MEAT Sector Analyse

MEAT Sector Analyse

MEAT Sector Analyse

- TAGS

- sector

- analyse

- mbumk.gov.al

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SMEI II Inception Report page 1<br />

THE EUROPEAN UNION’S IPA 2008 PROGRAMME<br />

FOR THE REPUBLIC OF ALBANIA<br />

“Capacity Building for Implementing the Rural<br />

Development Strategy”<br />

Delegation Agreement No: 2009/212-470<br />

Analysis of Meat <strong>Sector</strong><br />

A project funded by<br />

the European Union and the Federal<br />

Government of Germany<br />

April 2010<br />

This project is funded by<br />

The European Union and The Federal Government of Germany<br />

A project implemented by<br />

Deutsche Gesellschaft für Technische<br />

Zusammenarbeit (GTZ) GmbH

ALBANIA<br />

“Capacity Building for Implementing<br />

the Rural Development Strategy”<br />

Support to the Albanian Ministry of Agriculture,<br />

Food and Consumer Protection<br />

Meat <strong>Sector</strong> Study<br />

Dr.Martin Mautner Markhof / office@agroservice.com<br />

Prof. Dr.Bahri Musabelliu<br />

Alban Zusi<br />

April 2010<br />

Meat <strong>Sector</strong> Study, page 1<br />

Meat <strong>Sector</strong> Study

CONTENT<br />

ABBREVIATIONS<br />

Meat <strong>Sector</strong> Study<br />

0) EXECUTIVE SUMMARY………………………………………………………………………..7<br />

1) BACKGROUND AND KEY FIGURES………………………………………………………..11<br />

2) PRODUCER/FARMERS……………………………………………………………………….14<br />

Cattle……………………………………………………………………………………………..14<br />

Sheep and goats………………………………………………………………………………..16<br />

Pigs………………………………………………………………………………………………19<br />

Poultry……………………………………………………………………………………………20<br />

Animal feeding…………………………………………………………………………………..21<br />

Animal feed producers……………………………………………………………………….22<br />

3) PROCESSING INDUSTRY…………………………………………………………………....23<br />

Slaughterhouses………………………………………………………………………………..23<br />

Keputa………………………………………………………………………………………….25<br />

Meat processing companies…………………………………………………………………..26<br />

EHW GmbH……………………………………………………………………………………27<br />

KMY…………………………………………………………………………………………….27<br />

Meat Master…………………………………………………………………………………...28<br />

Darb Univers Frigo Darb………………………………………………………………….....28<br />

TONA Co………………………………………………………………….............................28<br />

DEKON FRIGO…………………………………………………………………...................28<br />

EL FRIGO 2……………………………………………………………………………………28<br />

FRIGO ALBA………………………………………………………………….......................29<br />

FIX-PRO shpk………………………………………………………………………………...29<br />

HAKO…………………………………………………………………………………………..29<br />

ALBIDEA ………………………………………………………………………………………29<br />

ROZAFA KACI shpk………………………………………………………………………….30<br />

I.N.C.A Nord Fish…………………………………………………………………................30<br />

4) GOVERNMENT POLICY FOR THE SECTOR AND INSTITUTIONAL ISSUES………...31<br />

Cattle………………………………………………………………………………………..….31<br />

Sheep……………………………………………………………………………………….….31<br />

Land property and reform……………………………………………………………...…….32<br />

Mountain areas………………………………………………………………………………..33<br />

Value Added Tax……………………………………………………………………………...34<br />

5) MARKET AND TRADE………………………………………………………………………...34<br />

Availability of products……………………………………………………………………...….34<br />

Supply chain…………………………………………………………………………………….34<br />

Consumption pattern…………………………………………………………………….……..35<br />

Legal framework for trade …………………………………………………………………….36<br />

Agro-food trade balance……………………………………………………………………….37<br />

6) LEVEL OF ATTAINMENT OF RELEVANT EU STANDARDS …………………………...39<br />

Occupational health and safety………………………………………………………….……39<br />

Environment……………………………………………………………………………………..39<br />

Food safety ……………………………………………………………………………………..40<br />

Animal health and welfare……………………………………………………………………..42<br />

Competent authorities………………………………………………………………………….44<br />

National Strategy for Development and Integration (NSDI) 2007-2013………………….45<br />

Meat <strong>Sector</strong> Study, page 2

Meat <strong>Sector</strong> Study<br />

Agriculture and fisheries……………………………………………………………………….46<br />

Farm level……………………………………………………………………………………….46<br />

Processing level………………………………………………………………………………...47<br />

7) PAST TRENDS AND FUTURE DEVELOPMENTS IN TERMS OF INVESTMENTS…...47<br />

Past trends……………………………………………………………………………………....47<br />

Actual situation………………………………………………………………………………….47<br />

Future developments…………………………………………………………………………..48<br />

8) IDENTIFICATION OF POTENTIAL AND NEEDS FOR THE SECTOR…………...……..49<br />

9) IDENTIFICATION OF TRAINING NEEDS FOR THE SECTOR…………………………..62<br />

Training needs for farmers…………………………………………………………………….63<br />

Training needs for slaughterhouse’s staff……………………………………………………63<br />

Training needs for meat processor’s staff……………………………………………………63<br />

Training needs for the public administration…………………………………………………63<br />

10) OUTCOME………………………………………………………………………………………64<br />

Overview of the meat sector ………………………………………………………………….64<br />

Potentials and obstacles……………………………………………………………………….65<br />

Final recommendations in order to target the specific investments ……………………...66<br />

LITERATURE AND WEBSITES CONSIDERED…………………………………………………69<br />

Map 1: Land use in Albania<br />

Map 2: Administration in Albania<br />

Table 1: Sub-sector’s contribution to the agricultural added value (in Lek and %)<br />

Table 2: Output of animal products<br />

Table 3: Animals in Albania (heads in 000)<br />

Table 4: Meat production 2000 – 2009<br />

Table 5: Average live weight of calves when slaughtered<br />

Table 6: Revenues per sheep and year; meat vs. milk<br />

Table 7: Break - even points for milk and meat<br />

Table 8: Poultry meat farm<br />

Table 9: Investment of the agro-industry in Lek million<br />

Table 10: Sausage and ham production of the agro-industry<br />

Table 11: Average size of agricultural enterprises and cooperatives<br />

Table 12: Livestock production<br />

Table 13: Meat consumption<br />

Table 14: Agro-food import and export<br />

Table 15: Import of agricultural and food products by quantity and value<br />

Table 16: Export of agricultural and food products by quantity and value<br />

Table 17: Investments in Albanian agroindustry<br />

Table 18: Animals in Albania (heads in 000)<br />

Meat <strong>Sector</strong> Study, page 3

Map 1: Land use in Albania<br />

Meat <strong>Sector</strong> Study<br />

(Source: SHUNDI, Andrea Prof.: Country Pasture/Forage Resource Profiles Albania; 2006)<br />

Meat <strong>Sector</strong> Study, page 4

Map 2: Administration in Albania<br />

Meat <strong>Sector</strong> Study, page 5<br />

Meat <strong>Sector</strong> Study<br />

Albania is divided into 12 administrative divisions called counties or in Albanian qark/qarku',<br />

often also prefekturë/prefektura; furthermore there are 65 municipalities and 308 communes.<br />

No Regions Area km²<br />

1 Berat 1802<br />

2 Diber 2507<br />

3 Durres 827<br />

4 Elbasan 3278<br />

5 Fier 1887<br />

6 Gjirokaster 2883<br />

7 Korce 3711<br />

8 Kukes 2373<br />

9 Lezhe 1581<br />

10 Shkoder 3562<br />

11 Tirana 1586<br />

12 Vlora 2706<br />

ALBANIA 28703

ABBREVIATIONS<br />

Meat <strong>Sector</strong> Study<br />

ADAMA Albanian Dairy and Meat Association<br />

ATTC Agricultural Technology Transfer Centres<br />

BSE Bovine Spongiform Encephalopathy, a cattle disease<br />

CAP Common Agricultural Policy<br />

CARDS Community Assistance for Reconstruction, Development and Stabilisation<br />

