L a p o r a n T a h u n a n 2 0 0 0 A n n u a l R e p o r t - ChartNexus

L a p o r a n T a h u n a n 2 0 0 0 A n n u a l R e p o r t - ChartNexus

L a p o r a n T a h u n a n 2 0 0 0 A n n u a l R e p o r t - ChartNexus

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

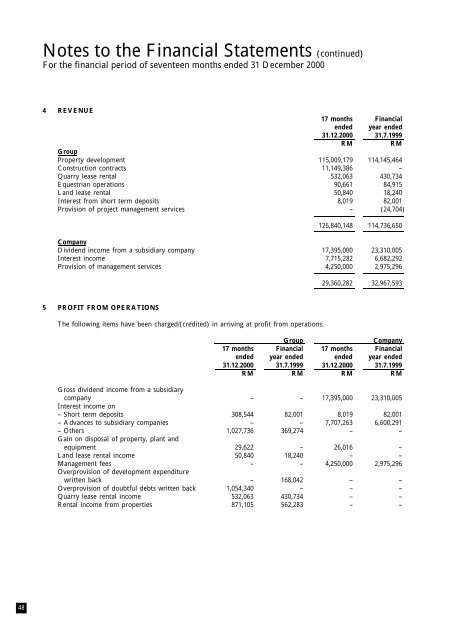

Notes to the Financial Statements (continued)For the financial period of seventeen months ended 31 December 20004 REVENUE17 months Financialended year ended31.12.2000 31.7.1999RMRMGroupProperty development 115,009,179 114,145,464Construction contracts 11,149,386 –Quarry lease rental 532,063 430,734Equestrian operations 90,661 84,915Land lease rental 50,840 18,240Interest from short term deposits 8,019 82,001Provision of project management services – (24,704)126,840,148 114,736,650CompanyDividend income from a subsidiary company 17,395,000 23,310,005Interest income 7,715,282 6,682,292Provision of management services 4,250,000 2,975,29629,360,282 32,967,5935 PROFIT FROM OPERATIONSThe following items have been charged/(credited) in arriving at profit from operations:GroupCompany17 months Financial 17 months Financialended year ended ended year ended31.12.2000 31.7.1999 31.12.2000 31.7.1999RM RM RM RMGross dividend income from a subsidiarycompany – – 17,395,000 23,310,005Interest income on– Short term deposits 308,544 82,001 8,019 82,001– Advances to subsidiary companies – – 7,707,263 6,600,291– Others 1,027,736 369,274 – –Gain on disposal of property, plant andequipment 29,622 – 26,016 –Land lease rental income 50,840 18,240 – –Management fees – – 4,250,000 2,975,296Overprovision of development expenditurewritten back – 168,042 – –Overprovision of doubtful debts written back 1,054,340 – – –Quarry lease rental income 532,063 430,734 – –Rental income from properties 871,105 562,283 – –48