SPRING SPRING - InsideOutdoor Magazine

SPRING SPRING - InsideOutdoor Magazine

SPRING SPRING - InsideOutdoor Magazine

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

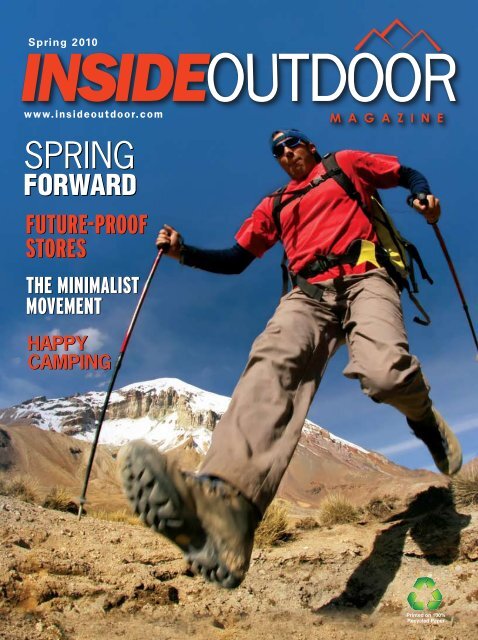

Spring 2010<br />

www.insideoutdoor.com<br />

<strong>SPRING</strong><br />

FORWARD<br />

FuTure-ProoF<br />

sTores sTores<br />

The MiniMalisT MiniMalisT<br />

MoveMenT MoveMenT<br />

Happy Happy<br />

Camping<br />

Camping<br />

Printed on 100%<br />

Recycled Paper

Sports Essentials<br />

The secret is<br />

what’s underneath!<br />

Elevate your performance with the<br />

most uniquely engineered base layer<br />

and underwear system on the market<br />

w ww.terramarsports.com<br />

(800) 468-7455

28<br />

FEaTUrES<br />

14 THE FUTURE-PROOF SALES FLOOR<br />

It’s becoming increasingly common for consumers to walk into<br />

a physical storefront armed with more technological capabilities<br />

than the entire store and staff have at their disposal. These alwaysconnected,<br />

hyper-informed consumers are just one reason why the<br />

in-store experience needs an upgrade.<br />

By Martin Vilaboy<br />

24 THE OUTDOOR INDUSTRY’S RFID EXPERIMENT<br />

radio frequency identification so far has been the victim of over-hype<br />

and high expectations, but one innovative outdoor company is<br />

breaking ground by providing outdoor dealers with an accessible<br />

entry point into this powerful supply chain management<br />

technology.<br />

By Martin Vilaboy<br />

4 | <strong>InsideOutdoor</strong> | Spring 2010<br />

14<br />

32<br />

C O N T E N T S<br />

DEparTmENTS<br />

Spring 2010<br />

28 HAPPY CAMPERS<br />

The bump in sales and participation experienced<br />

during last year’s camping season may be just the<br />

beginning. The continuing search for more affordable<br />

ways to spend summer vacations and a pent-up demand<br />

for outdoor experiences has camping primed<br />

for continued growth in 2010 and beyond.<br />

By Martin Vilaboy<br />

32 BARE ESSENTIALS<br />

Whether one views it as the latest fad or the future<br />

of running, minimalist footwear has taken steps<br />

that ultimately could impact the entire trail footwear<br />

category. We also take a close look at three minimalist<br />

models.<br />

By Ernest Shiwanov<br />

DaTa pOINTS<br />

8 NUMBERS WORTH NOTING<br />

matters of influence; park popularity; Twitter truths;<br />

Shifts in shrink<br />

GrEENSHEETS<br />

40 THE GREEN GLOSSARY<br />

Defining the movement<br />

6 Letter from the Editor<br />

12 rep News and moves<br />

45 Editorial Index<br />

46 advertiser Index

�����������������������������������������<br />

�����������������������������������<br />

���������������������������������<br />

G-MAX UNIVERSAL<br />

FOOTWEAR<br />

WATERPROOFER<br />

�� ���������������������<br />

�� �������������������������<br />

�� ��������������������<br />

FOR ALL OUTDOOR<br />

FOOTWEAR:<br />

����������������������������<br />

�������������<br />

�����������������������<br />

����������������������<br />

���������������������������<br />

����������������������������<br />

���������������������<br />

��������������������������<br />

�������������������������������<br />

�����������������������<br />

�����������������������������������<br />

��������������������<br />

������������������������������������� ������ �������������� ��������� �������� ���������� ��������������

Editor’s Letter<br />

Channel Crossing<br />

Have you ever wished you could Ctrl+Z your real life? maybe it’s just an indication<br />

of sitting at a pC too much, but sometimes when an ordinary task goes awry – say<br />

the box I’m fumbling with dumps its contents onto the garage floor, or the lid of the<br />

parmesan shaker pops off and dumps a mountain of white cheese on my plate of pasta<br />

– I get this momentary impulse to instantly undo what I just did by hitting Ctrl+Z, as if<br />

some type of virtual keyboard is floating in front of me at all times.<br />

Now, the point here isn’t to pitch an idea for another whacky adam Sandler project.<br />

rather, my confused desire to fix problems with a simple keystroke is analogous to the<br />

expectations growing among many of the shoppers entering your store, expectations<br />

that had better not be overlooked.<br />

First taking a step back, we’d all likely agree the rise of the Internet and online<br />

commerce, in particular, have fundamentally changed the game for all of us. Often,<br />

however, the most important changes aren’t always the ones most talked about. We hear<br />

lots of discussions about the ongoing battle between digital and brick-and-mortar channels<br />

and whether or not e-commerce eventually will account for 15 or 20 or 35 percent of overall<br />

retail sales, but there’s something much more disruptive taking place.<br />

most industry experts and commentators, by now, tend to agree that retail no<br />

longer can be defined in terms of virtual versus physical business models. When all is<br />

said and done, retailers that master multi-channel sales and capabilities, we are told,<br />

ultimately will be the strongest. That much seems pretty clear.<br />

almost inevitably a part of this move to mixed-model retailing, the once-distinct<br />

channels within the multi-channel environment in many ways are intersecting and<br />

blurring together, resulting in what’s come to be known as the “cross-channel” shopping<br />

experience. This cross-channel experience and its subsequent buying behavior, we’d<br />

argue, represent the greatest impacts that Web-based technologies will have on retail<br />

business models moving forward. more specifically, the increasing access to multichannel<br />

or cross-channel capabilities is quickly expanding and altering the expectations of<br />

shoppers no matter how or where they eventually make their purchases.<br />

put simply, consumers will want their shopping experiences to be precisely the<br />

way they want them no matter through which channel they are shopping at any given<br />

moment. The best aspects of the online or catalog experience, for example, will be<br />

expected on the sales floor, at least up to the point of what is technologically possible,<br />

and vice versa.<br />

Consumers who bring the online experience into a physical storefront by way of<br />

their smartphones can be seen as an early example of this potentially transformational<br />

trend. In this scenario, a spend-ready shopper who may be standing in the outerwear<br />

aisle of an outdoor shop still wants to search product reviews, check-out product<br />

specifications, comparison shop and even share images of a potential purchase with<br />

friends and family as if he is sitting at home in front of a laptop. Conversely, a retail<br />

Web site that offers 3D interactive images, virtual tours of hotel rooms or live chat<br />

with customer representatives all are examples of the physical store experience being<br />

adapted for online shopping. The growing popularity of “buy online, pick-up in store” is<br />

another example of such cross-channel expectations.<br />

as Jeremy Lockhorn, director of emerging media for razorfish, puts matters,<br />

e-commerce no longer stands for “electronic commerce” but instead it is short for<br />