CEFTA Central European Free Trade Agreement<br />

CESVI Cooperazione e Sviluppo, an Italian NGO<br />

EC European Commission<br />

FVO Food and Veterinary Office (Ireland)<br />

GAP Good Agricultural Practice<br />

GDP Gross Domestic Product<br />

GOA Government of Albania<br />

GTZ German Agency for Technical Cooperation<br />

HACCP Hazard Analysis and Critical Control Point<br />

IPA Instrument for Pre-Accession Assistance<br />

IPARD Instrument for Pre-Accession Assistance on Rural Development<br />

ISO International Organisation for Standardisation<br />

Lek Albanian Currency<br />

MAFCP Ministry of Agriculture, Food and Consumer Protection<br />

NFA National Food Authority<br />

NGO Non Governmental Organisation<br />

NSDI National Strategy for Development and Integration<br />

OIE World Organisation for Animal Health<br />

SLI State Labour Inspectorate<br />

SR Small Ruminants<br />

SWOT Strengths Weaknesses Opportunities and Threats<br />

VAT Value Added Tax<br />

WTO World Trade Organisation<br />

Exchange rate (1 st April 2010)<br />

Euro : Lek = 1 : 139,344000<br />

Source: http://ec.europa.eu/budget/inforeuro/index.cfm?fuseaction=currency_historique&<br />

currency= 6&Language=en<br />

Meat <strong>Sector</strong> Study, page 6

O. Executive Summary<br />

Meat <strong>Sector</strong> Study<br />

This meat sector study was prepared during January to April 2010 within the framework of<br />

the EU / GTZ project „Capacity Building for Implementing the Rural Development Strategy“ to<br />

provide a quantitative and qualitative description of the meat sector in Albania; starting from<br />

livestock keepers to slaughterhouses and meat processors. In addition a SWOT analysis<br />

accomplished the potential and weak points of the meat sector and summarized all the<br />

findings. This was necessary to have a sound base for upcoming decisions within the<br />

Ministry of Agriculture, Food and Consumer Protection (MAFCP), especially related to the<br />

envisaged Instrument for Pre-Accession Assistance on Rural Development (IPARD) support<br />

scheme. This scheme intends to assist financially investment in agriculture holdings, in<br />

processing and marketing of the agricultural products. Other recommendations which will not<br />

find IPARD support – as they do not fit the criteria of the two mentioned measures – have<br />

been made and eventually the Government of Albania (GOA) will find financing means<br />

trough national support programmes.<br />

The objective of this meat sector analysis was to give a quantitative and qualitative<br />

description of the Albanian meat sector, addressing both production and processing.<br />

The following methodology and approach were applied to write this study:<br />

a) Desk research;<br />

b) Intensive expert talks with MAFCP staff but also with the Agricultural Technology<br />

Transfer Centres (ATTC) and other institutions;<br />

c) Visit of more than 15 farms (see also ANNEX 1);<br />

d) Individual meeting with leading representatives of the meat processing industry<br />

(including visits of several processing plants and slaughterhouses), representatives of<br />

associations, traders and importers (see also ANNEX 1);<br />

e) More than 10 Focus Group meetings in all major geographical areas (political regions)<br />

to get immediate insight into the husbandry sector and to collect additional baseline<br />

data;<br />

f) Discussions with other internationally funded projects in this sector.<br />

In order to make the study transparent the focus was on cattle, sheep, goats, pigs and<br />

chicken only; other animal origin sectors (horse, buffalo, ostrich etc) have not been included.<br />

SWOT analyses have been made for each sub-group (farmers, slaughterhouses and meat<br />

processors) and the most important weaknesses in the sector are:<br />

• Unfavourable entity structures in production as most animals are kept by subsistence<br />

farmers on holdings with 1.2 – 1.8 ha;<br />

• High level of land fragmentation;<br />

• High fodder costs as almost all components have to be imported;<br />

• Low competitiveness and efficiency of production;<br />

• Unfavourable business environment for slaughterhouses which therefore are running at<br />

low capacity or not at all;<br />

• Unfavourable entity structures in processing especially for small meat processing<br />

plants slaughterhouses (the 5 - 10 big players are doing fine);<br />

• Insufficient attainment of national and/or EU standards at farm, slaughterhouse and<br />

small processing plant level;<br />

• Insufficient knowledge on modern production techniques / technologies and standards<br />

at farm and slaughterhouse level;<br />

• Insufficient professional advisory service.<br />

The outcome of the study shows very mixed results for the sub-groups. The results are<br />

astonishing.<br />

Meat <strong>Sector</strong> Study, page 7

Meat <strong>Sector</strong> Study<br />

The livestock husbandry deals on one side with ruminants like cows, sheep and goats and<br />

on the other side with pigs and poultry.<br />

The ruminants are taking advantage of the Albanian pastures which are plentiful available.<br />

However the number of all ruminants heads is going continuously down due to:<br />

• Limited farm size and dominance of subsistence farming with livestock farmers not able<br />

to invest;<br />

• As meat production with ruminants requires long production cycle we face a slow return<br />

on investment; (situation is better with dairy farmers as they get regular cash revenues<br />

by selling milk);<br />

• Poor premises and outdated technology, for example stables without windows and too<br />

little and old tractors;<br />

• Poor infrastructure; for example missing water holes in remote areas;<br />

• Poor marketing channels and no uniform offer regarding qualities and quantities;<br />

• Very limited demand from the slaughterhouses and meat processors;<br />

• Migration to urban areas.<br />

On the other side are the pig and poultry producers and the animal head counts are<br />

increasing continuously. Also here we have two different groups with quite different<br />

performances. There are the subsistence farmers again who keep a dozen chickens in the<br />

backyard for self-consumption and additionally often 2 - 3 piglets – also for self consumption.<br />

The more commercial pig farmers are struggling with the following handicaps:<br />

• No specialisation of pig farms because piglets of good quality and sufficient quantities<br />

(uniform groups) cannot be purchased on weekly markets so that farmers have to get<br />

involved in the whole process: mother sows – piglet production – fattening;<br />

• Consequently piglets have been imported (from Serbia and other countries) and as it<br />

was more profitable importers brought in 80 – 90 kg pigs almost ready for slaughtering;<br />

• Main reason why imports of ready pigs are cheaper is that fodder, if not produced on<br />

the farm, is expensive;<br />

• Poor marketing channels and no uniform offer of fattened pigs regarding qualities and<br />

quantities.<br />

The situation in the chicken sector looks much better as here are several investors active<br />

who have the funds for this capital-intensive business with fast returns on investments. Often<br />

these investors are already active in agribusiness for example with feed production<br />

companies or slaughterhouses. There is a trend to establish a complete integrated chain of<br />

operations, from chicken farms to feed mill and retail outlets. These new chicken farms of<br />

agribusiness type can therefore also use cheaper fodder as it is produced often in own feed<br />

mills.<br />

Coming to the processors we also see quite different performances; slaughterhouses<br />

underperform and meat processing companies do well.<br />

In Albania there are many slaughterhouses not in operation (see also UNDP Albania; The<br />

Agribusiness <strong>Sector</strong> in Albania, Inward Investment Opportunities; 05) and the active around<br />

20 slaughterhouses do daily slaughtering of 1 – 2 cattle and / or few pigs or small ruminants.<br />

All slaughterhouses are working far below their capacities because nobody forces the traders<br />

and butchers to slaughter there; this will be one of the main activities of the upcoming<br />

National Food Authority (NFA). Therefore slaughterhouses face no or limited raw material<br />

supply. Usually the facilities are outdated and in most cases they do not even comply with<br />

the Albanian law. Consequently EU standards on hygiene, public authority, traceability and<br />

HACCP are not fulfilled and liquid and solid waste material is just dumped into landfills or<br />

Meat <strong>Sector</strong> Study, page 8

Meat <strong>Sector</strong> Study<br />

washed away by the nearby river. The condition of the existing premises is poor so that most<br />

likely just new Greenfield investments in slaughterhouses will improve the situation.<br />

In contrast to the slaughterhouse sector the Albanian top meat processing companies like<br />

EHW, KMY, TONA and others are doing fine. The 10 biggest processing companies cover<br />

around 80 % of the market share, are financially strong and consider further investments with<br />

and without upcoming IPARD-support.<br />

Considering the whole meat sector under IPARD support schemes, there is definitely a need<br />

for financial support. In livestock farming the best potential is still within cattle and small<br />

ruminants as these livestock farms could make use of the natural advantages (i.e. pastures)<br />

which Albania has available. Less needs for financial support is required in the pig production<br />

and almost none in chicken farming.<br />

Also the processing sector has different stakeholders. Slaughterhouses will be needed in the<br />

future and as refurbishment is too expensive new slaughterhouses will have to be build.<br />

