Modelli per il Calcolo del Value at Risk

Modelli per il Calcolo del Value at Risk

Modelli per il Calcolo del Value at Risk

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

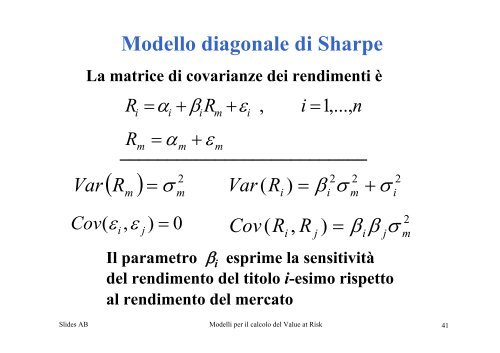

La m<strong>at</strong>rice di covarianze dei rendimenti è<br />

Ri = αi<br />

+ βiRm<br />

+ εi<br />

Slides AB <strong>Mo<strong>del</strong>li</strong> <strong>per</strong> <strong>il</strong> calcolo <strong>del</strong> <strong>Value</strong> <strong>at</strong> <strong>Risk</strong><br />

,<br />

i = 1,...,<br />

n<br />

Rm = α m + ε m<br />

__________________________<br />

( ) 2<br />

R =<br />

Var σ<br />

m<br />

Cov( ε , ε ) =<br />

i<br />

Mo<strong>del</strong>lo diagonale di Sharpe<br />

j<br />

m<br />

0<br />

Var σ σ<br />

2 2 2<br />

( Ri<br />

) = β i m + i<br />

2<br />

Cov( Ri<br />

, R j ) = β β σ i j m<br />

Il parametro β i esprime la sensitività<br />

<strong>del</strong> rendimento <strong>del</strong> titolo i-esimo rispetto<br />

al rendimento <strong>del</strong> merc<strong>at</strong>o<br />

41