New Employee Benefits Enrollment - Dow Corning

New Employee Benefits Enrollment - Dow Corning

New Employee Benefits Enrollment - Dow Corning

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

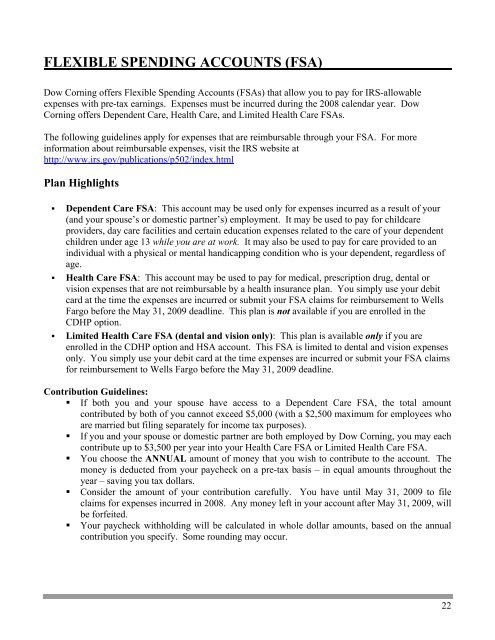

FLEXIBLE SPENDING ACCOUNTS (FSA)<br />

<strong>Dow</strong> <strong>Corning</strong> offers Flexible Spending Accounts (FSAs) that allow you to pay for IRS-allowable<br />

expenses with pre-tax earnings. Expenses must be incurred during the 2008 calendar year. <strong>Dow</strong><br />

<strong>Corning</strong> offers Dependent Care, Health Care, and Limited Health Care FSAs.<br />

The following guidelines apply for expenses that are reimbursable through your FSA. For more<br />

information about reimbursable expenses, visit the IRS website at<br />

http://www.irs.gov/publications/p502/index.html<br />

Plan Highlights<br />

� Dependent Care FSA: This account may be used only for expenses incurred as a result of your<br />

(and your spouse’s or domestic partner’s) employment. It may be used to pay for childcare<br />

providers, day care facilities and certain education expenses related to the care of your dependent<br />

children under age 13 while you are at work. It may also be used to pay for care provided to an<br />

individual with a physical or mental handicapping condition who is your dependent, regardless of<br />

age.<br />

� Health Care FSA: This account may be used to pay for medical, prescription drug, dental or<br />

vision expenses that are not reimbursable by a health insurance plan. You simply use your debit<br />

card at the time the expenses are incurred or submit your FSA claims for reimbursement to Wells<br />

Fargo before the May 31, 2009 deadline. This plan is not available if you are enrolled in the<br />

CDHP option.<br />

� Limited Health Care FSA (dental and vision only): This plan is available only if you are<br />

enrolled in the CDHP option and HSA account. This FSA is limited to dental and vision expenses<br />

only. You simply use your debit card at the time expenses are incurred or submit your FSA claims<br />

for reimbursement to Wells Fargo before the May 31, 2009 deadline.<br />

Contribution Guidelines:<br />

� If both you and your spouse have access to a Dependent Care FSA, the total amount<br />

contributed by both of you cannot exceed $5,000 (with a $2,500 maximum for employees who<br />

are married but filing separately for income tax purposes).<br />

� If you and your spouse or domestic partner are both employed by <strong>Dow</strong> <strong>Corning</strong>, you may each<br />

contribute up to $3,500 per year into your Health Care FSA or Limited Health Care FSA.<br />

� You choose the ANNUAL amount of money that you wish to contribute to the account. The<br />

money is deducted from your paycheck on a pre-tax basis – in equal amounts throughout the<br />

year – saving you tax dollars.<br />

� Consider the amount of your contribution carefully. You have until May 31, 2009 to file<br />

claims for expenses incurred in 2008. Any money left in your account after May 31, 2009, will<br />

be forfeited.<br />

� Your paycheck withholding will be calculated in whole dollar amounts, based on the annual<br />

contribution you specify. Some rounding may occur.<br />

22