Análisis y Estrategia - Casa de Bolsa Banorte

Análisis y Estrategia - Casa de Bolsa Banorte

Análisis y Estrategia - Casa de Bolsa Banorte

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

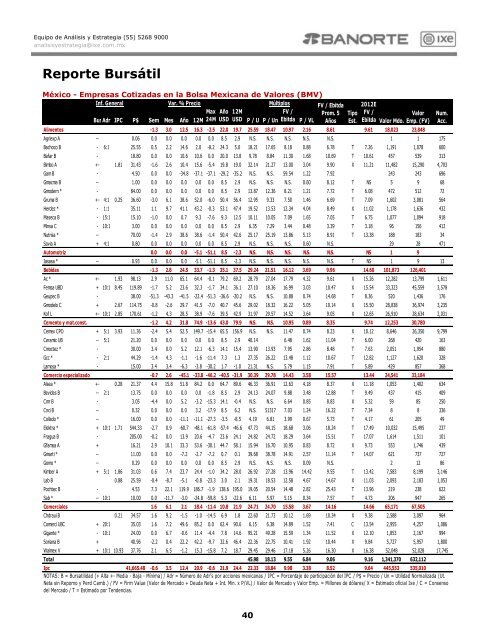

Equipo <strong>de</strong> Análisis y <strong>Estrategia</strong> (55) 5268 9000analisisyestrategia@ixe.com.mxReporte BursátilMéxico - Empresas Cotizadas en la <strong>Bolsa</strong> Mexicana <strong>de</strong> Valores (BMV)Inf. General Var. % Precio Múltiplos FV / EbitdaBur Adr IPC P$ Sem Mes AñoMax Año 12M12M 24M USD USD P / UFV /P / Un Ebitda P / VLProm. 5AñosValor Mdo.Alimentos -1.3 3.0 12.5 16.3 -2.5 22.0 19.7 25.59 18.47 10.97 2.16 8.61 9.61 18,023 23,848Agriexp A -- 0.06 0.0 0.0 0.0 0.0 0.0 8.5 2.9 N.S. N.S. N.S. N.S. N.S. 1 1 175Bachoco B - 6:1 25.55 0.5 2.2 14.6 2.0 -8.2 24.3 5.0 18.21 17.65 8.18 0.88 6.78 T 7.26 1,191 1,078 600Bafar B - 18.80 0.0 0.0 10.6 10.6 0.0 20.0 13.8 9.78 8.84 11.30 1.68 10.69 T 10.61 457 539 313Bimbo A +- 1.81 31.43 -1.6 2.6 10.4 15.6 -5.4 19.8 19.0 32.14 21.27 13.00 3.04 9.90 X 11.21 11,482 15,290 4,703Gam B - 4.50 0.0 0.0 -34.8 -37.1 -37.1 -29.2 -35.2 N.S. N.S. 59.54 1.22 7.92 243 243 696Gmacma B -- 1.00 0.0 0.0 0.0 0.0 0.0 8.5 2.9 N.S. N.S. N.S. 0.60 8.12 T NS 5 9 68Gmo<strong>de</strong>rn * - 84.00 0.0 0.0 0.0 0.0 0.0 8.5 2.9 13.87 12.36 8.21 1.21 7.72 T 6.08 472 512 72Gruma B +- 4:1 0.25 36.60 -3.0 6.1 38.6 52.0 -6.0 50.4 56.4 12.95 9.33 7.50 1.46 6.69 T 7.09 1,602 3,081 564Her<strong>de</strong>z * - 1:1 35.11 1.1 9.7 41.1 43.2 -0.3 53.1 47.4 19.52 13.53 12.34 4.04 8.49 X 11.02 1,178 1,636 432Maseca B - 15:1 15.10 -1.0 0.0 0.7 9.3 -7.6 9.3 12.5 10.11 10.05 7.09 1.65 7.05 T 6.75 1,077 1,094 918Minsa C - 10:1 3.00 0.0 0.0 0.0 0.0 0.0 8.5 2.9 6.35 7.29 3.44 0.48 3.39 T 3.18 96 156 412Nutrisa * -- 70.00 -1.4 2.9 38.6 38.6 -1.4 50.4 42.6 25.17 25.19 13.86 5.13 8.91 T 13.38 188 183 34Savia A + 4:1 0.80 0.0 0.0 0.0 0.0 0.0 8.5 2.9 N.S. N.S. N.S. 0.60 N.S. 29 28 471Automotriz 0.0 0.0 0.0 -5.1 -51.1 8.5 -2.3 N.S. N.S. N.S. N.S. N.S. NS 1 9ValorEmp. (FV)Iasasa * -- 0.93 0.0 0.0 0.0 -5.1 -51.1 8.5 -2.3 