88-96**news ital-ingl 2¡ bozza - Italcementi Group

88-96**news ital-ingl 2¡ bozza - Italcementi Group

88-96**news ital-ingl 2¡ bozza - Italcementi Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

operativo lordo di <strong>Italcementi</strong><br />

Spa, pari a 247,8 milioni di<br />

euro (206,6 milioni nel 2000),<br />

ha registrato un aumento del<br />

19,9% e rappresenta il 29,5%<br />

dei ricavi (27,6% nell’esercizio<br />

precedente). Il risultato<br />

operativo, 185,3 milioni di<br />

euro (109,4 milioni),<br />

rappresenta il 22,1% dei<br />

ricavi.<br />

■■■■■■<br />

T<br />

he positive trend<br />

continues despite the<br />

slowdown in the world<br />

economy and the uncertainty<br />

affecting markets.<br />

In the first quarter of 2002,<br />

overall <strong>Group</strong> performance<br />

improved compared with the<br />

already positive performance<br />

of the previous year’s first<br />

quarter, in line with the results<br />

recorded at year-end 2001.<br />

In financial year 2001, despite<br />

the unfavorable trend in<br />

energy costs, <strong>Italcementi</strong><br />

<strong>Group</strong> reported a significant<br />

improvement in income from<br />

industrial operations, due to<br />

increased sales and the<br />

successful implementation of<br />

a cost-cutting program.<br />

First quarter 2002<br />

In the first quarter of the year,<br />

the <strong>Italcementi</strong> <strong>Group</strong><br />

recorded net sales of €937.7<br />

million, an increase of 3.3%<br />

compared to the same period<br />

in 2001, due to the growth in<br />

operations (+1.3%), the<br />

enlargement of the<br />

consolidation area (+1.3%), as<br />

well as to translation effects<br />

(+0.7%).<br />

The main contribution to the<br />

increase in net sales came<br />

from the countries in the<br />

European Union, principally<br />

Italy, while the largest<br />

decreases were recorded in<br />

Turkey and, because of low<br />

price levels, Thailand.<br />

First-quarter performance is<br />

not generally representative of<br />

performance for the year as a<br />

whole because of the nature<br />

of the <strong>Group</strong>’s business<br />

sectors.<br />

In the first quarter gross<br />

operating profit (€176.7<br />

million) and operating income<br />

(€84 million) fell by 1.8% and<br />

2.5% respectively. The<br />

increase in operating costs,<br />

although limited by industrial<br />

efficiency improvement plans,<br />

was aggravated by the<br />

prolonged strike in Ciments<br />

Calcia’s (France) cement<br />

plants. The results were also<br />

affected by the fall in average<br />

unit net sales in Thailand. On<br />

the other hand, performance<br />

was good in Italy and the<br />

other countries in the<br />

European Union and in North<br />

America.<br />

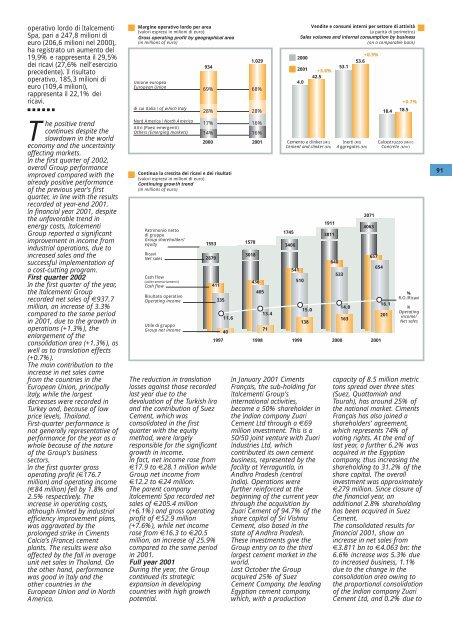

Margine operativo lordo per area<br />

(valori espressi in milioni di euro)<br />

Gross operating profit by geographical area<br />

(in millions of euro)<br />

Unione europea<br />

European Union<br />

di cui Italia / of which Italy<br />

Nord America / North America<br />

Altri (Paesi emergenti)<br />

Others (Emerging markets)<br />

Continua la crescita dei ricavi e dei risultati<br />

(valori espressi in milioni di euro)<br />

Continuing growth trend<br />

(in millions of euro)<br />

Patrimonio netto<br />

di gruppo<br />

<strong>Group</strong> shareholders’<br />

equity<br />

Ricavi<br />

Net sales<br />

Cash flow<br />

(utile+ammortamenti)<br />

Cash flow<br />

Risultato operativo<br />

Operating income<br />

Utile di gruppo<br />

<strong>Group</strong> net income<br />

934<br />

69%<br />

28%<br />

17%<br />

14%<br />

1553<br />

2879<br />

411<br />

The reduction in translation<br />

losses against those recorded<br />

last year due to the<br />

devaluation of the Turkish lira<br />

