10/05/2012 - Myclipp

10/05/2012 - Myclipp

10/05/2012 - Myclipp

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

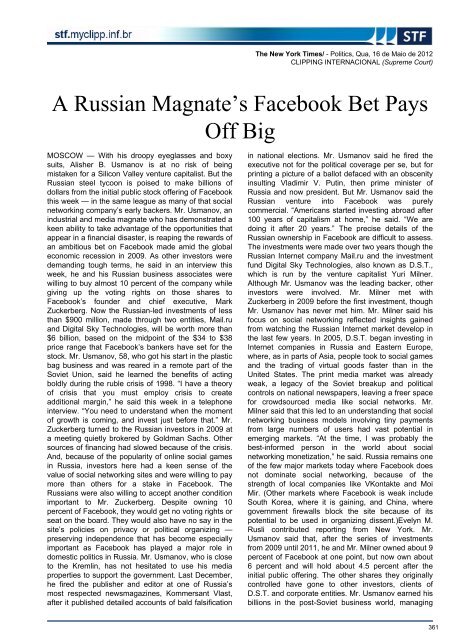

The New York Times/ - Politics, Qua, 16 de Maio de <strong>2012</strong><br />

CLIPPING INTERNACIONAL (Supreme Court)<br />

A Russian Magnate’s Facebook Bet Pays<br />

Off Big<br />

MOSCOW — With his droopy eyeglasses and boxy<br />

suits, Alisher B. Usmanov is at no risk of being<br />

mistaken for a Silicon Valley venture capitalist. But the<br />

Russian steel tycoon is poised to make billions of<br />

dollars from the initial public stock offering of Facebook<br />

this week — in the same league as many of that social<br />

networking company’s early backers. Mr. Usmanov, an<br />

industrial and media magnate who has demonstrated a<br />

keen ability to take advantage of the opportunities that<br />

appear in a financial disaster, is reaping the rewards of<br />

an ambitious bet on Facebook made amid the global<br />

economic recession in 2009. As other investors were<br />

demanding tough terms, he said in an interview this<br />

week, he and his Russian business associates were<br />

willing to buy almost <strong>10</strong> percent of the company while<br />

giving up the voting rights on those shares to<br />

Facebook’s founder and chief executive, Mark<br />

Zuckerberg. Now the Russian-led investments of less<br />

than $900 million, made through two entities, Mail.ru<br />

and Digital Sky Technologies, will be worth more than<br />

$6 billion, based on the midpoint of the $34 to $38<br />

price range that Facebook’s bankers have set for the<br />

stock. Mr. Usmanov, 58, who got his start in the plastic<br />

bag business and was reared in a remote part of the<br />

Soviet Union, said he learned the benefits of acting<br />

boldly during the ruble crisis of 1998. “I have a theory<br />

of crisis that you must employ crisis to create<br />

additional margin,” he said this week in a telephone<br />

interview. “You need to understand when the moment<br />

of growth is coming, and invest just before that.” Mr.<br />

Zuckerberg turned to the Russian investors in 2009 at<br />

a meeting quietly brokered by Goldman Sachs. Other<br />

sources of financing had slowed because of the crisis.<br />

And, because of the popularity of online social games<br />

in Russia, investors here had a keen sense of the<br />

value of social networking sites and were willing to pay<br />

more than others for a stake in Facebook. The<br />

Russians were also willing to accept another condition<br />

important to Mr. Zuckerberg. Despite owning <strong>10</strong><br />

percent of Facebook, they would get no voting rights or<br />

seat on the board. They would also have no say in the<br />

site’s policies on privacy or political organizing —<br />

preserving independence that has become especially<br />

important as Facebook has played a major role in<br />

domestic politics in Russia. Mr. Usmanov, who is close<br />

to the Kremlin, has not hesitated to use his media<br />

properties to support the government. Last December,<br />

he fired the publisher and editor at one of Russia’s<br />

most respected newsmagazines, Kommersant Vlast,<br />

after it published detailed accounts of bald falsification<br />

in national elections. Mr. Usmanov said he fired the<br />

executive not for the political coverage per se, but for<br />

printing a picture of a ballot defaced with an obscenity<br />

insulting Vladimir V. Putin, then prime minister of<br />

Russia and now president. But Mr. Usmanov said the<br />

Russian venture into Facebook was purely<br />

commercial. “Americans started investing abroad after<br />

<strong>10</strong>0 years of capitalism at home,” he said. “We are<br />

doing it after 20 years.” The precise details of the<br />

Russian ownership in Facebook are difficult to assess.<br />

The investments were made over two years though the<br />

Russian Internet company Mail.ru and the investment<br />

fund Digital Sky Technologies, also known as D.S.T.,<br />

which is run by the venture capitalist Yuri Milner.<br />

Although Mr. Usmanov was the leading backer, other<br />

investors were involved. Mr. Milner met with<br />

Zuckerberg in 2009 before the first investment, though<br />

Mr. Usmanov has never met him. Mr. Milner said his<br />

focus on social networking reflected insights gained<br />

from watching the Russian Internet market develop in<br />

the last few years. In 20<strong>05</strong>, D.S.T. began investing in<br />

Internet companies in Russia and Eastern Europe,<br />

where, as in parts of Asia, people took to social games<br />

and the trading of virtual goods faster than in the<br />

United States. The print media market was already<br />

weak, a legacy of the Soviet breakup and political<br />

controls on national newspapers, leaving a freer space<br />

for crowdsourced media like social networks. Mr.<br />

Milner said that this led to an understanding that social<br />

networking business models involving tiny payments<br />

from large numbers of users had vast potential in<br />

emerging markets. “At the time, I was probably the<br />

best-informed person in the world about social<br />

networking monetization,” he said. Russia remains one<br />

of the few major markets today where Facebook does<br />

not dominate social networking, because of the<br />

strength of local companies like VKontakte and Moi<br />

Mir. (Other markets where Facebook is weak include<br />

South Korea, where it is gaining, and China, where<br />

government firewalls block the site because of its<br />

potential to be used in organizing dissent.)Evelyn M.<br />

Rusli contributed reporting from New York. Mr.<br />

Usmanov said that, after the series of investments<br />

from 2009 until 2011, he and Mr. Milner owned about 9<br />

percent of Facebook at one point, but now own about<br />

6 percent and will hold about 4.5 percent after the<br />

initial public offering. The other shares they originally<br />

controlled have gone to other investors, clients of<br />

D.S.T. and corporate entities. Mr. Usmanov earned his<br />

billions in the post-Soviet business world, managing<br />

361