Raccolta delle documentazioni necessarie per l ... - Centro Estero

Raccolta delle documentazioni necessarie per l ... - Centro Estero

Raccolta delle documentazioni necessarie per l ... - Centro Estero

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

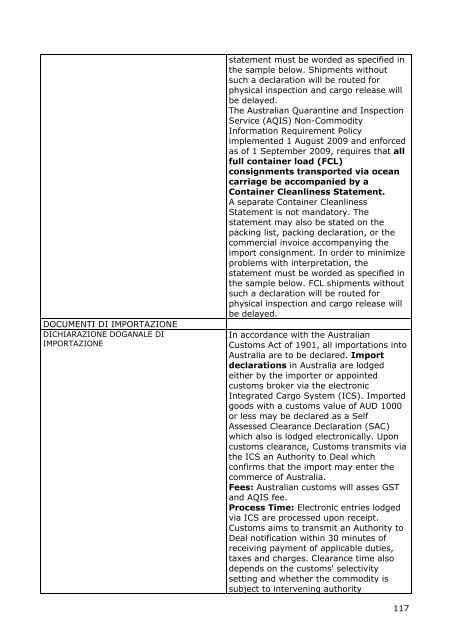

DOCUMENTI DI IMPORTAZIONE<br />

DICHIARAZIONE DOGANALE DI<br />

IMPORTAZIONE<br />

statement must be worded as specified in<br />

the sample below. Shipments without<br />

such a declaration will be routed for<br />

physical inspection and cargo release will<br />

be delayed.<br />

The Australian Quarantine and Inspection<br />

Service (AQIS) Non-Commodity<br />

Information Requirement Policy<br />

implemented 1 August 2009 and enforced<br />

as of 1 September 2009, requires that all<br />

full container load (FCL)<br />

consignments transported via ocean<br />

carriage be accompanied by a<br />

Container Cleanliness Statement.<br />

A separate Container Cleanliness<br />

Statement is not mandatory. The<br />

statement may also be stated on the<br />

packing list, packing declaration, or the<br />

commercial invoice accompanying the<br />

import consignment. In order to minimize<br />

problems with interpretation, the<br />

statement must be worded as specified in<br />

the sample below. FCL shipments without<br />

such a declaration will be routed for<br />

physical inspection and cargo release will<br />

be delayed.<br />

In accordance with the Australian<br />

Customs Act of 1901, all importations into<br />

Australia are to be declared. Import<br />

declarations in Australia are lodged<br />

either by the importer or appointed<br />

customs broker via the electronic<br />

Integrated Cargo System (ICS). Imported<br />

goods with a customs value of AUD 1000<br />

or less may be declared as a Self<br />

Assessed Clearance Declaration (SAC)<br />

which also is lodged electronically. Upon<br />

customs clearance, Customs transmits via<br />

the ICS an Authority to Deal which<br />

confirms that the import may enter the<br />

commerce of Australia.<br />

Fees: Australian customs will asses GST<br />

and AQIS fee.<br />

Process Time: Electronic entries lodged<br />

via ICS are processed upon receipt.<br />

Customs aims to transmit an Authority to<br />

Deal notification within 30 minutes of<br />

receiving payment of applicable duties,<br />

taxes and charges. Clearance time also<br />

depends on the customs' selectivity<br />

setting and whether the commodity is<br />

subject to intervening authority<br />

117