growers@sgcotton.com.au Roger Tomkins - Greenmount Press

growers@sgcotton.com.au Roger Tomkins - Greenmount Press

growers@sgcotton.com.au Roger Tomkins - Greenmount Press

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

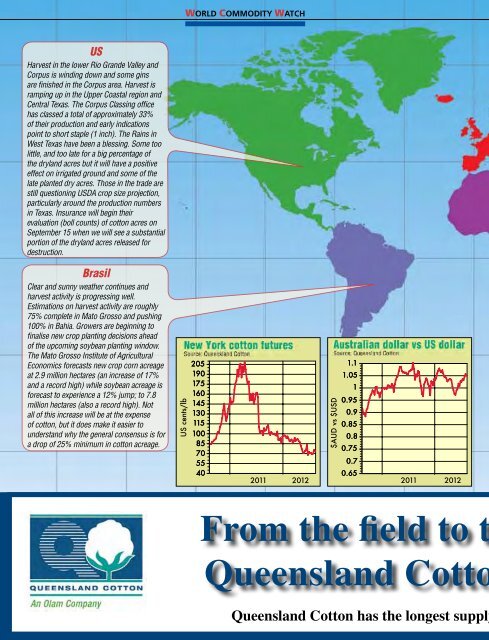

US<br />

Harvest in the lower Rio Grande Valley and<br />

Corpus is winding down and some gins<br />

are finished in the Corpus area. Harvest is<br />

ramping up in the Upper Coastal region and<br />

Central Texas. The Corpus Classing office<br />

has classed a total of approximately 33%<br />

of their production and early indications<br />

point to short staple (1 inch). The Rains in<br />

West Texas have been a blessing. Some too<br />

little, and too late for a big percentage of<br />

the dryland acres but it will have a positive<br />

effect on irrigated ground and some of the<br />

late planted dry acres. Those in the trade are<br />

still questioning USDA crop size projection,<br />

particularly around the production numbers<br />

in Texas. Insurance will begin their<br />

evaluation (boll counts) of cotton acres on<br />

September 15 when we will see a substantial<br />

portion of the dryland acres released for<br />

destruction.<br />

Brasil<br />

Clear and sunny weather continues and<br />

harvest activity is progressing well.<br />

Estimations on harvest activity are roughly<br />

75% <strong>com</strong>plete in Mato Grosso and pushing<br />

100% in Bahia. Growers are beginning to<br />

finalise new crop planting decisions ahead<br />

of the up<strong>com</strong>ing soybean planting window.<br />

The Mato Grosso Institute of Agricultural<br />

Economics forecasts new crop corn acreage<br />

at 2.9 million hectares (an increase of 17%<br />

and a record high) while soybean acreage is<br />

forecast to experience a 12% jump; to 7.8<br />

million hectares (also a record high). Not<br />

all of this increase will be at the expense<br />

of cotton, but it does make it easier to<br />

understand why the general consensus is for<br />

a drop of 25% minimum in cotton acreage.<br />

�����������<br />

WORLD COMMODITY WATCH<br />

��� ���<br />

��� ���<br />

��� ���<br />

��� ���<br />

��� ���<br />

��� ���<br />

��� ���<br />

��� ���<br />

�� ��<br />

�� ��<br />

�� ��<br />

�� ��<br />

�������������������<br />

������������<br />

��� ���<br />

���� ����<br />

���� ����<br />

��� ���<br />

���� ����<br />

��� ���<br />

���� ����<br />

��� ���<br />

���� ����<br />

From the field to t<br />

Queensland Cotto<br />

��<br />

��������������������<br />

Queensland Cotton has the longest supply