There is enough private interest in case that the competent authorities will start channelling<br />

all animals through slaughterhouses within the next months. Nevertheless IPARD funding will<br />

be needed.<br />

For the meat processing companies the authors see fewer necessities to support as the big<br />

players are doing fine and have a quite high level of standards already fulfilled. They are<br />

keen to export and need urgently improvements in the veterinary and food inspection system.<br />

Finally it has to be stressed out that Albania has no rendering plant and therefore all waste<br />

material from farms to slaughterhouses and meat processors are dumped into landfills. It is<br />

highly recommended to encourage the establishment of such a plant; this could be done also<br />

by the private sector especially of IPARD funding will be available and the NFA enforce<br />

relevant laws.<br />

Having covered the production side the study had also a look on the governmental<br />

stakeholders such as MAFCP, ATTC, NFA and others. These governmental bodies will need<br />

specific capacity building programmes to better understand the commercial side of the meat<br />

sector, IPRAD requirements regarding farmers and processors and their upcoming<br />

investment proposals and many more.<br />

For this meat sector study official data from MAFCP have been used wherever possible.<br />

Taking in consideration the overall situation in the sector and the results of the SWOT -<br />

analyses future interventions in the sector should be oriented mainly to:<br />

• Improve entity structure in production and processing and increase the competitiveness<br />

of the sector;<br />

• Increase overall competitiveness through investments for application of modern<br />

production techniques and technologies;<br />

• Improve status of attainment of national and EU standards on occupational health and<br />

safety, environmental issues, food and feed safety, animal health, animal welfare and<br />

more; these standards are closely related with the EU accession requirements;<br />

• Improve vocational training;<br />

• Improve performance and offer of service providers.<br />

Investment in Agricultural Holdings<br />

The following investments should be supported under IPARD:<br />

• Construction/extension/modernisation of animal shelters;<br />

• Construction and/or renovation of storage buildings and machine sheds;<br />

Meat <strong>Sector</strong> Study, page 9

Meat <strong>Sector</strong> Study<br />

• Silage handling equipment and machinery, on-farm animal feed preparation, handling,<br />

distribution systems and storage;<br />

• Automatic feeding & drinking equipment, watering, heating and ventilation, automating<br />

environmental control systems including energy-saving equipments authorised and<br />

defined under Directive 2007/43/EC;<br />

• Investments for manure handling, storage and treatment facilities;<br />

• Animal handling equipment and facilities (e.g. weighing, disinfection);<br />

• Transportation equipment compatible with Community animal welfare standards;<br />

• Watering systems;<br />

• Fences and gates;<br />

• Special equipment for weighing, health control;<br />

• Biogas facilities;<br />

• Purchase of specialized technological equipment including IT and software (herd<br />

management, animal registry, general farm management).<br />

The ranking of investment priorities according to the different types of animals should be as<br />

follows: sheep – cattle – goats – pigs – poultry.<br />

Investment in Processing and Marketing of the Agricultural Products<br />

The following investments should be supported under IPARD:<br />

• Construction or renovation of slaughterhouses;<br />

• Renovation of meat processing enterprises;<br />

• Equipment for improvement of hygiene and product quality, in full compliance with<br />

Community standards;<br />

• Investments for establishment of food safety systems (HACCP, GMP and GHP)<br />

including laboratories and equipment to improve the control of the product quality and<br />

hygiene;<br />

• Certification costs;<br />

• Improvement of environmental protection; equipment and facilities for reprocessing of<br />

intermediate products and processable wastes; treatment and elimination of wastes:<br />

waste water works in slaughterhouses and fat catcher facilities for meat processing<br />

establishments;<br />

• Investment for slaughtering animals in conditions compatible with animal welfare;<br />

• Purchase of equipment for packaging;<br />

• Cold storage equipment, purchasing refrigerated transport means of carcass and meat<br />

products;<br />

• IT hardware and software for product and process management, Software & tracking<br />

system to implement traceability of carcass and meat inside the processing<br />

establishment.<br />

The ranking of investment priorities in the processing sector should be as follows:<br />

slaughterhouses - (rendering plants) – meat processors.<br />

Beside IPARD funding the agricultural sector would need substantially more support from the<br />

GOA. The current allocation of the budget for the sector agriculture and rural development<br />

makes just 2.2 % while the agricultural sector still produces more than 15 % of the GDP.<br />

Despite progress in many sectors the agriculture and rural development sector is and will be<br />

in the near future the backbone of all economic development in Albania.<br />

Meat <strong>Sector</strong> Study, page 10

I. Background and Key Figures<br />

Meat <strong>Sector</strong> Study<br />

Albania has a population of more than 3 million inhabitants, and eventually the same number<br />

of Albanians who work and live abroad. The northern, north-eastern, south-eastern and<br />

central areas are characterized by hilly-mountainous terrain; whereas the north southern /<br />

costal area along the Adriatic and Ionian coast is lowland. It has a total land area of 28,750<br />

km² (equivalent to 2,875,000 ha); 696,000 ha are classified as agricultural land and<br />

2,179,000 ha as forestry, pasture and other fond. (Source: MAFCP; Statistical Yearbook<br />

2009) Out of the last group, around 423,000 ha are considered pastures.<br />

After 46 years of centrally planned economy, Albania’s agriculture has changed dramatically<br />

since the early 1990s. Before transition there have been 550 large state farms and<br />

cooperatives in Albania. After the collapse of the system and after the land distribution, which<br />

did not took place in the north, there have been about 467,000 very small family farms<br />

whereas today just 357,027 farm households are left with an average 1.5 ha - divided into 4<br />

parcels. On each farm live 4.8 people so that in total 1.7 million people are involved in<br />

farming activities; about 50 % of the population lives in rural areas.<br />

Despite being fragmented, this small farming agriculture has initially been vital to the<br />

alleviation of poverty in rural areas and provision to the urban markets with some elementary<br />

and indispensable foodstuff such as vegetables, meat and other dairy stuff. With 59 % of<br />

total labour and 21 % of GDP the agricultural sector, including also forestry, hunting and<br />

fishery, continues to be an important sector of the Albanian economy. Nevertheless the<br />

contribution to the GDP was continuously falling since 2005 (20.6 %), 2006 (19.4 %), 2007<br />

(18.9 %) and 2008 (16.5 %). (Source: INSTAT)<br />

Around 1.7 million people live on farms but the trend shows that many young people do not<br />

take over the subsistence farms of their parents or give up their farm activities and move to<br />

bigger towns; in these cases animals are sold or slaughtered but the land is kept as land<br />

property offers high financial security; sometimes the land is rented out to neighbours but<br />

often left alone without any use.<br />

Albanian farming is predominantly at subsistence level and most of the agricultural product is<br />

destined to home consumption. As a result only 18 % of crop production, 30 % of livestock<br />

products and a few percentages of off-farm processed products reach the market. Household<br />

income range differs between families living in mountain areas (poor) to those in the plains<br />

(less poor).<br />

As the centrally planned economy collapsed, the market-driven economy forced farmers over<br />

night to change their way of farming. Major shifts in agricultural production patterns have<br />

taken place with a significant increase of animal production that compensated the respective<br />

drop in crop and fruit production. Current production systems have mainly evolved as<br />

adjustment to the new situation with very small and fragmented farms which have to face<br />

other major constraints such as a poor physical infrastructure, lacking state or privately<br />

operated services, lack of food processing industries and an imperfect market.<br />

The agricultural sector’s contribution to the GDP can be allocated to the following subsectors.<br />

Table 1: Sub-sector’s contribution to the agricultural added value (in Lek and %)<br />

Nr. Description 2000 2006 2007 2008 2009<br />

Total mio LEK 126116 147306 149802 155669 159080<br />

Meat <strong>Sector</strong> Study, page 11

1 Livestock 71460 86633 90101 86882 87727<br />

2 Field crop 42483 42226 40482 45741 47352<br />

3 Fruit trees 12173 18446 19219 23046 24001<br />

Nr. % 2000 2006 2007 2008 2009<br />

1 Livestock 57% 59% 60% 56% 55%<br />

2 Field crop 34% 29% 27% 29% 30%<br />

3 Fruit trees 10% 13% 13% 15% 15%<br />

(Source: MAFCP; Statistical Yearbook 2009)<br />

Meat <strong>Sector</strong> Study<br />

Agricultural production and incomes contributes to the GDP; the major sub-group within<br />

agriculture is the livestock production with about 55 % of the total production of the sector,<br />

followed by field crops with 30 % and fruit production with 15 %.<br />

Over the last years the overall output of crops increased whereas the output of livestock<br />

