SmartMedic 100 - MAA

SmartMedic 100 - MAA

SmartMedic 100 - MAA

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>SmartMedic</strong> <strong>100</strong>KAMI MEMBANTU ANDA MERANCANG SESUATU YANG TIDAK DIRANCANG…Kemajuan dalam teknologi perubatan perlu dibayar dengan harga yang tinggi. Ditambah pula dengan kossara hidup dan pendidikan anak-anak, anda dan orang yang tersayang mungkin terpaksa menanggungkesempitan kewangan jika anda tidak merancang perbelanjaan hospital. Kebenarannya, pembedahan yangtidak diduga dan tidak dapat dielakkan boleh menghabiskan keseluruhan simpanan anda.Dengan <strong>SmartMedic</strong> <strong>100</strong>, kami menawarkan anda kemasukan hospital yang dijamin dan menguruskansegala bil-bil perubatan sejurus selepas anda keluar dari panel hospital kami. <strong>SmartMedic</strong> <strong>100</strong> memberikananda dan keluarga anda satu ketenangan dengan perlindungan yang komprehensif dan berkualiti terutamasekali bila anda memerlukannya.<strong>SmartMedic</strong> <strong>100</strong> bekerjasama dengan salah sebuah ‘Managed Care Organization’ iaitu Metronic iCaresServices. Metronic iCares Services menyediakan anda dengan bantuan percuma 24 jam bagi memudahkananda;• Kemasukan ke Hospital• Penyelesaian terus ke atas bil-bil hospital sejurus selepas keluar hospital*<strong>SmartMedic</strong> <strong>100</strong> juga menyediakan perlindungan yang tidak ternilai sehingga umur 80 tahun! Diri andadijamin dengan perlindungan ke atas sesuatu yang tidak dapat dielakkan apabila anda memperbaharuipelan ini tertakluk kepada had seumur hidup. Di samping itu, <strong>SmartMedic</strong> <strong>100</strong> juga menawarkan faedahKhairat Kematian** sebanyak RM5,000, yang mana akan dibayar jika berlakunya kematian semua sebab.Tambahan lagi, Smartmedic <strong>100</strong> dijamin pembaharuan sehingga berumur 80 tahun.Perlindungan di Seluruh Dunia…Anda boleh melancong dengan penuh ketenangan di mana anda sedia maklum bahawa anda akan dilindungidi mana-mana sahaja di serata dunia. Perkhidmatan-perkhidmatan yang disediakan adalah seperti berikut:• Program Bantuan Perubatan Antarabangsa – pemindahan perubatan kecemasan, penyeliaanpenghantaran balik dari segi perubatan, penghantaran ubtat yang tidak boleh didapati di pasarantempatan, penghantaran balik mayat, kepulangan anak-anak tanggungan, 24 jam khidmat bantuanuntuk rujukan perubatan dan sebagainya.• Bantuan Perjalanan*** - menyediakan maklumat berkaitan inokulasi, keperluan visa, bantuan penemuankehilangan bagasi, dokumen dan barang-barang persendirian, maklumat cuaca, maklumat pertukaranasing, aturan dan informasi penerbangan, rujukan perundangan, rujukan penterjemah dan penyampaianmesej kecemasan.• Bantuan Kereta***- penundaan kecemasan 24 jam dan pembaikan kecil di tepi jalan, bantuan keretasewa, bantuan urusan penginapan hotel dan rujukan kepada pusat-pusat perkhidmatan yang lain.• Bantuan Kediaman***- perkhidmatan membaiki paip, tukang cuci, pembaikan am dan kawalan seranggaperosak.* Tertakluk kepada kelayakan dan faedah had pelan. Sila rujuk kepada jadual faedah.** Faedah Khairat Kematian hanya didapati pada Pelan Asas <strong>SmartMedic</strong> <strong>100</strong> sahaja.*** Khidmat rujukan sahaja. Apa-apa perbelanjaan dan/atau tanggungan akan ditanggung oleh pemilik sijil. Segala khidmatbantuan disediakan oleh pihak ketiga and penyambungan khidmat bantuan tersebut adalah tertakluk kepada perjanjian diantaraPengendali Takaful dan pengendali khidmat bantuan.Ingin mengetahui dengan lebih lanjut?Sila hubungi perunding <strong>MAA</strong> Takaful hari ini untuk sebarang khidmat nasihat di atas pelan yang paling sesuaidengan kehendak anda untuk pertanyaan selanjutnya, sila hubungi Pusat Panggilan kami di 603 6287 6666atau emel kepada kami di info@maatakaful.com.my

