DIRECTORS' REPORT ON PGNiG SA'S OPERATIONS ... - Notowania

DIRECTORS' REPORT ON PGNiG SA'S OPERATIONS ... - Notowania

DIRECTORS' REPORT ON PGNiG SA'S OPERATIONS ... - Notowania

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

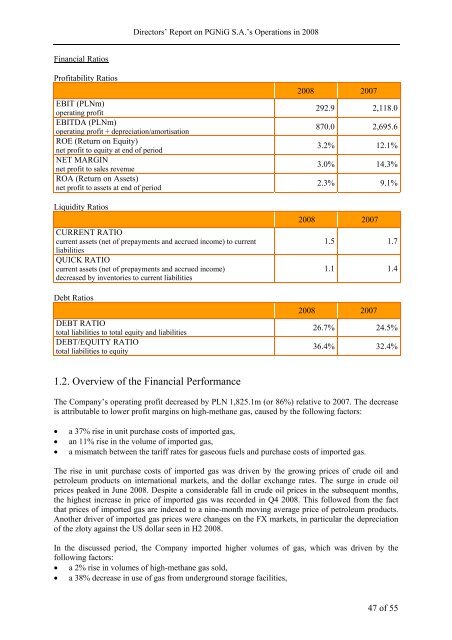

Financial Ratios<br />

Profitability Ratios<br />

EBIT (PLNm)<br />

operating profit<br />

EBITDA (PLNm)<br />

operating profit + depreciation/amortisation<br />

ROE (Return on Equity)<br />

net profit to equity at end of period<br />

NET MARGIN<br />

net profit to sales revenue<br />

ROA (Return on Assets)<br />

net profit to assets at end of period<br />

Liquidity Ratios<br />

Directors’ Report on <strong>PGNiG</strong> S.A.’s Operations in 2008<br />

CURRENT RATIO<br />

current assets (net of prepayments and accrued income) to current<br />

liabilities<br />

QUICK RATIO<br />

current assets (net of prepayments and accrued income)<br />

decreased by inventories to current liabilities<br />

Debt Ratios<br />

DEBT RATIO<br />

total liabilities to total equity and liabilities<br />

DEBT/EQUITY RATIO<br />

total liabilities to equity<br />

1.2. Overview of the Financial Performance<br />

2008 2007<br />

292.9 2,118.0<br />

870.0 2,695.6<br />

3.2% 12.1%<br />

3.0% 14.3%<br />

2.3% 9.1%<br />

2008 2007<br />

1.5 1.7<br />

1.1 1.4<br />

2008 2007<br />

26.7% 24.5%<br />

36.4% 32.4%<br />

The Company’s operating profit decreased by PLN 1,825.1m (or 86%) relative to 2007. The decrease<br />

is attributable to lower profit margins on high-methane gas, caused by the following factors:<br />

• a 37% rise in unit purchase costs of imported gas,<br />

• an 11% rise in the volume of imported gas,<br />

• a mismatch between the tariff rates for gaseous fuels and purchase costs of imported gas.<br />

The rise in unit purchase costs of imported gas was driven by the growing prices of crude oil and<br />

petroleum products on international markets, and the dollar exchange rates. The surge in crude oil<br />

prices peaked in June 2008. Despite a considerable fall in crude oil prices in the subsequent months,<br />

the highest increase in price of imported gas was recorded in Q4 2008. This followed from the fact<br />

that prices of imported gas are indexed to a nine-month moving average price of petroleum products.<br />

Another driver of imported gas prices were changes on the FX markets, in particular the depreciation<br />

of the złoty against the US dollar seen in H2 2008.<br />

In the discussed period, the Company imported higher volumes of gas, which was driven by the<br />

following factors:<br />

• a 2% rise in volumes of high-methane gas sold,<br />

• a 38% decrease in use of gas from underground storage facilities,<br />

47 of 55