2024-05 SUSTAINABLE BUS

What you can find inside? - A behind-the-scenes tour of Forsee Power’s battery-assembly plant in Poitiers (France). - VDL's ambitious plans for e-bus production in Roeselare, Belgium, that we visited - The resurgence of public ownership in the UK's bus services sector. - Volvo's latest innovations with the Volvo BZR and 8900 Electric buses. - Updates to the Solaris Urbino 12 Electric, the most sold electric bus model in Europe, that now feature modular drivetrain and more battery capacity - Our test drive with the Mercedes eCitaro G fuel cell bus - Insights into the Altas Novus City V7. - A comprehensive portfolio of zero-emission buses available in Europe.

What you can find inside?

- A behind-the-scenes tour of Forsee Power’s battery-assembly plant in Poitiers (France).

- VDL's ambitious plans for e-bus production in Roeselare, Belgium, that we visited

- The resurgence of public ownership in the UK's bus services sector.

- Volvo's latest innovations with the Volvo BZR and 8900 Electric buses.

- Updates to the Solaris Urbino 12 Electric, the most sold electric bus model in Europe, that now feature modular drivetrain and more battery capacity

- Our test drive with the Mercedes eCitaro G fuel cell bus

- Insights into the Altas Novus City V7.

- A comprehensive portfolio of zero-emission buses available in Europe.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

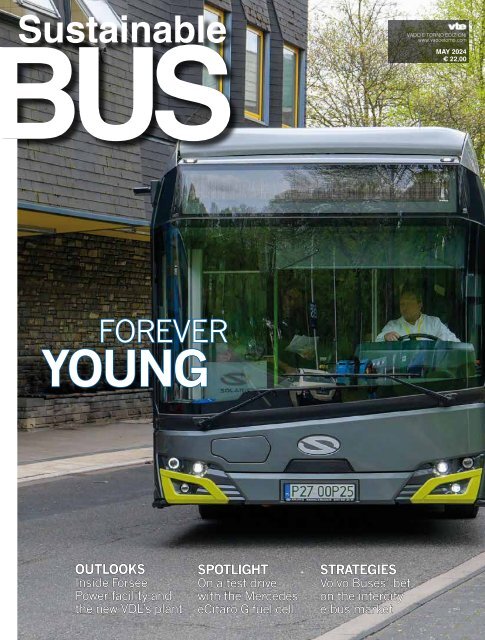

Sustainable<br />

US<br />

VADO E TORNO EDIZIONI<br />

www.vadoetorno.com<br />

MAY <strong>2024</strong><br />

€ 22,00<br />

FOREVER<br />

YOUNG<br />

OUTLOOKS<br />

Inside Forsee<br />

Power facility and<br />

the new VDL’s plant<br />

SPOTLIGHT<br />

On a test drive<br />

with the Mercedes<br />

eCitaro G fuel cell<br />

STRATEGIES<br />

Volvo Buses’ bet<br />

on the intercity<br />

e-bus market

Sustainable<br />

<strong>BUS</strong><br />

CONTENTS<br />

4<br />

<strong>SUSTAINABLE</strong>-<strong>BUS</strong>.COM MAY <strong>2024</strong><br />

POST-IT<br />

A 18-meter e-bus challenge<br />

took place in Bonn<br />

6<br />

TECHNO<br />

Hybrid module for the intercity:<br />

Iveco Bus Crossway has a new version<br />

FOR A<br />

BETTER<br />

LIFE.<br />

32<br />

12<br />

10<br />

12<br />

16<br />

INFRASTRUCTURE<br />

RVK Cologne and EMT Madrid have<br />

launched new or revamped depots<br />

OUTLOOKS<br />

Our visit at Forsee Power’s plant<br />

in Poitiers. Buses cover 2/3 of sales<br />

VDL new factory in Roeselare (Belgium)<br />

aims at producing +800 e-buses/year<br />

20<br />

UK, public ownership of bus<br />

services is back on the rise<br />

16<br />

24<br />

28<br />

32<br />

36<br />

40<br />

IN THE SPOTLIGHT<br />

Volvo BZR and 8900 Electric:<br />

a bet on the intercity segment<br />

Solaris Urbino 12 Electric:<br />

new update for a champion of flexibility<br />

Mercedes eCitaro G fuel cell:<br />

the marriage between BEV and FCEV<br />

Altas Novus City V7:<br />

the 7.5-meter on Zhongtong’s platform<br />

PORTFOLIO<br />

All the zero-emission buses<br />

on the European market<br />

24<br />

Starting this year, Sustainable<br />

Bus magazine offers printed<br />

issue subscriptions, adding<br />

a new option alongside<br />

distribution at trade events<br />

and free online access.<br />

Wherever you are located,<br />

you can now subscribe to<br />

receive paper issues directly<br />

to your home or office.<br />

FOR INFO<br />

3

POST-IT<br />

THE E-<strong>BUS</strong> TEST <strong>2024</strong><br />

A gathering of giants<br />

SIX 18M BEV <strong>BUS</strong>ES AND THREE ‘GUESTS’ TESTED IN BONN<br />

LESS IS OFTEN MORE.<br />

The new all-electric MAN Lion’s City 10 E.<br />

4<br />

Mercedes eCitaro G, Solaris Urbino 18 Electric, MAN Lion’s City<br />

18 E, Ebusco 3.0 18-meter. These manufacturers have<br />

converged in Bonn (Germany) in mid-April to subject<br />

their 18-meter electric buses to scrutiny and driving<br />

performance evaluations during the yearly E-Bus test<br />

initiative, promoted since 2017 by German trade media<br />

Omnibusspiegel. Sustainable Bus has been on-site covering<br />

the event, and a complete overview will be published in the<br />

next issue of Sustainable Bus magazine, which will be<br />

out in September.<br />

In addition to the headline participants, the E-Bus test in<br />

Bonn has also welcomed a selection of ‘guest’ e-buses<br />

available for test drives (therefore vehicles outside the<br />

category of articulated BEV buses then no subject to<br />

comparison). Among these are the Mellor Sigma 7 (that has<br />

entered the German market), MCV C127 EV (‘crowned’<br />

earlier this year with its first order), and the Italian-made<br />

Rampini Eltron.<br />

Among the highlights of the event, we must mention the<br />

newly-updated version Solaris 18-meter e-bus equipped<br />

with as many as 800 kWh of Solaris High Energy battery<br />

modules (with capacity for 1<strong>05</strong> passengers). Details of the new<br />

layout and technological equipment, which have also been<br />

implemented on the solo version, are explored in the Spotlight<br />

report on pages 28-31.<br />

MAN brought in Bonn one of the units commissioned by VAG<br />

Nuremberg, with 640 kWh battery capacity and room for 116<br />

passengers. Ebusco joined the initiative with its first 3.0 pre series<br />

articulated model (presented in late 2022, with major contracts awarded<br />

in Sweden and France). The Dutch company is currently switching<br />

(or better, going back) to a business model that includes assembly<br />

operations held in China by a local partner, the name of which has<br />

not been disclosed. The initiative is supported by the public transport<br />

company of Bonn (SWB), which is making depot space available.<br />

OUR TOUR BEGINS IN MILAN<br />

The Sustainable Bus Tour <strong>2024</strong><br />

will consist of two conference<br />

sessions focusing on the evolving<br />

landscape of public transport.<br />

Scheduled for May 9th, at<br />

Milan-based expo Next Mobility<br />

Exhibition, the first session aims<br />

to offer insights on the challenges<br />

posed by macro trends such as<br />

electrification and digitalization to<br />

transport operators and industry<br />

players (and their business<br />

models), as stakeholders are<br />

prompted to embrace innovation,<br />

develop new skills, and maintain<br />

a high degree of flexibility<br />

The session entitled ‘Balance<br />

shifts in public transport:<br />

operators and industry in the<br />

energy transition era’ will be<br />

introduced by UITP and will<br />

feature speakers from ATM<br />

Milano, RATP Dev, ZF and<br />

Iveco Group. Topics covered<br />

in the session will include<br />

industry insights, technological<br />

advancements, and the<br />

challenges and opportunities<br />

associated with transitioning to<br />

new technologies.<br />

From left to right: Rampini Eltron, Mellor Sigma<br />

7, MCV C127 EV, Ebusco 3.0 18m, Solaris Urbino 18<br />

Electric, MAN Lion’s City 18 E, Mercedes eCitaro G<br />

GOOD BYE VAN HOOL<br />

The trustees selecting VDL – Schmitz<br />

Cargobull’s proposal for takeover of the<br />

company on April 10th means the end of Van<br />

Hool’s 77-years long history as an independent<br />

company. The decision, aimed at securing the<br />

company’s future post-bankruptcy, underscores<br />

the urgency for a swift restart to prevent further<br />

setbacks for customers and employees. Van<br />

Hool’s initial announcement (dated 11th March)<br />

of ceasing city bus production and plans to<br />

relocate operations to Macedonia marked the<br />

beginning of a tumultuous period. Following<br />

subsequent bankruptcy declaration on April<br />

8th, various bids were tabled, including one<br />

from Dumarey Group and Van Hool North<br />

American dealer ABC Companies. Despite<br />

concerns about job preservation, the approval<br />

of VDL – Schmitz Cargobull’s proposal is<br />

motivated as trustees “believe a much faster<br />

start-up can be achieved”.<br />

With a record-breaking turning circle of 17.2 metres, compact dimensions and a wheelbase<br />