“everywhere commerce.” That goes not only for the location of the actual shopper but<br />

also the location of the technology that enables a satisfying and enjoyable shopping<br />

experience. put another way, the online revolution may be less about developing killer<br />

e-commerce sites, Facebook presences or Twitter campaigns and more about adapting<br />

the in-store experience for the coming generations of online consumers.<br />

No doubt, the power is in the hands of the consumer, both in terms of enabling<br />

technology and in the ability, when they don’t get what they want, to take their business<br />

to one among the ever-growing list of competitive players fighting for their attention.<br />

and, make no mistake, once a shopper leaves your list of loyal customers, there’s<br />

no Ctrl+Z function to bring them back. –MV<br />

6 | <strong>InsideOutdoor</strong> | Spring 2010<br />

martin Vilaboy<br />

Editor-in-Chief<br />

martin@bekapublishing.com<br />

percy Zamora<br />

Art Director<br />

outdoor@bekapublishing.com<br />

Ernest Shiwanov<br />

Editor at Large<br />

ernest@bekapublishing.com<br />

Berge Kaprelian<br />

Group Publisher<br />

berge@bekapublishing.com<br />

Jennifer Vilaboy<br />

Production Director<br />

jen@bekapublishing.com<br />

Suzanne Urash<br />

Ad Creative Designer<br />

suzanne@cre8groupinc.com<br />

Beka Publishing<br />

Berge Kaprelian<br />

President and CEO<br />

philip Josephson<br />

General Counsel<br />

Jim Bankes<br />

Business Accounting<br />

Corporate Headquarters<br />

745 N. Gilbert road<br />

Suite 124, pmB 303<br />

Gilbert, aZ 85234<br />

Voice: 480.503.0770<br />

Fax: 480.503.0990<br />

Email: berge@bekapublishing.com<br />

© 2010 Beka publishing, all rights reserved.<br />

reproduction in whole or in any form or<br />

medium without express written permission<br />

of Beka publishing, is prohibited. Inside<br />

Outdoor and the Inside Outdoor logo are<br />

trademarks of Beka publishing

Data Points<br />

Numbers worth NotiNg<br />

by Martin Vilaboy<br />

WHEN TO rECOmmEND<br />

Overwhelmingly, consumers report that product<br />

recommendations provide useful guidance when<br />

shopping, but the placement of recommendations also<br />

can have a significant impact on sales. The majority of<br />

Location of Recommendations that Prompted Purchase<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

58%<br />

Product Detail<br />

Source: ChoiceStream<br />

40%<br />

Category/Brand<br />

30%<br />

Sources active online of Shrink shoppers (those who spent more than<br />

$500 2009 online in the past 6 2008 months) indicate that they<br />

have bought something based on a retailer’s online<br />

product recommendation, Employee theft of<br />

68%<br />

but only 16 percent claim<br />

merchandise in stores<br />

to have purchased based on a recommendation in a<br />

shopping-related Customers email stealing<br />

62%<br />

(e.g., shipping confirmation). The<br />

merchandise<br />

52%<br />

majority of purchases were based on recommendations<br />

that appeared Employee on theft product of cash<br />

45%<br />

detail pages (58 percent)<br />

(voids, post-voids, deposits, etc)<br />

32%<br />

or Paper category/brand shrink (missed markdown,<br />

32%<br />

incorrect purchase order price, pages etc.) (40 percent).11515OLD<br />

31%<br />

FaSHIONED Organized crime INFLUENCE<br />

rings<br />

Despite the plethora of new ways to gather information,<br />

Register under-rings<br />

27%<br />

face-to-face interactions (sweethearting) with family and 22% friends remain<br />

the most influential factor over online purchasing. In<br />

18%<br />

Fraudulent returns<br />

fact, outside of the use of search engines, 25% the traditional<br />

methods for spreading product and promotional information<br />

-- namely, Source: RSR TV Research, and print December – continue 2009 to be most persuasive,<br />

even among online purchasers, suggests a survey by<br />

Opinion research and aranet. and while advice from<br />

friends and family tops the list, the use of social networking<br />

Cross-Channel Takes Over?<br />

sites to obtain such information is still in the nascent stage,<br />

Strongly Agree Agree Neutral Disagree Strongly Disagree<br />

show the findings.<br />

8 | <strong>InsideOutdoor</strong> | Spring 2010<br />

Cart<br />

23% 23% 21%<br />

Promotional email<br />

Order Conf.<br />

28%<br />

30%<br />

Home Page<br />

16%<br />

Transaction email<br />

The future of online commerce<br />

lies more with cross-channel<br />

or “merged” channel capabilities. 43% 43% 6%<br />

80%<br />

Influences on Online Buying Decisions<br />

% Very<br />

Influence<br />

Influenced<br />

(4 or 5 out of 5)<br />

Personal advice from friends or family members 59%<br />

TV news or other broadcasts 40%<br />

Search engines such as Google, Bing, Yahoo, or Ask.com 39%<br />

Ads seen on TV 36%<br />

Articles seen in newspapers or magazines 33%<br />

Ads seen in newspapers or magazines 31%<br />

Articles seen online 28%<br />

Radio news or other broadcasts 25%<br />

Direct mail 24%<br />

Ads heard on the radio 20%<br />

Emails received from retailers or manufacturers 20%<br />

Ads seen online 19%<br />

Messages or posts on social media such as Facebook,<br />

Twitter, LinkedIn, or MySpace<br />

18%<br />

Billboards 15%<br />

Source: ARAnet, February 2010<br />

parK IT<br />

Leisure travel overall may have dipped with the economy,<br />

but folks still found the time and money to visit our nation’s<br />

national park system. In 2009, national parks hosted 10<br />

million more visitors than in 2008, a 3.9 percent increase<br />

that marked the fifth busiest year ever for the National park<br />

System, according to Secretary of the Interior Ken Salazar.<br />

Top 10 Most Visited National Parks, 2009<br />

Park Unit Visitors<br />

Great Smoky Mountains National Park 9,491,437<br />

Grand Canyon National Park 4,348,068<br />

Yosemite National Park 3,737,472<br />

Yellowstone National Park 3,295,187<br />

Olympic National Park 3,276,459<br />

Rocky Mountain National Park 2,822,325<br />

Zion National Park 2,735,402<br />

Cuyahoga Valley National Park 2,589,288<br />

Grand Teton National Park 2,580,081<br />

Acadia National Park 2,227,698<br />

Source: U.S. Department of Interior<br />

4%<br />

6%<br />

U.S. M<br />

35-53<br />

37%<br />

Source:<br />

Fab<br />

Fabric Recovery in Grams<br />

Source

ECCO FAST TRAIL<br />

COMPRESSION MOULDED<br />

EVA MIDSOLE WITH VISIBLE<br />

RECEPTOR TECHNOLOGY<br />

GEIRANGER FJORD, NORWAY<br />

AUTUMN / WINTER 2010<br />

SYNTHETIC UPPER MATERIALS<br />

GORE-TEX® LINING<br />

FOR MORE INFORMATION CONTACT:<br />

WEST : MARK CONNORS at MCO@ECCO.COM // EAST : DANA SAWYER at DASA@ECCO.COM<br />

ECCOUSA.COM OR 800.866.3226<br />

RUGGED RUBBER OUTSOLE

Data Points<br />

The 285 million people that visited a national park or other<br />

unit of the National park System in 2009 was just shy of the<br />

all-time visitation record of 287.2 million in 1987. Great Smoky<br />

mountain National park continued its reign as the most<br />

visited national park in 2009, attracting 9.4 million visitors,<br />

while the Blue ridge parkway was the most visited unit of<br />

the system with nearly 16 million visitors.<br />

THE TrUTH aBOUT TWITTEr<br />

Despite the seemingly ubiquitous use of Twitter and its<br />

astronomical growth during the last few years, a new study<br />

from Barracuda Labs of more than 19 million accounts finds<br />

that most users of the microblogging startup aren’t very<br />

active. Starting with the assumption that an active user<br />

has at least 10 followers, follows at least 10 people and has<br />

tweeted at least 10 times, only 21 percent of Twitter users<br />

can be considered active. In terms of tweets, a whopping<br />

73 of Twitter users have tweeted less than 10 times, while<br />

34 percent hadn’t tweeted even once. Barracuda also found<br />

growth over time to be consistent with previous studies.<br />

While Twitter accounts grew like wildfire in early 2009, growth<br />

slowed to 0.34 percent month over month in December of<br />

2009. Going back to 2008, the report estimates growth to be<br />

just 0.31 percent. On the other hand, even small amounts of<br />

growth and active user percentages mean something when<br />

you’re talking about tens of millions of overall accounts.<br />

SHrINK SHIFT<br />

Likely related to soured economic conditions and rising<br />

employment rates, retailers reported some significant<br />

changes over previous years when asked about the top<br />

three sources of shrink, show findings from rSr research.<br />

Consumer theft of merchandise appears to be up, while<br />

employee theft of merchandise dropped decidedly. On the<br />

other hand, employee theft of cash or cash equivalents was<br />

more of a factor last year than in previous surveys.<br />

Source: ChoiceStream<br />

Sources of Shrink<br />

2009 2008<br />

Employee theft of<br />

merchandise in stores<br />

Customers stealing<br />

merchandise<br />

Employee theft of cash<br />

(voids, post-voids, deposits, etc)<br />

Paper shrink (missed markdown,<br />

incorrect purchase order price, etc.)<br />

Organized crime rings<br />

Register under-rings<br />

(sweethearting)<br />

Fraudulent returns<br />

Source: RSR Research, December 2009<br />

E-COmmErCE<br />

rEFrESH<br />

Web Site Design Priorities among U.S. Online Retailers by Business<br />

Model, % of Respondents<br />

Cross-Channel Takes Over?<br />

Storebased<br />

Catalog Web-only<br />

Brand Strongly Agree<br />

Manufacturer<br />

Total<br />

Agree Even back Neutral in the summer Disagree of 2009, Strongly Internet Disagree<br />

