Raccolta delle documentazioni necessarie per l ... - Centro Estero

Raccolta delle documentazioni necessarie per l ... - Centro Estero

Raccolta delle documentazioni necessarie per l ... - Centro Estero

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

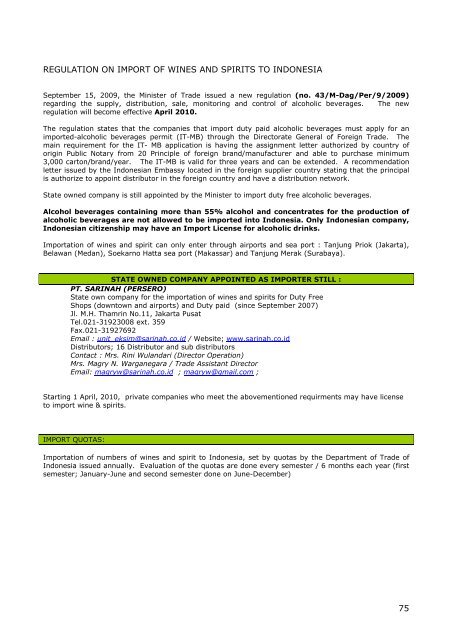

REGULATION ON IMPORT OF WINES AND SPIRITS TO INDONESIA<br />

September 15, 2009, the Minister of Trade issued a new regulation (no. 43/M-Dag/Per/9/2009)<br />

regarding the supply, distribution, sale, monitoring and control of alcoholic beverages. The new<br />

regulation will become effective April 2010.<br />

The regulation states that the companies that import duty paid alcoholic beverages must apply for an<br />

imported-alcoholic beverages <strong>per</strong>mit (IT-MB) through the Directorate General of Foreign Trade. The<br />

main requirement for the IT- MB application is having the assignment letter authorized by country of<br />

origin Public Notary from 20 Principle of foreign brand/manufacturer and able to purchase minimum<br />

3,000 carton/brand/year. The IT-MB is valid for three years and can be extended. A recommendation<br />

letter issued by the Indonesian Embassy located in the foreign supplier country stating that the principal<br />

is authorize to appoint distributor in the foreign country and have a distribution network.<br />

State owned company is still appointed by the Minister to import duty free alcoholic beverages.<br />

Alcohol beverages containing more than 55% alcohol and concentrates for the production of<br />

alcoholic beverages are not allowed to be imported into Indonesia. Only Indonesian company,<br />

Indonesian citizenship may have an Import License for alcoholic drinks.<br />

Importation of wines and spirit can only enter through airports and sea port : Tanjung Priok (Jakarta),<br />

Belawan (Medan), Soekarno Hatta sea port (Makassar) and Tanjung Merak (Surabaya).<br />

STATE OWNED COMPANY APPOINTED AS IMPORTER STILL :<br />

PT. SARINAH (PERSERO)<br />

State own company for the importation of wines and spirits for Duty Free<br />

Shops (downtown and airports) and Duty paid (since September 2007)<br />

Jl. M.H. Thamrin No.11, Jakarta Pusat<br />

Tel.021-31923008 ext. 359<br />

Fax.021-31927692<br />

Email : unit_eksim@sarinah.co.id / Website; www.sarinah.co.id<br />

Distributors; 16 Distributor and sub distributors<br />

Contact : Mrs. Rini Wulandari (Director O<strong>per</strong>ation)<br />

Mrs. Magry N. Warganegara / Trade Assistant Director<br />

Email: magryw@sarinah.co.id ; magryw@gmail.com ;<br />

Starting 1 April, 2010, private companies who meet the abovementioned requirments may have license<br />

to import wine & spirits.<br />

IMPORT QUOTAS:<br />

Importation of numbers of wines and spirit to Indonesia, set by quotas by the Department of Trade of<br />

Indonesia issued annually. Evaluation of the quotas are done every semester / 6 months each year (first<br />

semester; January-June and second semester done on June-December)<br />

75