of only 4.4 metres, the new fully-electric MAN Lion's City 10 E is the ideal solution for narrow<br />

inner-city streets. In combination with our integrated customized eMobility solutions,<br />

you benefi t from more value and less effort. www.man.eu/lionscity-e

TECNHO<br />

IVECO <strong>BUS</strong> LAUNCHES THE CROSSWAY HYBRID<br />

Intercity gets the module<br />

VOITH TECHNOLOGY FOR THE CROSSWAY<br />

After unveiling the Crossway Low Entry Hybrid in late 2022<br />

at the FIAA in Madrid (and the same LE configuration is also the<br />

first in the Crossway range equipped with a BEV powertrain),<br />

Iveco Bus is now introducing the mild hybrid version of the<br />

Crossway normal floor intercity bus. It’s available in three<br />

lengths: 10.7, 12, 13 meters; Pop and Line versions. It will be<br />

initially available in 12 and 13 meters options powered by natural<br />

gas, biomethane-compatible.<br />

The new model is already available for orders, Iveco stated in mid<br />

April, with the first units set to be delivered in Spain next July.<br />

The Crossway Hybrid is manufactured in the traditional<br />

Crossway plant of Vysoké Myto, Czech Republic, and features<br />

the new front end presented at Busworld in 2023, that introduces<br />

full LED lights, ADAS devices and the brand’s identity with the<br />

new Iveco logo.<br />

The hybrid technology is available with the Voith Diwa NXT<br />

gearbox combined with a 35 kW peak electrical recovery motor.<br />

It’s the same technology already available on the Urbanway and<br />

Crossway LE hybrid. The motor acts as a starter and generator to<br />

recover the kinetic energy accumulated during the deceleration<br />

and braking phases with a high-energy LTO battery (48 V)<br />

mounted on the roof. The electric motor supports the Cursor 9<br />

engine during the starting phases.<br />

Looking at the market, alternative drives are gaining in volume<br />

year on year also in the intercity segment. As far as CNG is<br />

concerned, growth in the Class II segment is in contrast to<br />

the stall of volumes of the same technology in Class I, on a<br />

European level. The availability of mild hybrid drivetrains<br />

also in the intercity segment led to a remarkable increase in<br />

registrations in 2023: during last year over 1,000 hybrid bus<br />

registrations were indeed collected in the intercity segment,<br />

massively growing from 19 in 2022 and 15 in 2021, as a<br />

testament of the high popularity of mild hybrid application as<br />

alternative to diesel for intercity bus operations.<br />

A RECORD SUPPLY<br />

Solaris has put its mark on the<br />

largest order of fuel cell modules<br />

in Ballard’s history. The two<br />

companies have indeed signed<br />

a Long Term Supply Agreement<br />

aimed at the supply of 1,000<br />

hydrogen fuel cell engines through<br />

2027 for the European transit bus<br />

market (made up of approximately<br />

80 percent FCmove-HD 70 kW<br />

and 20 percent FCmove-HD+<br />

100 kW engines<br />

to address both<br />

the 12-metre and<br />

18-metre bus<br />

markets). Deliveries are set to start<br />

in <strong>2024</strong> and run through the end<br />

of 2027. The deal “consolidates<br />

existing orders for approximately<br />

300 fuel cell modules, while<br />

adding after-market and extended<br />

warranty services to such existing<br />

orders, with a new supply<br />

commitment for an incremental<br />

approximately 700 fuel cell<br />

engines and related after-market<br />

extended<br />

warranty<br />

services”,<br />

Ballard states.<br />

After the Low Entry, now also the normal floor<br />

configuration of the Crossway is available in a<br />

mild hybrid version. The bus is ready for orders.<br />

Deliveries are starting next July.<br />

On the future of batteries<br />

BorgWarner’s showcase at VDV-backed<br />

Mobility Move in Berlin, in March, has been a<br />

first opportunity to get in touch with the group’s<br />

battery division following the agreement signed<br />

with BYD’s FinDreams, that awarded BorgWarner<br />

the licence to produce Blade Battery packs based<br />

on FinDreams’ cells. “The design of the LFP<br />

battery packs is done by BorgWarner, using some<br />

intellectual property of FinDreams”, explained us<br />

Martin Busche, Director<br />

Global R&D at BorgWarner<br />

Battery Systems. “The<br />

abundancy of the chemical<br />

components as well as<br />

intrinsic higher safety of<br />

LFP battery cells gives<br />

rise to bigger and cheaper<br />

cells - Busche says -. Bigger<br />

cells, and in the case of<br />

the LFP battery cell especially longer cells, can<br />

even increase the structural stability of the battery<br />

pack”. Competition is becoming quite an issue:<br />

“The commercial vehicle market is becoming<br />

increasingly price-sensitive, and this naturally<br />

increases the focus on cost-optimized products.<br />

Thanks to our experience in the automotive sector,<br />

we at BorgWarner are used to always keeping an<br />

eye on cost optimization for our products”.<br />

Your power<br />

partner,<br />

whichever<br />

route<br />

you take<br />

Our planet faces a significant challenge<br />

as we recognise the realities of climate<br />

change. That’s why were taking<br />

action to progress the widest range of<br />

power technologies to fuel industry<br />

decarbonisation.<br />

• Advanced Diesel<br />

• Hybrid<br />

• Natural Gas<br />

• Hydrogen Internal Combustion Engines<br />

• Hydrogen Fuel Cell<br />

• Battery-Electric<br />

Visit us at Busworld Türkiye<br />

Hall 1, Booth D36<br />

29-31 May <strong>2024</strong><br />

Learn more.<br />

cummins.com<br />

accelerazero.com<br />

6<br />

©<strong>2024</strong> Cummins Inc.

TECNHO<br />

MAN IS ESTABLISHING A BATTERY REPAIR CENTER NETWORK IN EUROPE<br />

Repairing batteries quickly<br />

A SERIES OF CENTERS WILL BE READY WITHIN 2025<br />

MAN is establishing a network of battery repair centres in<br />

Europe: two first hubs are already in operation, in Germany<br />

(Hanover-Laatzen) and Spain (Barcelona) – more are to follow<br />

in Europe during <strong>2024</strong> and 2025 (specifically in Italy, Denmark/<br />

