- Page 2 and 3:

CARTA DEL EDITOR IN CHIEFEditor in

- Page 4 and 5:

SUMARIO SUMMARY SUMÁRIO1Ú2Efectos

- Page 6 and 7:

StaffDe la Torre, José, Dean, Chap

- Page 8 and 9:

Staff2. MULTINACIONALES, INVERSIÓN

- Page 10 and 11:

SELECCIÓN PROCEDURE PROCEDIMENTOIN

- Page 12 and 13:

Instrucciones para Autores y Proced

- Page 14 and 15:

Instrucciones para Autores y Proced

- Page 16 and 17:

16 Efectos de la inversión en I+Ds

- Page 18 and 19:

Efectos de la inversión en I+D sob

- Page 20 and 21:

Efectos de la inversión en I+D sob

- Page 22 and 23:

Efectos de la inversión en I+D sob

- Page 24 and 25:

Efectos de la inversión en I+D sob

- Page 26 and 27:

Efectos de la inversión en I+D sob

- Page 28 and 29:

28El Pacto Mundial de las NacionesU

- Page 30 and 31:

El Pacto Mundial de las Naciones Un

- Page 32 and 33:

El Pacto Mundial de las Naciones Un

- Page 34 and 35:

El Pacto Mundial de las Naciones Un

- Page 36 and 37:

El Pacto Mundial de las Naciones Un

- Page 38 and 39:

El Pacto Mundial de las Naciones Un

- Page 40 and 41:

40La política de Industrializació

- Page 42 and 43:

La política de Industrialización

- Page 44 and 45:

La política de Industrialización

- Page 46 and 47:

La política de Industrialización

- Page 48 and 49:

La política de Industrialización

- Page 50 and 51:

La política de Industrialización

- Page 52 and 53:

La política de Industrialización

- Page 54:

54autorMiguel Blanco-Callejo 1Depar

- Page 57 and 58:

Miguel Blanco-CallejoA pesar de que

- Page 59 and 60:

Miguel Blanco-CallejoEn 2003, como

- Page 61 and 62: Miguel Blanco-Callejo3.1. Formula 1

- Page 63 and 64: Miguel Blanco-Callejoel patrocinio

- Page 65 and 66: Miguel Blanco-Callejo• Patrocinio

- Page 67 and 68: Miguel Blanco-Callejo-Copa Santande

- Page 70 and 71: Banco Santander, en la “pole posi

- Page 72: 72 Inversión extranjera yCompetiti

- Page 76 and 77: Inversion extranjera y Competitivid

- Page 78 and 79: Inversion extranjera y Competitivid

- Page 80 and 81: Inversion extranjera y Competitivid

- Page 82 and 83: Inversion extranjera y Competitivid

- Page 84 and 85: Inversion extranjera y Competitivid

- Page 86 and 87: Inversion extranjera y Competitivid

- Page 88 and 89: 88Inversión en infraestructuras:Cu

- Page 90 and 91: Inversión en infraestructuras: Cua

- Page 92 and 93: Inversión en infraestructuras: Cua

- Page 94 and 95: Inversión en infraestructuras: Cua

- Page 96 and 97: Inversión en infraestructuras: Cua

- Page 98 and 99: Inversión en infraestructuras: Cua

- Page 100 and 101: Inversión en infraestructuras: Cua

- Page 102 and 103: Inversión en infraestructuras: Cua

- Page 104 and 105: 104Conditional volatility in sustai

- Page 106 and 107: Conditional volatility in sustainab

- Page 108 and 109: Conditional volatility in sustainab

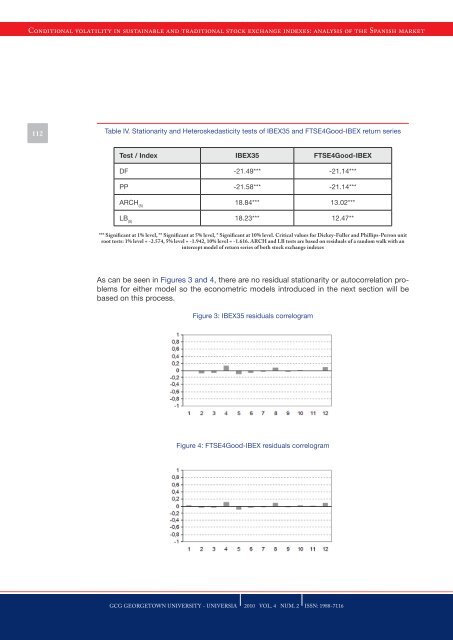

- Page 110 and 111: Conditional volatility in sustainab

- Page 114 and 115: Conditional volatility in sustainab

- Page 116 and 117: Conditional volatility in sustainab

- Page 118 and 119: Conditional volatility in sustainab

- Page 120 and 121: Conditional volatility in sustainab

- Page 122 and 123: Conditional volatility in sustainab

- Page 124 and 125: Conditional volatility in sustainab

- Page 126 and 127: Conditional volatility in sustainab

- Page 128 and 129: Conditional volatility in sustainab