Criteria for Rating German Residential Mortgage ... - Standard & Poor's

Criteria for Rating German Residential Mortgage ... - Standard & Poor's

Criteria for Rating German Residential Mortgage ... - Standard & Poor's

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

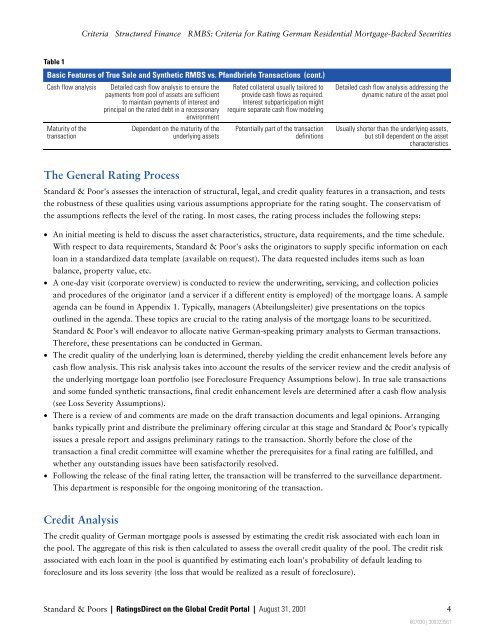

Table 1<br />

Basic Features of True Sale and Synthetic RMBS vs. Pfandbriefe Transactions (cont.)<br />

Cash flow analysis Detailed cash flow analysis to ensure the<br />

payments from pool of assets are sufficient<br />

to maintain payments of interest and<br />

principal on the rated debt in a recessionary<br />

environment<br />

Maturity of the<br />

transaction<br />

<strong>Criteria</strong> Structured Finance RMBS: <strong>Criteria</strong> <strong>for</strong> <strong>Rating</strong> <strong>German</strong> <strong>Residential</strong> <strong>Mortgage</strong>-Backed Securities<br />

Dependent on the maturity of the<br />

underlying assets<br />

The General <strong>Rating</strong> Process<br />

Rated collateral usually tailored to<br />

provide cash flows as required.<br />

Interest subparticipation might<br />

require separate cash flow modeling<br />

Potentially part of the transaction<br />

definitions<br />

Detailed cash flow analysis addressing the<br />

dynamic nature of the asset pool<br />

Usually shorter than the underlying assets,<br />

but still dependent on the asset<br />

characteristics<br />

<strong>Standard</strong> & <strong>Poor's</strong> assesses the interaction of structural, legal, and credit quality features in a transaction, and tests<br />

the robustness of these qualities using various assumptions appropriate <strong>for</strong> the rating sought. The conservatism of<br />

the assumptions reflects the level of the rating. In most cases, the rating process includes the following steps:<br />

• An initial meeting is held to discuss the asset characteristics, structure, data requirements, and the time schedule.<br />

With respect to data requirements, <strong>Standard</strong> & <strong>Poor's</strong> asks the originators to supply specific in<strong>for</strong>mation on each<br />

loan in a standardized data template (available on request). The data requested includes items such as loan<br />

balance, property value, etc.<br />

• A one-day visit (corporate overview) is conducted to review the underwriting, servicing, and collection policies<br />

and procedures of the originator (and a servicer if a different entity is employed) of the mortgage loans. A sample<br />

agenda can be found in Appendix 1. Typically, managers (Abteilungsleiter) give presentations on the topics<br />

outlined in the agenda. These topics are crucial to the rating analysis of the mortgage loans to be securitized.<br />

<strong>Standard</strong> & <strong>Poor's</strong> will endeavor to allocate native <strong>German</strong>-speaking primary analysts to <strong>German</strong> transactions.<br />

There<strong>for</strong>e, these presentations can be conducted in <strong>German</strong>.<br />

• The credit quality of the underlying loan is determined, thereby yielding the credit enhancement levels be<strong>for</strong>e any<br />

cash flow analysis. This risk analysis takes into account the results of the servicer review and the credit analysis of<br />

the underlying mortgage loan portfolio (see Foreclosure Frequency Assumptions below). In true sale transactions<br />

and some funded synthetic transactions, final credit enhancement levels are determined after a cash flow analysis<br />

(see Loss Severity Assumptions).<br />

• There is a review of and comments are made on the draft transaction documents and legal opinions. Arranging<br />

banks typically print and distribute the preliminary offering circular at this stage and <strong>Standard</strong> & <strong>Poor's</strong> typically<br />

issues a presale report and assigns preliminary ratings to the transaction. Shortly be<strong>for</strong>e the close of the<br />

transaction a final credit committee will examine whether the prerequisites <strong>for</strong> a final rating are fulfilled, and<br />

whether any outstanding issues have been satisfactorily resolved.<br />

• Following the release of the final rating letter, the transaction will be transferred to the surveillance department.<br />

This department is responsible <strong>for</strong> the ongoing monitoring of the transaction.<br />

Credit Analysis<br />

The credit quality of <strong>German</strong> mortgage pools is assessed by estimating the credit risk associated with each loan in<br />

the pool. The aggregate of this risk is then calculated to assess the overall credit quality of the pool. The credit risk<br />

associated with each loan in the pool is quantified by estimating each loan's probability of default leading to<br />

<strong>for</strong>eclosure and its loss severity (the loss that would be realized as a result of <strong>for</strong>eclosure).<br />

<strong>Standard</strong> & Poors | <strong>Rating</strong>sDirect on the Global Credit Portal | August 31, 2001 4<br />

867630 | 300323561