2009 - Ciputra Development

2009 - Ciputra Development

2009 - Ciputra Development

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The original consolidated financial statements included herein are in<br />

the Indonesian language<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

DAN ANAK PERUSAHAAN<br />

CATATAN ATAS LAPORAN KEUANGAN<br />

KONSOLIDASI<br />

Tahun yang Berakhir pada Tanggal-tanggal<br />

31 Desember 2010 dan <strong>2009</strong><br />

(Disajikan dalam rupiah, kecuali dinyatakan lain)<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

Years Ended<br />

December 31, 2010 and <strong>2009</strong><br />

(Expressed in rupiah, unless otherwise stated)<br />

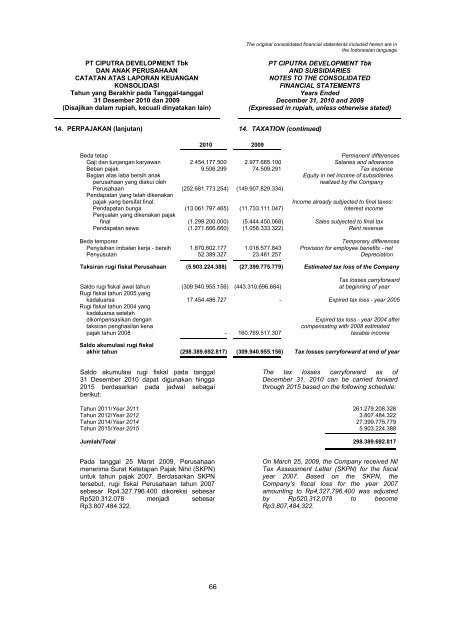

14. PERPAJAKAN (lanjutan) 14. TAXATION (continued)<br />

2010 <strong>2009</strong><br />

Beda tetap<br />

Permanent differences<br />

Gaji dan tunjangan karyawan 2.454.177.500 2.977.665.100 Salaries and allowance<br />

Beban pajak 9.506.299 74.509.291 Tax expense<br />

Bagian atas laba bersih anak<br />

Equity in net income of subsidiaries<br />

perusahaan yang diakui oleh<br />

realized by the Company<br />

Perusahaan (252.681.773.254) (149.907.829.334)<br />

Pendapatan yang telah dikenakan<br />

pajak yang bersifat final:<br />

Income already subjected to final taxes:<br />

Pendapatan bunga (13.061.797.465) (11.733.111.047) Interest income<br />

Penjualan yang dikenakan pajak<br />

final (1.299.200.000) (5.444.450.068) Sales subjected to final tax<br />

Pendapatan sewa (1.271.666.660) (1.058.333.322) Rent revenue<br />

Beda temporer<br />

Temporary differences<br />

Penyisihan imbalan kerja - bersih 1.870.602.177 1.016.577.843 Provision for employee benefits - net<br />

Penyusutan 52.389.327 23.461.257 Depreciation<br />

Taksiran rugi fiskal Perusahaan (5.903.224.388) (27.399.775.779) Estimated tax loss of the Company<br />

Tax losses carryforward<br />

Saldo rugi fiskal awal tahun (309.940.955.156) (443.310.696.684) at beginning of year<br />

Rugi fiskal tahun 2005 yang<br />

kadaluarsa 17.454.486.727 - Expired tax loss - year 2005<br />

Rugi fiskal tahun 2004 yang<br />

kadaluarsa setelah<br />

dikompensasikan dengan<br />

Expired tax loss - year 2004 after<br />

taksiran penghasilan kena<br />

compensating with 2008 estimated<br />

pajak tahun 2008 - 160.769.517.307 taxable income<br />

Saldo akumulasi rugi fiskal<br />

akhir tahun (298.389.692.817) (309.940.955.156) Tax losses carryforward at end of year<br />

Saldo akumulasi rugi fiskal pada tanggal<br />

31 Desember 2010 dapat digunakan hingga<br />

2015 berdasarkan pada jadwal sebagai<br />

berikut:<br />

The tax losses carryforward as of<br />

December 31, 2010 can be carried forward<br />

through 2015 based on the following schedule:<br />

Tahun 2011/Year 2011 261.279.208.328<br />

Tahun 2012/Year 2012 3.807.484.322<br />

Tahun 2014/Year 2014 27.399.775.779<br />

Tahun 2015/Year 2015 5.903.224.388<br />

Jumlah/Total 298.389.692.817<br />

Pada tanggal 25 Maret <strong>2009</strong>, Perusahaan<br />

menerima Surat Ketetapan Pajak Nihil (SKPN)<br />

untuk tahun pajak 2007. Berdasarkan SKPN<br />

tersebut, rugi fiskal Perusahaan tahun 2007<br />

sebesar Rp4.327.796.400 dikoreksi sebesar<br />

Rp520.312.078 menjadi sebesar<br />

Rp3.807.484.322.<br />

On March 25, <strong>2009</strong>, the Company received Nil<br />

Tax Assessment Letter (SKPN) for the fiscal<br />

year 2007. Based on the SKPN, the<br />

Company’s fiscal loss for the year 2007<br />

amounting to Rp4,327,796,400 was adjusted<br />

by Rp520,312,078 to become<br />

Rp3,807,484,322.<br />

66