Texas Sales and Use Tax Resale Gertificate - St. Patrick's of Texas

Texas Sales and Use Tax Resale Gertificate - St. Patrick's of Texas Texas Sales and Use Tax Resale Gertificate - St. Patrick's of Texas

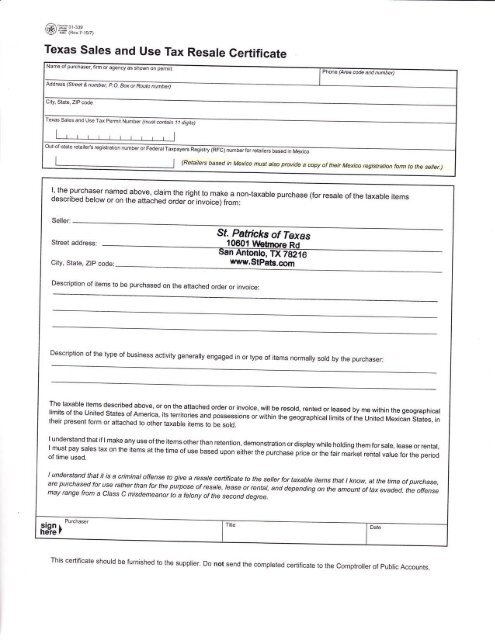

@ffii;"i:,'-,.", Texas Sales and Use Tax Resale Gertificate Name of purchaser, r'rm-r ad;;y a-ahil;;;;ffi;i Address fstreer & number, p.O. ao, o, ioiniiiiJl Out-of-state retaile/" r"Si.t, I (RetailersbasedinMexicomustatsoprovideacopyoftheirMexicoregistntionformtothese!ler.) l' the purchaser named above, claim the right to make a non-laxable purchase (for resale of the taxable items described below or on the attached order or invoice) from: Seller: Street address City, State, ZIP code: Sf. Pafncks of Texas .10901 Vtletpore nO San anton www.Stpats.com Description of items to be purchased on the attached order or invoice: Description of the type of business activity generally engaged in or type of items normally sold by the purchaser: The taxable items described above, or on the attached order or invoice, will be resold, rented or leased by me within the geographical limits of the united states of America' its territories and possessions or within the geographical limits of the United Mexican States, in their present form or attached to other taxable items to be sold. I understand that if I make any use of the items otherthan retention, demonstration or display while holding them for sale, lease or rental, I must pay sales tax on the items at the time of use based upon either the purchase price or the fair market rehtal value for the period of time used. I understand that it is a criminal offense to give a resale certificate to the seiler for taxable items that t know, at the time of purchase, are pttrchased for use ratherthan forthe purpose of resale, lease or rental, and depending on the amount oftax evaded, the offense may range from a Class C misdemeanor to a fetony of the second degree. . Purchaser figB) This certificate should be furnished to the supplier. Do not send the completed certificate to the comptroller of public Accounts.

@ffii;"i:,'-,.",<br />

<strong>Texas</strong> <strong>Sales</strong> <strong>and</strong> <strong>Use</strong> <strong>Tax</strong> <strong>Resale</strong> <strong>Gertificate</strong><br />

Name <strong>of</strong> purchaser, r'rm-r ad;;y a-ahil;;;;ffi;i<br />

Address fstreer & number, p.O. ao, o, ioiniiiiJl<br />

Out-<strong>of</strong>-state retaile/" r"Si.t,<br />

I<br />

(RetailersbasedinMexicomustatsoprovideacopy<strong>of</strong>theirMexicoregistntionformtothese!ler.)<br />

l' the purchaser named above, claim the right to make a non-laxable purchase (for resale <strong>of</strong> the taxable items<br />

described below or on the attached order or invoice) from:<br />

Seller:<br />

<strong>St</strong>reet address<br />

City, <strong>St</strong>ate, ZIP code:<br />

Sf. Pafncks <strong>of</strong> <strong>Texas</strong><br />

.10901 Vtletpore nO<br />

San anton<br />

www.<strong>St</strong>pats.com<br />

Description <strong>of</strong> items to be purchased on the attached order or invoice:<br />

Description <strong>of</strong> the type <strong>of</strong> business activity generally engaged in or type <strong>of</strong> items normally sold by the purchaser:<br />