(animal products) decreased.<br />

Table 2: Output of animal products<br />

Output in % 2007 2008<br />

Cattle 26 21<br />

Pigs 5 5<br />

Sheep and goats 15 13<br />

Poultry 4 5<br />

Milk 38 42<br />

Eggs 10 11<br />

Other animal products 2 3<br />

Total 100 100<br />

(Source: INSTAT)<br />

In the above table it can be seen that milk became more important but in total the meat<br />

sector is slightly ahead; within the different products cattle decreased the most, followed by<br />

sheep and goats whereas poultry increased and pigs remained stable.<br />

Since 1990 the total numbers for cattle, goats and chicken decreased whereas the<br />

population of sheep and pigs grew slightly. In the period 2000 – 2009 cattle, sheep and goats<br />

have been declining whereas pigs and chicken have been growing.<br />

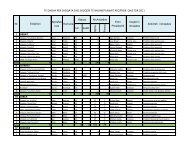

Table 3: Animals in Albania (heads in 000)<br />

Livestock 2000 2005 2006 2007 2008 2009<br />

Cattle 728 655 634 577 541 494<br />

Cows 448 430 420 396 360 353<br />

Sheep & goats 3045 2701 2770 2729 2620 2540<br />

Sheep 1939 1760 1830 1853 1800 1768<br />

Milked sheep 1448 1312 1426 1378 1321 1309<br />

Meat <strong>Sector</strong> Study, page 12

Goats 1104 941 940 876 820 772<br />

Milked goats 800 701 700 620 610 574<br />

Pigs 103 147 152 147 161 160<br />

Sow 10 13 13 16 14 13<br />

Poultry 5291 6432 6200 7135 8100 8313<br />

Chicken 4087 4671 4572 4712 5000 5138<br />

(Source: MAFCP; Statistical Yearbook 2009)<br />

Table 4: Meat production 2000 – 2009<br />

000/Ton<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Prodhimi i mishit<br />

Meat production<br />

2000 2005 2006 2007 2008 2009<br />

Gjedhi Cattle Te imtash Sheep$goat Derri Pig Shpendi Poutry<br />

(Source: MAFCP; Statistical Yearbook 2009)<br />

Meat <strong>Sector</strong> Study<br />

The meat consumption in Albania is already at 40 kg per capita but still far away from EU<br />

levels which are more than twice as high.<br />

Beside the farms there are in the value chain also the slaughtering and processing<br />

companies. With the exception of a few modern chicken slaughtering facilities there are<br />

almost no operating slaughterhouses in the country. The consequence or the reason for this<br />

fact is that animals are slaughtered generally on the farm or in some cases in primitive<br />

slaughter rooms on farms or in butcher shops.<br />

A different picture can be seen in the meat processing sector; there are several companies<br />

active and the bigger companies are very close to EU standards.<br />

As the local meat is limited and expensive, processing companies are importing 95 % of their<br />

needed raw meat mainly from Brazil and Canada, usually as deep frozen meat.<br />

In other words there is no link between Albanian livestock farmers and Albanian meat<br />

processing industry. More details in the next chapters.<br />

Meat <strong>Sector</strong> Study, page 13

II. Producers/Farmers<br />

Cattle<br />

Meat <strong>Sector</strong> Study<br />

According to MAFCP there are 297,418 farms keeping animals and out of them 226,442<br />

farms keep cattle. The total number of cattle is decreasing over the last years; from 634,000<br />

in 2006, to 577,000 in 2007 and finally to 494,000 in 2009; number of cows is 353,000.<br />

Major regions with cattle farms are Fier, Elbasan, Tirana and Shkoder.<br />

On Albanian farms the following – mainly milk oriented - breeds can be encountered; Jersey<br />

(35 %), Laramane e zeze (Black & White) (29 %), domestic breeds like (15 %), Holstein (13<br />

%) and Simmental (3 %) and others like Taranteze. (Source: MAFCP, 2008, Technical<br />

Report)<br />

The way the cattle are kept on the farms is quite different; on one side there are many small<br />

subsistence farms with 1 – 2 cows, mainly for milking. Albanian average herd size is 2.4<br />

cattle. Animals are staying in primitive tied stall barns, often without any windows. All the<br />

work is done by hand; feeding, removing the manure and also milking.<br />

On the other side there are specialised farms, many more on milk than on meat, with better<br />

premises, even of the majority uses old existing buildings which are slightly adapted.<br />

Nevertheless electricity is often missing, windows very limited so that it is quite dark in the<br />

stables and just a handful of farms has a dung removal installation – partly because labour is<br />

so cheap. Again with very few exceptions there are no manure handling, storage and<br />

treatment facilities.<br />

The number of farms having more than 5 heads is 2,904 and equivalents to around 1 % of all<br />

cattle farms. 20 farms in Albania have more than 50 heads; Lushnja is one farm with 200<br />

calves for fattening.<br />

Slaughtering of cattle is done partly on the farm by the farmer or the butcher who then takes<br />

the meat to his shop. Or the butcher does the slaughtering behind his shop as clients want to<br />

see live animals and are sceptical about readymade de-boned. The correct way foresees<br />

that cattle are slaughtered in approved slaughterhouses; but given the small number of<br />

slaughterhouses – around 20 – in operation and the fact that many of them process just 2<br />

cows a day, one may conclude that slaughtering is not properly done according to the law.<br />

The liquid and solid waste from slaughtering on the farm or in small slaughter points is<br />

bought into illegal landfills and taken away by nearby rivers.<br />

As most farmers are not specialised in meat production they slaughter their animals, calves,<br />

too young and before gaining sufficient weight. The average live weight of slaughtered calves<br />

is about 180 – 200 kg (150 - 170 kg), which is economically much too low; sometimes male<br />

veal is slaughtered with 3 - 4 months and a live weight of 100 kg! Reasons for to early<br />

slaughtering are the demand for very young animals (of all kinds) and the unavailability of<br />

cheap fodder.<br />

Interesting to note that the demand is not expressed in higher prices for younger animals;<br />

experts from the Agriculture Know-How Transfer Centre in Fushe Kruje mentioned that the<br />

sales price for 1 kg live weight is around Lek 300 regardless if the animals has 200 or 400 kg.<br />

To stop the trend slaughtering young animals the MAAR started recently an awareness<br />

campaign promoting 12 months old calves with 400 kg live weight as the ideal weight for<br />

slaughtering.<br />

Meat <strong>Sector</strong> Study, page 14

Meat <strong>Sector</strong> Study<br />

Actually the corresponding law is prepared but the draft version does not show any<br />

requirement regarding minimum live weight at time of slaughtering.<br />

The fattening is also correlated to the milk price as when the milk price is low in May and<br />

June, farmers tend to fatten calves longer and not to sell cheap milk.<br />

Table 5: Average live weight of calves when slaughtered<br />

Regions Calf (kg)<br />

Berat 160<br />

Dibër 160<br />

Durrës 240<br />

Elbasan 182<br />

Fier 200<br />

Gjirokastër 130<br />

Korçë 180<br />

Kukës 160<br />

Lezhë 83<br />

Shkodër 140<br />

Tiranë 180<br />

Vlorë 180<br />

ALBANIA 166<br />

(Source: MAFCP, , Technical Report)<br />

The Focus Group meetings showed a different picture as average live weight of bulls when<br />

slaughtered was between 200 and 400 kg, with a majority at 300 kg upwards; calves are<br />

between 6 and 15 months old.<br />

Price per kg live weight of calves, regardless if male or female is between 300 and 450 Lek;<br />

around Euro 2 – 3 per kg. Price for bulls and oxen is Lek 280 – 350, around Euro 2 – 2.50<br />

per kg. Farmers interested in fattening calves buy them often just a few days old for a price<br />

of Euro 120 – 150.<br />

Corresponding prices in Austria (March 2010) at farm gate are for bulls (live weight 680 kg!)<br />

and oxen Euro 1.64- 1.79, female calves Euro 1.21 – 1.37, cows Euro 0.80 – 1.06 and calves<br />

for slaughtering Euro 2.59 – 2.97; all prices without VAT, which is usually kept by the farmer.<br />

