SUSTAINABLE EVOLUTION - Gerdau

SUSTAINABLE EVOLUTION - Gerdau

SUSTAINABLE EVOLUTION - Gerdau

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ANNUAL REPORT 2011<br />

<strong>SUSTAINABLE</strong> <strong>EVOLUTION</strong>

<strong>Gerdau</strong><br />

<strong>SUSTAINABLE</strong><br />

<strong>EVOLUTION</strong><br />

Throughout its 110 years, <strong>Gerdau</strong> has grown,<br />

diversified its business in the steel value chain, and<br />

developed a strong commitment to people and the<br />

environment. It has built its history on the foundation<br />

of integrity, consistency, and professionalism, always<br />

seeking to establish a direct relationship of mutual<br />

gains with its shareholders, customers, suppliers,<br />

employees, and communities.<br />

Producing and delivering solutions in steel is<br />

<strong>Gerdau</strong>’s passion and purpose. The company<br />

strives for excellence in all aspects of its business<br />

besides working in an agile and flexible way with<br />

a capacity to face adversity and take advantage of<br />

market opportunities. With an industrial presence in<br />

14 countries - in the Americas, Europe, and Asia - it<br />

values understanding and respecting the cultures of<br />

each region where it operates.<br />

Today <strong>Gerdau</strong> is the leader in the segment of long<br />

steel in the Americas and one of the largest suppliers<br />

of special long steel in the world. It has over 45,000<br />

employees and its operations add up to a an installed<br />

capacity of over 25 million metric tons of steel per<br />

year. It is the largest scrap recycler in Latin America<br />

and worldwide transforms millions of metric tons of<br />

this raw material into new steel products each year.<br />

The Company is listed on the stock exchanges of São<br />

Paulo, New York, Madrid and Lima and has more than<br />

140,000 shareholders.<br />

For the landmark of its 110<br />

years, the Company issued<br />

a commemorative seal with<br />

the image of the Pontas de<br />

Paris Nail Factory, which<br />

gave rise to the Company.