retailers were preparing for a turnaround,<br />

Better organized and updated<br />

home, category and product pages<br />

Better search engine optimization<br />

Clearer navigation<br />

Speedier and more intuitive site<br />

search<br />

40.6%<br />

50%<br />

39.1%<br />

31.3%<br />

35%<br />

45%<br />

25%<br />

33.3%<br />

42.5%<br />

36.4%<br />

29.4%<br />

28.1%<br />

63.5% 43.7% show findings from Internet retailer and<br />

The future of online commerce Vovici. The increasingly consumer-centric focus<br />

38.5% lies more with 40.2% cross-channel<br />

or “merged” channel capabilities. of online shopping 43% sites has a full two-thirds 43% of<br />

40.4% 31.7% retailer respondents planning a site redesign<br />

30.8% 30% in 2010. among those sites that will refresh<br />

Faster checkout 31.3% 30% 25.9% 28.8% 28.3% their looks, better organization and updating<br />

More community features<br />

Bigger and clearer images<br />

Other<br />

28.1%<br />

31.3%<br />

3.1%<br />

18.3%<br />

28.3%<br />

5%<br />

26.8%<br />

22.4%<br />

12.3%<br />

38.5%<br />

28.8%<br />

11.5%<br />

of home, category and product pages are top<br />

27.8%<br />

priorities, followed by better search engine<br />

25.6%<br />

Online commerce optimization. will The ultimate goal is to help<br />

never be 9.8% more than 10-15% 7% 14% 21% 30%<br />

of overall retail sales. the consumer who demands a seamless<br />

Source: Internet Retailer, Vovici, Fall 2009<br />

shopping experience, suggest the findings<br />

and, in turn, help the bottom line.<br />

10 | <strong>InsideOutdoor</strong> | Spring 2010<br />

uct Detail<br />

ory/Brand<br />

otional email<br />

32%<br />

32%<br />

28%<br />

31%<br />

30%<br />

27%<br />

22%<br />

18%<br />

25%<br />

Source: Retail Systems Research<br />

SLOW rOaD TO rECOVEry<br />

45%<br />

52%<br />

62%<br />

68%<br />

While the financial markets may be improving, consumers<br />

are showing little faith that an economic rebound is around<br />

the corner. On the contrary, consumer outlook may be<br />

getting Retailers increasingly Prioritize bleak. Tools according and Technologies to Nielsen figures, to Drive more<br />

than Customer 90 percent Satisfaction of households in Stores still believe the recession is<br />

continuing, while those who believe a recovery is coming is<br />

down High to 21 Priority percent from Medium 24 percent Priority in a previous Low Priority Nielsen<br />

survey. at the same time, 77.2 percent of americans<br />

responding Customer-facing to a new tools BIG research survey said they have little<br />

to no confidence and technologies that the government’s 51% economic 34% policies 14% will<br />

help lower unemployment, a key indicator of future spending.<br />

“Consumers are telling us they have accepted this<br />

recession,” said James russo, vice president global<br />

consumer Employee-facing insight at tools Nielsen. 41% “They have accepted 49% this 10%<br />

