Prospect OTP Green Energy - Bursa de valori Bucure?ti

Prospect OTP Green Energy - Bursa de valori Bucure?ti

Prospect OTP Green Energy - Bursa de valori Bucure?ti

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

PROSPECT DE OFERTA PUBLICA<br />

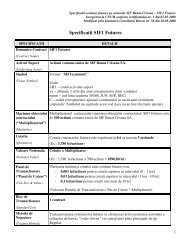

• Alocarea unita<strong>ti</strong>lor <strong>de</strong> fond in caz <strong>de</strong> suprasubscriere: conform principiului “Pro Rata”,<br />

<strong>de</strong>taliat in sec<strong>ti</strong>unile urmatoare ale <strong>Prospect</strong>ului;<br />

• Data alocarii: A treia zi lucratoare <strong>de</strong> la ul<strong>ti</strong>ma zi <strong>de</strong> subscriere in oferta publica si data la<br />

care, pe baza In<strong>de</strong>xului <strong>de</strong> Alocare (publicat printr-un anunt cu cel pu<strong>ti</strong>n 24 <strong>de</strong> ore anterior<br />

Datei alocarii), la instruc<strong>ti</strong>unea scrisa a Intermediarului/Distribuitor, BVB efectueaza alocarea<br />

subscrierilor realizate in cadrul ofertei, operand execu<strong>ti</strong>a tranzac<strong>ti</strong>ilor aferent acestui proces.<br />

Data alocarii este egala cu data tranzac<strong>ti</strong>ei;<br />

• Intermediar/Distribuitor: SSIF Intercapital Invest SA;<br />

• Distribuitori: <strong>OTP</strong> Bank Romania SA si BRD - Groupe Societe Generale SA;<br />

• Distribu<strong>ti</strong>a ofertei: La sediile Intercapital Invest, ale <strong>OTP</strong> Bank Romania SA, ale BRD -<br />

Groupe Societe Generale SA si ale oricarui distribuitor autorizat, conform preve<strong>de</strong>rilor<br />

prospectului, precum si prin sistemul <strong>de</strong> tranzac<strong>ti</strong>onare online a ac<strong>ti</strong>unilor al Intercapital Invest<br />

SA, ktra<strong>de</strong>, conform preve<strong>de</strong>rilor prospectului;<br />

• Durata fondului: 42 <strong>de</strong> luni si zece zile lucratoare <strong>de</strong> la data emisiunii asa cum este ea<br />

<strong>de</strong>finita in prezentul prospect;<br />

• Garantarea capitalului inves<strong>ti</strong>t: Capitalul ini<strong>ti</strong>al inves<strong>ti</strong>t in Fondul <strong>OTP</strong> <strong>Green</strong> <strong>Energy</strong>,<br />

reprezentand valoarea nominala a unita<strong>ti</strong>lor <strong>de</strong> fond alocate in urma inchi<strong>de</strong>rii cu succes a<br />

ofertei publice, este garantat printr-o garan<strong>ti</strong>e bancara emisa <strong>de</strong> <strong>OTP</strong> Bank Plc. Ungaria.<br />

Aceasta este o garan<strong>ti</strong>e interna, asa cum este <strong>de</strong>finita <strong>de</strong> reglementarile aplicabile ale CNVM.<br />

Garan<strong>ti</strong>a se aplica numai la sca<strong>de</strong>nta fondului, nu si in cazurile <strong>de</strong> rambursare an<strong>ti</strong>cipata sau<br />

lichidare an<strong>ti</strong>cipata, realizate conform legisla<strong>ti</strong>ei aplicabile;<br />

• Par<strong>ti</strong>ciparea inves<strong>ti</strong>torilor la performanta fondului:<br />

La maturitatea fondului, inves<strong>ti</strong>torii au dreptul sa primeasca o cota <strong>de</strong> par<strong>ti</strong>cipare la<br />

performanta calculata conform prezentului <strong>Prospect</strong> <strong>de</strong> Emisiune. Au dreptul <strong>de</strong> incasare a cotei<br />

<strong>de</strong> par<strong>ti</strong>cipare la performanta <strong>de</strong><strong>ti</strong>natorii <strong>de</strong> unita<strong>ti</strong> <strong>de</strong> fond inregistra<strong>ti</strong> in Registrul De<strong>ti</strong>natorilor<br />

<strong>de</strong> unita<strong>ti</strong> <strong>de</strong> fond la data <strong>de</strong> referinta, respec<strong>ti</strong>v cu cinci zile lucratoare inainte <strong>de</strong> data<br />

maturita<strong>ti</strong>i fondului;<br />

• Indicele ERIXP (European Renewable <strong>Energy</strong> In<strong>de</strong>x Price return): Indicele ERIXP<br />

urmareste performanta pretului ac<strong>ti</strong>unilor celor mai importante companii Europene din sectorul<br />

energiei regenerabile: biomasa (lemn), energie geotermala (u<strong>ti</strong>lizarea apelor termale), apa<br />

marina (u<strong>ti</strong>lizarea energiei valurilor), energie solara (energie fotovoltaica), hidro (centrale<br />

hidroelectrice), vant (centrale eoliene). Fiecare componenta are o pon<strong>de</strong>re <strong>de</strong> cel pu<strong>ti</strong>n 5% in<br />

cosul indicelui. Pon<strong>de</strong>rea este stabilita conform capitalizarii bursiere. Indicele este revizuit<br />

trimestrial din punct <strong>de</strong> ve<strong>de</strong>re al pon<strong>de</strong>rilor companiilor existente, iar semestrial este revizuita<br />

componenta indicelui.<br />

• Rascumpararea unita<strong>ti</strong>lor <strong>de</strong> fond: Rascumpararea unita<strong>ti</strong>lor <strong>de</strong> fond se va face la sca<strong>de</strong>nta,<br />

cu excep<strong>ti</strong>a cazurilor prevazute in art. 212 alin (4) din Regulamentul CNVM nr. 15/2004. In<br />

afara rascumpararii la sca<strong>de</strong>nta si a rascumpararii in cazul prevazut <strong>de</strong> Regulamentul 15 la Art.<br />

212 alin (4), nu exista alte clauze <strong>de</strong> rascumparare an<strong>ti</strong>cipata. Procedurile <strong>de</strong> rascumparare<br />

sunt prezentate in con<strong>ti</strong>nuare:<br />

12