Norway, Austria, Belgium, Netherlands, France, Poland and UK,<br />

with further countries in Europe being planned). The investment is<br />

forecasted to be in the range of “millions”, MAN states.<br />

MAN has been leading the e-bus market in Europe in 2023 thanks<br />

to 785 Lion’s City E registered in the continent, over three times<br />

the 2022’s figure of 230 (a 12.4 market share). The roll-out of the<br />

battery repair hubs in Europe is necessary because the first units<br />

of the new MAN eTruck generation will be delivered to customers<br />

within <strong>2024</strong>. Over 1,000 battery-electric MAN city buses<br />

(following launch in 2020) and more than 2,400 all-electric MAN<br />

vans are already on Europe’s roads, according to MAN.<br />

The aim is to operate a battery repair hub in every market in<br />

which MAN is represented with BEV commercial vehicles. Short<br />

transport routes and highly trained technicians on site will ensure<br />

that the battery can be repaired quickly, MAN points out.<br />

The aim is to operate a battery repair hub in<br />

every market in which MAN is represented with<br />

BEV commercial vehicles. The investment is<br />

forecasted to be in the range of “millions”.<br />

Subscribe to Sustainable Bus Magazine.<br />

Your ticket to the latest in<br />

public transport innovation<br />

How to subscribe:<br />

www.sustainable-bus.com<br />

or write a e-mail to:<br />

abbonamenti@vadoetorno.com<br />

VADO E TORNO EDIZIONI via Brembo 27 20139 Milan Italy

INFRASTRUCTURE<br />

MADE FOR THE CITY<br />

10<br />

KVB AIMS TO CONVERT THE FLEET BY 2030<br />

Cologne has a new e-bus depot<br />

63,000 SQUARE METERS, ROOM FOR OVER 100 E-<strong>BUS</strong>ES<br />

Cologne public transport operator KVB inaugurated in mid-<br />

March its new Porz electric bus depot, housing over 100 electric buses.<br />

Value of the investment? 35 million euros (12.2 provided by the state).<br />

The company is pursing the goal of transitioning its entire bus fleet to<br />

alternative drive systems by 2030.<br />

The 63,000 square metre site – as nine football pitches – was the heart of<br />

the former Dielektra site, manufacturing transformers and insulators for<br />

the electrical industry. Now KVB is bringing a new innovation to Porz.<br />

Besides charging infrastructure, the depot features a workshop,<br />

washing facility and a transport service building. KVB sister company<br />

RheinEnergie currently supplies the required alternating current via two<br />

10 kV lines. From the transfer station, the energy is divided between the<br />

depot’s own requirements (workshop, transport service building, etc.) and<br />

RVK’s charging infrastructure. In two transformer buildings, alternating<br />

current is transformed to 750 V, distributed to chargers and converted<br />

into direct current by these. The current flows are then distributed to the<br />

charging bonnets via cables along the traverses, whereby each charger<br />

can control two charging bonnets.<br />

FROM <strong>BUS</strong>ES TO INFRASTRUCTURE<br />

Daimler Buses Solutions, the latest<br />

subsidiary of Daimler Buses launched in<br />

June 2023, is electrifying the bus depot<br />

of HTM Personenvervoer in The Hague<br />

(NL). The project covers the entire socalled<br />

‘e-system’ and thus the installation<br />

of all 41 charging stations with a total<br />

of 122 charging points, providing the<br />

charging management, the software and<br />

the operating concept, as Daimler Truck<br />

states. Commissioning is scheduled for<br />

the third quarter of <strong>2024</strong>.<br />

As part of the overall package, Daimler<br />

Buses will be also delivering at least 95<br />

battery-electric buses.<br />

In this case Daimler Buses Solutions<br />

is setting up the entire e-infrastructure<br />

together with local partners ABB<br />

E-mobility and Batenburg Techniek. The<br />

UP TO 260 E-<strong>BUS</strong>ES<br />

A new inverted pantograph electric charging<br />

station has been inaugurated at the Carabanchel<br />

operations centre of EMT Madrid. Now the depot<br />

has been enhanced with further 118 electric bus’<br />

chargers, enabling a total of 260 vehicles to be<br />

charged simultaneously.<br />

With the fourth phase of charging station’s<br />

conversion still to be completed, the Carabanchel<br />

operations centre (undergoing a process of<br />

complete transformation) is expected to have a<br />

total of 320 charging points in operation within the<br />

end of this year and the beginning of next year: 230<br />

through inverted pantograph system and 90 by plugin.<br />

The cost of the conversion of the depot amounts<br />

to 6.7 million euros and the total investment budget<br />

– which also includes chargers and pantographs<br />

– is 11.3 million euros (90 percent financed by the<br />

European Next Generation EU funds).<br />

software for charging management will<br />

be supplied by Daimler Buses Solutions<br />

together with IVU Traffic Technologies.<br />

During the operations, buses will be<br />

charged with 360 kW output. During<br />

the night, the same capacity will be split<br />

between several buses.<br />

28 charging stations will be installed<br />

for 109 e-buses. The plan is to<br />

install 13 charging stations at 3<br />

other sites. In total, 122 charging<br />

points will be installed.<br />

THE ALL-ELECTRIC C127 EV<br />

The synthesis of design and functionality leads to comfortable and flexible<br />

options that both passengers and drivers appreciate - with safety.<br />

The framework made of high-strength stainless steel and extensive standard<br />

equipment underlines the quality. The ability to carry up to 90 passengers with<br />

a maximum battery capacity of 462 kWh and its overall height of 3.20 meters<br />

make it an efficient and economical representative in the all-electric city bus<br />

