Prospect OTP Green Energy - Bursa de valori Bucure?ti

Prospect OTP Green Energy - Bursa de valori Bucure?ti

Prospect OTP Green Energy - Bursa de valori Bucure?ti

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

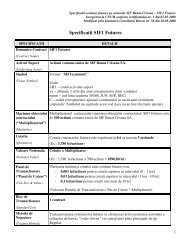

Strategia <strong>de</strong> inves<strong>ti</strong><strong>ti</strong>i a Fondului urmareste doua obiec<strong>ti</strong>ve:<br />

1. garantarea pentru <strong>de</strong><strong>ti</strong>natorii <strong>de</strong> unita<strong>ti</strong> <strong>de</strong> fond a capitalului ini<strong>ti</strong>al inves<strong>ti</strong>t;<br />

PROSPECT DE OFERTA PUBLICA<br />

2. furnizarea <strong>de</strong><strong>ti</strong>natorilor <strong>de</strong> unita<strong>ti</strong> <strong>de</strong> fond a unei cote variabile <strong>de</strong> par<strong>ti</strong>cipare la performanta<br />

Fondul <strong>OTP</strong> <strong>Green</strong> <strong>Energy</strong> este infiintat pe baza contractului <strong>de</strong> societate civila numarul 237 din data <strong>de</strong><br />

10.09.2009, semnat <strong>de</strong> Catalin Jianu Dan Iancu in calitate <strong>de</strong> Presedinte Directorat al Societa<strong>ti</strong>i <strong>de</strong><br />

Administrare a Fondului – <strong>OTP</strong> Asset Management Romania SAI SA. Autoritatea <strong>de</strong> reglementare a<br />

Fondului este Comisia Na<strong>ti</strong>onala a Valorilor Mobiliare, cu sediul in Strada Foisorului Nr. 2, Sector 3,<br />

<strong>Bucure</strong>s<strong>ti</strong>, telefon 021 326 68 07, fax 021 326 68 48/021 326 68 49, site web www.cnvmr.ro, email<br />

cnvm@cnvmr.ro.<br />

fondului stabilita in func<strong>ti</strong>e <strong>de</strong> suma performantelor lunare plafonate la maxim X%/luna ale<br />

indicelui ERIXP (European Renewable <strong>Energy</strong> In<strong>de</strong>x price return), pla<strong>ti</strong>ta catre inves<strong>ti</strong>tori la<br />

maturitatea fondului. Limita <strong>de</strong> varia<strong>ti</strong>e superioara lunara notata cu X% are o valoare<br />

cuprinsa intre 4,0% si 5,5%/luna, este anuntata in zece zile lucratoare <strong>de</strong> la data emisiunii<br />

si ramane fixa pe toata durata <strong>de</strong> viata a fondului. Performanta totala pla<strong>ti</strong>ta inves<strong>ti</strong>torilor<br />

nu poate fi mai mica <strong>de</strong> 12%.<br />

Titlul <strong>de</strong> par<strong>ti</strong>cipare la Fond este unitatea <strong>de</strong> fond, care reprezinta o <strong>de</strong><strong>ti</strong>nere <strong>de</strong> capital a unei persoane<br />

fizice sau juridice in ac<strong>ti</strong>vele nete ale Fondului si este <strong>de</strong> un singur <strong>ti</strong>p, nomina<strong>ti</strong>va, inregistrata si<br />

<strong>de</strong>materializata. Unita<strong>ti</strong>le <strong>de</strong> fond sunt pla<strong>ti</strong>te integral la momentul <strong>de</strong>contarii si vor fi emise intr-o<br />

singura serie, conferind <strong>de</strong><strong>ti</strong>natorilor drepturi si obliga<strong>ti</strong>i egale. Fondul nu va emite alte instrumente<br />

financiare in afara Unita<strong>ti</strong>lor <strong>de</strong> fond. Valoarea nominala ini<strong>ti</strong>ala a unei unita<strong>ti</strong> <strong>de</strong> fond la data <strong>de</strong><br />

emisiune este <strong>de</strong> 200 RON.<br />

Unita<strong>ti</strong>le <strong>de</strong> Fond sunt consi<strong>de</strong>rate emise incepand cu prima zi lucratoare dupa Data Decontarii. Dupa<br />

incheierea cu succes a ofertei publice <strong>de</strong> unita<strong>ti</strong> <strong>de</strong> fond, in termen <strong>de</strong> maxim 30 <strong>de</strong> zile, <strong>OTP</strong> Asset<br />

Management Romania SAI SA va solicita admiterea la tranzac<strong>ti</strong>onare a Fondului pe piata reglementata<br />

la ve<strong>de</strong>re a Bursei <strong>de</strong> Valori <strong>Bucure</strong>s<strong>ti</strong>.<br />

Societatea <strong>de</strong> administrare a Fondului va inves<strong>ti</strong> capitalul ob<strong>ti</strong>nut in urma emiterii <strong>ti</strong>tlurilor <strong>de</strong><br />

par<strong>ti</strong>cipare in ac<strong>ti</strong>vele men<strong>ti</strong>onate in prezentul document, in conformitate cu preve<strong>de</strong>rile legale in<br />

vigoare si limitele prezentate in acest document.<br />

<strong>OTP</strong> Asset Management Romania SAI SA, in calitate <strong>de</strong> societate <strong>de</strong> administrare a Fondului, <strong>de</strong>clara ca<br />

Fondul nu a intocmit situa<strong>ti</strong>i financiare pana la data prezentului prospect. Societatea <strong>de</strong> audit a<br />

Fondului <strong>OTP</strong> <strong>Green</strong> <strong>Energy</strong> este SC Expert Audit SRL cu sediul in Tulcea, Str. Dobrogeanu Gherea nr.<br />

1, CUI RO14058398, nr. Inregistrare la Reg. Com. J36/214/2001, cu care fondul a incheiat contractul<br />

numarul 140 din data <strong>de</strong> 09.09.2009.<br />

31