(Source: Kaerntner Bauer, Markt & Preis, No 9, 2010)<br />

The Focus Group meetings found out that farmers are selling their animals on specific animal<br />

markets, in a limited amount to traders, to a big deal to the local butcher shops and none of<br />

them to slaughterhouses, except one farmer.<br />

A meat classification system of carcasses of slaughter animals for cattle and veal (SEUROP)<br />

and related quality payment scheme is not in place and therefore farm output differs<br />

extremely in weight, colour, fat content and age.<br />

4 % of the farmers have no education at all, 16 % visited the primary school and 48 % also<br />

the secondary school. The educational background is limited as there are almost no<br />

vocational schools which would be needed to train small holders.<br />

Meat <strong>Sector</strong> Study, page 15

Meat <strong>Sector</strong> Study<br />

Financing for agricultural investment projects almost cannot be obtained from commercial<br />

banks, as land ownership and title are not always secure and banks are generally not much<br />

interested in agricultural land as collateral. Furthermore interest rates are high so that<br />

financing is brought up within the family, in case that there are investment projects at all.<br />

The cooperation between farmers, which is starting slowly in advanced countries like Austria,<br />

hardly exists in Albania. In the previous system farmers have been forced to cooperate and<br />

now farmers are staunchly independent, even though they could farm more profitably if they<br />

work together. Suggestions for cooperation could start in division of labour or specialising the<br />

cattle farms; one produces calves and the other one specialises in fattening them.<br />

Cattle, especially from subsistence farms, have usually no open yard and graze in the<br />

neighbourhood of the farm (and along the streets), regardless of the ownership of the land:<br />

Albania has around 423,000 ha of pastures and around 38 % are still owned by the state.<br />

The possibilities for expansion of natural pasture are limited due to the geographical situation<br />

in Albania with substantial mountainous area. Therefore increased feed must come from<br />

improved production of fodder such as lucernes, maize and other grasses, and improved<br />

utilization of industrial by-products such as olive cake, bran and soybean meal. Maize silage<br />

is almost unknown. Forage crops are now grown on 200,000 hectares (Source: MAFCP;<br />

Statistical Yearbook 2009), or 40 % of the cropped arable land, with lucernes comprising<br />

about two-thirds of this area. Most is harvested by hand – as agricultural equipment is too<br />

expensive - and there are problems with weeds and poor storage of hay.<br />

Generally there is room for improvements – especially on the small farms - concerning<br />

forage quality, management and feeding practices and also availability of clean seed.<br />

Grazing resources including pasture, forest, and some agricultural land are fundamental for<br />

livestock raising, but have degraded significantly over the last 20 years, particularly in land<br />

close to communities where over-grazing and over-cutting of wood have resulted in reduced<br />

productivity and soil erosion. (Source: SHUNDI, Andrea Prof.: Country Pasture/Forage<br />

Resource Profiles Albania; 2006)<br />

Bigger farms are managed better but have to purchase partly fodder from the market as<br />

farms are often too small to produce enough forage; that might start even with hay.<br />

Due to the small size of the herds biogas facilities are not in place.<br />

Governmental policy aims to stimulate just milk cow farmers. There is no support for meat<br />

production. Veterinary services are available to limited amount; actually only 61 % of the<br />

cows are artificially inseminated; one third of the Holstein and Jersey cows is inseminated<br />

with meat breeds such as Limousin and Charolais exclusively for meat production.<br />

Summarizing one might say that cattle farmers producing meat are oriented towards the<br />

fresh market, as imported deep frozen beef is much cheaper and therefore the meat<br />

processing industry is not interested in local beef.<br />

Cattle usually do not reach more than 420 – 460 kg live weight and average price therefore is<br />

Lek 320 -330 / kg.<br />

Sheep and goats<br />

55.942 of all farms in Albania keep sheep and 26.175 keep goat; the majority of sheep farm<br />

also keeps goats. The total number of sheep is almost constant; 1.830.000 in 2006,<br />

1.853.000 in 2007 and 1.768.000 in 2009; the number of milked sheep is always around<br />

400,000 lower. Figures for goats look as follows: 940.000 in 2006, 876.000 in 2007 and<br />

772,000 in 2009; the number of milked goats is always around 200,000 lower.<br />

Meat <strong>Sector</strong> Study, page 16

Meat <strong>Sector</strong> Study<br />

Sheep and goat farming plays a key environmental role that includes the natural upkeep of<br />

less fertile areas, the maintenance of biodiversity, sensitive ecosystems and water quality,<br />

the fight against erosion, floods, avalanches and fires. In Albania sheep and goat farming<br />

takes place in less favoured areas, where such farming is very often the only agricultural<br />

option and which therefore makes a crucial contribution to the economy in rural areas.<br />

Major regions with sheep and goat farms are Vlore, Gjirokaster, Fier and Elbasan. Goats<br />

prefer even more mountainous regions and better goat husbandry conditions are therefore in<br />

Kukes, Diber and Shkoder.<br />

Albanian farmers keep the following sheep breeds: Tsigaja (45 %), Komune (22 %), Merinos<br />

(12 %), Ruda (8 %), Mati (5 %), Bardhoka (5 %), Ile de France (1 %) and Awassi (1 %).<br />

Albanian farmers keep the following goat breeds: Muzhak (70 %), Mat (9 %), Has (6 %),<br />

Capore (5 %), Dukati (3 %), Velipoja (1 %), Dragobia (1%), Liqenasi (1 %) and Alpine (1 %).<br />

(Source: MAFCP, 2008, Technical Report)<br />

The average sheep flock size in the country counts 44 heads, the figure for goats is 45<br />

animals. Countrywide small flock sizes between 5 and 50 heads are still very numerous as<br />

many sheep are raised for self-consumption and just 3,177 farmers have between 100 and<br />

200 heads; only 797 have more than 200 heads. Corresponding goat figures are 914 and<br />

293. This is less than 10 % of all the farms with small ruminants and these 5,000 farms can<br />

be considered commercial small ruminant farms.<br />

Sheep and goats – when produced commercially - are kept in transhumance as long as there<br />

are enough opportunities for grazing; on some summer pastures farmers built very simple<br />

barns to shelter animals; in winter times the small ruminants are in better, but simple barns<br />

on the farm. Small ruminants of subsistence farmers are often kept on the farm.<br />

Husbandry of small ruminants can be done in several ways:<br />

1) Extensive system with transhumance from 6 to 8 months (all regions)<br />

2) Semi-intensive system with transhumance from 5 to 6 months (Gjirokastra)<br />

3) Grazing system on permanent pastures close to the holding<br />

4) Grazing on natural pasture in walking distance, with return of sheep or goats in the<br />

evening to the holding<br />

The feeding system in Albania is mostly based on grazing, at least for 5 months per year.<br />

Transhumance requires often daily distances of 30 km; this is very difficult for the animals<br />

especially if they cannot find water; cases are reported where animals have access to water<br />

holes every other day.<br />

In the winter period the “intensive” holdings feed animals with preserved forage (hay, alfalfa)<br />

and cereals, either produced on the farm or purchased; the harder the winter the more<br />

concentrates will be used. The feeding costs get also higher when animals must be kept<br />

longer in stables due to climatic conditions; animals must be fed in stables for a period of<br />

three to six months.<br />

In the current production system, the milk constitutes an important part of the breeders'<br />

income. The milk is either processed directly by the shepherd, or sold to small dairies for<br />

production of Kaskavall or Feta cheese. The milk makes up to 46 % of the total income from<br />

sheep. The income from meat is obtained through the sale of lambs and of cull-animals. The<br />

lambs are always sold by kilogram and best price can be achieved in December and the<br />

lowest price in August. (Source: UNDP Albania; “Strengthening the Marketing of Small<br />

Ruminants” Project, 2005)<br />

Meat <strong>Sector</strong> Study, page 17

Meat <strong>Sector</strong> Study<br />

A milk sheep could deliver 70 litres of milk annually which equivalents to LEK 7,000. The<br />

alternative would be to feed a lamb which could be sold with 20 kg live weight for LEK 7,000<br />

or eventually with 30 kg live weight for LEK 9,000.<br />

Table 6: Revenues per sheep and year; meat vs. milk<br />

Lamb (meat) 20 kg 350 Lek/kg 7000<br />

or 30 kg 300 Lek/kg 9000<br />

Sheep (milk) 70 l 100 Lek/l 7000<br />

(Source: Expert’s calculation, 2010)<br />

Milk versus meat, the utilization of milk<br />

The decision of using milk either for selling it to dairies or for fattening of the lambs should be<br />

based on the conversion rate milk to meat and the prices for the different products. The<br />

current conditions (2010) are summarized in the following table.<br />

Table 7: Break - even points for milk and meat<br />

Assuming 6 kg of milk, necessary to grow 1 kg of live weight in lambs, only a meat price of<br />