segment.<br />

Provider: MCV Deutschland GmbH, Ziegelwiese 1c, 59909 Bestwig<br />

DESIGNED TO LEAD . .<br />

BUILT TO LAST<br />

www.mcv-eg.com

OUTLOOKS<br />

3,000<br />

E-buses in<br />

operation<br />

OUR VISIT AT FORSEE POWER’S PLANT IN POITIERS, FRANCE<br />

4 GWh<br />

Target<br />

capacity 2028<br />

<strong>2024</strong> is expected to be the year of<br />

break-even in terms of EBITDA<br />

for Forsee Power, a manufacturer<br />

of battery modules ‘made<br />

in France’ whose core business is public<br />

transport (two-thirds of sales can be attributed<br />

to the bus sector). At the end of<br />

February, we had the opportunity to visit<br />

the Poitiers production plant, where the<br />

company aims to double its production<br />

capacity to reach 4 GWh by 2028.<br />

The French factory, opened in 2022, is<br />

the pivot of a global network that includes<br />

a second European plant in Wroclaw<br />

(Poland), a plant in Ohio (USA), and two<br />

Asian factories: in Pune, India, and in<br />

Zhongshan, China.<br />

A high-tech plant<br />

The Poitiers plant stands on the ashes of<br />

an industrial complex where the American<br />

group Federal Mogul produced pistons for<br />

diesel vehicles before ceasing operations<br />

in 2014. Forsee Power, in short, made a<br />

brownfield operation with substantial help<br />

from the institutions (government, Grand<br />

Poitiers agglomeration, Nouvelle-Aquitaine<br />

region), which helped finance the renovation<br />

and redevelopment of the factory<br />

in order to attract new players in the tech<br />

sphere. Forsee Power is actually renting<br />

in Poitiers for a total of twelve years. On<br />

the other end, the technological equipment<br />

is entirely borne by the group (which in<br />

2021 benefited from a 50 million euro loan<br />

from the EIB, the European Investment<br />

Bank). The equipment is distributed over<br />

the 10,000 square metres dedicated to<br />

production, to which are added 2.5 square<br />

kilometres dedicated to components,<br />

housed in a building constructed from<br />

scratch. To conclude our space overview,<br />

here is another 2,000 square metres dedicated<br />

to shipping operations.<br />

Safety issue are considered<br />

Our journey through the company’s production<br />

lines starts in the safety room. A<br />

squad of the company’s workers is trained<br />

to intervene in the event of a fire, including<br />

the qualification to drive a forklift in order<br />

to move any critical components quickly.<br />

Between the buildings there is a pool of<br />

water where suspicious ‘pieces’ can be<br />

thrown. A precaution, that of training workers<br />

to manage the fire risk, which the<br />

company assures us was adopted entirely<br />

voluntarily, without being required (incredible<br />

but true) by regulations.<br />

The production lines, five in all, feature<br />

a high level of automation. The technical<br />

check on the integrity and good condition<br />

of the cells, the first step in the production<br />

process, is the prerogative of a robot, as is<br />

the arrangement of the cells in ‘stacks’ (a<br />

kind of cell column), which are then arranged<br />

in modules and battery packs. Instead,<br />

the workforce of the French plant is responsible<br />

for the installation of the electrical<br />

and electronic components: from wires<br />

to the PDU (Power Distribution Unit), the<br />

electrical infrastructure is manually assembled<br />

and controlled. The same approach is<br />

implemented at Forsee Power’s plants in<br />

China and the United States.<br />

The factory employs around 200 workers<br />

CARRYING <strong>BUS</strong>ES<br />

IN ITS HEART<br />

In Poitiers the battery modules provider Forsee<br />

Power has an installed capacity of 2 GWh, with<br />

the aim of expanding to 4 in 2028. The bus sector<br />

accounts for two-thirds of sales. EBITDA<br />

is expected to break even this year<br />

At the end of February,<br />

we had the opportunity to<br />

visit the Poitiers production<br />

plant, where the<br />

company aims to double<br />

production capacity to<br />

reach 4 GWh by 2028.<br />

The French factory, opened<br />

in 2022, is the pivot<br />

of a global network that<br />

includes a second European<br />

plant in Wroclaw<br />

(Poland), a plant in Ohio<br />

(USA), and two Asian factories:<br />

in Pune, India, and<br />

in Zhongshan, China.<br />

12<br />

13

OUTLOOKS<br />

and has enough installed capacity to reach<br />

2 GWh per year at maximum operation<br />

(three shifts). At present, the factory works<br />

in two shifts and in 2023, 1 gigawatthour<br />

of batteries (equivalent to more than<br />

2,500 e-bus batteries, assuming a likely<br />

allocation of 400 kWh per bus) will be<br />

‘churned out’.<br />

Not just focusing on the ‘first’ life<br />

Forsee Power’s focus is not only on the<br />

development and manufacturing of batteries<br />

for the so-called ‘first life’, i.e.<br />

use as traction accumulators for electric<br />

vehicles, but extends to the management<br />

of ‘second life’ applications. Outside<br />

the French company’s perimeter remain<br />

cell production (for which the company<br />

sources from a number of partners among<br />

which LG, Toshiba and CALB have a<br />

prominent position, in addition to wellknown<br />

names such as Samsung SDI,<br />

Northvolt, Panasonic, Blue Solutions)<br />

and recycling management.<br />

At the moment, Forsee Power is a company<br />

that has buses as its real core business:<br />

public transport accounts for twothirds<br />

of its sales. In Europe there are now<br />

over 3,000 e-buses equipped with Forsee<br />

Power modules. Certainly, according to<br />

the company’s own figures, 135,000 vehicles<br />

are equipped worldwide, an overall<br />

Christophe Gurtner, e-buses<br />

today cover a big share in<br />

Forsee Power’s sales…<br />

“City buses are ideal candidates<br />

for BEV applications,<br />

considering their typical routes<br />

are under 200 km. For intercity<br />

travel, the viability depends on<br />

the availability of charging infrastructure.<br />

If daily charging<br />

is possible, batteries can be a<br />

feasible option. However, for<br />

long-distance coaches covering<br />

500 to 800 km per day,<br />

embedding sufficient batteries<br />

is technically possible but economically<br />

challenging. Alternative<br />

solutions like hydrogen<br />

hybrid technology, which is still<br />

embedding batteries, might be<br />

more suitable. Nonetheless,<br />

the market for city buses or<br />

figure ‘drugged’ by large volumes of scooters<br />

and 3-wheelers for the Asian market.<br />

Around 50 percent of Forsee Power’s business<br />

comes from exports outside Europe.<br />

The company’s strategy does not include<br />

the car segment and focuses on heavy<br />

vehicles (not only buses and trucks, but<br />

also construction and rail) and light vehicles<br />

(the aforementioned scooters and tuktuks<br />

for which the Far East markets are voracious).<br />

Commercial vehicles accounted<br />

for 85 percent of sales in 2023, up from 79<br />

per cent in 2022.<br />

It is a strategy that is in fact articulated<br />

between markets with high added value<br />

and large profit potential (heavy vehicles,<br />

excluding trucks) and applications harbouring<br />

large volumes and smaller margins<br />

(light vehicles), with trucks in between.<br />

Buses are driving Forsee’s business<br />

As we were saying, buses are the most successful<br />

application for Forsee’s business.<br />

The company is a partner of brands such<br />

as Wrightbus (which ranked fourth in the<br />

European e-bus market 2023), Van Hool,<br />

Iveco Bus (on the new range also modules<br />

made in-house are however offered), CaetanoBus<br />

and MCV.<br />

In terms of business performance, revenue<br />

growth in 2023 was 54 percent. The<br />

turnover is 171 million euros. As mentio-<br />

STRATEGIES, MARKET, SUPPLY CHAIN: CEO’S SPEAKING<br />

short intercity and suburban<br />

transportation (both buses and<br />

trucks) is such a big market<br />

that just focusing on that will<br />

feed our business for the coming<br />

ten years”.<br />

How do you build up your supply<br />

chain and which is your approach<br />

towards partners?<br />

“We need tested and qualified<br />

suppliers, it needs one to<br />

three years to decide to select<br />

a product from a supplier. Our<br />

approach involves establishing<br />

framework agreements, at<br />

least for 5 years. We qualified<br />

several suppliers but we have<br />

preferred suppliers that can<br />

bring us the right technology at<br />

the right cost and in sufficient<br />

volume. These preferred suppliers<br />

are integral to our supply<br />

chain, and we maintain intimate<br />

relations with them over<br />

many years to ensure continuity<br />

and reliability. Despite global<br />

crises like the Ukraine conflict<br />

in 2022, we’ve managed to<br />

maintain stable supply thanks<br />

to these robust partnerships”.<br />

What are your thoughts on<br />

the projects underway in order<br />

to create a EU-based cell<br />

supply base?<br />

“We’re actively engaged with<br />

different companies that are<br />

establishing European gigafactories.<br />

We hope that these<br />

company will be able to produce<br />

in the coming years as<br />

it’d simplify our supply chain.<br />

However, these European companies<br />

face stiff competition<br />

from established players. The<br />