The taxable items described above, or on the attached order or invoice, will be resold, rented or leased by me within the geographical<br />

limits <strong>of</strong> the united states <strong>of</strong> America' its territories <strong>and</strong> possessions or within the geographical limits <strong>of</strong> the United Mexican <strong>St</strong>ates, in<br />

their present form or attached to other taxable items to be sold.<br />

I underst<strong>and</strong> that if I make any use <strong>of</strong> the items otherthan retention, demonstration or display while holding them for sale, lease or rental,<br />

I must pay sales tax on the items at the time <strong>of</strong> use based upon either the purchase price or the fair market rehtal value for the period<br />

<strong>of</strong> time used.<br />

I underst<strong>and</strong> that it is a criminal <strong>of</strong>fense to give a resale certificate to the seiler for taxable items that t know, at the time <strong>of</strong> purchase,<br />

are pttrchased for use ratherthan forthe purpose <strong>of</strong> resale, lease or rental, <strong>and</strong> depending on the amount <strong>of</strong>tax evaded, the <strong>of</strong>fense<br />

may range from a Class C misdemeanor to a fetony <strong>of</strong> the second degree.<br />

. Purchaser<br />

figB)<br />

This certificate should be furnished to the supplier. Do not send the completed certificate to the comptroller <strong>of</strong> public Accounts.

@r#iJ;l';;,,,<br />

CERTIFICADO DE REVENTA PARA EL IMPUESTO SOBRE VENTAS Y USO DE TEXAS<br />

Nombre del comprador, firma o agencia como se muestra en el permiso<br />

Telefono (c6digo de 6rea y nlmero)<br />

Domicilio (Calle y n0mero. Apartado postal o Nlmero de ruta)<br />

Ciudad, Estado, C6digo postal<br />

Numero de permrso para el impuesto sobre ventas y uso de <strong>Texas</strong> (debe contener 11 digitos)<br />

El n0mero de registro de minorista de otro estado o su n0mero de Registro Federal de Causantes (RFC) de minoristas basados en Mexico<br />

t<br />

I<br />

(Los minoristas basados e, Mdxico tambien deben proporcionar una solicitud de registro mexicano al vendedor.)<br />

Yo, el comprador mencionado anteriormente, reclama que el derecho de hacer una compra no imponible (para<br />

reventa de los articulos imponibles descritos a continuaci6n o en la orden o factura adjunta) de:<br />

Vendedor:<br />

Domicilio:<br />

10601 Wbtrnore Rd<br />

San Antonlo, TX 7821e<br />

urow,gtP.t3,com<br />

Ciudad, Estado, C6digo postal:<br />

Descripci6n en la orden o factura adjunta de los articulos que se van a comprar:<br />

Descripci6n del tipo de actividad comercial que tiene generalmente o el tipo de articulos normalmente vendido por el comprador:<br />

Los articulos imponibles descritos anteriormente, o en la orden o factura adjunta, se revender6n, rentar5n o arrendar5n por mi dentro<br />

de los limites geogr5ficos de los Estados Unidos de Am6rica, sus territorios y posesiones, o dentro de los limites geogr6ficos de los<br />

Estados Unidos Mexicanos, en su forma presente o adjuntos a otros articulos imponibles en venta. n<br />

Entiendo que si hago cualquier uso de los articulos para otra cosa que no sea retenci6n, demostraci6n o exhibicion mientras los<br />

tenga en venta, renta o arrendamiento debo pagar impuestos sobre ventas por los articulos en el momento de uso en base al<br />

precio de compra o en base al valor justo del mercado por el periodo de tiempo usado.<br />

Entiendo que es un delito penal emitir un certificado de reventa al vendedor por articulos imponibles que yo s6, en el momento<br />

de la compra, son comprados para uso en vez de para el proposito de reventa, renta o arrendamiento y, dependiendo en la<br />

cantidad de impuestos, evadio, la <strong>of</strong>ensa puede variar de un delito menor clase C a un delito mayor de segundo grado.<br />

firmer<br />

aqui t<br />

Comorador<br />

Titulo<br />

Fecha<br />

Este certificado debe ser proporcionado al suministrador.<br />

No envie el certificado llenado a la Contraloria de Cuentas Pfblicas.