2009 - Ciputra Development

2009 - Ciputra Development 2009 - Ciputra Development

The original consolidated financial statements included herein are in the Indonesian language PT CIPUTRA DEVELOPMENT Tbk DAN ANAK PERUSAHAAN CATATAN ATAS LAPORAN KEUANGAN KONSOLIDASI Tahun yang Berakhir pada Tanggal-tanggal 31 Desember 2010 dan 2009 (Disajikan dalam rupiah, kecuali dinyatakan lain) PT CIPUTRA DEVELOPMENT Tbk AND SUBSIDIARIES NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Years Ended December 31, 2010 and 2009 (Expressed in rupiah, unless otherwise stated) 23. BEBAN POKOK PENJUALAN DAN BEBAN LANGSUNG (lanjutan) 2010 2009 23. COST OF SALES AND DIRECT COSTS (continued) Beban langsung Direct costs Pusat niaga 70.625.519.668 71.653.115.771 Shopping centres Hotel 56.670.324.429 47.118.665.963 Hotels Lapangan golf 24.412.115.420 22.473.818.480 Golf course Lain-lain 11.638.049.328 13.693.504.413 Others 163.346.008.845 154.939.104.627 Jumlah beban pokok penjualan dan beban langsung 957.985.199.480 733.065.104.427 Total cost of sales and direct costs Pada tahun 2010 dan 2009, tidak ada pembelian dari satu pemasok yang nilainya melebihi 10% dari jumlah pembelian. In 2010 and 2009, no purchases exceeding 10% of revenues were made from any single supplier. 24. BEBAN PENJUALAN 24. SELLING EXPENSES Rincian beban penjualan adalah sebagai berikut: The details of selling expenses are as follows: 2010 2009 Promosi dan iklan 66.222.854.084 41.672.210.496 Promotion and advertising Komisi penjualan 18.956.124.214 14.714.561.229 Sales commissions Jasa koordinasi (Catatan 32d) 4.005.302.216 3.980.309.352 Coordinations fees (Note 32d) Jamuan, sponsorship dan sumbangan 2.349.250.089 3.958.268.230 Entertainment, sponsorship and donation Gaji dan kesejahteraan karyawan 2.070.706.148 1.218.243.958 Salaries and employee benefits Lain-lain 10.465.241.721 5.420.480.290 Others Jumlah beban penjualan 104.069.478.472 70.964.073.555 Total selling expenses 25. BEBAN UMUM DAN ADMINISTRASI 25. GENERAL AND ADMINISTRATIVE EXPENSES Rincian beban umum dan administrasi adalah sebagai berikut: The details of general and administrative expenses are as follows: 2010 2009 Salaries, wages and Gaji, upah dan imbalan kerja lainnya 175.293.149.327 146.480.652.564 other employee benefits Penyusutan (Catatan 8) 29.833.737.936 28.917.704.460 Depreciation (Note 8) Fotokopi dan alat tulis kantor 9.188.912.985 6.552.311.668 Photocopy and stationery Jasa profesional 6.104.165.932 6.401.210.579 Professional fees Jamuan dan sumbangan 6.074.441.486 2.367.115.953 Entertainment and donations Perjalanan dinas dan transportasi 5.801.403.775 4.941.007.000 Travelling and transportation Pajak dan perijinan 4.766.079.978 3.590.824.927 Taxes and license Pos dan telekomunikasi 4.748.313.528 4.269.617.754 Postage and telecommunication Listrik, air dan telepon 4.526.871.811 2.303.405.608 Electricity, water and telephone Jasa koordinasi (Catatan 32d) 3.580.906.438 3.912.214.150 Coordination fees (Note 32d) Asuransi 2.130.835.797 2.021.797.344 Insurance Jasa manajemen (Catatan 32i) 423.497.292 956.421.199 Management fees (Note 32i) (Pembalikan) beban penyisihan piutang (2.628.276.402) 2.164.103.719 (Reversal of) bad debt expenses Lain-lain 38.969.388.791 29.626.674.381 Others Jumlah beban umum dan administrasi 288.813.428.674 244.505.061.306 Total general and administrative expenses 77

