perspective perspective - ChartNexus

perspective perspective - ChartNexus

perspective perspective - ChartNexus

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2. MATERIAL CONTRACTS (cont’d)<br />

75<br />

(xiii) Sale and purchase agreement dated 28 April 2005 between SSTwo and Ahmad Zaki bin Zahid for sale of a<br />

condominium for a cash consideration of RM647,072. Ahmad Zaki bin Zahid is a director of MRCB.<br />

(xiv) Sale and purchase agreement dated 29 April 2005 between SSTwo and Datuk Nur Jazlan bin Tan Sri Mohamed for<br />

sale of a condominium for a cash consideration of RM639,072. Datuk Nur Jazlan bin Tan Sri Mohamed is a director<br />

of the Company.<br />

(xv) Sale and purchase agreement dated 2 June 2005 between SSTwo and Dr Choo Kian Koon for sale of a condominium<br />

for a cash consideration of RM398,522. Dr Choo Kian Koon was a former director of SSTwo and the Company.<br />

(xvi) Sale and purchase agreements dated 13 June 2005 and 11 August 2005 between SSTwo and Chan Chee Meng for sale<br />

of two condominiums for a total cash consideration of RM702,528. Chan Chee Meng is a director of SSTwo.<br />

(xvii) Sale and purchase agreement dated 27 July 2005 between SSTwo and Datuk Zahari bin Omar for sale of a<br />

condominium for a cash consideration of RM432,461. Datuk Zahari bin Omar is a director of MRCB.<br />

(xviii) Joint venture agreement dated 18 January 2006 between the Company, Bolton Berhad ("Bolton"), Acegoal Pte Ltd<br />

("Acegoal") and Alpine Return Sdn Bhd ("ARSB") to govern ARSB, the joint-venture company for the proposed<br />

condominium development project on a piece of land located along Jalan Mayang, Kuala Lumpur. Pursuant to the<br />

said agreement, the issued and paid-up capital of ARSB shall be increased to RM40,000,000 and will be subscribed<br />

by the Company, Bolton and Acegoal in the proportion of 35%, 35% and 30% respectively. Acegoal is an indirect<br />

wholly-owned subsidiary of CapitaLand Limited which in turn is a major shareholder of the Company.<br />

3. NON-AUDIT FEES<br />

Non-audit fees paid to external auditors for the financial year ended 31 December 2005 amounted to RM79,420.<br />

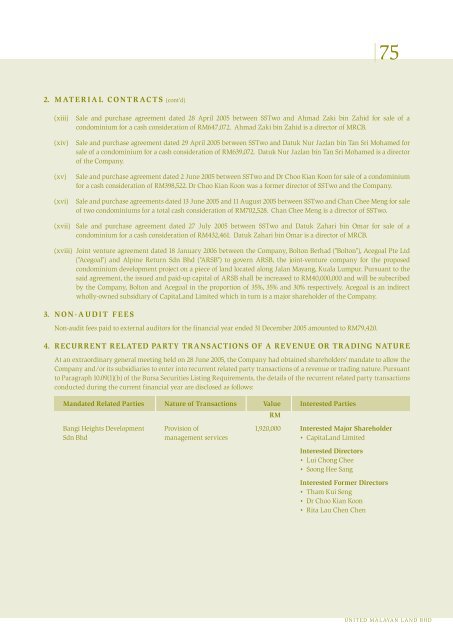

4. RECURRENT RELATED PARTY TRANSACTIONS OF A REVENUE OR TRADING NATURE<br />

At an extraordinary general meeting held on 28 June 2005, the Company had obtained shareholders' mandate to allow the<br />

Company and/or its subsidiaries to enter into recurrent related party transactions of a revenue or trading nature. Pursuant<br />

to Paragraph 10.09(1)(b) of the Bursa Securities Listing Requirements, the details of the recurrent related party transactions<br />

conducted during the current financial year are disclosed as follows:<br />

Mandated Related Parties Nature of Transactions Value<br />

RM<br />

Interested Parties<br />

Bangi Heights Development Provision of 1,920,000 Interested Major Shareholder<br />

Sdn Bhd management services • CapitaLand Limited<br />

Interested Directors<br />

• Lui Chong Chee<br />

• Soong Hee Sang<br />

Interested Former Directors<br />

• Tham Kui Seng<br />

• Dr Choo Kian Koon<br />

• Rita Lau Chen Chen<br />

UNITED MALAYAN LAND BHD