2009 - Ciputra Development

2009 - Ciputra Development

2009 - Ciputra Development

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The original consolidated financial statements included herein are in<br />

the Indonesian language<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

DAN ANAK PERUSAHAAN<br />

CATATAN ATAS LAPORAN KEUANGAN<br />

KONSOLIDASI<br />

Tahun yang Berakhir pada Tanggal-tanggal<br />

31 Desember 2010 dan <strong>2009</strong><br />

(Disajikan dalam rupiah, kecuali dinyatakan lain)<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

Years Ended<br />

December 31, 2010 and <strong>2009</strong><br />

(Expressed in rupiah, unless otherwise stated)<br />

1. UMUM (lanjutan)<br />

c. Anak Perusahaan (lanjutan)<br />

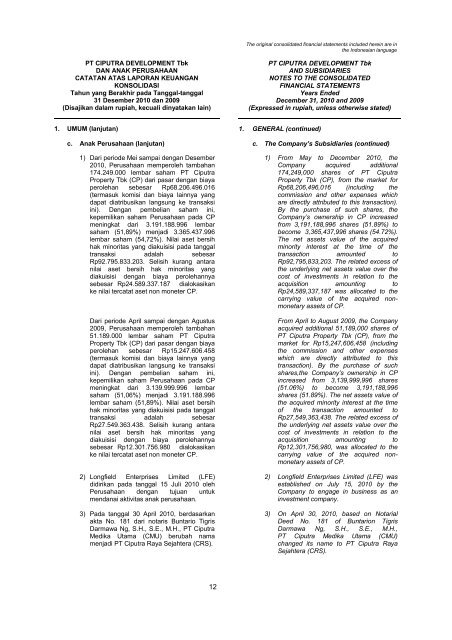

1) Dari periode Mei sampai dengan Desember<br />

2010, Perusahaan memperoleh tambahan<br />

174.249.000 lembar saham PT <strong>Ciputra</strong><br />

Property Tbk (CP) dari pasar dengan biaya<br />

perolehan sebesar Rp68.206.496.016<br />

(termasuk komisi dan biaya lainnya yang<br />

dapat diatribusikan langsung ke transaksi<br />

ini). Dengan pembelian saham ini,<br />

kepemilikan saham Perusahaan pada CP<br />

meningkat dari 3.191.188.996 lembar<br />

saham (51,89%) menjadi 3.365.437.996<br />

lembar saham (54,72%). Nilai aset bersih<br />

hak minoritas yang diakuisisi pada tanggal<br />

transaksi adalah sebesar<br />

Rp92.795.833.203. Selisih kurang antara<br />

nilai aset bersih hak minoritas yang<br />

diakuisisi dengan biaya perolehannya<br />

sebesar Rp24.589.337.187 dialokasikan<br />

ke nilai tercatat aset non moneter CP.<br />

Dari periode April sampai dengan Agustus<br />

<strong>2009</strong>, Perusahaan memperoleh tambahan<br />

51.189.000 lembar saham PT <strong>Ciputra</strong><br />

Property Tbk (CP) dari pasar dengan biaya<br />

perolehan sebesar Rp15.247.606.458<br />

(termasuk komisi dan biaya lainnya yang<br />

dapat diatribusikan langsung ke transaksi<br />

ini). Dengan pembelian saham ini,<br />

kepemilikan saham Perusahaan pada CP<br />

meningkat dari 3.139.999.996 lembar<br />

saham (51,06%) menjadi 3.191.188.996<br />

lembar saham (51,89%). Nilai aset bersih<br />

hak minoritas yang diakuisisi pada tanggal<br />

transaksi adalah sebesar<br />

Rp27.549.363.438. Selisih kurang antara<br />

nilai aset bersih hak minoritas yang<br />

diakuisisi dengan biaya perolehannya<br />

sebesar Rp12.301.756.980 dialokasikan<br />

ke nilai tercatat aset non moneter CP.<br />

2) Longfield Enterprises Limited (LFE)<br />

didirikan pada tanggal 15 Juli 2010 oleh<br />

Perusahaan dengan tujuan untuk<br />

mendanai aktivitas anak perusahaan.<br />

3) Pada tanggal 30 April 2010, berdasarkan<br />

akta No. 181 dari notaris Buntario Tigris<br />

Darmawa Ng, S.H., S.E., M.H., PT <strong>Ciputra</strong><br />

Medika Utama (CMU) berubah nama<br />

menjadi PT <strong>Ciputra</strong> Raya Sejahtera (CRS).<br />

1. GENERAL (continued)<br />

c. The Company’s Subsidiaries (continued)<br />

1) From May to December 2010, the<br />

Company acquired additional<br />

174,249,000 shares of PT <strong>Ciputra</strong><br />

Property Tbk (CP), from the market for<br />

Rp68,206,496,016 (including the<br />

commission and other expenses which<br />

are directly attributed to this transaction).<br />

By the purchase of such shares, the<br />

Company’s ownership in CP increased<br />

from 3,191,188,996 shares (51.89%) to<br />

become 3,365,437,996 shares (54.72%).<br />

The net assets value of the acquired<br />

minority interest at the time of the<br />

transaction amounted to<br />

Rp92,795,833,203. The related excess of<br />

the underlying net assets value over the<br />

cost of investments in relation to the<br />

acquisition amounting to<br />

Rp24,589,337,187 was allocated to the<br />

carrying value of the acquired nonmonetary<br />

assets of CP.<br />

From April to August <strong>2009</strong>, the Company<br />

acquired additional 51,189,000 shares of<br />

PT <strong>Ciputra</strong> Property Tbk (CP), from the<br />

market for Rp15,247,606,458 (including<br />

the commission and other expenses<br />

which are directly attributed to this<br />

transaction). By the purchase of such<br />

shares,the Company’s ownership in CP<br />

increased from 3,139,999,996 shares<br />

(51.06%) to become 3,191,188,996<br />

shares (51.89%). The net assets value of<br />

the acquired minority interest at the time<br />

of the transaction amounted to<br />

Rp27,549,363,438. The related excess of<br />

the underlying net assets value over the<br />

cost of investments in relation to the<br />

acquisition amounting to<br />

Rp12,301,756,980, was allocated to the<br />

carrying value of the acquired nonmonetary<br />

assets of CP.<br />

2) Longfield Enterprises Limited (LFE) was<br />

established on July 15, 2010 by the<br />

Company to engage in business as an<br />

investment company.<br />

3) On April 30, 2010, based on Notarial<br />

Deed No. 181 of Buntarion Tigris<br />

Darmawa Ng, S.H., S.E., M.H.,<br />

PT <strong>Ciputra</strong> Medika Utama (CMU)<br />

changed its name to PT <strong>Ciputra</strong> Raya<br />

Sejahtera (CRS).<br />

12