Buses are the most<br />

successful application<br />

for Forsee’s business,<br />

partner of brands such<br />

as Wrightbus, Van Hool,<br />

Iveco Bus (on the new<br />

range also modules made<br />

in-house are however<br />

offered), CaetanoBus and<br />

MCV. In terms of business<br />

performance, revenue<br />

growth in 2023 was 54<br />

percent. The turnover is 171<br />

million euros.<br />

fight will be tough, we hope to<br />

have some European winning<br />

newcomers and we’ll of course<br />

balance our supply among different<br />

companies”.<br />

You have been sharing promising<br />

figures and the market<br />

for e-mobility is clearly on a<br />

rise. However, Forsee Power’s<br />

performance on the stock<br />

exchange show a decrease in<br />

shares’ value…<br />

“Since we made our IPO in<br />

2021, we delivered the performances<br />

we had announced.<br />

Unluckily, in spite of that, the<br />

share value of the company is<br />

indeed declining. Today financial<br />

investors do not invest in<br />

small and medium tech companies<br />

in Europe. We are dealing<br />

with this macro trend and<br />

we need to be patient, keep doing<br />

what we are doing. Macro<br />

trends change and we’ll be benefiting<br />

from this”.<br />

Do you fear that the next European<br />

Parliament might delay<br />

the phase-out of ICE?<br />

“Out of political comments, I<br />

can say that, practically speaking,<br />

the targets that have been<br />

defined by European policymakers<br />

are not achievable<br />

from the industry. We have<br />

to face reality. There could be<br />

some postponement of the<br />

targets, as they are so drastic.<br />

But even if some targets will be<br />

postponed, we don’t feel we’ll<br />

be impacted by this, there is<br />

so much business to be done.<br />

It’s just matching the decisions<br />

with the reality of the industry”.<br />

R&D, what are you<br />

working on at the moment?<br />

“We are working<br />

on four sides. One is<br />

making battery with<br />

always higher energy<br />

density, second is<br />

having longer-life batteries so<br />

that TCO of vehicles can benefit.<br />

Third battle is of course to<br />

reduce costs. Fourth battle is<br />

about data: it’s really a data<br />

war, it’s crucial to use data<br />

from deployment of batteries<br />

on vehicles to learn and optimize,<br />

sharing these data with<br />

vehicles’ users. Batteries are<br />

the hearth. Performances of<br />

electric vehicles depend on the<br />

health of battery”.<br />

R.S.<br />

54%<br />

Revenue<br />

growth 2023<br />

ned at the beginning, <strong>2024</strong> is expected<br />

to be the first year with<br />

positive EBITDA in the history<br />

of Forsee Power, which<br />

has in its shareholding structure<br />

the Japanese investment<br />

company Mitsui & Co (the<br />

majority shareholder with 26<br />

percent) and its French counterpart<br />

Eurazeo (24 percent). There is<br />

also a 7 percent stake by Canadian fuel<br />

cell giant Ballard Power Systems. The<br />

company’s target is to reach a 7 percent<br />

EBITDA margin in 2028.<br />

Looking at the company’s strategies globally,<br />

the Chinese factory, operational<br />

since 2003, has a similar production capacity<br />

target of 4 GWh per year over a fouryear<br />

period, also on five production lines<br />

spread over 10,000 square metres. What<br />

about India? Two lines on 2,000 square<br />

metres, focus on light vehicles (the electric<br />

tuk-tuk market is very promising),<br />

target of 2 GWh in 2028, up significantly<br />

from 0.4 in 2022. The US plant, with<br />

the same extension as the French factory,<br />

started operations at the end of 2023<br />

and is expected to ’give birth’ to 1 GWh<br />

of modules this year, with a target of 3<br />

GWh in 2028. In Poland, Forsee Power<br />

maintains production of around one million<br />

small battery packs for various uses,<br />

including service centres.<br />

The product portfolio is broad: NMC and<br />

LTO (the latter is reserved mainly for<br />

fuel cell vehicles or pantograph electric<br />

vehicles, where high recharging power is<br />

required) have been on the list for some<br />

time; the latest novelty is the foray into<br />

LFP, which has been introduced in the second<br />

half of 2023. This news is in response<br />

to a general trend whereby LFP is gaining<br />

significant ground (a similar move was<br />

recently made by BorgWarner). BloombergNEF<br />

analysts wrote this in black and<br />

white two years ago (“LFP batteries have<br />

significantly increased their market share<br />

over the past three years and are expected<br />

to account for 40 percent of EV sales in<br />

2022”). Among the company’s ‘jewels’<br />

are the ZEN Slim modules, which are<br />

characterised by their extra-slim design<br />

and intended for direct integration into<br />

the chassis. Wrightbus’s choice, which<br />

is almost a must for a double-decker, responds<br />

to a well-defined trend that sees<br />

more and more manufacturers aiming to<br />

move the heavy modules from the roof to<br />

the lower part of the vehicle.<br />

Riccardo Schiavo<br />

14 15

OUTLOOKS<br />

VDL OPENED A NEW E-<strong>BUS</strong> PLANT IN BELGIUM<br />

MANUFACTURING THE FUTURE<br />

840<br />

Units per year<br />

capacity<br />

A brand new plant for electric buses in<br />

Roeselare will help VDL Bus & Coach to regain<br />

shares in the market? The plant’s production<br />

capacity is over 800 units per year. In 2023<br />

registrations were stuck at 108<br />

Seventy-seven thousand square<br />

metres of floor space, 27,000<br />

of which are reserved for the<br />

production lines: here VDL Bus<br />

& Coach will exclusively build the e-<br />

buses of the Citea range, in Low Entry<br />

and Low Floor configurations, in all four<br />

length variants. The factory ‘firepower’<br />

is 840 units per year, with the aim of regaining<br />

market share.<br />

Will the new factory (“the most modern<br />

in Europe”, according to announcements)<br />

be helpful in achieving a recovery<br />

of the shaky VDL bus division?<br />

On April 10th, VDL inaugurated the new<br />

production plant in Roeselare, Flanders<br />

(Belgium), just two years, two months<br />

and two days after the foundation stone<br />

was laid on February 8th, 2022.<br />

For the Dutch manufacturer, this is a<br />

springboard for (re)launch after a dif-<br />

In Roeselare (Belgium) VDL<br />

Bus & Coach will exclusively<br />

build the e-buses<br />

of the Citea range, in Low<br />

Entry and Low Floor configurations,<br />

in all four length<br />

variants. The Dutch group<br />

has been a front runner in<br />

e-bus sales in Europe, but<br />

2023 has seen a significant<br />

decrease in registrations.<br />

However, over 1,400 BEV<br />

buses by VDL are currently<br />

in operation (the sixth position<br />

in the European chart<br />

of e-bus OEM 2012 - 2023).<br />

16<br />

17

OUTLOOKS<br />

18<br />

ficult 2023 - not that 2022, to be fair,<br />

was any different - for the bus & coach<br />

business, whose sales fell sharply: -33<br />

percent. A significant drop that the OEM<br />

blames on the shortage of materials to<br />

manufacture the new generation of the<br />

Citea, the in-house electric city bus; a<br />

shortage that has caused the assembly<br />

line to work intermittently and, in turn,<br />

delayed vehicle deliveries.<br />

<strong>2024</strong> - 2025: VDL turns page?<br />

However, <strong>2024</strong> looks to be potentially<br />

the year of revitalisation for VDL. Not<br />

only for the opening of the plant in Belgium<br />

and the arrival of the new generation<br />

of the Futura coach (which, however,<br />

will perhaps be postponed to 2025),<br />

but also for having taken over, together<br />

with Schmitz-Cargobull, the assets of the<br />

bankrupt Van Hool. So, the opening of<br />

a new factory in Belgium dedicated entirely<br />

to e-buses, takes on further social<br />

and industrial significance.<br />

We were attending the ribbon-cutting ceremony,<br />

together with colleagues from<br />

the trade press from all over Europe, customers<br />

and suppliers of the brand. The<br />

Krommebeekpar site in Roeselare covers<br />

an area of 77,000 square metres and<br />

houses the production lines - which take<br />

up 27,000 square metres - the workshop,<br />

warehouse and offices. The workforce<br />

currently numbers around 600 employees,<br />

500 of whom are blue collar workers, but<br />

new hires are planned: who knows, maybe<br />

Roeselare will be the home for some of the<br />

people who found themselves out of work<br />

(even though it is 150 kilometres away<br />

from Koningshooikt, nest of Van Hool).<br />

New Citea’s goal: over 800 units/year<br />

The plant, as already mentioned, is dedicated<br />

exclusively to the production of<br />

the Citea e-bus range, and programmed to<br />

reach the perhaps all too ambitious goal,<br />

which was set some time ago by the board,<br />

of supplying the market with<br />

between 800 and 1,000 batterypowered<br />

urban buses per year.<br />

As Alain Doucet, managing<br />

director of the newly founded<br />

company VDL Bus Roeselare,<br />

told us, the factory’s production<br />

capacity is around 800<br />

units every twelve months, 840<br />

to be exact, equal to fifteen per<br />

week. But, currently, the production<br />

line pace is set at seven units every<br />

seven days, equal to a yearly projection<br />