and technologies<br />

new normal, and that’s a very critical component from a<br />

behavioral standpoint.”<br />

Mobile tools for<br />

store managers<br />

r Conf.<br />

15% 21% 64%<br />

e Page<br />

action email<br />

80%

ep moves aNd News<br />

With the start of the New year, many<br />

sales reps and agencies were deservedly<br />

signaled out for their contributions to the<br />

successes of the brands they dutifully<br />

represent out on the road.<br />

Buck Knives, for one, recently<br />

named Gadbois Agency, headed by<br />

Pierre Gadbois, as its 2009 Sales<br />

representative agency of the year. The<br />

agency, headquartered in Laval, Quebec,<br />

St. paul, serves Buck dealers in the<br />

Eastern Canadian provinces. Despite<br />

serving the smallest of Buck’s sales<br />

territories, the Gadbois sales team grew<br />

at more than 300 percent in 2009.<br />

Individual Sales representative<br />

of the year award was presented<br />

to Deb Garvick of the Tackett<br />

Brothers Agency, which covers<br />

11 states. Garvick, headquartered in<br />

Independence, mo., who has a rich<br />

history with Buck, was cited for “her<br />

efforts, attitude and willingness to ‘get it<br />

done,’ and for territory growth at every<br />

12 | <strong>InsideOutdoor</strong> | Spring 2010<br />

distribution channel in a difficult retail<br />

environment.”<br />

meanwhile, at Chaos Headwear,<br />

rep of the year honors are based on<br />

set sales criteria, such as most new<br />

accounts, more pre-season orders<br />

and re-orders, co-brands, branding<br />

and merchandising, and competition<br />

was tight, including a tie for third<br />

place. Taking top honors this year<br />

was Sam Adams of Western<br />

Sales Marketing, which represents<br />

Washington, Oregon, Utah, Nevada<br />

and montana for the company.<br />

awarded with a plaque and a monetary<br />

bonus, adams said “merchandising”<br />

made the difference this year. adams<br />

sold more racks this year to more<br />

retailers, allowing the brand to have<br />

a stronger presence in key accounts,<br />

said Chaos.<br />

adams narrowly passed veteran<br />

Chaos representative Marty Roth<br />

for second. roth has been with Chaos<br />

for more than five years, representing<br />

the brand in key resorts and retailers in<br />

New England. In a third place tie were<br />

the Accessory Gals, Sherry Krum<br />

and Chris Parsons for the East Coastmid<br />

atlantic territory and Best and<br />

Associates in the rocky mountain<br />

region. accessory Gals is new to the<br />

Chaos roster for 2009, while Best and<br />

associates had taken the rep of the year<br />

title for the previous two years.<br />

Up in Seattle, at Cascade Designs,<br />

the 2009 rep agency of the year was<br />

awarded to Canada West Sports<br />

Agencies LTD of Calgary, alberta.<br />

Canada West Sports agencies, including<br />

Doug Gudwer, Kori Russell and<br />

Chris Leeder, has been representing<br />

Cascade Designs’ brands for more than<br />

19 years. The award recognizes their<br />

performance providing exceptional<br />

service to Cascade Designs’ retailers in<br />

alberta, manitoba and Saskatchewan.<br />

as a result of their attention to detail

and can-do attitude, the majority of<br />

their dealer base grew sales of Cascade<br />

Designs’ products in 2009 in the face of a<br />

difficult economic year, says the company.<br />

and over at Big Agnes, its annual<br />

Sales rep of the year award recently was<br />

bestowed upon Bert Hopp of Hopp<br />

Outdoors. Hopp represents Big agnes<br />

in Indiana, Kentucky, Ohio and michigan.<br />

In 2009, Hopp lead all Big agnes sales<br />

territories in terms of highest growth<br />

percentage, pre-season participation and<br />

future commitments. He also procured<br />

the most new dealer bookings for 2010.<br />

MountainSource announced<br />

the addition of Bruce Gordon to its<br />

growing sales team. Gordon, who most<br />

recently served as director of sales for<br />

Chrome Industries, will oversee the<br />

mountainSource territory of Colorado’s<br />

Front range, Wyoming and Western<br />

Nebraska, in addition to supporting<br />

team strategies and initiatives<br />

throughout mountainSource’s growing<br />

communications platform.<br />

Native Eyewear has launched in<br />

the Canadian marketplace and expanded<br />

its North american sales force as part<br />

of its 2010 strategic growth initiatives.<br />

The eyewear company has doubled<br />

its presence in the South through a<br />

partnership with Baratti Marketing;<br />

increased its California, Nevada, and<br />

arizona outreach with the Blue Sky<br />

Group; and has expanded efforts into<br />

the Southeast and New England through<br />

its partnership with regional leader, The<br />

Don Coffey Company. Native also<br />

unrolled its first Canadian sales program<br />

in partnership with Guelph Brand<br />

Strategies.<br />

Hincapie Sportswear has<br />

hired Chris Gould as retail sales<br />

representatives for the brand in Las<br />

Vegas, Nev.; arizona; New mexico and<br />

El paso, Texas. Effective immediately,<br />

Gould will represent Hincapie for retail<br />

cycling apparel and accessory sales to<br />

independent bicycle dealers and sell<br />

Hincapie custom cycling clothing to<br />

clubs and teams in his territory.<br />

Footwear brand Cushe announced<br />

that Demian Kloer and his agency, Sol<br />

Adventures, will lead Western sales<br />

territories for the company. a former<br />

executive and founding member at prana,<br />

Kloer will be leading sales in Central and<br />

Southern California, as well as arizona.<br />

Crazy Creek Products announced<br />

that Steve Schneider of Schneider<br />

Sales Associates has joined the Crazy<br />

Creek sales team. Schneider will be<br />

representing Crazy Creek with dealers<br />

in the New England area including<br />

Connecticut, maine, massachusetts,<br />

New Hampshire, rhode Island and<br />

Vermont. Schneider has been servicing<br />

the specialty outdoor, travel and ski<br />

markets for the past 20 years and<br />

can be contacted at 802-985-9162 or<br />

repsnortheast@aol.com.<br />

Bringing more than 20 years of<br />

experience in the outdoor market,<br />

Adventure Sport Marketing is now<br />

representing the midwest territory for<br />

Jetboil. managed by Larry Hanson and<br />

his associate Tim Harwood, adventure<br />

Sport also represents Eagle Creek,<br />

princeton Tec, Suunto, Obox, red Feather<br />

Snowshoes and more. For Jetboil,<br />

they will be focusing on the states of<br />

minnesota, North Dakota, South Dakota,<br />

Iowa, Illinois, Wisconsin and the Upper<br />

peninsula of michigan.<br />

Spring 2010 | <strong>InsideOutdoor</strong> | 13

The FuTure-ProoF<br />

Floor<br />

TECHNOLOGy SET TO FaCILITaTE a rEVIVaL OF<br />

THE IN-STOrE ExpErIENCE<br />

by Martin Vilaboy<br />

Retail IT executives certainly have had<br />

lots to keep them up at night during<br />

the past several years. Just as they<br />

began to settle into the finer details<br />

of e-commerce enablement, along<br />

came super-cyber security attacks, social media<br />

14 | <strong>InsideOutdoor</strong> | Spring 2010<br />

applications, updated PCI compliance and mobile<br />

platforms, to name just a few things.<br />

Indeed, it’s easy to understand why the majority<br />

of retail technology resources and investments of late<br />

have gone toward keeping up with the ever-evolving<br />

world of online commerce (including, more recently,

Count on Serious Traction.<br />

Whatever the winter activity STABILicers provide the ice traction product you need.<br />

Quick and easy on and off and performance-designed for durability and comfort.<br />

Aggressive cleats bite into ice, rock, snow and pavement, providing unbeatable<br />

traction with every STABILicers product.<br />

serious<br />

traction<br />

gear<br />

800-782-2423<br />

www.32north.com

Source: RSR Research, December 2009<br />

Cross-Channel Takes Over?<br />

Strongly Agree Agree Neutral Disagree Strongly Disagree<br />

The future of online commerce<br />

lies more with cross-channel<br />

or “merged” channel capabilities.<br />

Online commerce will<br />

never be more than 10-15%<br />

of overall retail sales.<br />

Source: Retail Systems Research<br />

offering a new promotion,” argues Greg<br />

Belkin, research analyst for Aberdeen<br />

the world of mobile commerce). But the<br />

managers of retail servers and systems<br />

are about to become intimately more Group’s retail practice.<br />

Retailers Prioritize Tools and Technologies to Drive<br />

familiar with the old-fashioned brick-<br />

Customer Satisfaction in Stores<br />

and-mortar business.<br />

That’s High because Priority physical Medium retail Priority store<br />

fronts are in a state of flux, suggest<br />

Low Priority<br />

recent surveys of retailers by Aberdeen<br />

Customer-facing tools<br />

Group, with and 64 technologies percent of store-level 51%<br />

managers reporting less than 80 percent<br />

customer satisfaction rate in stores and<br />

nearly three-quarters of retail executives<br />

34% 14%<br />

lamenting Employee-facing that store tools teams are grappling<br />

41%<br />

to run the business and technologies with inadequate<br />

sales and service insight.<br />

In other words, the physical, instore<br />

experience needs an upgrade,<br />

49% 10%<br />

suggesting Mobile that we tools are for about to see a<br />

store managers 15% 21%<br />

shift in some IT spending from mostly<br />

digital assets to the brick-and-mortar<br />

64%<br />

sales floor.<br />

0% 20% 40% 60% 80% 100%<br />

“Close to 60 percent of our overall<br />

Source: Retail Systems Research<br />

IT budget for 2010 has been allocated<br />

toward reviving the store experience,”<br />

said the vice president of POS and merchandising<br />

for a tier-one apparel retailer<br />

responding to an Aberdeen survey.<br />

Make no mistake, this technology<br />

injection will usher in a new age of<br />

cross-channel retailing, stepping up<br />

the game for all mixed-model retailers.<br />

And whether it’s by choice or not, every across channels and media<br />

Retailers in North America Who Have Order Online/Pick<br />

retailer Up In-Store now competes Capabilities, in that multi- August 2009 (% of respondents)<br />

channel environment.<br />

“Gone No, but are we the plan days to implement where by these the end of 2010<br />

organizations can expect high levels of<br />

36.6%<br />

customer engagement simply by open-<br />

No, and we have no plans to implement this functionality<br />

ing a store, providing new product or Source: Retail Systems Research<br />

17.1%<br />

43%<br />

22%<br />

Yes, we offer in-store pickup from in-store inventory or by shipping<br />

16 | <strong>InsideOutdoor</strong> | Spring 2010<br />

4%<br />

43% 6% 6%<br />

7% 14% 21% 30% 27%<br />

With consumers scrutinizing spending<br />

while trying to boost their individual<br />

savings rate, retailers understand that<br />

each and every customer interaction becomes<br />

increasingly more important. And<br />

macro-economic conditions are just part<br />

of the story. Ultimately, the mainstreaming<br />

of online commerce means an ultrainformed<br />

and price-conscious consumer,<br />

in many cases, no longer needs to make<br />

the effort to go to a physical location.<br />

So when potential customers do visit a<br />

brick-and-mortar location, the customer<br />

experience had better be maximized.<br />

Technology Enablers in In-Store Marketing Efforts Today<br />

Signs of the growing pressure can be<br />

seen in sales per square foot numbers<br />

at American malls. By the end of 2009,<br />

the average sales per square foot had<br />

fallen to $401, down from a peak of<br />

$454 in 2007 and effectively wiping out<br />

five years of progress in this metric,<br />

show figures from Green Street Advisors.<br />

For some retailers, the decline has<br />

been even steeper. Between 1999 and<br />

2009, sales per square foot at Gap, the<br />

country’s largest apparel retailer, fell 40<br />

percent to $329, says Green Street.<br />

All the while, as customers gradually<br />

increase their product and promotions<br />

search, product attribute comparisons<br />

and purchases on the Web and through<br />

call-centers, “the expectations that a retailer<br />

will deliver the Web and call center<br />

sales and service standards in stores<br />

and across all other channels of sales,<br />

service and operations are mounting<br />

every day,” says Sahir Anand, research<br />

director at Aberdeen.<br />

In turn, we can expect to see technologies<br />

developed and deployed that<br />

seek to upgrade the customer experience<br />

surrounding the ease of researching,<br />

comparing, ordering and paying for<br />

goods and services in stores, as well as<br />

the post-sale experience, says Anand. At<br />

the same time, we are likely to see more<br />

attention paid to digital signage, interactive<br />

kiosks and systems that monitor<br />

and measure consumers’ navigation<br />

flow through stores and the effectiveness<br />

Major Role<br />

Ability to create targeted or personalized offers to shoppers 26% 69%<br />

Tools to better track in-store execution 33% 60%<br />

Tools to measure customer response to in-store marketing 32% 58%<br />

Loyalty program the helps identify shoppers and track purchase history 36% 58%<br />

