perspective perspective - ChartNexus

perspective perspective - ChartNexus

perspective perspective - ChartNexus

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ADDITIONAL COMPLIANCE INFORMATION<br />

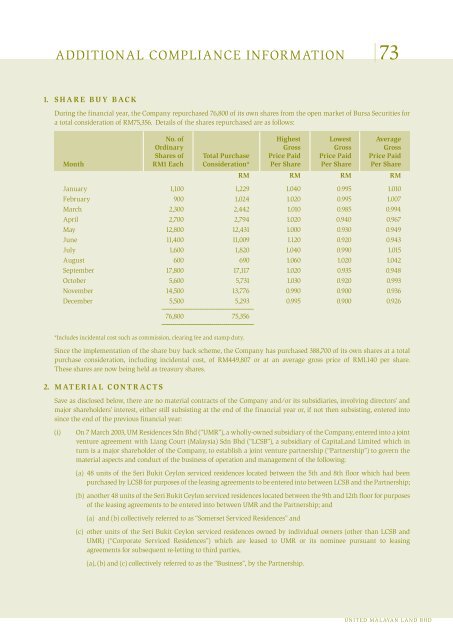

1. SHARE BUY BACK<br />

73<br />

During the financial year, the Company repurchased 76,800 of its own shares from the open market of Bursa Securities for<br />

a total consideration of RM75,356. Details of the shares repurchased are as follows:<br />

No. of Highest Lowest Average<br />

Ordinary Gross Gross Gross<br />

Shares of Total Purchase Price Paid Price Paid Price Paid<br />

Month RM1 Each Consideration* Per Share Per Share Per Share<br />

RM RM RM RM<br />

January 1,100 1,229 1.040 0.995 1.010<br />

February 900 1,024 1.020 0.995 1.007<br />

March 2,300 2,442 1.010 0.985 0.994<br />

April 2,700 2,794 1.020 0.940 0.967<br />

May 12,800 12,431 1.000 0.930 0.949<br />

June 11,400 11,009 1.120 0.920 0.943<br />

July 1,600 1,820 1.040 0.990 1.015<br />

August 600 690 1.060 1.020 1.042<br />

September 17,800 17,117 1.020 0.935 0.948<br />

October 5,600 5,731 1.030 0.920 0.993<br />

November 14,500 13,776 0.990 0.900 0.936<br />

December 5,500 5,293 0.995 0.900 0.926<br />

––––––––––––––––––––––––––––––––––––––––––––––––––––<br />

76,800 75,356<br />

–––––––––––––––––––––––––––––––––––––––––––––––<br />

*Includes incidental cost such as commission, clearing fee and stamp duty.<br />

Since the implementation of the share buy back scheme, the Company has purchased 388,700 of its own shares at a total<br />

purchase consideration, including incidental cost, of RM449,807 or at an average gross price of RM1.140 per share.<br />

These shares are now being held as treasury shares.<br />

2. MATERIAL CONTRACTS<br />

Save as disclosed below, there are no material contracts of the Company and/or its subsidiaries, involving directors' and<br />

major shareholders' interest, either still subsisting at the end of the financial year or, if not then subsisting, entered into<br />

since the end of the previous financial year:<br />

(i) On 7 March 2003, UM Residences Sdn Bhd (“UMR”), a wholly-owned subsidiary of the Company, entered into a joint<br />

venture agreement with Liang Court (Malaysia) Sdn Bhd (“LCSB”), a subsidiary of CapitaLand Limited which in<br />

turn is a major shareholder of the Company, to establish a joint venture partnership (“Partnership”) to govern the<br />

material aspects and conduct of the business of operation and management of the following:<br />

(a) 48 units of the Seri Bukit Ceylon serviced residences located between the 5th and 8th floor which had been<br />

purchased by LCSB for purposes of the leasing agreements to be entered into between LCSB and the Partnership;<br />

(b) another 48 units of the Seri Bukit Ceylon serviced residences located between the 9th and 12th floor for purposes<br />

of the leasing agreements to be entered into between UMR and the Partnership; and<br />

(a) and (b) collectively referred to as “Somerset Serviced Residences” and<br />

(c) other units of the Seri Bukit Ceylon serviced residences owned by individual owners (other than LCSB and<br />

UMR) (“Corporate Serviced Residences”) which are leased to UMR or its nominee pursuant to leasing<br />

agreements for subsequent re-letting to third parties,<br />

(a), (b) and (c) collectively referred to as the “Business”, by the Partnership.<br />

UNITED MALAYAN LAND BHD