600<br />

Workers<br />

of 340 units. Despite the<br />

fact that the plant alone can<br />

churn out the entire Citea range<br />

- Low Entry and Low Floor, in<br />

all four length variants (12, 13.5, 14<br />

and 18 metres) -, the company said it deliberately<br />

and strategically chose to share<br />

manufacturing of the electric Class I bus<br />

with the other plant in Valkenswaard (in<br />

the mother country), in order to maximise<br />

production capacity.<br />

The phrase repeated like a mantra throughout<br />

the day, starting with VDL Group<br />

CEO Willem Van Der Leegte, is “the<br />

most modern bus factory in Europe”.<br />

Several pieces of evidence support this<br />

claim, starting with the fact that the factory<br />

is said to be carbon neutral: solar<br />

panels make it largely self-sufficient in<br />

terms of energy needs. But that’s not all:<br />

less artificial lighting and more natural<br />

light coming in through the large glass<br />

façades, reuse of rainwater, mediumheavy<br />

concrete construction (which flat-<br />

77K<br />

Square<br />

meters<br />

The workforce currently<br />

numbers around 600<br />

employees, 500 of<br />

whom are blue collar<br />

workers, but new hires<br />

are planned: who knows,<br />

maybe Roeselare will be<br />

the home for some of<br />

the people who found<br />

themselves out of work<br />

(even though it is 150<br />

kilometres away from<br />

Koningshooikt, nest of<br />

Van Hool).<br />

tens the heating and cooling<br />

cycle curve in summer) and<br />

green roofs on the offices,<br />

which not only contribute to the<br />

building’s aesthetics, but also make<br />

the air cleaner and act as natural insulation,<br />

providing a cooling effect on the<br />

indoor environment.<br />

The production lines are high-tech and<br />

partly robotised, and like the rest of the<br />

building, have underfloor heating and<br />

ventilation systems that ensure efficient<br />

use of energy and are synonymous with<br />

healthy air. In short, the Roeselare plant<br />

has been designed and built in the name<br />

of sustainability and innovation, with a<br />

strong focus on the well-being of workers<br />

and employees, as well as on building<br />

electric buses as efficiently as possible.<br />

The premises are good, very good: we<br />

will see how many vehicles “the most<br />

modern factory in Europe” will be rolling<br />

out production lines in the coming<br />

months.<br />

Fabio Franchini<br />

19

OUTLOOKS<br />

Margaret Thatcher, UK Prime Minister<br />

between 1979 and 1990,<br />

was once rumoured to have said<br />

something like “If a man finds<br />

himself a passenger on a bus at the age of 26,<br />

he’s a failure in life”. Evidence doesn’t support<br />

whether Thatcher said this, but for some<br />

critics of today’s largely privatised UK bus<br />

network, the meaning is more important. In<br />

1986, Thatcher’s government de-regulated<br />

the UK bus network outside of London,<br />

transferring publicly run ownership and<br />

management to privately run bus operators.<br />

The rationale was that private ownership<br />

and market competition would improve services<br />

– unless you believe the sentiment of<br />

the quotation, rightly or wrongly attributed to<br />

The Iron Lady.<br />

Since de-regulation, in general, private bus<br />

operators in the UK have provided services<br />

based on commercial viability. However,<br />

patronage across most areas of the UK has<br />

continued to decline since de-regulation, and<br />

governments over recent years have tacitly<br />

accepted the need for improvement in the<br />

model. This has seen stages of adjustment,<br />

most significantly drawing on powers presented<br />

in the Bus Services Act of 2017, where<br />

the government’s Bus Back Better national<br />

bus strategy of 2021 acknowledged the need<br />

to change from a situation where services are<br />

planned on a purely commercial basis.<br />

Today, local transport authorities must provide<br />

services via two main options. The first<br />

involves an agreement with bus operators<br />

known as an Enhanced Partnership, that includes<br />

shared goals on service improvement.<br />

Crucially, operators still retain control – and<br />

financial risk – over operational decisions<br />

like routes and frequency. Alternatively,<br />

Mayoral Combined Authorities, covering<br />

10 areas in England outside of the capital,<br />

mainly focussed on large urban areas, can<br />

also use franchising powers. Franchising gives<br />

greater control to regional government<br />

with freedom over service provision similar<br />

to that granted to London. Under franchised<br />

powers, authorities can choose and amend<br />

routes, frequencies, and operational hours,<br />

and control ticket pricing. To achieve this,<br />

authorities buy the service from operators,<br />

issuing contracts to run routes according to<br />

negotiated prices. As such, franchising forms<br />

a middle option between a privatised system<br />

and state-controlled operation.<br />

Emerging franchised services<br />

So far, Greater Manchester has launched a<br />

franchised service, with Liverpool City Region<br />

to follow, and this March, West Yorkshire<br />

also recently announced its intentions to<br />

franchise. Wider in the UK, the devolved governments<br />

are also progressing the opportunity.<br />

The Strathclyde Partnership for Transport<br />

in the west of Scotland, including Glasgow,<br />

also announced in March that it would launch<br />

franchising. In Wales, the government is set to<br />

decide on new legislation, which if successful<br />

could see franchising starting from 2026.<br />

Authorities set to exercise franchising believe<br />

that its people will be better served with a<br />

bus service run with greater local government<br />

control. Transport for Greater Manchester<br />

(TfGM) says that since 1986, the number<br />

of bus journeys across city districts dropped<br />

from around 355m to 182m in 2019, whereas<br />

in London, where buses were not deregulated,<br />

the number of bus journeys roughly doubled<br />

in the same period. Instead, TfGM’s Bee<br />

Network franchised service, launched in September<br />

2023, has objectives to grow bus patronage<br />

by 30 percent by 2030, and says the<br />

volume of bus users are already up, alongside<br />

service punctuality.<br />

The increased public accountability of a franchised<br />

service also has the potential to accelerate<br />

the zero-emissions transition. Greater<br />

Manchester aims to deliver a fully electric<br />

bus fleet by 2032, and towards this goal, since<br />

launching bus franchising, the Bee Network<br />

is running 50 new zero-emission buses,<br />

with a further 120 requested for delivery by<br />

January 2025.<br />

To achieve its objectives, TfGM has received<br />

more than £1bn from the UK central<br />

government’s City Region Sustainable<br />

Transport Settlement, where £5.7bn in total<br />

has been awarded to eight city regions outside<br />

of London. The Manchester authority<br />

will also allocate government-issued Bus<br />

Service Improvement Plan (BSIP) funding.<br />

While TfGM says that route specifications<br />

and fares will need to be set at a sustainable<br />

level that keeps buses attractive to customers,<br />

it confirms the need to balance<br />

commercial viability. Moreover, its strategy<br />

acknowledges the requirement for additional<br />

government investment.<br />

“One reading of Andy Burnham’s (Mayor of<br />

Greater Manchester) Bee Network is that it<br />

is a direct challenge to Keir Starmer to say:<br />

this needs to be funded”, says Professor Jon<br />

Shaw, University of Plymouth, who specialises<br />

in the geography of transport, travel and<br />

mobility. Andy Burnham is a Labour party<br />

member, and Keir Starmer, leader of the<br />

UK’s left-centre party, the traditional adversary<br />

to the Conservative party that de-regulated<br />

the bus service, is currently in a strong<br />

position in the opinion polls to win the next<br />

UK election, taking place later this year.<br />

The economics of franchising<br />

Jon Shaw adds: “If Manchester runs its<br />

network well, it will be expensive, but this<br />

investment should bring back revenue long<br />

term because more people will be using it”.<br />

Meanwhile, this April, the Labour party<br />

has just announced that if it forms a UK<br />

government, it will effectively extend the<br />

option of franchising powers to all local authorities<br />

that want it. Already, areas not designated<br />

a Mayoral Combined Authority can<br />

apply for franchising powers, but they have<br />

to meet criteria relating to reliability in service<br />

delivery and financial management.<br />

“The economics of franchising comes down<br />

to who bears the risk”, says Professor Graham<br />

Parkhurst, Director, Centre for Transport<br />

and Society at University of the West<br />

of England, Bristol. “Currently, the UK bus<br />

network is operated at pretty low cost, even<br />

though it receives a lot of subsidy, because<br />

the risk is in the private sector. If you’re<br />

going to take that away, the public sector will<br />

take on the risk premium, and this is sometimes<br />

lost in the public discourse. Revenue is<br />

key, so the issue comes back to fair pricing,<br />

UK, PUBLIC OWNERSHIP IS TAKING BACK CONTROL ON <strong>BUS</strong> SERVICES<br />

