Tőkepiaci anomáliák

Tőkepiaci anomáliák

Tőkepiaci anomáliák

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Tőkepiaci</strong> <strong>anomáliák</strong><br />

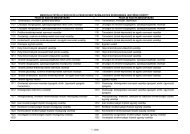

Irodalom<br />

ANDOR GY. – ORMOS M. – SZABÓ B. [1999]: Empirical tests of capital asset pricing model (capm)<br />

in the Hungarian capital market. Periodica polytechnica ser. Soc. Man. Sci. 7. évf. 1. sz. 47–61.<br />

old.<br />

ARIEL, R. A. [1987]: A monthly effect in stock returns. Journal of Financial Economics. 38. évf.<br />

18. sz. 161–174. old.<br />

BANZ, R. [1981]: The relationship between return and market value of common stock. Journal of<br />

Financial Economics. 32. évf. 3–18. old.<br />

BARBERIS, A. – SHLEIFER, A. – VISHNY, R. [1998]: A model of investor sentiment. Journal of Financial<br />

Economics. 49. évf. 307–343. old.<br />

BASU, S. [1977]: Investment performance of common stocks in relation to their price-earning ratios: a<br />

test of the efficient market hypothesis. The Journal of Finance. 32. évf. 3. sz. 663–682. old.<br />

BROUWER, I. – VAN DER PUT, J. – VELD, C. [1997]: Contrarian investment strategies in a European<br />

context. Journal of Business Finance & Accounting. 24. évf. 306–386. old.<br />

BROWN S. J. – WARNER J. B. [1980]: Measuring security price performance, Journal of Financial<br />

Economics. 31. évf. 8. sz. 205–225. old.<br />

CLARE, A. – THOMAS, S. [1995]: The overreaction hypothesis and the UK stock market. Journal of<br />

Business Finance and Accounting. 22. évf. 7. sz. 961–973. old.<br />

CONRAD, J. – KAUL, G. [1993]: Long-term overreaction or biases in computed returns? Journal of<br />

Finance. 48. évf. 1. sz. 39–63. old.<br />

DANIEL, K. – HIRSHLEIFER, D. – SUBRAHMANYAM, A. [1997]: A theory of overconfidence, selfattribution,<br />

and security market under- and over-reactions. Munkaanyag.<br />

DE BONDT W. F. M. – THALER R., H. [1990]: Do security analysts overreact? The American<br />

Economic Review. 80. évf. 2. sz. 52–57.<br />

DE BONDT, W. F. M. – THALER R. H. [1985]: Does the stock market overreact? Journal of Finance.<br />

40. évf. 3. sz. 793–808. old.<br />

FAMA, E. F. – FRENCH, K. R. [1992]: The cross-section of expected stock returns, Journal of<br />

Finance. 47. évf. 2. sz. 427–465. old.<br />

FAMA, E. F. – FRENCH, K. R. [1996]: Multifactor explanations of asset pricing anomalies. Journal of<br />

Finance. 51. évf. 1. sz. 55–84. old.<br />

FAMA, E. F. [1997]: Market efficiency, long-term returns, and behavioral finance. Munkaanyag.<br />

Chicago.<br />

GIBBONS MR. – HESS P. [1981]: Day of the week effects and asset returns. The Journal of Business.<br />

54. évf. 579–596. old.<br />

KAHNEMAN, D. – TVERSKY, A. [1973]: On the psychology of prediction. Psychological Review. 80,<br />

évf. 1. sz. 237–251. old.<br />

KAHNEMAN, D. – TVERSKY, A. [1979]: Prospect theory: an analysis of decision under risk.<br />

Econometrica. 47. évf. 2. sz. 263–291. old.<br />

KAUL, G. – NIMALENDRAN, M. [1990]: Price reversal: bid-ask errors or market overreaction? Journal<br />

of Financial Economics. 28. évf 1. sz. 67–93. old.<br />

KEIM, D. [1983]: Size related anomalies and stock returns seasonality: further empirical evidence.<br />

Journal of Financial Economics. 21. évf. 1. sz. 13–32. old.<br />

Statisztikai Szemle, 85. évfolyam 12. szám<br />

1031