CFE - 2006 annual report - Vinci

CFE - 2006 annual report - Vinci

CFE - 2006 annual report - Vinci

- TAGS

- annual

- vinci

- publi.vinci.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

On November 30 th , 2005 the group <strong>CFE</strong> acquired all the remaining shares of Van Wellen Ltd and its subsidiaries Aannemingen<br />

Van Wellen Ltd and Projectontwikkeling Van Wellen Ltd for 12,000 thousand Euro, among which 6,000 thousand Euro are due<br />

in December <strong>2006</strong>. The discounted amount is presented under the “other current liabilities”. The measurement of property,<br />

plant & equipment at fair value is based on an internal evaluation using the market price as benchmark. The impact of the<br />

fair value adjustment on these property, plant & equipment corresponding to the previously held part, is recognized in equity<br />

for 1,025 thousand Euro (after deferred taxes).<br />

Assuming that the business combinations of these companies would have occurred as from January 1 st 2005, the impact<br />

on revenue and on net result of the year would have been respectively 48,995 thousand Euro and 3,100 thousand Euro higher.<br />

The non-allocated goodwill originates in the fact that the group <strong>CFE</strong> does not control the clients of these entities; it is never-<br />

theless justified by the fact that the group <strong>CFE</strong> could have a network to develop its activities in Flanders and within the road -<br />

building sector.<br />

In addition, the group <strong>CFE</strong> through its subsidiary DEME increased its participation in Europe Aggrégats (35% at the end of<br />

December 2004 and 50% at the end of 2005). The acquisition price amounts to 347 thousand Euro. The fair value of assets<br />

and liabilities of this subsidiary are not included in the table here above, as the impact was not material. Assuming that these<br />

business combinations would have taken place as per January 1 st 2005, the impact on revenue and net result of the year would<br />

have been insignificant.<br />

In the assumption that these business combinations would have taken place as per January 1 st 2005, revenue and net result<br />

of the year would have been respectively 1,024,401 thousand Euro and 28,602 thousand Euro.<br />

In 2005 the group <strong>CFE</strong> decided to reverse the write-off recognized on deferred tax assets recognized when allocating the<br />

goodwill of BPC Ltd. As the goodwill was completely allocated to the fair value of assets and liabilities, this adjustment has<br />

been recognized in the result of the year.<br />

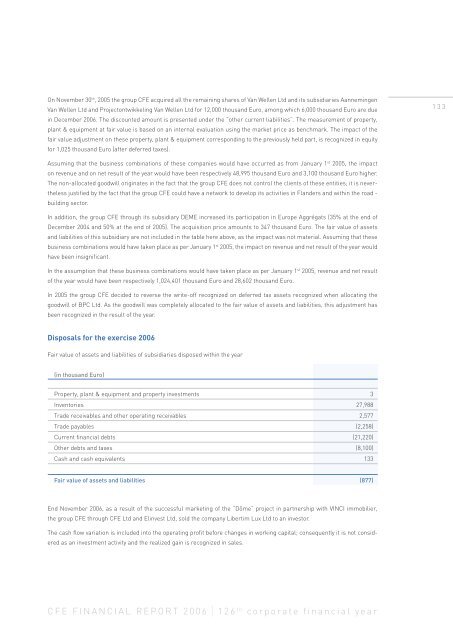

Disposals for the exercise <strong>2006</strong><br />

Fair value of assets and liabilities of subsidiaries disposed within the year<br />

(in thousand Euro)<br />

Property, plant & equipment and property investments 3<br />

Inventories 27,988<br />

Trade receivables and other operating receivables 2,577<br />

Trade payables (2,258)<br />

Current financial debts (21,220)<br />

Other debts and taxes (8,100)<br />

Cash and cash equivalents 133<br />

Fair value of assets and liabilities (877)<br />

End November <strong>2006</strong>, as a result of the successful marketing of the “Dôme” project in partnership with VINCI immobilier,<br />

the group <strong>CFE</strong> through <strong>CFE</strong> Ltd and Elinvest Ltd, sold the company Libertim Lux Ltd to an investor.<br />

The cash flow variation is included into the operating profit before changes in working capital; consequently it is not consid-<br />

ered as an investment activity and the realized gain is recognized in sales.<br />

C F E F I N A N C I A L R E P O R T 2 0 0 6 I 1 2 6 t h c o r p o r a t e f i n a n c i a l y e a r<br />

1 3 3