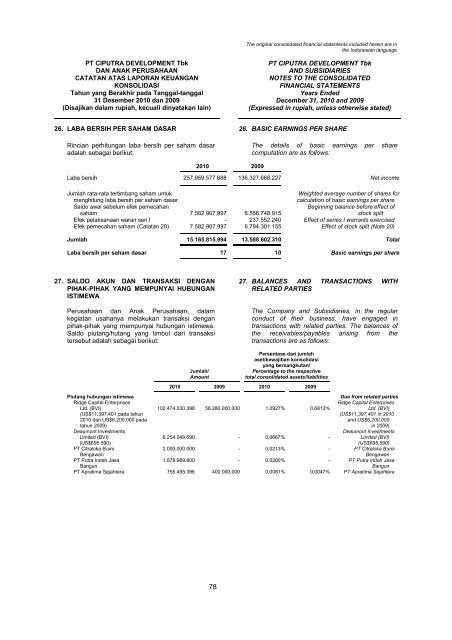

The original consolidated financial statements included herein are in the Indonesian language PT CIPUTRA DEVELOPMENT Tbk DAN ANAK PERUSAHAAN CATATAN ATAS LAPORAN KEUANGAN KONSOLIDASI Tahun yang Berakhir pada Tanggal-tanggal 31 Desember 2010 dan 2009 (Disajikan dalam rupiah, kecuali dinyatakan lain) PT CIPUTRA DEVELOPMENT Tbk AND SUBSIDIARIES NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Years Ended December 31, 2010 and 2009 (Expressed in rupiah, unless otherwise stated) 26. LABA BERSIH PER SAHAM DASAR 26. BASIC EARNINGS PER SHARE Rincian perhitungan laba bersih per saham dasar adalah sebagai berikut: The details of basic earnings per share computation are as follows: 2010 2009 Laba bersih 257.959.577.688 136.327.668.227 Net income Jumlah rata-rata tertimbang saham untuk Weighted average number of shares for menghitung laba bersih per saham dasar calculation of basic earnings per share Saldo awal sebelum efek pemecahan Beginning balance before effect of saham 7.582.907.997 6.556.748.915 stock split Efek pelaksanaan waran seri I - 237.552.240 Effect of series I warrants exercised Efek pemecahan saham (Catatan 20) 7.582.907.997 6.794.301.155 Effect of stock split (Note 20) Jumlah 15.165.815.994 13.588.602.310 Total Laba bersih per saham dasar 17 10 Basic earnings per share 27. SALDO AKUN DAN TRANSAKSI DENGAN PIHAK-PIHAK YANG MEMPUNYAI HUBUNGAN ISTIMEWA Perusahaan dan Anak Perusahaan, dalam kegiatan usahanya melakukan transaksi dengan pihak-pihak yang mempunyai hubungan istimewa. Saldo piutang/hutang yang timbul dari transaksi tersebut adalah sebagai berikut: 27. BALANCES AND TRANSACTIONS WITH RELATED PARTIES The Company and Subsidiaries, in the regular conduct of their business, have engaged in transactions with related parties. The balances of the receivables/payables arising from the transactions are as follows: Jumlah/ Amount Persentase dari jumlah aset/kewajiban konsolidasi yang bersangkutan/ Percentage to the respective total consolidated assets/liabilities 2010 2009 2010 2009 Piutang hubungan istimewa Due from related parties Ridge Capital Enterprises Ridge Capital Enterprises Ltd. (BVI) 102.474.030.398 58.280.000.000 1,0927% 0,6813% Ltd. (BVI) (US$11.397.401 pada tahun (US$11,397,401 in 2010 2010 dan US$6.200.000 pada and US$6,200,000 tahun 2009) in 2009) Deaumont Investments Deaumont Investments Limited (BVI) 6.254.049.690 - 0,0667% - Limited (BVI) (US$695.590) (US$695,590) PT Citraloka Bumi 2.000.000.000 - 0,0213% - PT Citraloka Bumi Bengawan Bengawan PT Putra Indah Jasa 1.878.989.800 - 0,0200% - PT Putra Indah Jasa Bangun Bangun PT Apratima Sejahtera 755.495.396 400.000.000 0,0081% 0,0047% PT Apratima Sejahtera 78

