2009 - Ciputra Development

2009 - Ciputra Development 2009 - Ciputra Development

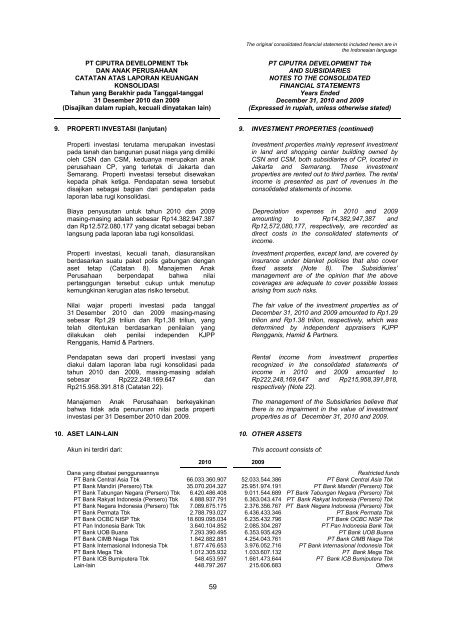

The original consolidated financial statements included herein are in the Indonesian language PT CIPUTRA DEVELOPMENT Tbk DAN ANAK PERUSAHAAN CATATAN ATAS LAPORAN KEUANGAN KONSOLIDASI Tahun yang Berakhir pada Tanggal-tanggal 31 Desember 2010 dan 2009 (Disajikan dalam rupiah, kecuali dinyatakan lain) PT CIPUTRA DEVELOPMENT Tbk AND SUBSIDIARIES NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Years Ended December 31, 2010 and 2009 (Expressed in rupiah, unless otherwise stated) 9. PROPERTI INVESTASI (lanjutan) 9. INVESTMENT PROPERTIES (continued) Properti investasi terutama merupakan investasi pada tanah dan bangunan pusat niaga yang dimiliki oleh CSN dan CSM, keduanya merupakan anak perusahaan CP, yang terletak di Jakarta dan Semarang. Properti investasi tersebut disewakan kepada pihak ketiga. Pendapatan sewa tersebut disajikan sebagai bagian dari pendapatan pada laporan laba rugi konsolidasi. Biaya penyusutan untuk tahun 2010 dan 2009 masing-masing adalah sebesar Rp14.382.947.387 dan Rp12.572.080.177 yang dicatat sebagai beban langsung pada laporan laba rugi konsolidasi. Properti investasi, kecuali tanah, diasuransikan berdasarkan suatu paket polis gabungan dengan aset tetap (Catatan 8). Manajemen Anak Perusahaan berpendapat bahwa nilai pertanggungan tersebut cukup untuk menutup kemungkinan kerugian atas risiko tersebut. Nilai wajar properti investasi pada tanggal 31 Desember 2010 dan 2009 masing-masing sebesar Rp1,29 triliun dan Rp1,38 triliun, yang telah ditentukan berdasarkan penilaian yang dilakukan oleh penilai independen KJPP Rengganis, Hamid & Partners. Pendapatan sewa dari properti investasi yang diakui dalam laporan laba rugi konsolidasi pada tahun 2010 dan 2009, masing-masing adalah sebesar Rp222.248.169.647 dan Rp215.958.391.818 (Catatan 22). Manajemen Anak Perusahaan berkeyakinan bahwa tidak ada penurunan nilai pada properti investasi per 31 Desember 2010 dan 2009. Investment properties mainly represent investment in land and shopping center building owned by CSN and CSM, both subsidiaries of CP, located in Jakarta and Semarang. These investment properties are rented out to third parties. The rental income is presented as part of revenues in the consolidated statements of income. Depreciation expenses in 2010 and 2009 amounting to Rp14,382,947,387 and Rp12,572,080,177, respectively, are recorded as direct costs in the consolidated statements of income. Investment properties, except land, are covered by insurance under blanket policies that also cover fixed assets (Note 8). The Subsidiaries’ management are of the opinion that the above coverages are adequate to cover possible losses arising from such risks. The fair value of the investment properties as of December 31, 2010 and 2009 amounted to Rp1.29 trilion and Rp1.38 trilion, respectively, which was determined by independent appraisers KJPP Rengganis, Hamid & Partners. Rental income from investment properties recognized in the consolidated statements of income in 2010 and 2009 amounted to Rp222,248,169,647 and Rp215,958,391,818, respectively (Note 22). The management of the Subsidiaries believe that there is no impairment in the value of investment properties as of December 31, 2010 and 2009. 10. ASET LAIN-LAIN 10. OTHER ASSETS Akun ini terdiri dari: This account consists of: 2010 2009 Dana yang dibatasi penggunaannya Restricted funds PT Bank Central Asia Tbk 66.033.360.907 52.033.544.386 PT Bank Central Asia Tbk PT Bank Mandiri (Persero) Tbk 35.070.204.327 25.951.974.191 PT Bank Mandiri (Persero) Tbk PT Bank Tabungan Negara (Persero) Tbk 6.420.486.408 9.011.544.689 PT Bank Tabungan Negara (Persero) Tbk PT Bank Rakyat Indonesia (Persero) Tbk 4.888.937.791 6.363.043.474 PT Bank Rakyat Indonesia (Persero) Tbk PT Bank Negara Indonesia (Persero) Tbk 7.089.675.175 2.376.356.767 PT Bank Negara Indonesia (Persero) Tbk PT Bank Permata Tbk 2.788.793.027 6.436.433.346 PT Bank Permata Tbk PT Bank OCBC NISP Tbk 18.609.095.034 6.235.432.796 PT Bank OCBC NISP Tbk PT Pan Indonesia Bank Tbk 3.640.104.852 2.085.304.287 PT Pan Indonesia Bank Tbk PT Bank UOB Buana 7.293.390.495 6.353.935.429 PT Bank UOB Buana PT Bank CIMB Niaga Tbk 1.842.882.881 4.254.043.761 PT Bank CIMB Niaga Tbk PT Bank Internasional Indonesia Tbk 1.877.476.653 3.976.052.716 PT Bank Internasional Indonesia Tbk PT Bank Mega Tbk 1.012.305.932 1.033.607.132 PT Bank Mega Tbk PT Bank ICB Bumiputera Tbk 548.453.597 1.661.473.644 PT Bank ICB Bumiputera Tbk Lain-lain 448.797.267 215.606.683 Others 59