Tools to optimize messaging offered to customers in stores 25% 56%<br />

Promotion planning tools to better coordinate across organizations 31% 53%<br />

Single content management system to enable common information assets<br />

28% 51%<br />

Technology to reach shoppers during the in-store shopping process 13% 47%<br />

Technology to reach shoppers as they enter the store 21% 35%<br />

Mobile technologies to reach consumers on their mobile phones while in stores 19% 24%<br />

Very<br />

important<br />

S<br />

P<br />

B<br />

S

We¹re Green<br />

��� �����<br />

310-831-2334<br />

���� ������<br />

�����������������<br />

even in a<br />

whiteout<br />

SUSTAIN - A Collection of Environmentally<br />

Friendly Textiles from ASF Group<br />

����� ������<br />

���������������������������<br />

������ ������<br />

�����������������<br />

Petroleum is the base of most outerwear fabrics. It is becoming<br />

increasingly scarce in the world and its products leave a heavy<br />

impact on the environment. By building eco-friendly fabrics,<br />

our SUSTAIN Collection takes another step forward towards a<br />

cleaner planet.<br />

The ASF Group produces technically advanced fabrics that use<br />

Recycled Polyester and other Eco-friendly Fibers for performance<br />

outerwear. For more info on how we create green fabrics, please<br />

contact us.<br />

SUSTAIN - Environmentally Friendly Fabric Collection<br />

� �������� ���������<br />

� ��������������������������� ���������<br />

� ������������ �������� ����������<br />

� ������� ������� ������<br />

We are the fabric builders—from fiber, to fabric, to factory, to finished.<br />

www.asfgroup.com

Employee theft of<br />

merchandise in stores<br />

62%<br />

68%<br />

Customers stealing<br />

of in-store marketing, as studies merchandise have<br />

shown how the amount of time a shop-<br />

Employee theft of cash<br />

per spends (voids, in a store post-voids, directly deposits, correlates etc)<br />

52%<br />

Technology Enablers Deployed for an Automated and Connected<br />

45% Store Experience<br />

32%<br />

with the frequency Paper shrink of (missed visits markdown, and the total<br />

amount incorrect spent per purchase visit. order price, etc.)<br />

32%<br />

28%<br />

Best-in-Class<br />

Retailers*<br />

Average<br />

Performers*<br />

Laggards*<br />

Organized crime rings<br />

THE NEW Register under-rings<br />

(sweethearting)<br />

DEaLErSHIp<br />

Web-based 31% point-of-service applications<br />

Workforce 30% management applications<br />

Store 27% performance dashboard<br />

22%<br />

Store loyalty programs<br />

60<br />

44<br />

40<br />

40<br />

23<br />

33<br />

27<br />

18<br />

19<br />

23<br />

13<br />

13<br />

A sign of the coming Fraudulent shift returns can be<br />

seen in General Motors’ new “Test<br />

Drive Studio” retail experiment. De-<br />

Source: RSR Research, December 2009<br />

signed with a laid back, hip attitude,<br />

complete with cafés and Wi-Fi access,<br />

GM’s new semi-permanent or perma-<br />

18%<br />

Self-service employee kiosks 30<br />

25%<br />

Mobile handheld computers 30<br />

*Based on set of standard key performance indicators<br />

Source: Aberdeen Group<br />

22<br />

23<br />

17<br />

17<br />

nent brick-and-mortar Cross-Channel Takes facilities Over? seek services, alliances and branded entertain- while at the same time finding ways to<br />

to redefine the often nerve-racking<br />

Strongly Agree Agree Neutral<br />

automobile shopping experience<br />

ment at the company.<br />

Disagree Strongly Disagree<br />

The “un-dealership” program will<br />

continue to delight the customer.<br />

As is often the case, new technolo-<br />

by transfixing online research and run on a pilot basis in Miami, Los Angies represent the primary means to<br />

comparison shopping behavior to a geles, Philadelphia and Chicago, and if these ends.<br />

The future of online commerce<br />

physical location. Unlike traditional successful, the studio program will be 4%<br />

lies more with cross-channel<br />

or “merged” channel capabilities. 43%<br />

43%<br />

dealerships, GM’s Test Drive Studios expanded, says Tihanyi.<br />

6% 6% GETTING pErSONaL<br />

reportedly will have minimal brand- Along with such changes in shop- Among the primary drivers behind<br />

ing and no hovering, high-pressure ping behavior, mixed-model retail- the push toward in-store IT investment<br />

salespeople. Studio visitors will be ers also are coming to realize that is a desire among retailers to personal-<br />

able to test out both GM’s Chevrolet the physical storefront is the most ize the shopping experience, suggest<br />

models along with competitors’ mod-<br />

Online commerce will<br />

els in never each be segment more than in 10-15% which 7% Chevy 14%<br />

of overall retail sales.<br />

vehicles compete.<br />

expensive and often lowest-margin<br />

channel 21% to operate, 30% say analysts at 27%<br />

RSR Research, due to the costs of real<br />

several retailer surveys. That could<br />

include technologies that upgrade instore<br />

merchandising, pricing, promo-<br />

“If you take Malibu as an example, estate, physical infrastructure, inventions and the overall ease of the buying<br />

we will also have vehicles like Camry, tory distribution and labor to support and post-sale experience. Not only can<br />

Accord, Ford Fusion or Taurus, so you it. This new awareness, coupled with a more tailored experience increase up-<br />

get a really Source: good Retail cluster Systems Research of vehicles to recessionary spending, has forced sell/cross-sell, impulse purchases and<br />

experience at your own pace,” says Steve retail executives to look for ways to add-ons, thereby maximizing spend of<br />

Tihanyi, general director for marketing reduce operating and labor expenses, the fewer and fewer customers that find<br />