IS FRANCHISING<br />

THE ANSWER?<br />

In the UK outside London, there’s growing media<br />

attention on the prospect of public ownership of<br />

the bus network via franchised services. Can this<br />

hybrid model of public ownership with private<br />

operation arrest the decline in bus patronage?<br />

So far, Greater Manchester<br />

has launched a franchised<br />

service, with Liverpool<br />

City Region to follow. This<br />

March, West Yorkshire also<br />

announced its intentions to<br />

franchise. Wider in the UK,<br />

the Strathclyde Partnership<br />

for Transport in the west of<br />

Scotland, including Glasgow,<br />

also announced in<br />

March that it would launch<br />

franchising. In Wales, a new<br />

legislation, if approved,<br />

could see franchising starting<br />

from 2026.<br />

20<br />

21

OUTLOOKS<br />

This April, the Labour party<br />

has announced that if it<br />

forms a UK government,<br />

it will extend the option<br />

of franchising powers to<br />

all local authorities that<br />

want it. Already, areas<br />

not designated a Mayoral<br />

Combined Authority can<br />

apply for franchising<br />

powers, but they have to<br />

meet criteria relating to<br />

reliability in service delivery<br />

and financial management.<br />

and franchising doesn’t automatically mean<br />

that fares will be lower”.<br />

Vital to establishing commercial viability is<br />

increasing patronage, which largely depends<br />

on service reliability.<br />

Increasing patronage will be key<br />

Buses need to be on time, whether through<br />

prioritisation, plus improvements that<br />

reduce dwell times, or by minimising congestion.<br />

TfGM’s strategy includes plans to<br />

increase bus average speeds on key routes.<br />

However, between 2011 and 2021, the number<br />

of cars available for household use in<br />

Greater Manchester grew by 13 percent. The<br />

city has stopped short of introducing schemes<br />

to disincentivise car driving, like those<br />

in London and other urban UK areas, but to<br />

increase bus ridership, authorities who believe<br />

in greater public control have difficult<br />

decisions to make.<br />

“In order to run a bus service effectively, it<br />

comes with politically difficult issues, like<br />

reallocating road space to buses, so there is<br />

still massive constraint within which an incoming<br />

government would be able to make<br />

franchising fully work, even if they had<br />

more sympathy to a regulated model”, says<br />

Jon Shaw. While comparisons to the relative<br />

success of London’s franchised system and<br />

high patronage is contrasted against the large<br />

subsidy allocated to the capital, a key factor<br />

is the city’s relatively low car ownership<br />

per household.<br />

“Is that low car ownership caused by external<br />

factors, like lack of road and parking<br />

space, or is it that a far more comprehensive<br />

public transport system makes it possible for<br />

people to manage with a lower level of car<br />

ownership in London?”, asks Professor Peter<br />

White, expert on public transport systems,<br />

University of Westminster. “Many cities like<br />

Manchester, for example, have a higher level<br />

of car ownership that’s grown since the mid<br />

‘80s. I don’t think franchising on its own is<br />

going to reverse the car ownership level”.<br />

London’s success in bus ridership is also<br />

down to the city’s integrated transport, and<br />

franchising presents the opportunity to enhance<br />

the passenger experience, similar to<br />

London’s more joined-up approach.<br />

“London has a very longstanding multioperator<br />

ticket and this is the one area where<br />

franchising could unlock significant change<br />

if there is real willingness to fund it”, says<br />

Graham Parkhurst.<br />

“Franchising might enable better coordination<br />

of timetables to give regular headways<br />

along a route where several operators operate”,<br />

adds Peter White. “That could offer the<br />

convenience of integrated ticketing systems,<br />

and it would also reduce dwell time”.<br />

Is franchising the only way?<br />

Some UK areas have seen some modal shift<br />

from car to bus without requiring franchising.<br />

Oxfordshire is the best performing<br />

English ‘county’ region in terms of bus use<br />

per capita, with 59 journeys per head of population<br />

in the county as a whole, including<br />

rural areas, according to recent figures. The<br />

city of Oxford also has an effective and longstanding<br />

park and ride system.<br />

“Small, independent operators may find it’s<br />

very difficult to operate under a franchised<br />

framework in terms of the financial risks<br />

they would take when bidding for service<br />

contracts, especially in rural areas”, says<br />

Peter White. “Larger operators may be<br />

able to take on more risk in bidding for that<br />

work, and that could squeeze out smaller<br />

operators. Long term, that could be quite<br />

harmful: they do play a very useful role in<br />

service provision”.<br />

The Confederation of Passenger Transport<br />

(CPT) that represents the bus industry in the<br />

UK also says that outside the large cities,<br />

local leaders may find they can meet their<br />

ambitions for local transport more quickly<br />

and with less risk by continuing to work in<br />

close partnership with bus operators, rather<br />

than opting for franchising. The organisation<br />

adds that whether a region is franchised or<br />

not, the priorities are the same: making sure<br />

passengers have more buses going to more<br />

places, more quickly and reliably.<br />

“What matters is how well an operation is<br />

run, rather than ownership as such”, says Peter<br />

White. “The issue is more about factors<br />

like reliability. Authorities need to look at the<br />

outcome that’s being produced. Franchising<br />

is a means to an end, rather than an end itself”.<br />

So far, the uptake for franchising remains relatively<br />

restrained, and is still very much in a<br />

period of emergence. In this respect, the situation<br />

is largely untested so far in the UK.<br />

“Both the initial deregulation in the ‘80s and<br />

franchising are, in effect, experiments in how<br />

you run a bus service”, says Peter White. “It’s<br />

a pity that we didn’t experiment with franchising<br />

when buses were deregulated in the<br />

first place, so that we might have had some<br />

long-term conclusions from franchising in<br />

some of the large metropolitan areas outside<br />

London. Instead, we need to allow a couple<br />

more years to make any sensible judgment<br />

on the outcome”.<br />

Alex Byles<br />

Charging<br />

forward<br />

to accelerate the world’s<br />

transition to eMobility<br />

One drives all.<br />

Our Integrated Drive Module<br />

simplifies the electrification<br />

of all kinds of vehicles.<br />

22

IN THE SPOTLIGHT<br />

VOLVO BZR & VOLVO 8900 ELECTRIC<br />

OUT OF TOWN<br />

Two launches in one: Volvo Buses<br />

presented the new Low Entry and High<br />

Floor electric chassis named BZR. The<br />

first model based on the new platform<br />

(sharing batteries with the group’s<br />

electric truck) is the intercity 8900<br />

Electric, which will be bodied by MCV<br />

Exactly one year after the announcement of<br />

the strategic change in its European business<br />

model (stop production of complete buses,<br />

focus on partnerships with bodybuilders),<br />

Volvo Buses is relaunching with the presentation of a<br />

new electric platform for Low Entry and High Floor<br />

buses, effectively marking the company’s debut in the<br />

intercity electric segment. A projection that will see the<br />

Volvo 8900 Electric as its first ‘standard-bearer’: the<br />

new model, based on the new BZR chassis (that joins<br />

the low-floor platform BZL in the OEM’s offer), will be<br />

launched in ‘selected European markets’ in 2025.<br />

Away from Germany<br />

A peripheral but not meaningless third piece of news: the<br />

group is leaving Germany. Both public transport buses<br />

and Volvo coaches will henceforth not be offered on the<br />

Teutonic market, as a consequence of strategic choices.<br />

In Germany, after all, Volvo’s share in the bus and coach<br />

in recent years has always been below 1 percent. An<br />

early concept of the future 8900 Electric was previewed<br />

to the trade press in mid-March within an event orga-<br />

The Volvo 8900 Electric<br />

will land on the European<br />

market in 2025. Size? 12.3<br />

and 14.9 m. A 13-metre<br />

model will soon come. The<br />

LE vehicles have capacity<br />

of 88 and 110 passengers<br />

respectively.<br />

nized by the manufacturer in Gothenburg, in the context<br />

of the brand new World of Volvo convention and<br />

event center (officially opened mid-April). The vehicle<br />

shown to journalists features Volvo bodywork, and is in<br />

fact bound to be a unique example: as is well known,<br />

the company has signed a partnership agreement with<br />

MCV that envisages the production in Egypt of bodies<br />

for electric city buses, starting with the 7900 Electric.<br />

A collaboration that, even at the time of signing, included<br />

an effort in the “development of an electric intercity<br />

platform”. These words have now become a reality.<br />

As we were saying, the Volvo 8900 Electric, which can<br />

be homologated in Class I and II, will land on the European<br />

market no earlier than 2025. Size? There will be<br />

two: 12,296 and 14,896 mm (but the chassis also lends<br />

itself to 9.5-metre and articulated or bi-articulated ver-<br />

24<br />

25

IN THE SPOTLIGHT<br />

Where on the urban BZL<br />

chassis (and the 9700<br />

Electric range) battery<br />

modules bear BorgWarner<br />

(formerly Akasol)<br />

logos, the BZR features<br />

cube-shaped battery<br />

modules signed by Volvo<br />

Penta, combined with<br />

a new 600 Volt cooling<br />

system. What about the<br />

formula? NCA. Volvo is<br />

planning to establish<br />