600 ALL/kg LW would valorise the milk with 100 ALL / kg of milk, currently paid by the dairy<br />

processors in Saranda. (right arrow).<br />

During the top season, at live weight prices of 450 ALL (Saranda, December 2009), the litre<br />

of milk would be valorised with 75 ALL through feeding, against the 100 ALL which are paid<br />

by the dairy, hence clearly in favour of selling the milk (central arrow).<br />

When meat prices fall to the level of 300 ALL / kg LW , the litre of milk is valorised equally<br />

(break - even) through feeding to the lamb and to selling of milk, at a milk price of 60 ALL /<br />

litre, which is close to the conditions reported in Korca in the southern part of the country (left<br />

arrow).<br />

Although – as shown above - the price relations are clearly in favour of milk production, the<br />

farmers however underlined that they intend to produce both: milk and meat, probably to<br />

Meat <strong>Sector</strong> Study, page 18

Meat <strong>Sector</strong> Study<br />

reduce risks and due to the need and the distribution of cash income (lamb before Christmas,<br />

monthly milk cash income during January and February). (Source: UNDP Albania / MOLLA A;<br />

Base Line Study on Production Systems and Economics of Sheep Husbandry in Southern<br />

Albania, 2010)<br />

The Focus Group meetings mentioned that lambs when slaughtered are between 3 and 6<br />

months old and have a live weight between 20 and 40 kg, but mainly between 20 and 30 kg;<br />

in case that lambs are slaughtered for religious holidays they are usually younger and not<br />

that heavy. Regular prices are Lek 300 – 350 per kg live weight, in Euro 2.20 – 2.50.<br />

Corresponding prices in Austria (March 2010) at farm gate are for lambs alive with 40 – 45<br />

kg are Euro 2.05 (very good quality) and the others for Euro 1.65 per kg. Cull ewe have a<br />

price of Euro 0.50 per kg alive. All prices are without VAT, which is usually kept by the farmer.<br />

(Source: Kaerntner Bauer, Markt & Preis, No 9, 2010)<br />

Average live weight of lambs when slaughtered is in many cases too low but often farmers<br />

sell lambs early as prices are good before religious holidays and others want to focus more<br />

on milk and try to sell lamb as early as possible – neglecting the opportunity to feed it with<br />

something else instead of mother milk.<br />

Slaughtering of small ruminants is done on the farms, by the butchers in the slaughter points<br />

and a few in slaughterhouses. Situation is worse than with cattle as animals are smaller and<br />

easier to slaughter.<br />

Pigs<br />

According to MAFCP there are 297,418 farms keeping animals and out of them 42,036 farms<br />

keep pigs. The total number of pigs is steadely growing and reached 160,000 in 2009 and<br />

out of them 13,000 mother sows. Most pigs are raised in these small farms and bigger units<br />

are rare; in 2008, there were about 330 farms with 6 - 10 pigs, 181 farms with 11- 50 heads<br />

and 17 farms with more than 50 heads. For example DRIZA, a mixed operation and an<br />

agribusiness key player, keeps 30 sows and thus fattens 600 – 800 pigs per year.<br />

Around 70 % of the piglets are produced in an extensive production system but 90 % of the<br />

pigs are grown in an intensive system.<br />

Some pig fattening farms imported in the past piglets with around 25 kg live weight; as<br />

animal feed is expensive and therefore the production costs high, they shifted the weight of<br />

imported animals from 25 kg to 80 kg! Almost finished pigs - 56,000 heads according to<br />

official statistics - are getting fattened until they are sold, generally within two weeks.<br />

In Albania the breeds large white and landrace and all cross-breeds can be found. Premises<br />

reflect the farmer’s attitude if the fattening is just for auto-consumption or a commercial<br />

business; from big brand new stables with automatic feeding technique to simple barns<br />

where beside the 2 cows and 5 sheep also 2 pig are fattened.<br />

Corresponding is also the slaughtering, which might take place in basic slaughter rooms next<br />

to the fattening stables or in so called slaughtering points close to high frequented roads or<br />

simply in the backyard of a farm. The slaughter-weights vary between 70 and 120 kg alive.<br />

Pig husbandry is both a profitable and fragile undertaking; prices are changing rapidly, also<br />

of imported animals and therefore the business is not predictable. As animal feed is<br />

expensive and farmers lack of financial resources, early slaughtering of underweight pigs is<br />

widespread and reduces the profitability. Other obstacle is that livestock farmers have just<br />

limited knowledge about low-fat meat production which is best preferred. Hence, 20-30 % of<br />

carcass weight loss because of fat, affects heavily profit reduction.<br />

Meat <strong>Sector</strong> Study, page 19

Meat <strong>Sector</strong> Study<br />

A family can make a living off 5 sows but pig production costs are high – this is because the<br />

majority of feed grains and all soya have to be imported plus these imported feedstuffs then<br />

attract a tax of 20 %.<br />

Farmers with 1 or 2 sows feed them on home grown feeds. Maize is commonly grown and<br />

dried in open racks. Most small farmers have a couple of cows with the milk being used for<br />

cheese production. The whey is then used as pig feed. Farmers who have 5 sows or more<br />

buy in pig feed. Buying and selling of pigs is done through numerous local markets.<br />

Feed is bagged in meal or pellets form and all feeding is done by hand. Most farmers dump<br />

all the slaughtering by-products and the liquid waste usually runs into the nearby river.<br />

(Source: LUMB, Stuart; Albanian Pig Production; 2004)<br />

Poultry<br />

The total number of poultry is steadely growing and reached 8,313,000 in 2009; out of them<br />

5,138,000 chickens – after 4,087,000 in 2000. The chicken (broiler) sector, even affected by<br />

the avian influenza in 2006, is growing fast. According to MAFCP there are 297,418 farms<br />

keeping animals and out of them 279,522 farms raise chicken.<br />

As the total number of chickens is around five million, in average there are 18 chickens on a<br />

farm (Source: MAFCP; Statistical Yearbook 2009).<br />

The small farmers have just 5 – 10 chicken and grow their own feed such as maize. Chicken<br />

are usually kept in small premises or together with the other farm animals. Manure storage is<br />

not known and slaughtering takes place on the farm. Consequently the productivity is low<br />

and just the surplus is sold in the neighbourhood.<br />

As it is seen from the data of the following table shows that there are 38 meat oriented<br />

poultry farms, 17 out of them keep more than 10,000 heads like “Driza Ltd”, Fier with an<br />

annual capacity of more than 1 million heads, “Uina Ltd”, Librazhd with an annual capacity of<br />

600 thousand heads, “Agrozo Ltd”, Lushnje, with an annual capacity of about 800 thousand<br />

heads, “Chicken Farm” Kavaje, with an annual capacity of about 1.5 million heads and<br />

“Shehu” Korce, with an annual capacity of about 600 thousand heads.<br />

Table 8: Poultry meat farm<br />

Poultry meat farm 2005 2006 2007 2008 2009<br />

Total numbers 23 20 29 36 38<br />

1000 - 5000 Head 11 8 7 17 16<br />

5000 -10000 Head 3 3 6 5 5<br />

over 10000 Head 9 9 16 14 17<br />

(Source: MAFCP; Statistical Yearbook 2009)<br />

Due to the expansion of these centres, broiler production increased from 4,000 tons in 2000<br />

to 16,000 tons in 2008 and 17,000 tons in 2009 (Source: MAFCP; Statistical Yearbook 2009).<br />

In 2009 total live weight production in Albania reached 143,000 tons; cattle 66,000 tons,<br />

sheep and goat 44,000 tons, pigs 16,000 tons and poultry 17,000 tons or 11,88 % of the total<br />

production.<br />

Meat <strong>Sector</strong> Study, page 20

Meat <strong>Sector</strong> Study<br />

This is substantially more than y few years ago but compared to the EU 27 with 23.1 kg /<br />

capita still low.<br />

There is no other sector in Albania where the difference between subsistence farmers and<br />

professional, commercial farmers is that vast like in broiler production. As this is a very<br />

capital intensive business, big players invest substantial amounts of money and can expect a<br />

high and especially fast return.<br />

The production is growing faster than the consumption and self-sufficiency is now at around<br />

50 %.<br />

During the focus group meetings 10 very different representatives of chicken farmers have<br />

been interviewed. There have been farmers producing up to 150 chickens a year and they<br />

can be considered as self-suppliers. On the other side there have been two farmers selling<br />

30,000 and 450,000 chicken a year.<br />

The breeds encountered are called “shot” and “red broiler”.<br />

The finished chicken had a live weight between 1 and 2 kg, in some cases up to 3 and 4 kg.<br />