it necessary to come to a store, but cross<br />

channel shoppers who are exposed to<br />

Retailers Prioritize Tools and Technologies to Drive<br />

Customer Satisfaction in Stores<br />

the “unfussiness and coolness” of the<br />

Web shopping experience “are expect-<br />

High Priority Medium Priority Low Priority<br />

ing more personalized experiences in<br />

stores,” Anand warns.<br />

Retailers asked about enablers to<br />

Customer-facing tools<br />

and technologies 51% 34% 14%<br />

improve in-store marketing efforts, for<br />

example, repeatedly place the ability to<br />

“create targeted and personalized offers<br />

for shoppers” at the top of the list, show<br />

retailer surveys by RSR Research. All the<br />

Employee-facing tools<br />

and technologies 41% 49% 10%<br />

while, only about a quarter of retailers<br />

claim to have such tools in place, suggesting<br />

that it will be a priority of investment<br />

moving forward.<br />

Mobile tools for<br />

store managers 15% 21% 64%<br />

Similarly, retailers surveyed by RSR<br />

are bullish on technologies that help<br />

identify shoppers and track purchase<br />

0% 20% 40% 60% 80% 100%<br />

history, measure customer response<br />

to in-store marketing and optimize<br />

Source: Retail Systems Research<br />

messaging offered to customers as they<br />

18 | <strong>InsideOutdoor</strong> | Spring 2010<br />

80%

EXPLORE THE<br />

GLOBAL SHOW<br />

The annual summit of the outdoor industry.<br />

With innovative side events for the business community.<br />

July 15 – 18, 2010<br />

Friedrichshafen, Germany www.outdoor-show.com<br />

For trade visitors only

enter the store. The general sentiment<br />

festering in the foreground is that<br />

targeted promotions and offerings are<br />

far more effective than scattershot approaches<br />

in the mass media.<br />

In the long term, this need to personalize<br />

will bring about the development<br />

of futuristic technologies such as<br />

face recognition of customers as they<br />

walk through the door or even personal<br />

virtual shopping assistants. In the<br />

shorter term, IT staffs will be charged<br />

with deploying business intelligence<br />

and predictive analysis software that is<br />

capable of compiling and digesting massive<br />

amounts of customer demographic,<br />

psychographic, preferences and purchase<br />

history information.<br />

So far, one of the more under-utilized<br />

tools for gathering and acting upon<br />

such customer data are customer loyalty<br />

programs. Up to this point, it’s common<br />

for retailers to gather just fundamental<br />

demographic information and transaction<br />

histories through loyalty programs,<br />

suggest findings from the CMO Council,<br />

while only about a third capture personal<br />

20 | <strong>InsideOutdoor</strong> | Spring 2010<br />

or product preferences from program<br />

members. Even when data is being collected,<br />

program members “overwhelmingly<br />

felt program membership lacked<br />

a level of personalization or individual<br />

message delivery that they craved,” says<br />

Sandra Zoratti, vice president of global<br />

solution marketing for InfoPrint Solutions<br />

and a CMO Council advisory board<br />

member. And, in case you’re wondering,<br />

a form letter or email with a person’s<br />

name pasted on the top is not viewed by<br />

consumers as tailored communications.<br />

Indeed, while the majority of<br />

members say they are at least somewhat<br />

satisfied with loyalty or rewards<br />

program memberships, nearly one in<br />

five respondents had never received a<br />

personalized communication that was<br />

based on their individual preferences<br />

or behaviors, show the CMO Council’s<br />

findings, while an overwhelming majority,<br />

73 percent, admitted to being the<br />

recipient of promotions for products or<br />

services they already owned.<br />

Topping the list of complaints about<br />

loyalty and rewards programs were a<br />

lack of personalized attention (named<br />

by 24 percent of consumers), rewards<br />

that lacked substance (24 percent), not<br />

enough individualized communications<br />

(23 percent) and too much spam email<br />

and junk mail (21 percent).<br />

Even more alarming, more than half<br />

of program members (54 percent) said<br />

they are considering discontinuing their<br />

participation due to the barrage of irrelevant<br />

messaging, low-valued rewards<br />

and impersonal engagements, say CMO<br />

Council researchers.<br />

These results are not lost on retail and<br />

brand marketers, who place capabilities<br />

that personalize interactions and target<br />

messages, increase the relevancy of communications<br />

and gather more insight<br />

and intelligence for better customer<br />

handling all among the top five ways<br />

to generate a greater ROI from club<br />

members. That means, along with basic<br />

demographic and purchase history data,<br />

we can expect to see mechanisms put<br />

into place that amass information on<br />

brand loyalty and attachment, personal<br />

and product preferences and satisfaction<br />

We Need YOU!<br />

Beka Publishing is hiring experienced<br />

sales representatives for <strong>InsideOutdoor</strong> <strong>Magazine</strong>.<br />

Send your resume to berge@bekapublishing.com<br />

www.insideoutdoor.com

levels, suggests the findings from the<br />

CMO Council.<br />

Of course, achieving the necessary<br />

visibility means any and all customer<br />

information will need to be seamlessly<br />

accessible across channels, tying data<br />

from the point of sale to customer provided<br />

information to online activity,<br />

including purchase history as well as<br />

wish lists and even browsing history.<br />

Quite simply, retailers are beginning<br />

to understand that the back office silos<br />

dividing e-commerce from brick-andmortar<br />

from call center and catalog<br />

operations must be torn down so data<br />

and communications can cross channels<br />

right along with consumer shopping<br />

behavior.<br />

Of course, it’s not uncommon for<br />

the different elements supporting these<br />

distinct retail operations to have been<br />

designed and developed independently<br />

of each other, often outsourced<br />

to separate third-party entities. In such<br />

cases, “POS vendors represent the<br />

most natural integrators,” says Mendy<br />

Mendelsohn, CEO of 3GVision, a<br />

“Transparency is a must; it’s a consumer<br />

expectation,” says Lockhorn.<br />

“Don’t provide it and you will lose trust.”<br />

provider of solutions that allow mobile<br />

phones to scan barcodes. Many POS<br />

solution providers, he says, already are<br />

moving to facilitate transactions across<br />

all channels.<br />

HaND TO<br />

HaND COmBaT<br />

Anyone who doubts the impending<br />

need to integrate all channels simply<br />

can look in the palm of their hand. More<br />

than any other technology or socioeconomic<br />

development, the mobile phone is<br />

rapidly reshaping the sales floor, and it’s<br />

one area where retailers’ technological<br />

capabilities run the risk of falling behind<br />

that of the average consumer.<br />

Possibly the greatest personalization<br />

tool on the planet, the smartphone (connected,<br />

of course, to a 3G or coming 4G<br />

wireless network) effectively represents<br />

an on-the-go subscriber databank that<br />

seamlessly interoperates with Facebook<br />

profiles, Twitter searches, price<br />

comparison services and even online<br />

directories of favorite restaurants.<br />

Moving forward, we can be sure that<br />

applications will be developed that<br />

will scour the smart devices, as well as<br />

the user’s activities, to find clues as to<br />

what a willing consumer likes, what<br />

Spring 2010 | <strong>InsideOutdoor</strong> | 21

Best-in-Class Differentiating Enablers for Fulfilling In-Store Cross-Channel Customer Affinity<br />

they search for, where and when they<br />

prefer to purchase and how much they<br />

tend to pay. The upshot is a competitive<br />

market in which a consumer is pinged<br />

with a highly specific and personalized<br />

promotional offer – one that also considers<br />

geography, season and even time<br />

of day – directly to her palm whenever<br />

she comes anywhere near a particular<br />

store location.<br />

And that’s just a small part of the<br />

impact mobility will have on the instore<br />

experience. Consider a teenage<br />

girl shopping for a new prom dress,<br />

for example. It’s not uncommon today,<br />

says Jeremy Lockhorn, director of<br />

emerging media for Razorfish, for a<br />

young dress shopper to click a picture<br />

of a dress with a camera phone while<br />

still in a store and immediately post<br />

the image to a Facebook or Flickr account<br />

for friends and family members<br />

to view and share their opinion on – all<br />

in real time. So all of a sudden, that<br />

retailer must consider things such as<br />

lighting and the quality of the image<br />

so Mom back home has a favorable<br />

view of the dress.<br />

Granted, in the interest of tempering<br />

the hype, it should be noted that fully<br />

capable smartphones still only account<br />

for about a third of all handsets cur-<br />

rently in use. But smartphone sales are<br />

skyrocketing, with a further boost soon<br />

to come as smart devices shatter the<br />

$100 price point. According to Nielsen<br />

estimates, it’s possible that as many as<br />

half of the consumers walking into any<br />

given store will be armed with a fully<br />

featured smartphone by the middle of<br />

next year.<br />

As more and more customers come<br />

through the door enabled with mobile<br />

Internet access, many retailers will be<br />

forced to alter all-too-common policies<br />

of not allowing access to store employees.<br />

For no other reason, retailers can<br />

not accept a scenario in which customers<br />

have access to more resources,<br />

Customer Sales Channel Preferences Impacting Store Experience,<br />

% of Retailers<br />

Rapidly changing shopping preferences based on price and value 40%<br />

Evolving sales channel purchase behaviors 40%<br />

Customers less tolerant of long transaction times 21%<br />

Inadequate product knowledge for store employees 16%<br />

Source: Aberdeen Group<br />

Best-in-Class<br />

Retailers*<br />

information and capabilities than the<br />

staff members who are supposed to be<br />

serving them.<br />

“Transparency is a must; it’s a<br />

consumer expectation,” says Lockhorn.<br />

“Don’t provide it and you will<br />

lose trust.”<br />

This new reality not only will lead<br />

to investments in smarter tools for sales<br />

staffers, but retailers also would be wise<br />

to fully embrace the in-store Internet<br />

experience. Rather than disallowing<br />

the use of camera phones on the sales<br />

floor or blocking in-store access, as some<br />

retailers have done, a storewide Wi-Fi<br />

Average<br />

Performers*<br />

Access to Web and catalog product availability and information within store 50% 31% 29%<br />

