2009 - Ciputra Development

2009 - Ciputra Development

2009 - Ciputra Development

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The original consolidated financial statements included herein are in<br />

the Indonesian language<br />

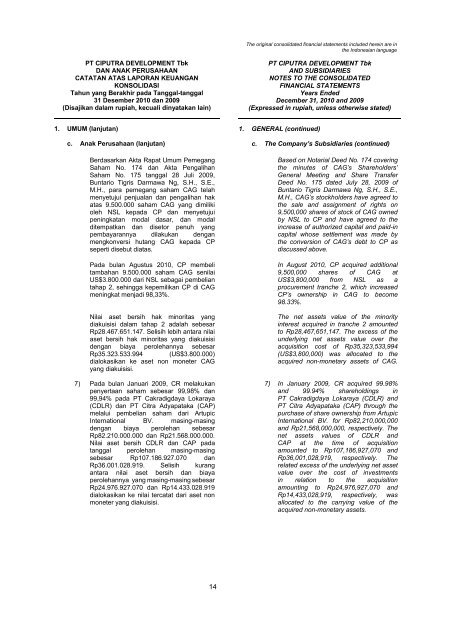

PT CIPUTRA DEVELOPMENT Tbk<br />

DAN ANAK PERUSAHAAN<br />

CATATAN ATAS LAPORAN KEUANGAN<br />

KONSOLIDASI<br />

Tahun yang Berakhir pada Tanggal-tanggal<br />

31 Desember 2010 dan <strong>2009</strong><br />

(Disajikan dalam rupiah, kecuali dinyatakan lain)<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

Years Ended<br />

December 31, 2010 and <strong>2009</strong><br />

(Expressed in rupiah, unless otherwise stated)<br />

1. UMUM (lanjutan) 1. GENERAL (continued)<br />

c. Anak Perusahaan (lanjutan) c. The Company’s Subsidiaries (continued)<br />

Berdasarkan Akta Rapat Umum Pemegang<br />

Saham No. 174 dan Akta Pengalihan<br />

Saham No. 175 tanggal 28 Juli <strong>2009</strong>,<br />

Buntario Tigris Darmawa Ng, S.H., S.E.,<br />

M.H., para pemegang saham CAG telah<br />

menyetujui penjualan dan pengalihan hak<br />

atas 9.500.000 saham CAG yang dimiliki<br />

oleh NSL kepada CP dan menyetujui<br />

peningkatan modal dasar, dan modal<br />

ditempatkan dan disetor penuh yang<br />

pembayarannya dilakukan dengan<br />

mengkonversi hutang CAG kepada CP<br />

seperti disebut diatas.<br />

Pada bulan Agustus 2010, CP membeli<br />

tambahan 9.500.000 saham CAG senilai<br />

US$3.800.000 dari NSL sebagai pembelian<br />

tahap 2, sehingga kepemilikan CP di CAG<br />

meningkat menjadi 98,33%.<br />

Nilai aset bersih hak minoritas yang<br />

diakuisisi dalam tahap 2 adalah sebesar<br />

Rp28.467.651.147. Selisih lebih antara nilai<br />

aset bersih hak minoritas yang diakuisisi<br />

dengan biaya perolehannya sebesar<br />

Rp35.323.533.994 (US$3.800.000)<br />

dialokasikan ke aset non moneter CAG<br />

yang diakuisisi.<br />

7) Pada bulan Januari <strong>2009</strong>, CR melakukan<br />

penyertaan saham sebesar 99,98% dan<br />

99,94% pada PT Cakradigdaya Lokaraya<br />

(CDLR) dan PT Citra Adyapataka (CAP)<br />

melalui pembelian saham dari Artupic<br />

International BV. masing-masing<br />

dengan biaya perolehan sebesar<br />

Rp82.210.000.000 dan Rp21.568.000.000.<br />

Nilai aset bersih CDLR dan CAP pada<br />

tanggal perolehan masing-masing<br />

sebesar Rp107.186.927.070 dan<br />

Rp36.001.028.919. Selisih kurang<br />

antara nilai aset bersih dan biaya<br />

perolehannya yang masing-masing sebesar<br />

Rp24.976.927.070 dan Rp14.433.028.919<br />

dialokasikan ke nilai tercatat dari aset non<br />

moneter yang diakuisisi.<br />

Based on Notarial Deed No. 174 covering<br />

the minutes of CAG’s Shareholders’<br />

General Meeting and Share Transfer<br />

Deed No. 175 dated July 28, <strong>2009</strong> of<br />

Buntario Tigris Darmawa Ng, S.H., S.E.,<br />

M.H., CAG’s stockholders have agreed to<br />

the sale and assignment of rights on<br />

9,500,000 shares of stock of CAG owned<br />

by NSL to CP and have agreed to the<br />

increase of authorized capital and paid-in<br />

capital whose settlement was made by<br />

the conversion of CAG’s debt to CP as<br />

discussed above.<br />

In August 2010, CP acquired additional<br />

9,500,000 shares of CAG at<br />

US$3,800,000 from NSL as a<br />

procurement tranche 2, which increased<br />

CP’s ownership in CAG to become<br />

98.33%.<br />

The net assets value of the minority<br />

interest acquired in tranche 2 amounted<br />

to Rp28,467,651,147. The excess of the<br />

underlying net assets value over the<br />

acquisition cost of Rp35,323,533,994<br />

(US$3,800,000) was allocated to the<br />

acquired non-monetary assets of CAG.<br />

7) In January <strong>2009</strong>, CR acquired 99.98%<br />

and 99.94% shareholdings in<br />

PT Cakradigdaya Lokaraya (CDLR) and<br />

PT Citra Adyapataka (CAP) through the<br />

purchase of share ownership from Artupic<br />

International BV. for Rp82,210,000,000<br />

and Rp21,568,000,000, respectively. The<br />

net assets values of CDLR and<br />

CAP at the time of acquisition<br />

amounted to Rp107,186,927,070 and<br />

Rp36,001,028,919, respectively. The<br />

related excess of the underlying net asset<br />

value over the cost of investments<br />

in relation to the acquisition<br />

amounting to Rp24,976,927,070 and<br />

Rp14,433,028,919, respectively, was<br />

allocated to the carrying value of the<br />

acquired non-monetary assets.<br />

14