According to the interviewees the chicken sales price per kg live weight varied between Lek<br />

170 and 700! The average poultry meat price per kg is between Lek 300 and 1,000!<br />

While small holders consume everything within their family and sell nothing at all, the biggest<br />

chicken farmer mentioned that he makes Lek 243 million per year; i.e. Euro 1.7 million!<br />

As mentioned above the small producers with around 100 chickens consumed all of them<br />

within their families; most of the chickens have been marketed in the village directly to<br />

consumers or in the next town to consumers – that includes also the farmer producing<br />

450,000 chickens a year. Rather small quantities have been sold to traders and<br />

slaughterhouses.<br />

The commercial poultry farms (layers, broilers, turkeys) use more than 80 % of the total<br />

150,000 t of finished feed sold in Albania. In an agribusiness sense poultry is the most<br />

developed, organised and updated sector.<br />

Through partnership between ENZY food processing company and ABDUA company a<br />

hatchery poultry farm has been established near Kavaja. The joint operation is producing<br />

one-day old broiler chicks and has started to supply several Albanian chicken producers.<br />

Other one-day old broilers are imported from Greece.<br />

Animal feeding<br />

The meat production is still done with a low level of inputs; the extensive system of<br />

production is dominant. Statistics show that about 85 % of cattle, 97 % of small ruminants, 70<br />

% of piglets and 50 % of poultry, are being bred extensively. This is the situation as the farms<br />

are very small and financing for improvements usually not available. Even inefficient, the<br />

husbandry systems, especially of small ruminants and cattle, are generating income.<br />

More advanced production systems using higher inputs can be found in pork production, 80<br />

% of the sows, 85 % of poultry, and 20% of cows. Almost 100 % of the poultry farms, 15 % of<br />

cattle farms and 90 % of pig farms are using high inputs. Cattle ranchers are sometimes<br />

feeding the animals intensively if they are focused on milk production.<br />

Animal feed producers<br />

Meat <strong>Sector</strong> Study, page 21

Meat <strong>Sector</strong> Study<br />

The three big fodder producers AGROTEK ALB shpk, Aiba Company shpk and Floryhen<br />

shpk control 70 – 80 % of the market in Albania. They offer different forms of concentrates,<br />

premixes, microelements, raw materials such as soya bean, fish meal, maize, wheat etc.<br />

Usually feed products are pressed into pellet forms. Wheat and barley is purchased mainly<br />

locally, but other inputs such as soya are imported from Greece, Italy and Serbia. Feed is<br />

produced for cattle, sheep, goat, pigs and poultry; main customers are chicken and pig farms<br />

with 40 % each; the rest of the products is for cattle, sheep and goat farms. Distribution takes<br />

place trough partly exclusive distributors and just big farms are served directly.<br />

Product prices vary between Lek 35 – 100 plus 20 % VAT per kg; estimated market volume<br />

is 50 – 60,000 tons annually. The feed producers are often certified in ISO 9001:2000,<br />

Hazard Analysis and Critical Control Point (HACCP) and other quality management<br />

programmes.<br />

As farmers have often limited access to extension services the feed producers provide also<br />

services in veterinary and zoo technical consulting or assist farmers in getting in touch with<br />

experts.<br />

The companies are also involved in “neighbouring businesses” such as egg production or<br />

slaughterhouses.<br />

Producers see a major threat for their sector in the limited availability of raw materials; as a<br />

consequence many products like soya have to be imported and transport costs are high.<br />

Fodder is cheaper for example in Serbia and as it is cheaper to transport 1 kg of pork meat<br />

(produced in Serbia) instead of 4 kg of cereals (for the production of 1 kg of pork meat in<br />

Albania), feed producers are afraid of the increasing competition in this sector; competition<br />

became stronger with the Central European Free Trade Agreement (CEFTA) and will get<br />

more intensive when approaching the European Union.<br />

The Albanian feed industry offers all kinds of feeds for the local livestock producers, except<br />

fish and pet food. A few feed mills offer the feed in both mash and pelleted form. Almost all<br />

raw ingredients are imported like soya (up to 24,000 to / year) and grains, except for<br />

limestone. The main sources for raw materials are neighbouring countries, mainly Italy and<br />

Greece but other countries, like France, Romania, Bulgaria, are also used. The biggest<br />

constraint for direct imports from big producers such as the USA, Brazil and Argentina is the<br />

fact that Albania’s main harbour, Durres on the Mediterranean Sea, can receive shiploads to<br />

a maximum of 12,000 metric tonnes. Therefore all ships have to be reloaded in Greece and<br />

that increases the costs.<br />

Albanian feed mills are quite familiar with the well-known companies such as: Bühler, Brock,<br />

Van Aarsen, Big Dutchman, Facco, Chore Times, Pas Reform, Farmer, Chemifarma,<br />

Lohman, Schauman, etc.<br />

III. PROCESSING INDUSTRY<br />

Slaughterhouses<br />

Meat <strong>Sector</strong> Study, page 22

Meat <strong>Sector</strong> Study<br />

During the communist regime, meat was a rare and rationed product. It was not even allowed<br />

to keep animals in private gardens and consequently the meat consumption was very low.<br />

Therefore also the need for slaughterhouses was limited.<br />

Today the meat consumption is already at 40 kg per capita but still far away from EU levels<br />

which are twice as high. With the increasing meat consumption the slaughterhouses became<br />

more important.<br />

According to MAFCP only few slaughterhouses in Albania are operating according to<br />

national legislation. In the 12 administrative regions the situation looks as follows:<br />

1. Berat<br />

Kucova: There is a slaughterhouse managed by the municipality which meets somehow the<br />

requirements.<br />

Çorovoda: The old slaughterhouse is out of function. A new slaughterhouse is under<br />

discussion and eventually financed by MAFCP and FAO.<br />

Poliçan: A new slaughterhouse will is under consideration, financed by MAFCP.<br />

2. Diber<br />

With the exception of KEPUTA shpk in Burrel no other slaughterhouse in this district fulfils<br />

sanitary-veterinary requirements.<br />

3. Durres<br />

Durres: There is a private slaughterhouse which somehow meets the requirements, but is<br />

still missing some equipment.<br />

4. Elbasan<br />

Elbasan: The municipality slaughterhouse does not correspond to the national requirements.<br />

A new slaughterhouse will is under consideration, financed by MAFCP.<br />

Gramsh: Municipality has a slaughterhouse which meets somehow sanitary-veterinary<br />

conditions.<br />

5. Fier<br />

This district shows 10 operating slaughterhouses, 3 in Fier, 2 in Patos (one for poultry), 2 in<br />

Ballsh, and three in Lushnja (one of them for poultry); except the one in Divjaka they are<br />

operating satisfactory according to national standards..<br />

6. Gjirokaster<br />

Gjirokaster: On district level, there is one slaughterhouse under reconstruction.<br />

Tepelena has one slaughterhouse which is approved by the veterinary service.<br />

In Permet an Italian NGO - Cooperazione e Sviluppo (CESVI) - established a<br />

slaughterhouse.<br />

7. Korce<br />

Novosella has one slaughterhouse provided with all the facilities in conformity with EU<br />

legislation (15 heads / hour); it is regularly inspected by the veterinary inspectorate.<br />

8. Kukes<br />

Kukes has one public slaughterhouse which is under the privatization process; it has been<br />

built by a project and meets the sanitary-veterinary requirements for such an activity.<br />

9. Lezhe<br />

Lezha has one acceptable private slaughterhouse for cattle and pigs.<br />

10. Shkoder<br />

No operating slaughterhouses in this district that fulfils sanitary-veterinary requirements.<br />

Meat <strong>Sector</strong> Study, page 23

Meat <strong>Sector</strong> Study<br />

11. Tirana<br />

Tirana has one private slaughterhouse (KMY/Yzberish), which meets all the requirements but<br />

is used only for the company’s needs.<br />

12. Vlora<br />

No operating slaughterhouses in this district that fulfils sanitary-veterinary requirements.<br />

UNDP is working on an MAFCP financed slaughterhouse with high standards, but it was not<br />

in operation by summer 2010.<br />

(Source: MAFCP; Slaughterhouses in Albania, present situation and prospect; 2006)<br />