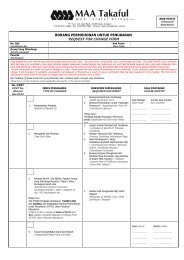

<strong>SmartMedic</strong> <strong>100</strong>Jadual FaedahPelan 1 (RM) Pelan 2 (RM) Pelan 3 (RM) Pelan 4 (RM)HAD TAHUNAN KESELURUHAN 50,000 <strong>100</strong>,000 150,000 200,000HAD SEUMUR HIDUP 150,000 300,000 450,000 600,000Khairat Kematian* (SEMUA SEBAB) 5,000Faedah HospitalBilik Hospital & Makan (maks. 200 harisetahun)150 200 300 450Unit Rawatan Rapi (maks. 60 hari setahun)Bekalan & Khidmat HospitalYuran PembedahanYuran Pakar BiusBilik BedahUjian Diagnostik Pra-Hospital(Dalam masa 60 hari sebelum kemasukan)Seperti Yang DicajRundingan Pakar Pra-Hospital(Dalam masa 60 hari sebelum kemasukan)Lawatan Pakar Perubatan Dalam Hospital(mak. 200 hari setiap tahun)Rawatan Selepas Penghospitalan(Dalam masa 30 hari dari tarikh keluar)Faedah Pesakit LuarRawatan Pesakit Luar bagi Kemalangan danKecemasan(Dalam masa 24 jam dan rawatan susulansehingga mak. 31 hari)Seperti Yang DicajRawatan Fisioterapi Pesakit Luar(Dalam masa 90 hari dari tarikh keluarhospital/pembedahan)Bayaran Ambulans 300 400 500 750Rawatan Dialisis Buah Pinggang Pesakit Luar(setiap tahun)12,000 18,000 25,000 35,000Rawatan Kanser Pesakit Luar (setiap tahun) 12,000 18,000 25,000 35,000Faedah-Faedah Yang LainEkaun Tunai Harian di Hospital Kerajaan(maks. 200 hari setiap tahun)50 60 75 85Penjagaan Kejururawatan di Rumah(Maks. Setiap hilang upaya)500 750 1,000 1,500Manfaat Penjaga Harian bagi Kanak-KanakYang Dilindungi(Maks. Setiap hilang upaya)200 250 300 400Yuran Laporan Perubatan 80 80 <strong>100</strong> <strong>100</strong>Cukai Perkhidmatan KerajaanSeperti Yang DicajNota:* Faedah Khairat Kematian hanya didapati pada Pelan Asas <strong>SmartMedic</strong> <strong>100</strong> sahaja.

<strong>SmartMedic</strong> <strong>100</strong>• Penyalahgunaan alkohol dan dadah atau yang berkaitan dengannya.• Pembedahan kosmetik, elektif atau plastic, ataupun keabnormalan atau kecacatan kongenital• Rawatan pergigian kecuali diperlukan kerana kecederaan akibat kemalangan• Pemeriksaan rutin kesihatan dan apa-apa pemeriksaan yang tak melibatkan kemasukan ke hospital• Rawatan yang tidak perlu dari segi perubatan• Pembelanjaan perubatan yang ditanggung oleh mana-mana badan/organisasi atau program perubatandari mana-mana syarikat insurans dan Takaful.• Penjagaan peribadi, rehat pulih atau jagaan kebersihan, dadah yang tidak dibenarkan, kemabukan,pensterilan, penyakit venereal dan sekuelnya, AIDS (Sindrom Kurang Daya Tahan Penyakit) atau ARC(Kompleks Berkaitan AIDS) dan penyakit berkaitan HIV, dan apa-apa penyakit berjangkit yang memerlukankuarantin oleh undang-undangNota: Pengecualian di atas tidak menyeluruh and segala bentuk rujukan hendaklah dirujuk kepadaklausa pengecualian di dalam sijil kontrak.Tarikh Tamat SijilSijil <strong>SmartMedic</strong> <strong>100</strong> akan tamat jika:1. Caruman anda tidak dibayar lebih dari 31 hari.2. Pemegang Sijil telah mencapai umur 80 tahun.3. Selepas pembayaran untuk Khairat Kematian.4. Jumlah faedah yang dibayar kepada Orang Yang Dilindungi telah melebihi Had Seumur Hidup.5. Penamatan tempoh sijil asas (terpakai untuk sijil rider sahaja).NOTA• Menaiktaraf Bayaran Bersama Bilik dan Makan – Jika Orang Yang Dilindungi dimasukkan ke dalamhospital padar kadar Bilik & Makan yang lebih tinggi daripada manfaat yang dia layak. Orang YangDilindungi hendaklah menanggung 10% daripada jumlah manfaat yang lain yang telah diterangkandalam jadual faedah bagi setiap tuntutan.• Faedah Keseluruhan yang berbayar dalam masa setahun hendaklah tidak melebihi Had TahunanKeseluruhan.• Faedah Keseluruhan yang berbayar seumur hidup adalah tertakluk kepada Had Seumur Hidup.• Brosur ini adalah untuk maklumat am sahaja. Ia bukanlah sijil perlindungan Takaful.• Terma-terma dan syarat-syarat yang tepat boleh dirujuk kepada sijil perlindungan Takaful.

