2007 - Pinguely Haulotte

2007 - Pinguely Haulotte

2007 - Pinguely Haulotte

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>2007</strong><br />

annual report # p101-102<br />

Consolidated financial statements of December 31st, <strong>2007</strong><br />

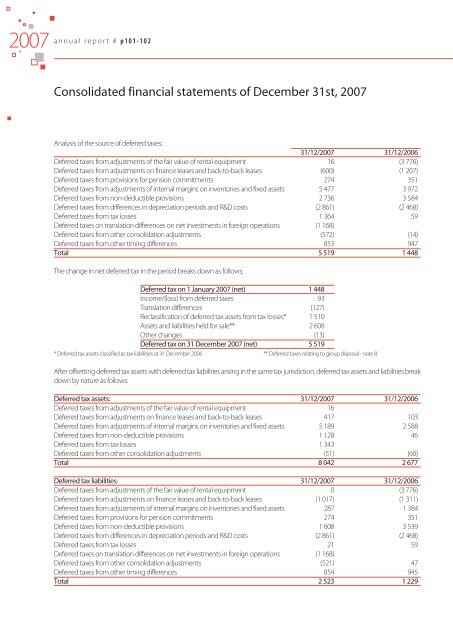

Analysis of the source of deferred taxes:<br />

31/12/<strong>2007</strong> 31/12/2006<br />

Deferred taxes from adjustments of the fair value of rental equipment 16 (3 776)<br />

Deferred taxes from adjustments on finance leases and back-to-back leases (600) (1 207)<br />

Deferred taxes from provisions for pension commitments 274 351<br />

Deferred taxes from adjustments of internal margins on inventories and fixed assets 5 477 3 972<br />

Deferred taxes from non-deductible provisions 2 736 3 584<br />

Deferred taxes from differences in depreciation periods and R&D costs (2 861) (2 468)<br />

Deferred taxes from tax losses 1 364 59<br />

Deferred taxes on translation differences on net investments in foreign operations (1 168)<br />

Deferred taxes from other consolidation adjustments (572) (14)<br />

Deferred taxes from other timing differences 853 947<br />

Total 5 519 1 448<br />

The change in net deferred tax in the period breaks down as follows:<br />

Deferred tax on 1 January <strong>2007</strong> (net) 1 448<br />

Income/(loss) from deferred taxes 93<br />

Translation differences (127)<br />

Reclassification of deferred tax assets from tax losses* 1 510<br />

Assets and liabilities held for sale** 2 608<br />

Other changes (13)<br />

Deferred tax on 31 December <strong>2007</strong> (net) 5 519<br />

* Deferred tax assets classified as tax liabilities at 31 December 2006 ** Deferred taxes relating to group disposal - note 8<br />

After offsetting deferred tax assets with deferred tax liabilities arising in the same tax jurisdiction, deferred tax assets and liabilities break<br />

down by nature as follows:<br />

Deferred tax assets: 31/12/<strong>2007</strong> 31/12/2006<br />

Deferred taxes from adjustments of the fair value of rental equipment 16<br />

Deferred taxes from adjustments on finance leases and back-to-back leases 417 103<br />

Deferred taxes from adjustments of internal margins on inventories and fixed assets 5 189 2 588<br />

Deferred taxes from non-deductible provisions 1 128 46<br />

Deferred taxes from tax losses 1 343<br />

Deferred taxes from other consolidation adjustments (51) (60)<br />

Total 8 042 2 677<br />

Deferred tax liabilities: 31/12/<strong>2007</strong> 31/12/2006<br />

Deferred taxes from adjustments of the fair value of rental equipment 0 (3 776)<br />

Deferred taxes from adjustments on finance leases and back-to-back leases (1 017) (1 311)<br />

Deferred taxes from adjustments of internal margins on inventories and fixed assets 287 1 384<br />

Deferred taxes from provisions for pension commitments 274 351<br />

Deferred taxes from non-deductible provisions 1 608 3 539<br />

Deferred taxes from differences in depreciation periods and R&D costs (2 861) (2 468)<br />

Deferred taxes from tax losses 21 59<br />

Deferred taxes on translation differences on net investments in foreign operations (1 168)<br />

Deferred taxes from other consolidation adjustments (521) 47<br />

Deferred taxes from other timing differences 854 945<br />

Total 2 523 1 229