- Page 111 and 112: The original consolidated financial

- Page 113 and 114: The original consolidated financial

- Page 115 and 116: The original consolidated financial

- Page 117 and 118: The original consolidated financial

- Page 119 and 120: The original consolidated financial

- Page 121 and 122: The original consolidated financial

- Page 123 and 124: The original consolidated financial

- Page 125 and 126: The original consolidated financial

- Page 127 and 128: The original consolidated financial

- Page 129 and 130: The original consolidated financial

- Page 131 and 132: The original consolidated financial

- Page 133 and 134: The original consolidated financial

- Page 135 and 136: The original consolidated financial

- Page 137 and 138: The original consolidated financial

- Page 139 and 140: The original consolidated financial

- Page 141 and 142: The original consolidated financial

- Page 143 and 144: The original consolidated financial

- Page 145 and 146: The original consolidated financial

- Page 147 and 148: The original consolidated financial

- Page 149 and 150: The original consolidated financial

- Page 151 and 152: The original consolidated financial

- Page 153 and 154: The original consolidated financial

- Page 155 and 156: The original consolidated financial

- Page 157 and 158: The original consolidated financial

- Page 159 and 160: The original consolidated financial

- Page 161: The original consolidated financial

- Page 165 and 166: The original consolidated financial

- Page 167 and 168: The original consolidated financial

- Page 169 and 170: The original consolidated financial

- Page 171 and 172: The original consolidated financial

- Page 173 and 174: The original consolidated financial

- Page 175 and 176: The original consolidated financial

- Page 177 and 178: The original consolidated financial

- Page 179 and 180: The original consolidated financial

- Page 181 and 182: The original consolidated financial

- Page 183 and 184: The original consolidated financial

- Page 185 and 186: The original consolidated financial

- Page 187 and 188: The original consolidated financial

- Page 189 and 190: The original consolidated financial

- Page 191 and 192: The original consolidated financial

- Page 193 and 194: The original supplementary financia

The original consolidated financial statements included herein are in<br />

the Indonesian language<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

DAN ANAK PERUSAHAAN<br />

CATATAN ATAS LAPORAN KEUANGAN<br />

KONSOLIDASI<br />

Tahun yang Berakhir pada Tanggal-tanggal<br />

31 Desember 2010 dan <strong>2009</strong><br />

(Disajikan dalam rupiah, kecuali dinyatakan lain)<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

Years Ended<br />

December 31, 2010 and <strong>2009</strong><br />

(Expressed in rupiah, unless otherwise stated)<br />

26. LABA BERSIH PER SAHAM DASAR 26. BASIC EARNINGS PER SHARE<br />

Rincian perhitungan laba bersih per saham dasar<br />

adalah sebagai berikut:<br />

The details of basic earnings per share<br />

computation are as follows:<br />

2010 <strong>2009</strong><br />

Laba bersih 257.959.577.688 136.327.668.227 Net income<br />

Jumlah rata-rata tertimbang saham untuk<br />

Weighted average number of shares for<br />

menghitung laba bersih per saham dasar<br />

calculation of basic earnings per share<br />

Saldo awal sebelum efek pemecahan<br />

Beginning balance before effect of<br />

saham 7.582.907.997 6.556.748.915 stock split<br />

Efek pelaksanaan waran seri I - 237.552.240 Effect of series I warrants exercised<br />

Efek pemecahan saham (Catatan 20) 7.582.907.997 6.794.301.155 Effect of stock split (Note 20)<br />

Jumlah 15.165.815.994 13.588.602.310 Total<br />

Laba bersih per saham dasar 17 10 Basic earnings per share<br />

27. SALDO AKUN DAN TRANSAKSI DENGAN<br />

PIHAK-PIHAK YANG MEMPUNYAI HUBUNGAN<br />

ISTIMEWA<br />

Perusahaan dan Anak Perusahaan, dalam<br />

kegiatan usahanya melakukan transaksi dengan<br />

pihak-pihak yang mempunyai hubungan istimewa.<br />

Saldo piutang/hutang yang timbul dari transaksi<br />

tersebut adalah sebagai berikut:<br />

27. BALANCES AND TRANSACTIONS WITH<br />

RELATED PARTIES<br />

The Company and Subsidiaries, in the regular<br />

conduct of their business, have engaged in<br />

transactions with related parties. The balances of<br />

the receivables/payables arising from the<br />

transactions are as follows:<br />

Jumlah/<br />

Amount<br />

Persentase dari jumlah<br />

aset/kewajiban konsolidasi<br />

yang bersangkutan/<br />

Percentage to the respective<br />

total consolidated assets/liabilities<br />

2010 <strong>2009</strong> 2010 <strong>2009</strong><br />

Piutang hubungan istimewa<br />

Due from related parties<br />

Ridge Capital Enterprises<br />

Ridge Capital Enterprises<br />

Ltd. (BVI) 102.474.030.398 58.280.000.000 1,0927% 0,6813% Ltd. (BVI)<br />

(US$11.397.401 pada tahun (US$11,397,401 in 2010<br />

2010 dan US$6.200.000 pada and US$6,200,000<br />

tahun <strong>2009</strong>) in <strong>2009</strong>)<br />

Deaumont Investments<br />

Deaumont Investments<br />

Limited (BVI) 6.254.049.690 - 0,0667% - Limited (BVI)<br />

(US$695.590)<br />

(US$695,590)<br />

PT Citraloka Bumi 2.000.000.000 - 0,0213% - PT Citraloka Bumi<br />

Bengawan<br />

Bengawan<br />

PT Putra Indah Jasa 1.878.989.800 - 0,0200% - PT Putra Indah Jasa<br />

Bangun<br />

Bangun<br />

PT Apratima Sejahtera 755.495.396 400.000.000 0,0081% 0,0047% PT Apratima Sejahtera<br />

78