The original consolidated financial statements included herein are in the Indonesian language PT CIPUTRA DEVELOPMENT Tbk DAN ANAK PERUSAHAAN CATATAN ATAS LAPORAN KEUANGAN KONSOLIDASI Tahun yang Berakhir pada Tanggal-tanggal 31 Desember 2010 dan 2009 (Disajikan dalam rupiah, kecuali dinyatakan lain) PT CIPUTRA DEVELOPMENT Tbk AND SUBSIDIARIES NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Years Ended December 31, 2010 and 2009 (Expressed in rupiah, unless otherwise stated) 10. ASET LAIN-LAIN (lanjutan) 10. OTHER ASSETS (continued) 2010 2009 Uang muka pembelian tanah dan lainnya 82.826.300.607 111.047.018.968 Advances for purchase of land and others Biaya dibayar di muka 12.465.125.906 1.963.178.881 Prepaid expenses Peralatan operasional hotel 2.098.960.358 2.394.031.458 Hotel operational equipment Lain-lain 21.186.118.680 16.794.157.037 Others Jumlah aset lain-lain 276.140.469.897 260.186.739.645 Total other assets Dana yang dibatasi penggunaannya terdiri dari saldo rekening bank dalam pengawasan (escrow account) yang dikelola oleh beberapa anak perusahaan tertentu sehubungan dengan fasilitas kredit pemilikan rumah yang diperoleh oleh pelanggan anak-anak perusahaan. Pada tahun 2010, uang muka pembelian tanah dan lainnya sebagian besar terdiri dari uang muka pembelian tanah di Surabaya dan Tangerang yang masing-masing dimiliki oleh CS dan CR dan uang muka pembelian gedung kantor yang dimiliki oleh CI, sedangkan pada tahun 2009 terdiri dari uang muka pembelian tanah di Jakarta, Surabaya dan Tangerang yang masing-masing dimiliki oleh CDLR, CS dan CR. Restricted funds represent escrow accounts in several banks maintained by certain subsidiaries in relation to the housing loans obtained by the customers of the subsidiaries. In 2010, advances for purchase of land and others mainly consist of payments for purchases of land properties located in Surabaya and Tangerang which are owned by CS and CR, respectively, and for purchase of office building which is owned by CI, while in 2009, the advances mainly consist of payments for purchases of land located in Jakarta, Surabaya and Tangerang which are owned by CDLR, CS and CR, respectively. 11. HUTANG BANK 11. LOANS FROM BANKS Akun ini terdiri dari: This account consists of: 2010 2009 Hutang bank Bank loans Rupiah Rupiah PT Bank Mega Tbk 246.657.547.603 102.228.556.682 PT Bank Mega Tbk PT Bank Mandiri (Persero) Tbk 35.501.529.286 - PT Bank Mandiri (Persero) Tbk PT Bank Internasional Indonesia Tbk - 11.415.556.000 PT Bank Internasional Indonesia Tbk PT Bank Bukopin Tbk - 8.823.251.177 PT Bukopin Tbk PT Bank Central Asia Tbk - 2.560.526.804 PT Bank Central Asia Tbk Jumlah hutang bank 282.159.076.889 125.027.890.663 Total loans from banks Pada tanggal 31 Desember 2010 dan 2009, rincian angsuran di masa mendatang atas hutang bank adalah sebagai berikut: As of December 31, 2010 and 2009, the details of future installments of loans from banks are as follows: Tahun Jatuh Tempo 2010 2009 Year Due 2010 - 19.652.165.039 2010 2011 29.001.529.286 13.370.024.610 2011 2012 45.000.000.000 10.222.855.668 2012 2013 50.000.000.000 20.445.711.336 2013 2014 50.000.000.000 20.445.711.336 2014 2015 51.500.000.000 20.445.711.336 2015 2016 51.500.000.000 20.445.711.338 2016 2017 5.157.547.603 - 2017 Jumlah angsuran 282.159.076.889 125.027.890.663 Total installments 60

- Page 93 and 94: The original consolidated financial

- Page 95 and 96: The original consolidated financial

- Page 97 and 98: The original consolidated financial

- Page 99 and 100: The original consolidated financial

- Page 101 and 102: The original consolidated financial

- Page 103 and 104: The original consolidated financial

- Page 105 and 106: The original consolidated financial

- Page 107 and 108: The original consolidated financial

- Page 109 and 110: The original consolidated financial

- Page 111 and 112: The original consolidated financial

- Page 113 and 114: The original consolidated financial

- Page 115 and 116: The original consolidated financial

- Page 117 and 118: The original consolidated financial

- Page 119 and 120: The original consolidated financial

- Page 121 and 122: The original consolidated financial

- Page 123 and 124: The original consolidated financial

- Page 125 and 126: The original consolidated financial

- Page 127 and 128: The original consolidated financial

- Page 129 and 130: The original consolidated financial

- Page 131 and 132: The original consolidated financial

- Page 133 and 134: The original consolidated financial

- Page 135 and 136: The original consolidated financial

- Page 137 and 138: The original consolidated financial

- Page 139 and 140: The original consolidated financial

- Page 141 and 142: The original consolidated financial

- Page 143: The original consolidated financial

- Page 147 and 148: The original consolidated financial

- Page 149 and 150: The original consolidated financial

- Page 151 and 152: The original consolidated financial

- Page 153 and 154: The original consolidated financial

- Page 155 and 156: The original consolidated financial

- Page 157 and 158: The original consolidated financial

- Page 159 and 160: The original consolidated financial

- Page 161 and 162: The original consolidated financial

- Page 163 and 164: The original consolidated financial

- Page 165 and 166: The original consolidated financial

- Page 167 and 168: The original consolidated financial

- Page 169 and 170: The original consolidated financial

- Page 171 and 172: The original consolidated financial

- Page 173 and 174: The original consolidated financial

- Page 175 and 176: The original consolidated financial

- Page 177 and 178: The original consolidated financial

- Page 179 and 180: The original consolidated financial

- Page 181 and 182: The original consolidated financial

- Page 183 and 184: The original consolidated financial

- Page 185 and 186: The original consolidated financial

- Page 187 and 188: The original consolidated financial

- Page 189 and 190: The original consolidated financial

- Page 191 and 192: The original consolidated financial

- Page 193 and 194: The original supplementary financia

The original consolidated financial statements included herein are in<br />

the Indonesian language<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

DAN ANAK PERUSAHAAN<br />

CATATAN ATAS LAPORAN KEUANGAN<br />

KONSOLIDASI<br />

Tahun yang Berakhir pada Tanggal-tanggal<br />

31 Desember 2010 dan <strong>2009</strong><br />

(Disajikan dalam rupiah, kecuali dinyatakan lain)<br />

PT CIPUTRA DEVELOPMENT Tbk<br />

AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

Years Ended<br />

December 31, 2010 and <strong>2009</strong><br />

(Expressed in rupiah, unless otherwise stated)<br />

9. PROPERTI INVESTASI (lanjutan) 9. INVESTMENT PROPERTIES (continued)<br />

Properti investasi terutama merupakan investasi<br />

pada tanah dan bangunan pusat niaga yang dimiliki<br />

oleh CSN dan CSM, keduanya merupakan anak<br />

perusahaan CP, yang terletak di Jakarta dan<br />

Semarang. Properti investasi tersebut disewakan<br />

kepada pihak ketiga. Pendapatan sewa tersebut<br />

disajikan sebagai bagian dari pendapatan pada<br />

laporan laba rugi konsolidasi.<br />

Biaya penyusutan untuk tahun 2010 dan <strong>2009</strong><br />

masing-masing adalah sebesar Rp14.382.947.387<br />

dan Rp12.572.080.177 yang dicatat sebagai beban<br />

