Takaful Wanita - MAA

Takaful Wanita - MAA

Takaful Wanita - MAA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Fund Options<br />

You have the option of choosing any of the following <strong>MAA</strong> <strong>Takaful</strong> Shariah Funds which best suit your investment objective and<br />

risk tolerance level:<br />

a. <strong>MAA</strong> <strong>Takaful</strong> Shariah Growth Fund<br />

• It provides a capital growth over medium to long-term investment through predominantly invested in Shariah-compliant<br />

equities and equity related securities. A part of the fund will be invested in Islamic debt securities and short-term Islamic<br />

money market instruments.<br />

• It suits for high-risk investors who are looking for a high growth potential.<br />

b. <strong>MAA</strong> <strong>Takaful</strong> Shariah Balanced Fund<br />

• It provides a balanced mix of income returns, as well as capital growth over medium to long term investment through a<br />

diversified portfolio of Shariah-compliant securities, predominantly Malaysian equities, Islamic debt securities and shortterm<br />

Islamic money market.<br />

• It suits for moderate to high-risk investors who prefer a higher-than-deposits return generated from dividend yield Shariahcompliant<br />

equities and fixed income instruments.<br />

c. <strong>MAA</strong> <strong>Takaful</strong> Shariah Income Fund<br />

• It provides a steady capital growth at rates higher than average fixed deposit rates over medium to long-term period through<br />

primarily invest in Islamic debt securities and short-term Islamic money market instruments. A small portion will be invested<br />

in dividend yield Shariah-compliant equities.<br />

• It suits for low to moderate-risk investors who seek a consistent and stable income distribution from Shariah-compliant fixed<br />

income instruments such as Sukuk.<br />

d. <strong>MAA</strong> <strong>Takaful</strong> Shariah Flexi Fund<br />

• It aims to provide a positive return over medium to long-term investment period, given the flexibility of the asset allocation.<br />

• It suits for moderate to high-risk investors who prefer a stable investment returns and potential for medium to long-term<br />

capital appreciation.<br />

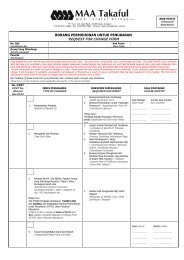

<strong>Takaful</strong>ink <strong>Wanita</strong> Fees and Charges<br />

Tabarru’<br />

: Based on age, rating (if any) and Basic Sum Covered.<br />

Certificate Fee<br />

: RM5 per month.<br />

Switching Fee<br />

: One free switching is allowed each certificate year. Subsequent switching will be subject to a fee<br />

of RM50 per transaction.<br />

Reinstatement Fee<br />

: RM50.<br />

Wakalah Fee Irregular Top-Up : 5% of the Irregular Top-Up amount.<br />

Service Fee Irregular Top-Up : RM25 for every Irregular Top-Up.<br />

*The allocated 95% of Total Irregular Top-Up minus RM25 is available for investment in the<br />

Participant Investment Account (PIA).<br />

Wakalah Tharawat Fee : 1% - 1.5% per annum, determined based on the weighted (Fund Management Fee) average of<br />

total gross assets of each <strong>MAA</strong> <strong>Takaful</strong> Shariah Funds.<br />

Partial Withdrawal Charge : RM50 per withdrawal.<br />

Surrender Charge<br />

: NIL.