Tőkepiaci anomáliák

Tőkepiaci anomáliák

Tőkepiaci anomáliák

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1032<br />

Statisztikai Szemle, 85. évfolyam 12. szám<br />

Nagy—Ulbert: Tôkepiaci <strong>anomáliák</strong><br />

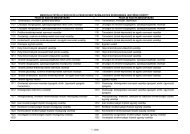

KENDALL, M. [1953]: The analysis of economic time series. Journal of the Royal Statistical<br />

Society, Series A. 96 . évf. 1. sz. 11–25. old.<br />

LAKONISHOK, J. – SHLEIFER, A. – VISHNY, R. [1994]: Contrarian investment, extrapolation, and risk.<br />

Journal of Finance. 49. évf. 6. sz. 1541–1578. old.<br />

LO, A. W. – MACKINLAY, A. C. [1990]: When are contrarian profits due to market overreaction?<br />

Review of Financial Studies. 54. évf. 3. sz. 175–205. old.<br />

LOUGHRAN, J. – RITTER, J. [1996]: Long-term market overreaction: the effect of low-priced stocks.<br />

The Journal of Finance. 51. évf. 5. sz. 1959–1970. old.<br />

POTERBA, J. M. – SUMMERS, L. H. [1988]: Mean reversion in stock prices. Journal of Financial<br />

Economics. 39. évf. 1. sz. 27–59. old.<br />

REINGANUM, M. [1981]: Misspecification of capital asset pricing: empirical anomalies based on<br />

earnings’ yields and market values. Journal of Financial Economics. 32. évf. 1. sz. 19–46. old.<br />

RITTER, J. [1988]: The buying and selling behavior of individual investors at the turn of the year.<br />

The Journal of Finance. 43. évf. 5. sz. 701–718. old.<br />

SAMUELSON P. A. [1965]: Proof that properly anticipated prices fluctuate randomly. Industrial<br />

Management Review. 6. évf. 1. sz. 41–90. old.<br />

SLOVIC, P. [1987]: Kockázatészlelés. (Ford.: Englander Tibor) Pszichológia. 7. évf. 4. sz. 455–468.<br />

old.<br />

ULBERT ET AL. [2000]: Az ötfázisú tőzsdemodell. Bankszemle. 44. évf. 3. sz. 44–59. old.<br />

VARGA J. – RAPPAI G. [2002]: Heteroscedasticity and efficient estimates of Beta. Hungarian<br />

Statistical Review. Special Number 7. 127–137. old.<br />

ZAROWIN, P. [1990]: Size, seasonality, and stock market overreaction. Journal of Financial and<br />

Quantitative Analysis. 25. évf. 1. sz. 113–125. old.<br />

Summary<br />

One of the most influential financial paradigms of the last century is the Efficient Market Hypotheses<br />

(EMH) formulated by Eugene Fama and described by random walk and martingale models.<br />

However, during the last decades several so-called market anomalies have been uncovered one<br />

of them is the so-called reversal and momentum effect.<br />

This paper tests the reversal and momentum hypothesis on the Budapest Stock Exchange. After<br />

reviewing some theoretical and empirical results from the field we describe the methodology and<br />

data used. Our main conclusion is that on this market and on the analysed period a rather strong reversion<br />

effect can be documented and exploited through contrarian strategies, and in the long run it<br />

is possible that prices follow a mean reverting process.