Financial Accounting: Liabilities & Equities (FA3) Exam Review

Financial Accounting: Liabilities & Equities (FA3) Exam Review

Financial Accounting: Liabilities & Equities (FA3) Exam Review

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

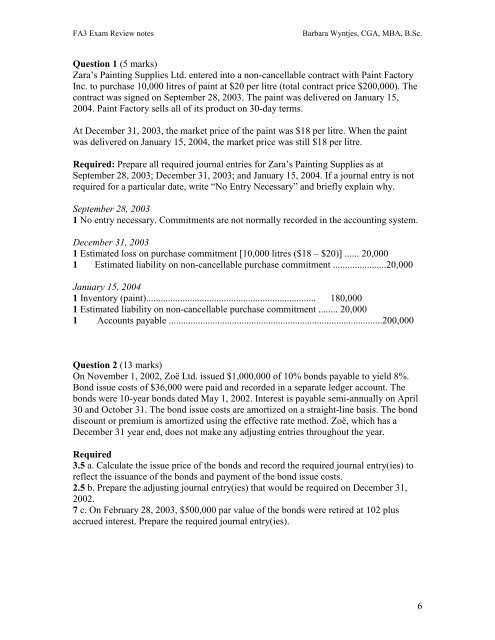

<strong>FA3</strong> <strong>Exam</strong> <strong>Review</strong> notes Barbara Wyntjes, CGA, MBA, B.Sc.<br />

Question 1 (5 marks)<br />

Zara’s Painting Supplies Ltd. entered into a non-cancellable contract with Paint Factory<br />

Inc. to purchase 10,000 litres of paint at $20 per litre (total contract price $200,000). The<br />

contract was signed on September 28, 2003. The paint was delivered on January 15,<br />

2004. Paint Factory sells all of its product on 30-day terms.<br />

At December 31, 2003, the market price of the paint was $18 per litre. When the paint<br />

was delivered on January 15, 2004, the market price was still $18 per litre.<br />

Required: Prepare all required journal entries for Zara’s Painting Supplies as at<br />

September 28, 2003; December 31, 2003; and January 15, 2004. If a journal entry is not<br />

required for a particular date, write ―No Entry Necessary‖ and briefly explain why.<br />

September 28, 2003<br />

1 No entry necessary. Commitments are not normally recorded in the accounting system.<br />

December 31, 2003<br />

1 Estimated loss on purchase commitment [10,000 litres ($18 – $20)] ...... 20,000<br />

1 Estimated liability on non-cancellable purchase commitment ......................20,000<br />

January 15, 2004<br />

1 Inventory (paint)...................................................................... 180,000<br />

1 Estimated liability on non-cancellable purchase commitment ........ 20,000<br />

1 Accounts payable ........................................................................................200,000<br />

Question 2 (13 marks)<br />

On November 1, 2002, Zoë Ltd. issued $1,000,000 of 10% bonds payable to yield 8%.<br />

Bond issue costs of $36,000 were paid and recorded in a separate ledger account. The<br />

bonds were 10-year bonds dated May 1, 2002. Interest is payable semi-annually on April<br />

30 and October 31. The bond issue costs are amortized on a straight-line basis. The bond<br />

discount or premium is amortized using the effective rate method. Zoë, which has a<br />

December 31 year end, does not make any adjusting entries throughout the year.<br />

Required<br />

3.5 a. Calculate the issue price of the bonds and record the required journal entry(ies) to<br />

reflect the issuance of the bonds and payment of the bond issue costs.<br />

2.5 b. Prepare the adjusting journal entry(ies) that would be required on December 31,<br />

2002.<br />

7 c. On February 28, 2003, $500,000 par value of the bonds were retired at 102 plus<br />

accrued interest. Prepare the required journal entry(ies).<br />

6