable part of taking different important decisions. It causes irrational reactions of the market participants, who are exposed to different impulses and easily get emotional after receiving some information. It’s very often the kind of behaviour typical of gamblers.

- Page 1 and 2:

ZESZYTY NAUKOWE Szkoły Głównej G

- Page 3 and 4:

Spis treści Aldona Zawojska, Magda

- Page 5 and 6:

6 model realnego cyklu koniunktural

- Page 7 and 8:

8 stanu równowagi. Do ustalenia wa

- Page 9 and 10:

10 Potencjalny PKB można oszacowa

- Page 11 and 12:

12 koniunkturalnych są siły realn

- Page 13 and 14:

14 pieniądza. W gospodarce występ

- Page 15 and 16:

16 Procentowe odchylenie PKB od tre

- Page 17 and 18:

18 6 6 SD luk popytowych 5 4 3 2 SD

- Page 19 and 20:

20 Literatura BIEC (Bureau for Inve

- Page 21 and 22:

22 Fiscal policy as a stabilizer of

- Page 23 and 24:

24 Tabela 1 Wielkość bezpośredni

- Page 25 and 26:

26 Rosnąca w ostatnich latach licz

- Page 27 and 28:

28 Tabela 5 Liczba i struktura prac

- Page 29 and 30:

30 Tabela 6 Produktywność pracy w

- Page 31 and 32:

32 2. 3. 4. Bezpośrednie inwestycj

- Page 33 and 34: Tomasz Siudek Katedra Ekonomiki i O

- Page 35 and 36: Podobieństwa i różnice między s

- Page 37 and 38: stępowanie charakterystycznej dla

- Page 39 and 40: W analizowanych systemach bankowoś

- Page 41 and 42: • po trzecie, systemy bankowości

- Page 43 and 44: niej można ją określić jako poz

- Page 45 and 46: Europejskie grupy bankowości spó

- Page 47 and 48: Jakub Kraciuk Katedra Ekonomiki Rol

- Page 49 and 50: polistycznej. G.J. Stigler uważał

- Page 51 and 52: nia, to jednak przemyślana transak

- Page 53 and 54: całego przemysłu spożywczego wyn

- Page 55 and 56: 57 Dendrogram - Metoda Warda Rysune

- Page 57 and 58: STIGLER G.J., 1968: The Organizatio

- Page 59 and 60: 62 Uwarunkowania prawne wypłaty dy

- Page 61 and 62: 64 dendę, czyli większy dochód b

- Page 63 and 64: 66 lokowania kapitału nie powinna

- Page 65 and 66: 68 8 6 4 2 3,33 5,21 2,54 2,69 0 20

- Page 67 and 68: 70 re w danym roku wypłaciły dywi

- Page 69 and 70: 72 jący instrumentami pochodnymi,

- Page 71 and 72: 74 0 zł i 500 zł jest większa ni

- Page 73 and 74: 76 między emocjami a szacowanym pr

- Page 75 and 76: 78 tylko teoretyczne, ale również

- Page 77 and 78: 80 obserwujący grę na giełdzie,

- Page 79 and 80: 82 błąd, zamiast zamknąć pozycj

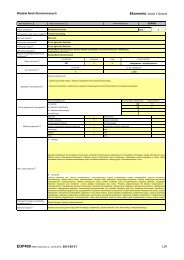

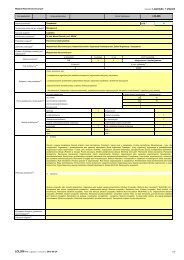

- Page 81 and 82: 84 Tabela 1 Sesja przetargowa 152/2

- Page 83: 86 W badanym okresie handlowano pó

- Page 87 and 88: 90 zań, rzeczowy charakter opodatk

- Page 89 and 90: 92 Celem opracowania jest określen

- Page 91 and 92: Tabela 1 Obciążenie z tytułu pod

- Page 93 and 94: 96 Udział podatku rolnego w koszta

- Page 95 and 96: Tabela 3 Obciążenie z tytułu pod

- Page 97 and 98: 100 W regionie Mazowsze i Podlasie

- Page 99 and 100: 102 GRUZIEL K., 2006: Opodatkowanie

- Page 101 and 102: 104 produkcji. Perspektywą dla owc

- Page 103 and 104: 106 Tabela 1 Szanse i zagrożenia p

- Page 105 and 106: 108 Tabela 2 Mocne i słabe strony

- Page 107 and 108: Anna Grontkowska Katedra Ekonomiki

- Page 109 and 110: 113 Tabela 1 Charakterystyka badany

- Page 111 and 112: 115 Tabela 2 Wskaźniki charakteryz

- Page 113 and 114: 117 3000 2500 2000 1500 1000 Pogowi

- Page 115 and 116: 119 Gospodarstwa prowadzące chów

- Page 117 and 118: Aneta Stańko Agnieszka Sokół Kat

- Page 119 and 120: 123 % 80 70 60 50 40 30 20 10 OPS w

- Page 121 and 122: 125 Tabela 1 Badane gospodarstwa do

- Page 123 and 124: 127 Prawie jedna trzecia bezrobotny

- Page 125 and 126: 129 zł 400 350 300 250 200 150 100

- Page 127 and 128: 131 w domu noclegowym Caritas w Leg

- Page 129 and 130: 133 1. 2. 3. 4. 5. 6. Wśród gospo

- Page 131 and 132: Edyta Kwiatkowska Ganna Levytska Ka

- Page 133 and 134: 137 50 40 % 30 20 10 0 1993 1994 19

- Page 135 and 136:

139 Czynniki warunkujące popyt na

- Page 137 and 138:

141 Tendencje i nowe zjawiska w roz

- Page 139 and 140:

143 Obecnie funkcjonujące na polsk

- Page 141 and 142:

145 Condition and development direc

- Page 143 and 144:

148 stania paszy, a także od użyt

- Page 145 and 146:

150 Tabela 1 Cena i zużycie paszy

- Page 147 and 148:

152 gęsi rzeźne k grz (t) = 0,254

- Page 149 and 150:

154 6,0 produkt preciętny i margin

- Page 151:

156 material. Both characteristics