Ability to place Web and catalog orders in the stores 44% 36% 14%<br />

Customized store promotion offers on customer’s mobile phones 33% 19% 8%<br />

*Based on set of standard key performance indicators<br />

Source: Aberdeen Group<br />

22 | <strong>InsideOutdoor</strong> | Spring 2010<br />

Laggards*<br />

service, for example, would at least allow<br />

a retailer to monitor the online activity<br />

of customers.<br />

Down the road, camera phones<br />

also will one day act as self-service<br />

checkout devices, one that not only<br />

allows customers to avoid standing<br />

in line but that also can present offers<br />

on a pair of socks or some waterproofing<br />

treatment as the customer scans<br />

the barcode to purchase a new pair of<br />

leather hiking boots.<br />

Certainly, we are still a few years<br />

away from fully connected and automated<br />

stores dominating Main Street<br />

and advanced m-commerce applications<br />

achieving mainstream penetration.<br />

On the other hand, best-in-class<br />

retailers – or those that outperform the<br />

pack in a standard set of key performance<br />

indicators – aren’t standing by<br />

and waiting.<br />

Rather, as much as 50 percent of<br />

leading retailers now provide access to<br />

Web and catalog product and information<br />

within stores, while 44 percent offer<br />

the ability to place orders through those<br />

channels within their physical storefronts,<br />

show Aberdeen figures. A third of<br />

best-in-class retailers already customize<br />

store promotional offers on customers’<br />

mobile phones.<br />

“E-commerce no longer simply<br />

means ‘electronic commerce’,” says<br />

Lockhorn, “it’s now moving to ‘everywhere<br />

commerce.’”<br />

Like never before, consumers are<br />

informed, empowered and connected,<br />

and they have no shortage of choices<br />

within a hyper-competitive marketplace.<br />

As a result, consumers increasingly will<br />

expect more value from a storefront than<br />

a convenient physical presence and a<br />

familiar brand, and for many of them,<br />

the future is now.

SAVE THE DATE<br />

GET READY FOR OUTDOOR RETAILER SUMMER MARKET 2010<br />

Outdoor Retailer serves you as the ultimate business marketplace for a full spectrum experience of a diverse and<br />

vibrant industry.<br />

Attend Outdoor Retailer to:<br />

• Stay relevant; get informed of the latest in outdoor apparel, hardgoods, accessories, initiatives, technologies and resources.<br />

• Envision your merchandise story for spring 11.<br />

• Make side by side product comparisons to ensure you are stocking the right mix.<br />

• Consolidate weeks of individual line viewings in just 5 days at Outdoor Retailer. Making informed buying decisions<br />