N.S. N.S. N.S. N.S. N.S. T NS 1 9 13Bebidas -1.3 2.8 24.5 33.7 -1.3 35.1 37.5 29.24 21.51 16.12 3.69 9.96 14.60 101,873 126,401Ac * +- 1.93 98.13 2.9 11.0 65.1 64.4 -0.1 79.2 69.2 28.79 27.04 17.79 4.32 9.61 X 15.26 12,282 13,799 1,611Femsa UBD + 10:1 8.45 119.89 -1.7 5.2 23.6 32.3 -1.7 34.1 36.1 27.10 18.36 16.99 3.03 10.47 X 15.54 33,323 45,559 3,578Geupec B - 38.00 -51.3 -43.3 -41.5 -22.4 -51.3 -36.6 -20.2 N.S. N.S. 10.88 0.74 14.68 T 8.36 520 1,436 176Gmo<strong>de</strong>lo C + 2.67 114.75 -0.8 -2.6 29.7 41.5 -7.0 40.7 45.6 29.02 18.32 16.22 5.05 10.14 X 15.50 28,838 36,974 3,235Kof L +- 10:1 2.85 170.61 -1.2 4.3 28.5 38.9 -7.6 39.5 42.9 31.97 29.57 14.52 3.64 9.05 X 12.65 26,910 28,634 2,031Cemento y mat.const. -1.2 4.2 31.8 74.9 -13.6 43.0 79.9 N.S. N.S. 10.95 0.89 8.35 9.74 12,253 30,780Cemex CPO + 5:1 3.93 11.36 -2.4 5.4 52.5 149.7 -15.4 65.5 156.9 N.S. N.S. 11.47 0.74 8.23 X 10.12 8,646 26,350 9,799Ceramic UB -- 5:1 21.20 0.0 0.0 0.0 0.0 0.0 8.5 2.9 40.14 6.48 1.62 11.04 T 6.00 268 420 163Cmoctez * - 30.00 3.4 0.0 5.2 12.1 -6.3 14.1 15.4 13.90 13.93 7.95 2.86 8.48 T 7.63 2,051 1,954 880Gcc * - 2:1 44.29 -1.4 4.3 -1.1 -1.6 -11.4 7.3 1.3 27.35 26.22 13.48 1.12 10.67 T 12.82 1,127 1,620 328Lamosa * - 15.00 3.4 3.4 -6.3 -3.8 -30.2 1.7 -1.0 21.31 N.S. 5.79 1.15 7.91 T 5.89 429 857 368Comercio especializado -0.7 2.6 -45.1 -33.8 -46.2 -40.5 -31.9 30.39 29.78 14.43 3.58 15.57 13.44 24,541 33,184Alsea * +- 0.28 21.37 4.4 15.8 51.8 84.2 0.0 64.7 89.6 46.33 36.91 12.63 4.18 8.37 X 11.18 1,053 1,402 634Bevi<strong>de</strong>s B -- 2:1 13.75 0.0 0.0 0.0 0.0 -1.8 8.5 2.9 24.13 24.07 9.88 3.48 12.88 T 9.49 437 415 409Cmr B - 3.05 -4.4 0.0 5.2 -3.2 -15.3 14.1 -0.4 N.S. N.S. 6.64 0.85 8.83 X 5.32 59 85 250Cnci B -- 0.32 0.0 0.0 0.0 3.2 -17.9 8.5 6.2 N.S. 51317 7.03 1.24 16.22 T 7.34 8 8 336Collado * -- 16.00 0.0 0.0 -11.1 -11.1 -27.3 -3.5 -8.5 4.19 6.81 3.99 0.67 5.73 T 4.17 61 205 49Elektra * + 10:1 1.71 544.33 -2.7 0.9 -60.7 -48.1 -61.8 -57.4 -46.6 47.73 44.15 18.68 3.06 18.24 T 17.49 10,032 15,495 237Fragua B - 205.00 -0.2 0.0 13.9 20.6 -4.7 23.6 24.1 24.82 24.72 18.29 3.64 