a production plant for<br />

battery cells.<br />

sions, while the 13-metre model will soon<br />

enrich the range). The vehicle, in Low Entry<br />

configuration, will be offered in two and<br />

three-axle versions, with a capacity of 110<br />

passengers on the longest version, where up<br />

to 57 seats can be fitted. On the 12-metre bus,<br />

the capacity is 88 people (43 of them seated).<br />

A bet on the intercity e-bus market<br />

In terms of design, the front end bears a striking<br />

resemblance to the urban 7900 Electric<br />

(the only difference is the height of the ‘strip’<br />

above the windscreen, which is more pronounced<br />

on the intercity), while the rear end<br />

is the same as on the 8900 with combustion<br />

engine. The bus features all the elements of<br />

Volvo’s active safety platform, including<br />

side sensors for monitoring the blind spot.<br />

They are clearly visible close to the front<br />

wheels. Compliance with R29 and R93 safety<br />

regulations is optional and will only be<br />

standard in certain markets. Mirror cams are<br />

also available on request.<br />

Part of the batteries are located on the<br />

roof. Specifically, two modules, while the<br />

remainder (two or three modules on the<br />

12-metre bus, three or four on the 15-metre<br />

bus) are housed at the rear, under the<br />

seats of the raised part of the bus.<br />

A total of four to five and five to six modules<br />

is available on the two versions respectively<br />

(although the platform allows future customisation<br />

possibilities and space to place up<br />

to eight modules, the Gothenburg engineers<br />

guarantee). Considering a single module capacity<br />

of 90 kWh, two capacities are available<br />

for each ‘size’: 360 or 450 kWh on the<br />

12-metre bus, 450 or 540 on the three-axle.<br />

Of course, in the case of battery equipment<br />

below the maximum available, space is freed<br />

up for a minimum of luggage space: up to<br />

0.9 cubic metres on the 15-metre bus. There<br />

might be two or three doors: the front is<br />

single sliding or double sliding inwards, the<br />

middle door is double or single (in the ‘long’<br />

version) sliding, for the third door (available<br />

on request), there is only single sliding.<br />

The 8900 lends itself to fitting both 3<strong>05</strong>/70<br />

and 295/80 tyres.<br />

What about charging connectors? Customers<br />

can choose one or two, to be placed<br />

on the right side just behind the front door<br />

or on the left at the same height. Rooftop<br />

charging is also possible, in which case<br />

Volvo continues to espouse the OppCharge<br />

paradigm, with pantographs dropping down<br />

from the charger. In this case, charging power<br />

can be up to 450 kW.<br />

A common e-mobility platform<br />

The driveline offers a choice of one or two<br />

motors, developed in-house, connected to<br />

the drive axle via a two-speed transmission,<br />

for a peak power of up to 400 kW.<br />

This is the same powertrain used on the<br />

articulated electric urban 7900.<br />

The BZR platform was presented as the<br />

first to be created through extensive sharing<br />

of components within the group. And<br />

indeed, where on the urban BZL chassis<br />

(and the 9700 Electric range) the modules<br />

bear BorgWarner (formerly Akasol) logos,<br />

the BZR features cube-shaped battery modules<br />

signed by Volvo Penta, combined<br />

with a new 600 Volt cooling system. What<br />

VOLVO 8900 ELECTRIC, THE ID CARD<br />

Length mm 12,296 14,896<br />

Width mm 2,550 2,550<br />

Height mm 3,625 3,625<br />

Wheelbase mm 6,100 7,000 - 1,400<br />

Front overhang mm 2,899 2,899<br />

Rear overhang mm 3,297 3,597<br />

Seats max n 43 57<br />

Passenger capacity max n 88 110<br />

Tyres 3<strong>05</strong>/70 R22.5 - 295/80 R22.5 3<strong>05</strong>/70 R22.5 - 295/80 R22.5<br />

Motor supplier Volvo Volvo<br />

Output max / cont. kW 2x200 / 2x167 2x200 / 2x167<br />

Torque max / cont. Nm (at wheel) 31,000 31,000<br />

Front axle Volvo RFS-L Volvo RFS-L<br />

Rear axle Volvo RS1228C Volvo RS1228C<br />

Battery supplier Volvo Penta Volvo Penta<br />

Battery formula NCA NCA<br />

Battery capacity max kWh 450 540<br />

Energy density Wh/kg 168 168<br />

Charging technology Plug-in / OppCharge Plug-in / OppCharge<br />

about the formula? NCA. It is related to the<br />

more common NMC: the only difference is<br />

the use of aluminium instead of manganese.<br />

They are the same as those fitted to the<br />

BEV truck range. In any case, the future<br />

opens up interesting questions, since, at a<br />

group level, Volvo is planning to establish a<br />

production plant for battery cells (this is not<br />

a typo: it will not be a matter of assembling<br />

modules from externally purchased cells,<br />

as is prevalent in Europe to date). In the<br />

meantime, Proterra’s battery business has<br />

been officially taken over by the Swedish<br />

group, which, however, plans to use it only<br />

for the US market.<br />

Focus on climate<br />

The Volvo 8900 Electric can be equipped<br />

with an extensive suite of active safety systems,<br />

now in its third generation, developed<br />

in-house by Volvo, whose notifications<br />

are fully integrated into the cockpit: from<br />

Forward Collision Warning to Intelligent<br />

Speed Assist, from Blind Spot Monitoring<br />

to Lane Keeping Support and Tyre Pressure<br />

Monitoring. Let’s talk about air conditioning.<br />

It is performed mainly by the Valeo Revo-E-<br />

HP R744 system, which is capable of 28 kW<br />

in cooling and 25 in heating. If needed in heating,<br />

two Thermo HV units, also by Valeo,<br />

can be added to it for an additional 24 kW.<br />

For colder climates, a 23 kW fuel-powered<br />

system remains available.<br />

26<br />

27

IN THE SPOTLIGHT<br />

SOLARIS URBINO 12 ELECTRIC<br />

I’M UP TO DATE<br />

At Mobility Move in Berlin Solaris<br />

unveiled the ‘new’ 12-metre<br />

electric Urbino, the company’s<br />

best-seller, with a modular<br />

driveline and new batteries<br />

The New Solaris Urbino, a highly successful<br />

model launched eight years ago, have been<br />

available in a BEV version right from the<br />

start (while the previous-generation electric<br />

Urbino had already been presented in 2011), allowing<br />

the dynamic Polish manufacturer to gain great experience<br />

in this type of alternative drive. With more than<br />

2,500 e-buses delivered, Solaris is today the leading<br />

European player in the zero-emission bus sector, with<br />

a clear desire to continue to update the product from<br />

the technical point of view, thus increasing the possible<br />

choices and customisation.<br />

For all tastes<br />

As an alternative to the ZF AxTrax e-powered axle, a<br />

central motor from Austria’s TSA (model TMF35-28-<br />

4) or ZF’s CeTrax Cx220 110B have been available for<br />

a few years now, so that supporters of one or the other<br />

solution can be satisfied. The performance of the three<br />

variants ranges from 160 kW of power for the TSA,<br />

to 220 of the CeTrax and up to 2x125 kW of the ZF’s<br />

“motor wheels” (with as much as 22,000 Nm of total<br />

maximum torque downstream of the integrated hub reduction).<br />

If one of the central motors is chosen, one can<br />

logically intervene on the transmission ratio, opting for<br />

a greater or lesser reduction depending on the mission<br />

profile required. The position of the central motor is,<br />

curiously enough, in front of the rear deck, on the lefthand<br />

side; a solution that requires a forward extension<br />

of the base close to the wheels and the positioning of a<br />

rearward-facing two-seater behind the disabled seat. As<br />

for the drive, both solutions have their pros and cons.<br />

Among the advantages of the motorised axle is certainly<br />

the smaller internal size. In favour of the mid-axle<br />

motor, on the other hand, there is quieter operation and<br />

decidedly easier maintenance, as well as (it seems)<br />

greater efficiency in energy recovery during braking.<br />

In any case, letting the customer choose the preferred<br />

The rear structure has<br />

changed completely. The<br />

engine tower inherited from<br />

thermal vehicles, which<br />

housed part of the batteries,<br />

the inverter and the<br />

cooling units are gone. The<br />

batteries are all at the roof.<br />

28<br />

29

IN THE SPOTLIGHT<br />

The collaboration with<br />

Impact Clean Power<br />

Technology has led to the<br />

development of new NMCbased<br />

High Energy 100<br />

batteries, with a capacity<br />

of 102.9 kWh per module,<br />

featuring the same size<br />

of the previously fitted<br />

range, capable of 88 kWh.<br />

The weight is also similar<br />

(just about ten kilos<br />

more), for a 14 percent<br />

benefit in terms of<br />

energy capacity.<br />

driveline already puts Solaris in an advantageous<br />

position compared to competitors who<br />

go their own way, sometimes without being<br />

sure of which solution is actually the best.<br />

ID CARD<br />

Length mm 12,000<br />

Width mm 2,550<br />

Height mm 3,300<br />

Wheelbase mm 5,900<br />

Front overhang mm 2,700<br />

Rear overhang mm 3,400<br />

Passenger capacity n. 100 (with 300 kWh battery and GVW of 20t)<br />

Seats max n. 41<br />

Doors n. 2 - 3<br />

Tyres 275/70 R 22.5<br />

Motor<br />

ZF AxTrax / ZF CeTrax / TSA<br />

Motor type<br />

In-wheel / central / central<br />

Peak output kW 2 x 125 / 200 / 160<br />

Battery model High Energy 100*<br />

Battery supplier<br />

Impact Clean Power Technologies*<br />

Battery formula<br />

NMC*<br />

Battery capacity kWh<br />

up to 600 kWh (6 modules)<br />

*also available: LFP modules (140 kWh each) and LTO (30 kWh per module)<br />

The new generation<br />

Let’s talk about the updates introduced at<br />

VDV-backed Mobility Move exhibition,<br />

held in Berlin at the beginning of March.<br />

The increasingly strong collaboration with<br />

Impact Clean Power Technology, a Warsaw-based<br />

company specialising in batteries<br />