on the front yields a prior profit outcome.<br />

TRADESHOW • AUGUST 3-6, 2010<br />

Salt Palace Convention Center • Salt Lake City, UT<br />

OPEN AIR DEMO • AUGUST 2, 2010<br />

Jordanelle Reservoir • Heber City, UT<br />

Register Today<br />

WWW.OUTDOORRETAILER.COM

An<br />

ouT-oF-STock<br />

SoluTion<br />

THE OUTDOOr<br />

INDUSTry’S rFID<br />

ExpErImENT<br />

Before completely writing off the impact<br />

RFID ultimately will have on retail supply<br />

chains, first keep in mind how it took<br />

30 years for the barcode to reach mainstream<br />

penetration, says Brian Kilcourse,<br />

managing partner of Retail Systems Research. What’s<br />

more, if a small group of courageous retailers such as<br />

Ralph’s and Giant Foods hadn’t taken the bold step<br />

to invest up to $200,000 per store in a new machine<br />

known as the electronic cash register, “we might not<br />

have achieved the level of acceptance we now take<br />

for granted with the barcode,” says Kilcourse.<br />

When radio frequency identification failed to<br />

live up to sales-pitch promises of bringing about<br />

transformational change, detractors declared it as<br />

another example of a technology looking for a solution.<br />

More likely at issue is the fact that businesses<br />

24 | <strong>InsideOutdoor</strong> | Spring 2010<br />

by Martin Vilaboy<br />

prefer to achieve their transformational changes in<br />

incremental amounts.<br />

In other words, before it could alter the course<br />

of supply chain management and delivery tracking,<br />

RFID, like most emerging technology platforms and<br />

protocols, first needed time to take incremental baby<br />

steps, proving a few business cases along the way.<br />

And while some high-profile pilots and attempts to<br />

establish standards by brands such as Wal-Mart and<br />

Target failed to make a big splash, RFID quietly has<br />

achieved widespread use and provided successful<br />

return within numerous industries and applications,<br />

including access control, automobile immobilization,<br />

baggage handling and electronic toll collection.<br />

Among the “modernizing” applications that are<br />

expected to show the strongest growth between now<br />

and 2014 are cargo tracking and security, animal ID,

eal-time location systems, ticketing and<br />

item-level tagging in fashion apparel and<br />

retail, says Michael Liard, practice director<br />

for ABI Research. And now, one of those<br />

incremental steps is being taken by a small<br />

but forward-thinking outdoor company.<br />

For Sole, a provider of custom footbeds,<br />

sport sandals and performance socks, the<br />

problem that needed a solution was one<br />

of the worst problems a store or brand<br />

can have: out-of-stock circumstances at<br />

its dealers. What scenario could be worse,<br />

particularly for impulse items such as customizable<br />

insoles, than having a customer<br />

perched in front of a display, wallet open,<br />

but the display doesn’t have the right size?<br />

“Carrying a full size run in four or<br />

five SKUs is a lot of insoles, so it’s easy to<br />

have an out-of-stock situation,” says Ken-<br />

dra Stritch, hardware developer for Sole.<br />

Even one of Sole’s small to mid-sized<br />

accounts, says Stritch, must manage<br />

more than 200 insoles on the wall at any<br />

given time. Confident that inventory<br />

optimization was an area ripe for system<br />

innovation, as well as a universal challenge<br />

for both manufacturers and retailers,<br />

alike, Sole’s tech team was charged<br />

with coming up with a solution. RFID,<br />

it turned out, “is very well suited for the<br />

type of inventory management we are<br />

doing,” says Stritch.<br />

When Sole’s management team<br />

couldn’t find a third-party solution it<br />

liked, “we built the RFID system ourselves,”<br />

said company president Mike<br />

Baker, upon announcement of the pilot<br />

program last fall. “We think this will be<br />

a game-changer for our business and<br />

potentially throughout the industry.”<br />

Indeed, the type of RFID-based<br />

item-level tagging, tracking and autoreplenishment<br />

capabilities built into the<br />

Sole platform are virtually unheard of<br />

among brands its size. Even for much<br />

larger brands and retailers, grasping the<br />

RFID “holy grail” of item-level, real-time<br />

inventory management has been challenging,<br />

if not elusive.<br />

Currently in the beta testing stage<br />

with a handful of select retail partners,<br />

Sole’s solution actually is quite elegant<br />

in its simplicity, when considering the<br />

technology involved. For starters, each<br />

product’s package is tagged with a microchip<br />

encoded with product and order<br />

details (at this point, only Sole’s footbeds<br />

Spring 2010 | <strong>InsideOutdoor</strong> | 25

are included in the beta, but plans are<br />

to incorporate sandals down the road).<br />

Hardware installed on a free-standing<br />

point-of-purchase display then reads the<br />

tags and transmits necessary data back<br />

to Sole’s retailer Web portal.<br />

When a footbed is purchased and<br />

subsequently leaves the store, the system<br />

automatically gets updated, allowing<br />

dealers to manage stock by the second<br />

rather than by the day, week or month.<br />

Through the online inventory management<br />

software, dealers can see exactly<br />

what they have in stock, what they need<br />

to order and whether new product is on<br />

the way, all in real time. The retailer Web<br />

site also allows Sole dealers to manage<br />

and approve orders, track shipping, pay<br />

bills and access marketing materials.<br />

Streamlining matters even further, the<br />

RFID solution can be set up to automatically<br />

order replacement stock whenever<br />

an item is sold or inventory reaches<br />

a certain level. In the beta testing, for<br />

example, the system typically sends<br />

out an alert notice once a store hits 30<br />

percent of its ideal stock. At that point,<br />

serious traction gear<br />

26 | <strong>InsideOutdoor</strong> | Spring 2010<br />

the specific size of the specific SKU that<br />

is below 30 percent is flagged in the<br />

system, and as soon as there is enough<br />

product flagged to fill a box (a measure<br />

taken to minimize shipping fees), the<br />

order is shipped out.<br />

Of course, nothing happens without<br />

the approval of the individual dealers,<br />

who decide what their ideal inventories<br />

should look like and can control when<br />

and how many items of each size are<br />

delivered. Special orders and on-the-fly<br />

adjustments also would have to be initiated<br />

by the dealer through the system.<br />

Still, some may be reticent to hand<br />

over control to a vendor’s automation<br />

software. “There are always questions<br />

over how accurate it is,” says Stritch, but<br />

she is confident the data from the pilot<br />

will prove things out.<br />

“We’ll alleviate those fears by being able<br />

to say, ‘we have this much testing, and we<br />

haven’t had any problems,’” she says.<br />

So far, for example, Sole has been<br />

getting 100 percent reads on its tags,<br />

says Stritch, “so we don’t have any<br />

concerns there.”<br />

And while Sole’s motivation behind<br />

the program ultimately is to increase<br />

sales, the objective isn’t to ship unwanted<br />

or unneeded orders just for the sake<br />

of sneaking more dollars though the<br />

door, Stritch reassures.<br />

As it turns out, it’s actually the system’s<br />

auto-replenishment capabilities<br />

that are proving to be one of the most<br />

appealing aspects of the program for the<br />

participating dealers.<br />

“We are finding that the buyers are<br />

most interested in the decreased time<br />

they are going to have to spend counting<br />

inventory and placing the orders,” says<br />

Stritch. “Some of our top accounts have<br />

to place orders on a very regular basis,<br />

every week or couple of weeks.”<br />

Down the road, it’s likely another key<br />

benefit of the program will emerge for<br />

Sole, its retail partners and the outdoor<br />

industry in general. And it’s arguably<br />

the most interesting and far-reaching upside<br />

of the experiment.<br />

Having worked in the beta stage with<br />

one Calgary-based retailer for more than<br />

four months now, Sole has found itself<br />

800-782-2423 www.32north.com

with “a large amount of data from that<br />

store,” says Stritch, out of which the<br />

company is starting to be able to recognize<br />

patterns and analyze trends.<br />

Stritch readily admits that “we don’t<br />

even know yet what we will be able<br />

to know,” but the data has been very<br />

interesting to examine, she says. Sole can<br />

see, for example, when a footbed walked<br />

away from a display and when that<br />

exact footbed came back. The system can<br />

show if a customer walked around with<br />

an item for a half hour and then decided<br />

to return it to the rack, or if the footbed<br />

was left at the check-out counter and<br />

then returned to the display by an employee<br />

after the shop closed for the day.<br />

Such information may be minimally<br />

beneficial to insole sales, but consider<br />

this type of tracking on a piece of apparel.<br />

“You would know how many<br />

times a black shirt went to the dressing<br />

room and came back,” says Stritch.<br />

Eventually, Sole plans to provide<br />

reporting on the data to its sales reps<br />

and retailers, as well as suggestions on<br />

inventory assortments and volumes that<br />

The toughest part about<br />

camping should be getting<br />

to your campsite.<br />

The Outdoor Accessories People<br />

Call 1-877-264-4526 for a catalog<br />

or visit us online at: www.coghlans.com<br />

will maximize sell-through and inventory<br />

efficiencies.<br />

To be a part of the RFID beta testing,<br />

or to join the program once it goes live,<br />

retailers only must be willing to stay fully<br />

stocked. There are no volume or dollar<br />

commitments, and the RFID-enabled<br />

free-standing POP display and all other<br />

ancillary customer premises equipment<br />

are provided free of charge. Size of a<br />

shop, likewise, is not a determining factor.<br />

No store is too small to be considered,<br />

says Stritch, and smaller shops with large<br />

potential for growth are particularly appealing<br />

candidates for inclusion.<br />

In many ways, custom footbeds could<br />

be precisely the type of product category<br />

that is ideal for an item-level, auto-replenishment<br />

application of RFID technology.<br />

For starters, the entire assortment of<br />

sizes and models typically can be hung<br />

together on one relatively small display,<br />

requiring just a bubble or circle of connectivity.<br />

Secondly, product generally doesn’t<br />

change much season to season, and it’s<br />

not impacted by trends in fashion, culture<br />

or the weather, so retailers don’t have to<br />

be worried about getting stuck with stock<br />

or insoles ending up on a closeout list. At<br />

the same time, footbeds, like all footwear,<br />

require the manual management of lots<br />

of different sizes even when stocking just<br />

a handful of SKUs.<br />

Conversely, attempts by major chains<br />

to improve perpetual inventory across an<br />

entire store or streamline warehouse and<br />

distribution operations across an entire organization<br />

simply may have been setting<br />

these RFID applications up for failure.<br />

“Wal-Mart tried it but cancelled the program,”<br />

says Stritch, “but a lot of that comes<br />

down to understanding the technology and<br />

what they were trying to get out of it.”<br />

Sole’s RFID application certainly is<br />

small and somewhat limited, by comparison,<br />

described even as niche, but the<br />

company arguably has a firm understanding<br />

of what the technology can do<br />

and how it can be applied to solve its<br />

problem. And it’s clearly not a problem<br />

that is unique to Sole.<br />

Retailers interested in participating in<br />

Sole’s RFID program, should contact the<br />

company at 403-204-0907.<br />

Outdoor Accessories<br />

for a better outdoor experience.<br />

Spring 2010 | <strong>InsideOutdoor</strong> | 27

Happy<br />

Campers<br />

CampING marKET prImED FOr<br />

CONTINUED GrOWTH<br />

Strange as it may sound, the economic<br />

recession may have been exactly what the<br />

camping market needed. Before camping’s<br />

thriftiness captured everyone’s attention last<br />

year, participation numbers we’re in a downward<br />

slump, illustrated in both consumer response surveys<br />

and National Park visits.<br />

28 | <strong>InsideOutdoor</strong> | Spring 2010<br />

by Martin Vilaboy<br />

In California alone, for example, about half of<br />

residents said they had camped at developed sites in<br />

2002, according to the California State Parks Planning<br />

Division. The percentage dropped to 39 percent in<br />

2008. The mean number of days California residents<br />

participated in camping also dropped, from 11.2<br />

in 2002 to 6.9 in 2008. Indeed, since the late 1990s,

Top 20 Recreational Activities<br />

California Residents Would Like to<br />

Participate in More Often<br />

Activity % Yes<br />

Walking for fitness or pleasure 45.6%<br />

Camping in developed sites with facilities 45%<br />

Bicycling on paved surfaces 44.7%<br />

Day hiking on trails 44.1%<br />

Picnicking in picnic areas 41.9%<br />

Beach activities 41.7%<br />

Visiting outdoor nature museums, zoos,<br />

gardens or arboretums<br />

41.4%<br />

Visiting historical or cultural sites 39.9%<br />

Attending outdoor cultural events 39%<br />

Off-highway vehicle use 37.3%<br />

Driving for pleasure, sightseeing, drive<br />

through natural scenery<br />

36.8%<br />

Swimming in pool 36.4%<br />

Wildlife viewing, bird watching, viewing<br />

natural scenery<br />

32.4%<br />

Outdoor photography 28.4%<br />

Swimming in freshwater lakes, rivers, streams 28.2%<br />

Jogging/running for exercise 27.3%<br />

Fishing – freshwater 23.1%<br />

Using open turf areas 22.7%<br />

Backpacking 20.9%<br />

Paddle sports<br />

Source: California State Parks Planning Division<br />

20.4%<br />

participation rates in both camping and<br />

backpacking have been flat to negative,<br />

show figures from the Outdoor Industry<br />

Foundation.<br />

Then, after starting to gain some<br />

momentum in the second half of 2008,<br />

all of sudden in 2009, at a time when leisure<br />

travel was dipping and disposable<br />

spending all but froze over, tent camping<br />

visits at the 360 sites run by U.S.<br />

National Parks Service hit its highest<br />

level since 2003, up to 3.184 million. The<br />

6.24 percent rise in tent camping visits<br />

outpaced the 4.3 percent lift in overall<br />

visits last year.<br />

Backcountry permits, meanwhile,<br />

were flat, showing a modest .78 percent<br />

growth, but even the increase of<br />

just 14,051 to 1.8 million also pushed<br />

backcountry permits to its highest level<br />

since 2003.<br />

Last year, incidentally, also marked<br />

the first time since 2000 that total<br />

recreational visits to NPS sites exceeding<br />

280 million. Overall recreational<br />

visits were up 3.9 percent year over<br />

year, with growth reportedly strongest<br />

along national seashores, particular in<br />

Florida and Mississippi, and nearby<br />

major metro areas, such as Washington<br />

D.C and New York City. Overall,<br />

visits rose at 63 percent of the 361<br />

sites and declined in only 12 states,<br />

including the remote destinations<br />