2007 - Pinguely Haulotte

2007 - Pinguely Haulotte

2007 - Pinguely Haulotte

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Excerpt of the management report to the annual general meeting<br />

of April 22nd, 2008<br />

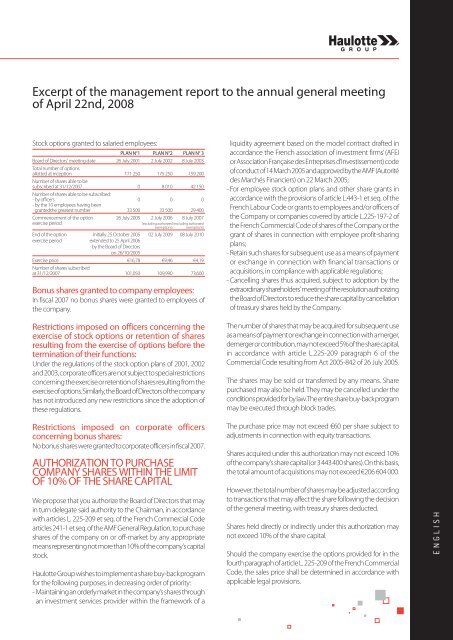

Stock options granted to salaried employees:<br />

PLAN N°1 PLAN N°2 PLAN N° 3<br />

Board of Directors' meeting date 26 July 2001 2 July 2002 8 July 2003<br />

Total number of options<br />

allotted at inception 171 250 175 250 159 200<br />

Number of shares able to be<br />

subscribed at 31/12/<strong>2007</strong><br />

Number of shares able to be subscribed:<br />

0 8 010 42 150<br />

- by officers 0 0 0<br />

- by the 10 employees having been<br />

grantedthe greatest number 33 500 33 500 29 400<br />

Commencement of the option 26 July 2005 2 July 2006 8 July <strong>2007</strong><br />

exercise period (excluding authorized (excluding authorized<br />

exemptions) exemptions)<br />

End of the option Initially 25 October 2005 02 July 2009 08 July 2010<br />

exercise period extended to 25 April 2006<br />

by the Board of Directors<br />

on 26/10/2005<br />

Exercise price €16,78 €9,46 €4,19<br />

Number of shares subscribed<br />

at 31/12/<strong>2007</strong> 101,050 109,990 73,600<br />

Bonus shares granted to company employees:<br />

In fiscal <strong>2007</strong> no bonus shares were granted to employees of<br />

the company.<br />

Restrictions imposed on officers concerning the<br />

exercise of stock options or retention of shares<br />

resulting from the exercise of options before the<br />

termination of their functions:<br />

Under the regulations of the stock option plans of 2001, 2002<br />

and 2003, corporate officers are not subject to special restrictions<br />

concerning the exercise or retention of shares resulting from the<br />

exercise of options. Similarly, the Board of Directors of the company<br />

has not introduced any new restrictions since the adoption of<br />

these regulations.<br />

Restrictions imposed on corporate officers<br />

concerning bonus shares:<br />

No bonus shares were granted to corporate officers in fiscal <strong>2007</strong>.<br />

AUTHORIZATION TO PURCHASE<br />

COMPANY SHARES WITHIN THE LIMIT<br />

OF 10% OF THE SHARE CAPITAL<br />

We propose that you authorize the Board of Directors that may<br />

in turn delegate said authority to the Chairman, in accordance<br />

with articles L. 225-209 et seq. of the French Commercial Code<br />

articles 241-1 et seq. of the AMF General Regulation, to purchase<br />

shares of the company on or off-market by any appropriate<br />

means representing not more than 10% of the company's capital<br />

stock.<br />

<strong>Haulotte</strong> Group wishes to implement a share buy-back program<br />

for the following purposes, in decreasing order of priority:<br />

- Maintaining an orderly market in the company’s shares through<br />

an investment services provider within the framework of a<br />

liquidity agreement based on the model contract drafted in<br />

accordance the French association of investment firms’ (AFEI<br />

or Association Française des Entreprises d’Investissement) code<br />

of conduct of 14 March 2005 and approved by the AMF (Autorité<br />

des Marchés Financiers) on 22 March 2005;<br />

- For employee stock option plans and other share grants in<br />

accordance with the provisions of article L.443-1 et seq. of the<br />

French Labour Code or grants to employees and/or officers of<br />

the Company or companies covered by article L.225-197-2 of<br />

the French Commercial Code of shares of the Company or the<br />

grant of shares in connection with employee profit-sharing<br />

plans;<br />

- Retain such shares for subsequent use as a means of payment<br />

or exchange in connection with financial transactions or<br />

acquisitions, in compliance with applicable regulations;<br />

- Cancelling shares thus acquired, subject to adoption by the<br />

extraordinary shareholders' meeting of the resolution authorizing<br />

the Board of Directors to reduce the share capital by cancellation<br />

of treasury shares held by the Company.<br />

The number of shares that may be acquired for subsequent use<br />

as a means of payment or exchange in connection with a merger,<br />

demerger or contribution, may not exceed 5% of the share capital,<br />

in accordance with article L.225-209 paragraph 6 of the<br />

Commercial Code resulting from Act 2005-842 of 26 July 2005.<br />

The shares may be sold or transferred by any means. Share<br />

purchased may also be held. They may be cancelled under the<br />

conditions provided for by law. The entire share buy-back program<br />

may be executed through block trades.<br />

The purchase price may not exceed €60 per share subject to<br />

adjustments in connection with equity transactions.<br />

Shares acquired under this authorization may not exceed 10%<br />

of the company's share capital (or 3 443 400 shares). On this basis,<br />

the total amount of acquisitions may not exceed €206 604 000.<br />

However, the total number of shares may be adjusted according<br />

to transactions that may affect the share following the decision<br />

of the general meeting, with treasury shares deducted.<br />

Shares held directly or indirectly under this authorization may<br />

not exceed 10% of the share capital.<br />

Should the company exercise the options provided for in the<br />

fourth paragraph of article L. 225-209 of the French Commercial<br />

Code, the sales price shall be determined in accordance with<br />

applicable legal provisions.<br />

ENGLISH