In Albania there are many slaughterhouses not in operation and the remaining less than 20<br />

slaughterhouses – that correspond more or less to national standards - do often daily<br />

slaughtering of 1 – 2 cattle and / or few pigs or small ruminants. All slaughterhouses are<br />

working far below their capacities which often vary from 10 - 40 cattle and 20 - 100 small<br />

ruminants per day. One of the reasons therefore is that authorities do not force the traders<br />

and butchers to slaughter there. Therefore slaughterhouses face no or limited raw material<br />

supply. Usually the facilities are outdated and in most cases they do not even comply with<br />

the Albanian law. EU standards on hygiene, public authority, traceability and HACCP are not<br />

fulfilled.<br />

For example many slaughterhouses only separate the carcass from the entrails, leaving<br />

other operations to butchers, such as separation of internal organs from the carcass and<br />

breaking of the bulk and anatomical cuts, that are even harder for authorities to check and<br />

monitor. (Source: FAO / VERCUNI, A. et ZHLLIMA, E.: The food supply and distribution<br />

system of Tirana, Albania; 2008)<br />

As the costs of setting up slaughterhouses depend less on the walls and more on electricity<br />

and water supply, stainless steel equipment, modern machinery, sufficient space (away from<br />

housing areas), cooling rooms and more, it is not economically justified to refurbish (very<br />

poor) existing slaughterhouses.<br />

All the slaughterhouses in the country are considered Small and Medium Enterprises as they<br />

have less than 250 employees and a turnover not reaching Euro 50 million annually.<br />

Regarding the poultry sector there are three major slaughterhouses for poultry in rather good<br />

condition:<br />

• Chicken Farm in Kavaja (fully automatic slaughterhouse belonging to Frigofood<br />

company)<br />

• AGRIZOO in Lushnja region (half automatic)<br />

• DRIZA in Fier region (half automatic)<br />

Smaller ones are located in Korca, Fier, Lushnja etc.<br />

Slaughtering points<br />

In Albania there are more than 200 slaughtering points with primitive equipment and without<br />

control of local authorities. Very often these slaughtering points are located on the roadside<br />

of major roads like Tirana - Shkoder; usually the facility includes just one room with a<br />

refrigerator and the meat for sale is hanging outside so that it is good visible to all drivers<br />

coming along the road. This type of “slaughterhouses” does not correspond to Albanian law<br />

and several times such slaughtering points or butcher shops have been closed by the police;<br />

as these facilities are not registered the veterinary inspectors are not entitled to control them<br />

Meat <strong>Sector</strong> Study, page 24

Meat <strong>Sector</strong> Study<br />

and therefore the police has to intervene. On the other side it has to be mentioned that some<br />

of these practices look more hygienic than official slaughterhouses which are usually in a<br />

rather poor condition.<br />

Fees for slaughtering<br />

The fees for slaughtering in registered slaughterhouses have not been much increased since<br />

2004 and are now according to expert’s opinions as follows:<br />

• 600 Lek for grown up cattle<br />

• 500 Lek for calves<br />

• 400 Lek for sheep and goat<br />

• 500 Lek for pigs<br />

The corresponding meat inspection fees are as follows:<br />

• 400 Lek for cattle<br />

• 200 Lek for calves<br />

• 200 Lek for small stock<br />

• 100-200 Lek for pigs<br />

Municipalities are in most cases the owner of the existing slaughterhouses and therefore<br />

they are often poorly managed. In some cases the municipalities rent the facility out to the<br />

private sector. In both cases the low number of slaughters does not cover the investment<br />

cost, in many cases not even the running costs. For example there are slaughterhouses with<br />

adequate equipment to hang up the slaughtered animals but the equipment is not used as it<br />

does not pay off for a few animals per day.<br />

Veterinary inspections do not always take place according to the law and make thus doubtful<br />

slaughters statistics and control of epizootic situation. One reason therefore might be also<br />

the double authority in the veterinary inspection that source from the Law No.8652 dated 31 st<br />

July 2000 “On the organization and functionality of local government”. Because of that<br />

sometimes nobody takes the responsibility to enforce the proper inspections.<br />

In general, liquid and solid slaughter residues (waste) are not treated according to hygiene<br />

and environment requirements, but are directly disposed into sewer channels and dumped<br />

into landfills.<br />

Keputa<br />

The company KEPUTA shpk was established in 2003 in the city of Burrel, Diber county. Also<br />

the slaughterhouse is located there.<br />

Main activities include buying of live animals in the region and slaughtering; further activities<br />

are meat processing and trade of fresh meat. The number of employees is 4 and the annual<br />

turnover roughly Euro 65,000. All the required raw meat for processing is from the internal<br />

market.<br />

KEPUTA is the first and the only slaughterhouse in Albania that applied for an EU Number to<br />

export fresh meat; process still pending.<br />

Investment plan focuses on new equipment for processing.<br />

Meat processing companies<br />

In contrast to the slaughterhouse sector the Albanian top meat processing companies like<br />

EHW, KMY, TONA and others are doing fine. The 10 biggest processing companies cover<br />

Meat <strong>Sector</strong> Study, page 25

Meat <strong>Sector</strong> Study<br />

around 80 % of the market share; they are financially strong and consider further<br />

investments with and without upcoming IPARD-support.<br />

Table 9: Investment of the agro-industry in Lek million<br />

Year 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009<br />

Investments 121 105 100 67 92 426 170 119 174 35<br />

(Source: MAFCP; Statistical Yearbook 2009)<br />

Nevertheless the official investments of the agro-industry made just Euro 250,000 in 2009<br />

(equivalent to 35 million Lek).<br />

Assuming that the imported beef and pork meat is used by the meat processing industry<br />

(2007: 6.705 tons beef and 15.139 tons pork meat; 2008: 5.377 tons beef and 11.529 tons<br />

pork meat), the total raw material input into the meat industry makes 16,906 tons (2008);<br />

some very little volume of fresh meat could be added, for example for prosciutto.<br />

Table 10: Sausage and ham production of the agro-industry<br />

Year 2000 2005 2006 2007 2008 2009<br />

Sausage and<br />

ham production<br />

in tons<br />

4055 9485 9824 9145 10341 8878<br />

(Source: MAFCP; Statistical Yearbook 2009)<br />

All the 65 meat processing companies (Source: MAFCP; Statistical Yearbook 2009) in the<br />

country are considered Small and Medium Enterprises as they have less than 250<br />

employees and a turnover not reaching Euro 50 million annually.<br />

The meat processed is mainly pork, but also poultry and beef and sausage-making products<br />

prevail in the production structure. Companies use sophisticated technology in processing<br />

frozen meat but face limited know how in processing fresh meat.<br />

The leading companies have a sound documentation of their production including traceability<br />

and applied HACCP. Albanian standards according to Food Law and orders of MAFCP are<br />

often applied; even EU standards on hygiene, public authority, traceability and HACCP are in<br />

place at big companies which are almost ready for EU export licences.<br />

The premises of the top meat processing companies like EHW, KMY, TONA and others are<br />

very modern and fulfil in many cases already EC standards.<br />

A specific weakness is the waste disposal as there are nowhere liquid or solid waste disposal<br />

systems in place; all the leftovers are bought into illegal landfills and are running into the<br />

nearby rivers. The companies are aware of this deficit but as veterinary inspection do not<br />

insist on better technical solutions the situation remains as it is now.<br />

In Albania there are several important and successful meat processing companies and the<br />

major companies are presented here in brief.<br />

EHW GmbH<br />

Meat <strong>Sector</strong> Study, page 26

Meat <strong>Sector</strong> Study<br />

The company was established in 1992 on the Motorway to Durres, 4 k west of Tirana, is<br />

owned by the family Leka and an Italian partner at equal shares and has its main activities in<br />

processing meat into 70 kinds of salami (würstel, parizier, llukanik, milan, naples, saxony,<br />

montana and suxhuk salami) ham, ham with chicken fillet, chicken würstel, grill meatballs<br />

and an Italian San Daniele style ham (prosciutto). The products are sold in 13 EHW butcher<br />

shops (10 in Tirana) and according to the management EHW has 60 % market share in<br />

Tirana and 40 % in Albania!<br />

Due to the high local prices for meat all the required raw meat for processing is imported<br />

from Brazil, USA and Canada. The imported volume is around 3,500 tons per year what<br />

results in a daily processed amount of 10 tons. The company employs 200 people and<br />

makes an annual turnover of roughly Euro 20 million.<br />

IQNET and other international recognised certification companies have certified the company<br />

regarding quality management ISO 9001:2000, HACCP, food safety and others. Like the<br />

other Albanian meat processors also EHW is not importing the meat directly from abroad but<br />

uses the services of an international trader who purchases the meat on its own behalf or on<br />

behalf of EHW.<br />

Next steps will be an enlargement of the product range by additional trading products,<br />