<strong>SmartMedic</strong> <strong>100</strong>TP213/1/L

<strong>SmartMedic</strong> <strong>100</strong>WE HELP YOU PLAN THE UNPLANNED...Advances in medical technology come at a price; a very high one. Add to that the costs of living and children’seducation, and you and your loved ones could suffer tremendous financial hardship if you do not plan for yourhospitalization expenses. The truth is, a completely unforeseen and unavoidable operation can sometimes dryup our entire savings.With <strong>SmartMedic</strong> <strong>100</strong>, we offer you a guaranteed hospital admission and take care of your medical bills upondischarge at our panel hospitals. <strong>SmartMedic</strong> <strong>100</strong> gives you and your family a peace of mind with high qualityand comprehensive coverage when you need it most!<strong>SmartMedic</strong> <strong>100</strong> is smartly engaged with a reliable and trusted Managed Care Organisation namely MetroniciCares Services. The Metronic iCares Services is providing you with 24 hour hassle free assistance:• In your admission to the hospital• Direct settlement of your hospital bill upon discharge*<strong>SmartMedic</strong> <strong>100</strong> also provides you invaluable coverage up to age 80 years old! Assure yourself of protectionagainst the unexpected when you renew your coverage subject to your lifetime limit. Apart from that,<strong>SmartMedic</strong> <strong>100</strong> also provides you a Funeral Expenses** benefit of RM5,000, which is payable upon deathdue to any causes.In addition, Smartmedic <strong>100</strong> is guaranteed renewable up to age 80.Worldwide Coverage…You can travel with peace of mind, knowing that you are protected anywhere in the world. The services are:• International Medical Assistance – emergency medical evacuation, medically supervised repatriation,dispatch of essential medication not available locally, repatriation mortal remains, return of dependentchildren, 24 hour assistance on medical referrals and etc• Travel Assistance*** - provides information concerning inoculation, visa requirement assistance, assistsin location of lost luggage, documents and personal items, weather information, foreign exchangeinformation, arrangement of flights and flights information, legal referral to interpreter/translator andemergency message relay.• Car Assistance***- 24 hours emergency towing and minor roadside repair, car rental assistance,arrangement of hotel accommodation and referral to service centre.• Home Assistance***- plumbing, locksmith, general repair and pest control assistance.* Subject to eligibility and benefit limit of the plan. Please refer to the schedule of benefit.** Funeral Expenses benefit is applicable to <strong>SmartMedic</strong> <strong>100</strong> Basic Plan only.*** Referral services only. Any expenses and/ or liabilities incurred shall be borne by certificate owner. These services are providedby a third party and continuation of these services is subject to the agreement between the Takaful operator and servicesprovider.Need to know more?Just call your <strong>MAA</strong> Takaful consultant today for advice on the most suitable plan that meet your needs. Forfurther enquiries, please call our Call Center at 603 6287 6666 or email us at info@maatakaful.com.my

<strong>SmartMedic</strong> <strong>100</strong>Schedule of BenefitPlan 1 (RM) Plan 2 (RM) Plan 3 (RM) Plan 4 (RM)ANNUAL LIMIT 50,000 <strong>100</strong>,000 150,000 200,000LIFE TIME LIMIT 150,000 300,000 450,000 600,000Funeral Expenses* (ALL CAUSES) 5,000Hospital BenefitsHospital Room & Board (max 200 days perannum)150 200 300 450Intensive Care unit (max 60 days per annum)Hospital Supplies & ServicesSurgical FeesAnesthetists FeesOperating TheatrePre-Hospital Diagnostic Test(within 60 days prior to admission)As ChargedPre- Hospital Specialist Consultation(within 60 days prior to admission)In-Hospital physician Visit(max. 200 days per annum)Post Hospitalisation Treatment(within 31 days from discharge)Out Patient BenefitsEmergency Accidental Outpatient Treatment(within 24 hours and follow up treatment to amax. of 31 days)As ChargedOut-Patient Physiotherapy Treatment(within 90 days from discharge/ surgery)Ambulance Fees 300 400 500 750Out- Patient Kidney Dialysis Treatment(per annum)12,000 18,000 25,000 35,000Out-patient Cancer Treatment (per annum) 12,000 18,000 25,000 35,000Other BenefitsDaily Cash Allowance at Government Hospital(max. 200 days per annum)50 60 75 85Home Nursing Care (max. per disability) 500 750 1,000 1,500Insured Child’s Daily Guardian Benefit(max. per disability)200 250 300 400Medical report Fees 80 80 <strong>100</strong> <strong>100</strong>Government Service TaxAs ChargedNote:* The Funeral Expenses is applicable to <strong>SmartMedic</strong> <strong>100</strong> Basic Plan only.

