PT WINTERMAR OFFSHORE MARINE Tbk DAN ENTITAS ANAK PT ...

PT WINTERMAR OFFSHORE MARINE Tbk DAN ENTITAS ANAK PT ...

PT WINTERMAR OFFSHORE MARINE Tbk DAN ENTITAS ANAK PT ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

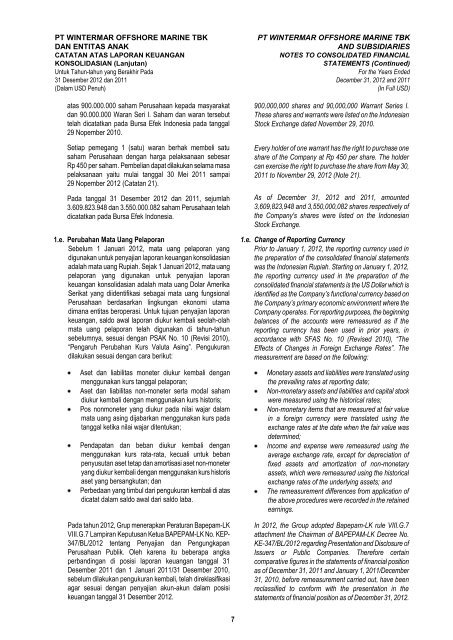

<strong>PT</strong> <strong>WINTERMAR</strong> <strong>OFFSHORE</strong> <strong>MARINE</strong> TBK<strong>PT</strong> <strong>WINTERMAR</strong> <strong>OFFSHORE</strong> <strong>MARINE</strong> TBK<strong>DAN</strong> <strong>ENTITAS</strong> <strong>ANAK</strong>AND SUBSIDIARIESCATATAN ATAS LAPORAN KEUANGANNOTES TO CONSOLIDATED FINANCIALKONSOLIDASIAN (Lanjutan)STATEMENTS (Continued)Untuk Tahun-tahun yang Berakhir PadaFor the Years Ended31 Desember 2012 dan 2011 December 31, 2012 and 2011(Dalam USD Penuh)(In Full USD)atas 900.000.000 saham Perusahaan kepada masyarakatdan 90.000.000 Waran Seri I. Saham dan waran tersebuttelah dicatatkan pada Bursa Efek Indonesia pada tanggal29 Nopember 2010.Setiap pemegang 1 (satu) waran berhak membeli satusaham Perusahaan dengan harga pelaksanaan sebesarRp 450 per saham. Pembelian dapat dilakukan selama masapelaksanaan yaitu mulai tanggal 30 Mei 2011 sampai29 Nopember 2012 (Catatan 21).Pada tanggal 31 Desember 2012 dan 2011, sejumlah3.609.823.948 dan 3.550.000.082 saham Perusahaan telahdicatatkan pada Bursa Efek Indonesia.1.e. Perubahan Mata Uang PelaporanSebelum 1 Januari 2012, mata uang pelaporan yangdigunakan untuk penyajian laporan keuangan konsolidasianadalah mata uang Rupiah. Sejak 1 Januari 2012, mata uangpelaporan yang digunakan untuk penyajian laporankeuangan konsolidasian adalah mata uang Dolar AmerikaSerikat yang diidentifikasi sebagai mata uang fungsionalPerusahaan berdasarkan lingkungan ekonomi utamadimana entitas beroperasi. Untuk tujuan penyajian laporankeuangan, saldo awal laporan diukur kembali seolah-olahmata uang pelaporan telah digunakan di tahun-tahunsebelumnya, sesuai dengan PSAK No. 10 (Revisi 2010),“Pengaruh Perubahan Kurs Valuta Asing”. Pengukurandilakukan sesuai dengan cara berikut:Aset dan liabilitas moneter diukur kembali denganmenggunakan kurs tanggal pelaporan;Aset dan liabilitas non-moneter serta modal sahamdiukur kembali dengan menggunakan kurs historis;Pos nonmoneter yang diukur pada nilai wajar dalammata uang asing dijabarkan menggunakan kurs padatanggal ketika nilai wajar ditentukan;Pendapatan dan beban diukur kembali denganmenggunakan kurs rata-rata, kecuali untuk bebanpenyusutan aset tetap dan amortisasi aset non-moneteryang diukur kembali dengan menggunakan kurs historisaset yang bersangkutan; danPerbedaan yang timbul dari pengukuran kembali di atasdicatat dalam saldo awal dari saldo laba.Pada tahun 2012, Grup menerapkan Peraturan Bapepam-LKVIII.G.7 Lampiran Keputusan Ketua BAPEPAM-LK No. KEP-347/BL/2012 tentang Penyajian dan PengungkapanPerusahaan Publik. Oleh karena itu beberapa angkaperbandingan di posisi laporan keuangan tanggal 31Desember 2011 dan 1 Januari 2011/31 Desember 2010,sebelum dilakukan pengukuran kembali, telah direklasifikasiagar sesuai dengan penyajian akun-akun dalam posisikeuangan tanggal 31 Desember 2012.900,000,000 shares and 90,000,000 Warrant Series I.These shares and warrants were listed on the IndonesianStock Exchange dated November 29, 2010.Every holder of one warrant has the right to purchase oneshare of the Company at Rp 450 per share. The holdercan exercise the right to purchase the share from May 30,2011 to November 29, 2012 (Note 21).As of December 31, 2012 and 2011, amounted3,609,823,948 and 3,550,000,082 shares respectively ofthe Company's shares were listed on the IndonesianStock Exchange.1.e. Change of Reporting CurrencyPrior to January 1, 2012, the reporting currency used inthe preparation of the consolidated financial statementswas the Indonesian Rupiah. Starting on January 1, 2012,the reporting currency used in the preparation of theconsolidated financial statements is the US Dollar which isidentified as the Company’s functional currency based onthe Company’s primary economic environment where theCompany operates. For reporting purposes, the beginningbalances of the accounts were remeasured as if thereporting currency has been used in prior years, inaccordance with SFAS No. 10 (Revised 2010), “TheEffects of Changes in Foreign Exchange Rates”. Themeasurement are based on the following:Monetary assets and liabilities were translated usingthe prevailing rates at reporting date;Non-monetary assets and liabilities and capital stockwere measured using the historical rates;Non-monetary items that are measured at fair valuein a foreign currency were translated using theexchange rates at the date when the fair value wasdetermined;Income and expense were remeasured using theaverage exchange rate, except for depreciation offixed assets and amortization of non-monetaryassets, which were remeasured using the historicalexchange rates of the underlying assets; andThe remeasurement differences from application ofthe above procedures were recorded in the retainedearnings.In 2012, the Group adopted Bapepam-LK rule VIII.G.7attachment the Chairman of BAPEPAM-LK Decree No.KE-347/BL/2012 regarding Presentation and Disclosure ofIssuers or Public Companies. Therefore certaincomparative figures in the statements of financial positionas of December 31, 2011 and January 1, 2011/December31, 2010, before remeasurement carried out, have beenreclassified to conform with the presentation in thestatements of financial position as of December 31, 2012.D1/March 28, 2013 7 paraf: