Events 2005 - ChartNexus

Events 2005 - ChartNexus

Events 2005 - ChartNexus

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Financial Statements 31 December <strong>2005</strong><br />

5. SIGNIFICANT ACCOUNTING POLICIES (Continued)<br />

5.2 Basis of consolidation (Continued)<br />

The difference between the purchase price and the fair value of the net assets of the subsidiary companies at the date of<br />

acquisition is treated as goodwill or reserve on consolidation.<br />

Minority interest is that part of the net results of operations and of net assets of a subsidiary company attributable to<br />

interest which are not owned directly or indirectly by the Group.<br />

Minority interest is measure at the minority’s proportion of the net assets of subsidiary companies at the date of<br />

acquisition, and the minority’s share of changes in equity since the date of the acquisition.<br />

Losses applicable to the minority in excess of the minority’s interest in the subsidiary company’s equity are allocated<br />

against the interest of the Group except to the extent that the minority has a binding obligation and is able to make an<br />

additional investment to cover the losses. When that subsidiary are attributed to the equity holders of the Company until<br />

the minority’s share of losses previously absorbed by the equity holders of the Company has been recovered.<br />

5.3 Property, plant and equipment and depreciation<br />

The gross carrying amounts of property, plant and equipment are initially measured at cost. Land and buildings which have<br />

been subsequently revalued, are stated at valuation less accumulated depreciation and accumulated impairment losses, if<br />

any. All other property, plant and equipment are stated at cost or valuation less accumulated depreciation and accumulated<br />

impairment losses, if any.<br />

No depreciation is provided for freehold land, plant and building under construction and printing presses and ancillary<br />

equipment under production. Leasehold land is amortised over the respective lease periods ranging from 72 to 888 years.<br />

Depreciation on other property, plant and equipment is calculated on a straight line basis to write off the cost or valuation<br />

of these assets over their estimated useful lives.<br />

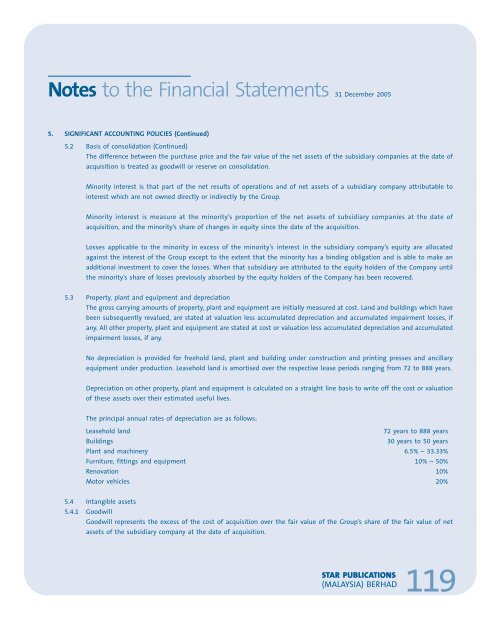

The principal annual rates of depreciation are as follows:<br />

Leasehold land 72 years to 888 years<br />

Buildings 30 years to 50 years<br />

Plant and machinery 6.5% – 33.33%<br />

Furniture, fittings and equipment 10% – 50%<br />

Renovation 10%<br />

Motor vehicles 20%<br />

5.4 Intangible assets<br />

5.4.1 Goodwill<br />

Goodwill represents the excess of the cost of acquisition over the fair value of the Group’s share of the fair value of net<br />

assets of the subsidiary company at the date of acquisition.<br />

STAR PUBLICATIONS<br />

(MALAYSIA) BERHAD<br />

119