Financial Accounting: Liabilities & Equities (FA3) Exam Review

Financial Accounting: Liabilities & Equities (FA3) Exam Review Financial Accounting: Liabilities & Equities (FA3) Exam Review

FA3 Exam Review notes Barbara Wyntjes, CGA, MBA, B.Sc. b. Based on an annual review, CDF Company changed its amortization policy from straight line to declining balance. How should this change in policy be applied, assuming that CDF has all of the information required to make the change? 1) Prospectively 2) Retrospectively without restatement 3) Retrospectively with restatement 4) This change should not be allowed c. Maluk Mining Ltd. spent $3,000,000 developing a silver mine. The $3,000,000 in development costs was debited to an asset account ―Natural resources — Silver Mine‖. Maluk estimated that the mine would yield 10,000,000 ounces of silver. Maluk commenced operations in 2002. During 2002, 2,000,000 ounces of silver were mined. Early in 2003, a new vein of ore was discovered that contained an estimated additional 4,000,000 ounces of silver. During 2003, 3,000,000 ounces of silver were mined. What is the amount of depletion expense in 2003? 1) $471,429 2) $600,000 3) $642,857 4) $900,000 j. KYM Corporation discovered an error in its record keeping from the previous year. Utilities for the month of December were recorded as $2,600 instead of the correct amount of $6,200. Which of the following journal entries would be made to correct the error in the current year? Ignore taxes. 1) Utilities expense .................................................................................3,600 Utilities payable .................................................................................. 3,600 2) Retained earnings .............................................................................. 3,600 Utilities payable .................................................................................. 3,600 3) Utilities payable ..................................................................................3,600 Retained earnings ................................................................................ 3,600 4) Utilities payable ..................................................................................3,600 Utilities expense .................................................................................. 3,600 Multiple Choice solutions: a. 2 $100,000 – $100,000 (4/5) = $20,000; $20,000 / 4 = $5,000 b. 1 c. 2 3,000,000 × $0.20 1 = $600,000 1 Depletion rate in 2002 $3,000,000/10,000,000 ounces = $0.30 per ounce Depletion base in 2003 $3,000,000 – $600,000 2 = $2,400,000 10,000,000 ounces – 2,000,000 ounces + 4,000,000 ounces = 12,000,000 ounces Depletion rate in 2003 $2,400,000/12,000,000 ounces = $0.20 per ounce 2 2,000,000 × $0.30 j. 2 20