15.51 T 17.07 1,614 1,511 101Gfamsa A + 16.21 2.9 10.1 33.3 53.6 -30.1 44.7 58.1 15.94 16.70 10.95 0.83 8.72 X 9.73 553 1,746 439Gmarti * -- 11.00 0.0 0.0 -7.2 -2.7 -7.2 0.7 0.1 39.68 38.78 14.91 2.57 11.14 T 14.07 621 737 727Gomo * -- 0.29 0.0 0.0 0.0 0.0 0.0 8.5 2.9 N.S. N.S. N.S. 0.09 N.S. 2 12 86Kimber A + 5:1 1.86 31.03 0.6 7.4 23.7 24.4 -1.0 34.2 28.0 26.92 27.28 13.96 14.42 9.55 T 13.42 7,583 8,199 3,146Lab B 0.88 25.59 -0.4 -8.7 -5.1 -0.8 -23.3 3.0 2.1 19.31 18.53 12.58 4.67 14.67 X 11.03 2,093 2,183 1,053Pochtec B - 4.53 7.3 22.1 119.9 186.7 -1.9 138.6 195.0 19.05 20.54 14.48 2.82 25.43 T 13.96 219 238 622Sab * -- 10:1 10.00 0.0 -11.7 -3.0 -24.8 -59.8 5.3 -22.6 6.11 5.97 5.15 0.34 7.57 T 4.73 206 947 265Comerciales 1.6 6.1 2.1 18.4 -11.4 10.8 21.9 24.71 24.70 15.58 3.67 14.16 14.66 65,171 67,505Chdraui B 0.21 34.57 1.6 9.2 -1.5 -1.0 -14.5 6.9 1.8 22.60 21.73 10.12 1.69 10.34 X 9.38 2,588 3,097 964Comerci UBC + 20:1 35.03 1.6 7.2 49.6 85.2 0.0 62.4 90.6 6.15 6.38 14.89 1.52 7.41 C 13.54 2,955 4,257 1,086Gigante * - 10:1 24.00 0.0 6.7 -0.6 11.4 -4.4 7.8 14.6 95.21 49.28 15.59 1.34 11.52 X 12.10 1,853 2,167 994Soriana B + 40.96 -2.2 0.4 22.2 42.2 -9.7 32.6 46.4 22.36 22.75 10.41 1.92 10.44 X 9.84 5,727 5,957 1,800Walmex V + 10:1 10.93 37.76 2.1 6.5 -1.2 15.3 -15.8 7.2 18.7 29.45 29.46 17.18 5.26 16.30 X 16.38 52,048 52,028 17,745Total 45.98 18.13 9.55 6.84 9.06 9.16 1,341,370 632,112Ipc 41,665.48 -0.6 3.5 12.4 20.9 -0.6 21.9 24.4 22.33 18.84 9.98 3.38 8.52 9.64 445,553 535,010NOTAS: B = Bursatilidad (+ Alta +- Media - Baja - Mínima) / Adr = Número <strong>de</strong> Adr's por acciones mexicanas / IPC = Porcentaje <strong>de</strong> participación <strong>de</strong>l IPC / P$ = Precio / Un = Utilidad Normalizada (Ut.Neta sin Repomo y Perd Camb.) / FV = Firm Value (Valor <strong>de</strong> Mercado + Deuda Neta + Int. Min. x P/VL) / Valor <strong>de</strong> Mercado y Valor Emp. = Millones <strong>de</strong> dólares/ X = Estimado oficial Ixe / C = Consenso<strong>de</strong>l Mercado / T = Estimado por Ten<strong>de</strong>ncias.TipoEst.2012EFV /EbitdaNum.Acc.40