and the contribution of Suez<br />

Cement, which was<br />

consolidated in the first<br />

quarter with the equity<br />

method, were largely<br />

responsible for the significant<br />

growth in income.<br />

In fact, net income rose from<br />

€17.9 to €28.1 million while<br />

<strong>Group</strong> net income from<br />

€12.2 to €24 million.<br />

The parent company<br />

<strong>Italcementi</strong> Spa recorded net<br />

sales of €205.4 million<br />

(+6.1%) and gross operating<br />

profit of €52.9 million<br />

(+7.6%), while net income<br />

rose from €16.3 to €20.5<br />

million, an increase of 25.9%<br />

compared to the same period<br />

in 2001.<br />

Full year 2001<br />

During the year, the <strong>Group</strong><br />

continued its strategic<br />

expansion in developing<br />

countries with high growth<br />

potential.<br />

335<br />

11.6<br />

40<br />

1578<br />

3018<br />

1.029<br />

68%<br />

28%<br />

16%<br />

16%<br />

2000 2001<br />

436<br />

405<br />

13.4<br />

71<br />

1745<br />

3406<br />

541<br />

Vendite e consumi interni per settore di attività<br />

(a parità di perimetro)<br />

Sales volumes and internal consumption by business<br />

(on a comparable basis)<br />

2000<br />

2001<br />

Cemento e clinker (Mt)<br />

Cement and clinker (Mt)<br />

510<br />

15.0<br />

1911<br />

3811<br />

2071<br />

4063<br />

1997 1998 1999 2000 2001<br />

4.0<br />

138<br />

+3.8%<br />

42.5<br />

In January 2001 Ciments<br />

Français, the sub-holding for<br />

<strong>Italcementi</strong> <strong>Group</strong>’s<br />

international activities,<br />

became a 50% shareholder in<br />

the Indian company Zuari<br />

Cement Ltd through a €69<br />

million investment. This is a<br />

50/50 joint venture with Zuari<br />

Industries Ltd, which<br />

contributed its own cement<br />

business, represented by the<br />

facility at Yerraguntla, in<br />

Andhra Pradesh (central<br />

India). Operations were<br />

further reinforced at the<br />

beginning of the current year<br />

through the acquisition by<br />

Zuari Cement of 94.7% of the<br />

share cap<strong>ital</strong> of Sri Vishnu<br />

Cement, also based in the<br />

state of Andhra Pradesh.<br />

These investments give the<br />

<strong>Group</strong> entry on to the third<br />

largest cement market in the<br />

world.<br />

Last October the <strong>Group</strong><br />

acquired 25% of Suez<br />

Cement Company, the leading<br />

Egyptian cement company,<br />

which, with a production<br />

640<br />

53.1<br />

Inerti (Mt)<br />

Aggregates (Mt)<br />

533<br />

14.0<br />

163<br />

+0.9%<br />

53.6<br />

657<br />

Calcestruzzo (Mm 3 )<br />

Concrete (Mm 3 )<br />

654<br />

18.4 18.5<br />

16.1<br />

201<br />

+0.7%<br />

%<br />

R.O./Ricavi<br />

%<br />

Operating<br />

income/<br />

Net sales<br />

capacity of 8.5 million metric<br />

tons spread over three sites<br />

(Suez, Quattamiah and<br />

Tourah), has around 25% of<br />

the national market. Ciments<br />

Français has also joined a<br />

shareholders’ agreement,<br />

which represents 74% of<br />

voting rights. At the end of<br />

last year, a further 6.2% was<br />

acquired in the Egyptian<br />

company, thus increasing the<br />

shareholding to 31.2% of the<br />

share cap<strong>ital</strong>. The overall<br />

investment was approximately<br />

€279 million. Since closure of<br />

the financial year, an<br />

additional 2.8% shareholding<br />

has been acquired in Suez<br />

Cement.<br />

The consolidated results for<br />

financial 2001, show an<br />

increase in net sales from<br />

€3.811 bn to €4.063 bn: the<br />

6.6% increase was 5.3% due<br />

to increased business, 1.1%<br />

due to the change in the<br />

consolidation area owing to<br />

the proportional consolidation<br />

of the Indian company Zuari<br />

Cement Ltd, and 0.2% due to<br />

91