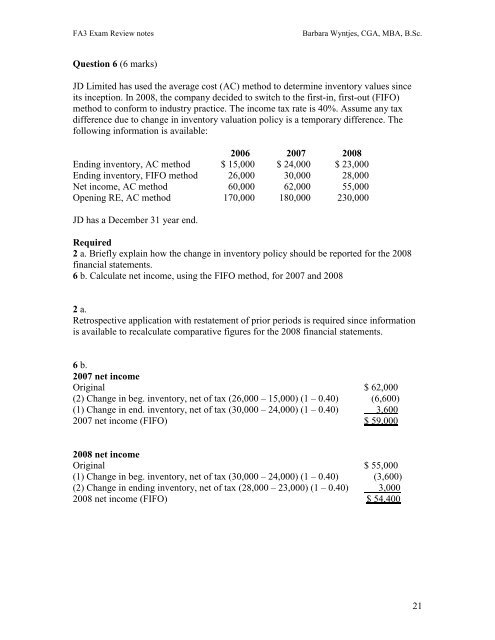

FA3 Exam Review notes Barbara Wyntjes, CGA, MBA, B.Sc. Question 6 (6 marks) JD Limited has used the average cost (AC) method to determine inventory values since its inception. In 2008, the company decided to switch to the first-in, first-out (FIFO) method to conform to industry practice. The income tax rate is 40%. Assume any tax difference due to change in inventory valuation policy is a temporary difference. The following information is available: 2006 2007 2008 Ending inventory, AC method $ 15,000 $ 24,000 $ 23,000 Ending inventory, FIFO method 26,000 30,000 28,000 Net income, AC method 60,000 62,000 55,000 Opening RE, AC method 170,000 180,000 230,000 JD has a December 31 year end. Required 2 a. Briefly explain how the change in inventory policy should be reported for the 2008 financial statements. 6 b. Calculate net income, using the FIFO method, for 2007 and 2008 2 a. Retrospective application with restatement of prior periods is required since information is available to recalculate comparative figures for the 2008 financial statements. 6 b. 2007 net income Original $ 62,000 (2) Change in beg. inventory, net of tax (26,000 – 15,000) (1 – 0.40) (6,600) (1) Change in end. inventory, net of tax (30,000 – 24,000) (1 – 0.40) 3,600 2007 net income (FIFO) $ 59,000 2008 net income Original $ 55,000 (1) Change in beg. inventory, net of tax (30,000 – 24,000) (1 – 0.40) (3,600) (2) Change in ending inventory, net of tax (28,000 – 23,000) (1 – 0.40) 3,000 2008 net income (FIFO) $ 54,400 21

- Page 1 and 2: FA3 Exam Review notes Barbara Wyntj

- Page 3 and 4: FA3 Exam Review notes Barbara Wyntj

- Page 5 and 6: FA3 Exam Review notes Barbara Wyntj

- Page 7 and 8: FA3 Exam Review notes Barbara Wyntj

- Page 9 and 10: FA3 Exam Review notes Barbara Wyntj

- Page 11 and 12: FA3 Exam Review notes Barbara Wyntj

- Page 13 and 14: FA3 Exam Review notes Barbara Wyntj

- Page 15 and 16: FA3 Exam Review notes Barbara Wyntj

- Page 17 and 18: FA3 Exam Review notes Barbara Wyntj

- Page 19: FA3 Exam Review notes Barbara Wyntj

- Page 23 and 24: FA3 Exam Review notes Barbara Wyntj

- Page 25 and 26: FA3 Exam Review notes Barbara Wyntj

- Page 27: FA3 Exam Review notes Barbara Wyntj

<strong>FA3</strong> <strong>Exam</strong> <strong>Review</strong> notes Barbara Wyntjes, CGA, MBA, B.Sc.<br />

Question 6 (6 marks)<br />

JD Limited has used the average cost (AC) method to determine inventory values since<br />

its inception. In 2008, the company decided to switch to the first-in, first-out (FIFO)<br />

method to conform to industry practice. The income tax rate is 40%. Assume any tax<br />

difference due to change in inventory valuation policy is a temporary difference. The<br />

following information is available:<br />

2006 2007 2008<br />

Ending inventory, AC method $ 15,000 $ 24,000 $ 23,000<br />

Ending inventory, FIFO method 26,000 30,000 28,000<br />

Net income, AC method 60,000 62,000 55,000<br />

Opening RE, AC method 170,000 180,000 230,000<br />

JD has a December 31 year end.<br />

Required<br />

2 a. Briefly explain how the change in inventory policy should be reported for the 2008<br />

financial statements.<br />

6 b. Calculate net income, using the FIFO method, for 2007 and 2008<br />

2 a.<br />

Retrospective application with restatement of prior periods is required since information<br />

is available to recalculate comparative figures for the 2008 financial statements.<br />

6 b.<br />

2007 net income<br />

Original $ 62,000<br />

(2) Change in beg. inventory, net of tax (26,000 – 15,000) (1 – 0.40) (6,600)<br />

(1) Change in end. inventory, net of tax (30,000 – 24,000) (1 – 0.40) 3,600<br />

2007 net income (FIFO) $ 59,000<br />

2008 net income<br />

Original $ 55,000<br />

(1) Change in beg. inventory, net of tax (30,000 – 24,000) (1 – 0.40) (3,600)<br />

(2) Change in ending inventory, net of tax (28,000 – 23,000) (1 – 0.40) 3,000<br />

2008 net income (FIFO) $ 54,400<br />

21