langsung pada laporan laba rugi konsolidasi.<br />

Properti investasi, kecuali tanah, diasuransikan<br />

berdasarkan suatu paket polis gabungan dengan<br />

aset tetap (Catatan 8). Manajemen Anak<br />

Perusahaan berpendapat bahwa nilai<br />

pertanggungan tersebut cukup untuk menutup<br />

kemungkinan kerugian atas risiko tersebut.<br />

Nilai wajar properti investasi pada tanggal<br />

31 Desember 2010 dan <strong>2009</strong> masing-masing<br />

sebesar Rp1,29 triliun dan Rp1,38 triliun, yang<br />

telah ditentukan berdasarkan penilaian yang<br />

dilakukan oleh penilai independen KJPP<br />

Rengganis, Hamid & Partners.<br />

Pendapatan sewa dari properti investasi yang<br />

diakui dalam laporan laba rugi konsolidasi pada<br />

tahun 2010 dan <strong>2009</strong>, masing-masing adalah<br />

sebesar Rp222.248.169.647 dan<br />

Rp215.958.391.818 (Catatan 22).<br />

Manajemen Anak Perusahaan berkeyakinan<br />

bahwa tidak ada penurunan nilai pada properti<br />

investasi per 31 Desember 2010 dan <strong>2009</strong>.<br />

Investment properties mainly represent investment<br />

in land and shopping center building owned by<br />

CSN and CSM, both subsidiaries of CP, located in<br />

Jakarta and Semarang. These investment<br />

properties are rented out to third parties. The rental<br />

income is presented as part of revenues in the<br />

consolidated statements of income.<br />

Depreciation expenses in 2010 and <strong>2009</strong><br />

amounting to Rp14,382,947,387 and<br />

Rp12,572,080,177, respectively, are recorded as<br />

direct costs in the consolidated statements of<br />

income.<br />

Investment properties, except land, are covered by<br />

insurance under blanket policies that also cover<br />

fixed assets (Note 8). The Subsidiaries’<br />

management are of the opinion that the above<br />

coverages are adequate to cover possible losses<br />

arising from such risks.<br />

The fair value of the investment properties as of<br />

December 31, 2010 and <strong>2009</strong> amounted to Rp1.29<br />

trilion and Rp1.38 trilion, respectively, which was<br />

determined by independent appraisers KJPP<br />

Rengganis, Hamid & Partners.<br />

Rental income from investment properties<br />

recognized in the consolidated statements of<br />

income in 2010 and <strong>2009</strong> amounted to<br />

Rp222,248,169,647 and Rp215,958,391,818,<br />

respectively (Note 22).<br />

The management of the Subsidiaries believe that<br />

there is no impairment in the value of investment<br />

properties as of December 31, 2010 and <strong>2009</strong>.<br />

10. ASET LAIN-LAIN 10. OTHER ASSETS<br />

Akun ini terdiri dari:<br />

This account consists of:<br />

2010 <strong>2009</strong><br />

Dana yang dibatasi penggunaannya<br />

Restricted funds<br />

PT Bank Central Asia Tbk 66.033.360.907 52.033.544.386 PT Bank Central Asia Tbk<br />

PT Bank Mandiri (Persero) Tbk 35.070.204.327 25.951.974.191 PT Bank Mandiri (Persero) Tbk<br />

PT Bank Tabungan Negara (Persero) Tbk 6.420.486.408 9.011.544.689 PT Bank Tabungan Negara (Persero) Tbk<br />

PT Bank Rakyat Indonesia (Persero) Tbk 4.888.937.791 6.363.043.474 PT Bank Rakyat Indonesia (Persero) Tbk<br />

PT Bank Negara Indonesia (Persero) Tbk 7.089.675.175 2.376.356.767 PT Bank Negara Indonesia (Persero) Tbk<br />

PT Bank Permata Tbk 2.788.793.027 6.436.433.346 PT Bank Permata Tbk<br />

PT Bank OCBC NISP Tbk 18.609.095.034 6.235.432.796 PT Bank OCBC NISP Tbk<br />

PT Pan Indonesia Bank Tbk 3.640.104.852 2.085.304.287 PT Pan Indonesia Bank Tbk<br />

PT Bank UOB Buana 7.293.390.495 6.353.935.429 PT Bank UOB Buana<br />

PT Bank CIMB Niaga Tbk 1.842.882.881 4.254.043.761 PT Bank CIMB Niaga Tbk<br />

PT Bank Internasional Indonesia Tbk 1.877.476.653 3.976.052.716 PT Bank Internasional Indonesia Tbk<br />

PT Bank Mega Tbk 1.012.305.932 1.033.607.132 PT Bank Mega Tbk<br />

PT Bank ICB Bumiputera Tbk 548.453.597 1.661.473.644 PT Bank ICB Bumiputera Tbk<br />

Lain-lain 448.797.267 215.606.683 Others<br />

59