értekezés - Budapesti Corvinus Egyetem

értekezés - Budapesti Corvinus Egyetem

értekezés - Budapesti Corvinus Egyetem

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

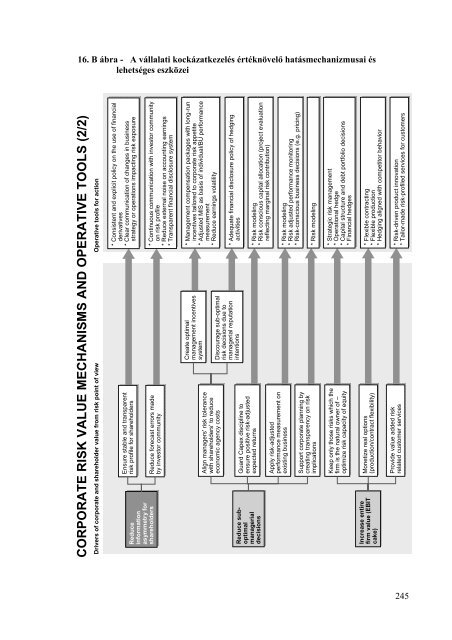

16. B ábra - A vállalati kockázatkezelés értéknövelő hatásmechanizmusai és<br />

lehetséges eszközei<br />

CORPORATE RISK VALUE MECHANISMS AND OPERATIVE TOOLS (2/2)<br />

Drivers of corporate and shareholder value from risk point of view Operative tools for action<br />

Reduce<br />

information<br />

asymmetry for<br />

shareholders<br />

Ensure stable and transparent<br />

risk profile for shareholders<br />

Reduce forecast errors made<br />

by investor community<br />

* Consistent and explicit policy on t t<br />

derivatives<br />

* Clear communication of of changes<br />

strategy or or operations impacting r<br />

he use of of financial<br />

in in business<br />

risk exposure<br />

* Continuous communication with<br />

investor community<br />

on risk profile<br />

* Reduce external noise on accoun<br />

ting earnings<br />

* Transparent financial disclosure sy system stem<br />

Reduce suboptimal<br />

managerial<br />

decisions<br />

Align managers' risk tolerance<br />

with shareholders' to to reduce<br />

economic agency costs<br />

Guard Capex discipline to to<br />

ensure positive risk-adjusted<br />

expected returns<br />

Apply risk-adjusted<br />

performance measurement on<br />

existing business<br />

Support corporate planning by<br />

creating transparency on risk<br />

implications<br />

Create optimal<br />

management incentives<br />

system<br />

Discourage sub-optimal<br />

risk decisions due to to<br />

managerial reputation<br />

intentions<br />

* Management compensation pack<br />

incentives tailored to to corporate ris<br />

* Adjusted MIS as basis of of individu<br />

measurement<br />

* Reduce earnings volatility<br />

* Adequate financial disclosure pol<br />

activities<br />

* Risk modeling<br />

* Risk conscious capital allocation (<br />

reflecting marginal risk contributi<br />

* Risk modeling<br />

kages with long-run<br />

sk k appetite<br />

dual/BU performance<br />

licy of of hedging<br />

(project evaluation<br />

on)<br />

* Risk modeling<br />

* Risk adjusted performance monit<br />

itoring<br />

* Risk-conscious business decisions<br />

(e.g. pricing)<br />

Keep only those risks which the<br />

firm is is the natural owner of of –<br />

optimize risk capacity of of equity<br />

* Strategic risk management<br />

* Operational hedge<br />

* Capital structure and debt portfoli<br />

* Financial hedges<br />

o decisions<br />

Increase entire<br />

firm value (EBIT<br />

cake)<br />

Monetize real options<br />

(production/contract flexibility)<br />

* Flexible contracting<br />

* Flexible production<br />

* Hedging aligned with competitor behavior<br />

Provide value added risk<br />

related customer services<br />

* Risk-driven product innovation<br />

* Tailor-made risk-profiled services for customers<br />

245