<strong>SmartMedic</strong> <strong>100</strong>Table of Indicative ContributionsAnnual ContributionAge Band(last birthday)Male<strong>SmartMedic</strong> <strong>100</strong> (Basic Plan)FemalePlan 1 Plan 2 Plan 3 Plan 4 Plan 1 Plan 2 Plan 3 Plan 430 days – 5 665 844 1,077 1,465 665 844 1,077 1,4656 – 15 387 484 610 820 387 484 610 82016 – 21 553 699 888 1,201 577 730 929 1,25822 – 29 514 650 822 1,114 536 679 860 1,16630 – 39 633 804 1,026 1,359 662 842 1,075 1,42440 – 49 874 1,097 1,385 1,821 878 1,112 1,415 1,87150 – 54 1,321 1,653 2,084 2,728 1,322 1,672 2,124 2,80055 – 59 1,747 2,175 2,730 3,561 1,758 2,20 8 2,790 3,66360 – 64 (renewal only) 2,113 2,649 3,342 4,381 2,058 2,594 3,287 4,32665 – 69 (renewal only) 2,676 3,369 4,267 5,611 2,620 3,313 4,211 5,55570 – 74 (renewal only) 3,115 3,960 4,931 6,465 3,002 3,847 4,818 6,35275 – 79 (renewal only) 4,041 5,096 6,310 8,225 3,871 4,926 6,140 8,055Note:1. The contribution rate is not guaranteed. Please refer to Summary Information Sheet for furtherdetails on the nature of contribution.2. <strong>MAA</strong> Takaful Berhad reserves the right to revise the contribution rate at time of renewal by givingninety (90) days written notice prior to certificate anniversary date to the participant.EligibilityAnyone from 30 days up to 59 years of age and who is in good health is eligibleWakalah Model<strong>MAA</strong> Takaful operates under the principal of Wakalah, whereby the Takaful Operator acts as an agent tothe Participant for managing the operations of the Takaful business. A Wakalah fee will be charged upfrontfrom the Contributions paid. Surplus arising (if any) at the end of each financial year will be sharedbetween participant and <strong>MAA</strong> Takaful at 50:50 ratio. No surplus will be paid if the certificate is surrenderedor terminated due to a claim.Tax ReliefAnnual premium paid for <strong>SmartMedic</strong> <strong>100</strong> will qualify for the RM 3,000 medical tax relief, subject to the finaldecision by the Inland Revenue Board.ExclusionAny injury/illness arising from the following is not covered• Pre-existing conditions• Specified Illness occurring during the first 120 days of continuous cover• Any person who resides outside Malaysia for more than 90 consecutive days while the certificate is in force.• Any medical or physical conditions arising within the first thirty (30) days• Self inflicted injuries and illegal acts• Wars, strikes and riots• Any armed forces or military operations• Pregnancy, miscarriage or child births• Mental or nervous disorder

<strong>SmartMedic</strong> <strong>100</strong>• Alcoholism and drug abuse or its related conditions• Cosmetics, elective or plastic surgery, or congenital abnormalities• Dental treatment unless necessitated by accidental injury• Routine health checks and any investigations not directly related to admission• Treatment which is not medically necessary• Medical Expenses which is payable by any laws, medical program of insurance/ Takaful certificate• Private nursing, rest cures or sanitaria care, illegal drugs, intoxication, sterilization, venereal disease andits sequel, AIDS or ARC (AIDS Related Complex) and HIV related diseases and any communicable diseaserequiring quarantined by lawNote: The above exclusions are not exhaustive and cross reference may be made to the Exclusionclause of the Certificate contract.Certificate Expiry<strong>SmartMedic</strong> <strong>100</strong> certificate will expire if:1. Contribution is not paid within the grace period of 31 days.2. Certificate owner reaches age 80 years old.3. Upon payment of the Funeral Expenses.4. The total benefits paid have exceeded the Life time Limit.Note: The benefits under this plan will not be paid up upon certificate expiration.NOTE• Upgrade Room & Board Co payment – If the person covered is hospitalized at a room & board rate whichis higher than his/her eligible benefit, the person covered shall bear 10% of the other eligible benefits,described in the schedule of benefits for each and every claim.• Total benefits payable in a year must not exceed the Annual Limit.• Total benefits payable during the lifetime is subject to the Lifetime Limit• This brochure is for general information only. It is not a certificate of Takaful. The precise terms and conditionsare specified in the Takaful certificate.