Providence Engineering - 2023 Benefits Guide

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

WHICH MEDICAL INSURANCE PLAN IS<br />

RIGHT FOR YOU?<br />

Choosing the right medical plan is an important decision. Take the<br />

time to learn about your options to ensure you select the right plan<br />

for you and your family.<br />

THINGS TO CONSIDER<br />

1. Do you prefer to pay more for medical insurance out of your<br />

paycheck, but less when you need care?<br />

2. Or, do you prefer to pay less out of your paycheck, but more<br />

when you need care?<br />

3. What planned medical services do you expect to need in the<br />

upcoming year?<br />

4. Are you able to budget for your deductible by setting aside<br />

pre-tax dollars from your paycheck in an HSA or FSA?<br />

5. Do you or any of your covered family members take<br />

prescription medications on a regular basis?<br />

Here is a short video summarizing the differences in the plans<br />

available:<br />

HDHP VS PPO<br />

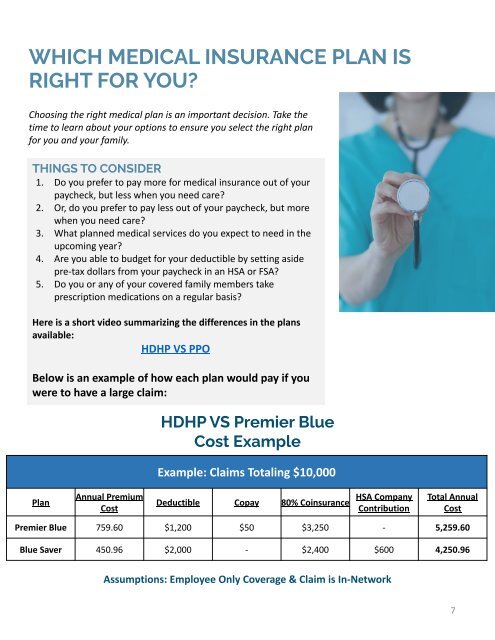

Below is an example of how each plan would pay if you<br />

were to have a large claim:<br />

HDHP VS Premier Blue<br />

Cost Example<br />

Example: Claims Totaling $10,000<br />

Plan<br />

Annual Premium<br />

Cost<br />

Deductible Copay 80% Coinsurance<br />

HSA Company<br />

Contribution<br />

Total Annual<br />

Cost<br />

Premier Blue 759.60 $1,200 $50 $3,250 - 5,259.60<br />

Blue Saver 450.96 $2,000 - $2,400 $600 4,250.96<br />

Assumptions: Employee Only Coverage & Claim is In-Network<br />

7