MEXICO<br />

GUATEMALA<br />

HONDURAS<br />

MISSION<br />

To create value for our customers,<br />

shareholders, employees, and communities<br />

by operating as a sustainable steel business.<br />

VISION<br />

COLOMBIA<br />

PERU<br />

BOLIVIA<br />

CHILE<br />

To be a global organization and a benchmark<br />

in any business we conduct.<br />

ARGENTINA<br />

VALUES<br />

UNITED STATES<br />

DOMINICAN REPUBLIC<br />

VENEZUELA<br />

URUGUAY<br />

BRAZIL<br />

CANADA<br />

Be the CUSTOMER’s choice<br />

SAFETY above all<br />

Respected, engaged and fulfilled EMPLOYEES<br />

Pursuing EXCELLENCE with SIMPLICITY<br />

Focus on RESULTS<br />

INTEGRITY with all stakeholders<br />

Economic, social and environmental SUSTAINABILITY<br />

UNITED KINGDOM<br />

GERMANY<br />

FRANCE<br />

SPAIN<br />

ITALY<br />

GERDAU AROUND THE WORLD<br />

61<br />

143<br />

4<br />

48<br />

4<br />

126<br />

3<br />

Steel mills<br />

Downstream operations<br />

Iron ore extraction areas<br />

Scrap collection and processing facilities *<br />

Power plants<br />

Retail facilities<br />

Private port terminals<br />

<strong>Gerdau</strong> headquarters<br />

Associated companies<br />

Joint ventures<br />

* Scrap collection and processing facilities, solid pig<br />

iron production facilities, and coal units.<br />

INDIA

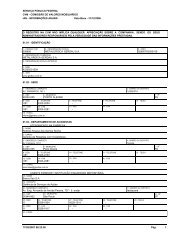

KEY INDICATORS*<br />

Consolidated financial performance (R$ million)<br />

40,000<br />

30,000<br />

20,000<br />

10,000<br />

0<br />

35,407<br />

4,651<br />

2011<br />

EBITDA 1<br />

2,098<br />

31,393<br />

5,201<br />

2010<br />

1 Represents earnings before interest, taxes, depreciation and<br />

amortization, also known as generation of cash from operations.<br />

* The dollar exchange rate on December 31, 2011 was R$ 1.8758.<br />

2,457<br />

Net revenue Net income<br />

Financial margins 2011 2010<br />

Gross margin 14% 18%<br />

Net margin 6% 8%<br />

EBITDA margin 13% 17%<br />

Output and shipments 2011 2010<br />

Steel production (thousand metric tons) 19,623 17,852<br />

Rolled steel production<br />

(thousand metric tons)<br />

Consolidated shipments<br />

(thousand metric tons)<br />

16,419 14,782<br />

19,164 17,363<br />

Investiments 2011 2010<br />

Investments in fixed assets<br />

(R$ million)<br />

1,961 1,289<br />

Environmental management 2011 2010<br />

Reuse of by-products<br />

(% of total generated)<br />

78.3 78.0<br />

Investments (R$ million) 370.9 137.7<br />

Social responsibility projects 2011 2010<br />

Investiments (R$ million) 61.0 57.4<br />

Volunteer employees<br />

(% of applicable personnel)<br />

24.9 24.1<br />

Capital markets 2011 2010<br />

Metalúrgica <strong>Gerdau</strong> S.A.<br />

Dividends (R$ per share) 0.55 0.65<br />

Dividend yield (%) 2 3.1 2.4<br />

<strong>Gerdau</strong> S.A.<br />

ANNUAL REPORT GERDAU 2011<br />

Dividends (R$ per share) 0.35 0.44<br />

Dividend yield (%) 2 2.4 1.9<br />

2 Ratio of dividend paid per share to quotation on the last day of the year.

2<br />

TABLE OF CONTENTS<br />

Message from the Chairman of the Board<br />

Message from the CEO<br />

110 years of history<br />

Corporate governance<br />

Risk management<br />

Strategy and competitive advantage<br />

Business<br />

Performance of operations<br />

Finances<br />

Relationships<br />

Employees<br />

Customers<br />

Suppliers<br />

Shareholders<br />

Society<br />

Environment<br />

Environmental management<br />

Timeline<br />

Summarized financial statements<br />

Glossary<br />

Corporate information<br />

03<br />

04<br />

06<br />

08<br />

15<br />

16<br />

18<br />

19<br />

28<br />

32<br />

33<br />

37<br />

39<br />

40<br />

42<br />

44<br />

45<br />

48<br />

54<br />

64<br />

68<br />

HIGHLIGHTS<br />

ANNUAL REPORT GERDAU 2011<br />

▪ <strong>Gerdau</strong> completes 110 years of business operations,<br />

currently occupying a leading position in the long<br />

steel segment in the Americas and one of the largest<br />

suppliers of special long steel in the world.<br />

▪ The Company has defined as its strategy to sell<br />

part of its iron ore resources in Brazil and to continue<br />

investing toward self-sufficiency of this important raw<br />

material at its integrated mills in Brazil.<br />

▪ Investments continue to be made for beginning the<br />

production of flat steel in Brazil. The new rolling mill<br />

for hot rolled coils will start its operations by the end of<br />

2012 at <strong>Gerdau</strong> Açominas (MG).<br />

▪ <strong>Gerdau</strong> announces a project to expand the supply<br />

of special steels in Brazil and in the United States,<br />

as well as making significant investment in India.<br />

These initiatives are aimed at the segment of special<br />

bar quality (SBQ), which is sold primarily to the<br />

automotive supply chain.<br />

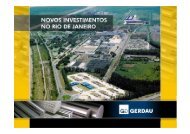

▪ The project to expand the Cosigua (RJ) mill began<br />

and a new rolling mill for wire rod and rolled rebar will<br />

be installed there. The equipment will be operational<br />

in 2013, with an initial installed capacity of 600,000<br />

metric tons per year, a volume that will be expand<br />

to 1.1 million metric tons a year during its second<br />

phase. With this investment, the rolling mill’s total<br />

annual capacity will increase from 1.5 million to 2.1<br />

million metric tons in 2013, and in the second phase<br />

will reach 2.6 million metric tons per year.<br />

▪ The public offering of shares of <strong>Gerdau</strong> S.A. is<br />

completed with the net proceeds of R$ 3.6 billion<br />

in cash resources for <strong>Gerdau</strong>. Of this total, R$ 2.1<br />

billion were used to make advance payment of debts.<br />

Because of this, there was a 27% reduction in net<br />

debt and an increase of 108% of cash in comparison<br />

between December 2011 and the same period in<br />

2010, which keeps the Company in a comfortable<br />

financial situation for years to come.

MESSAGE FROM THE<br />

CHAIRMAN OF THE BOARD<br />

Strategy of balancing profitability<br />

and growth with sustainability<br />

Each year, we have always worked hard to exceed<br />

our own levels of efficiency and competitiveness.<br />

The year 2011 was no different and it is the year that<br />

<strong>Gerdau</strong> completed 110 years of operations. We had<br />

a good financial and operational performance<br />

despite the instability of the global economic scenario,<br />

due mainly to the European economic crisis. We were<br />

able to adjust our operations to the swings in the<br />

markets where we operate, following our strategy of<br />

balancing profitability and growth with sustainability.<br />

TOWARD REACHING FULL SUSTAINABILITY<br />

The strength of our management structure, the<br />

continuous training of our teams, our top quality<br />

services to customers, investments for the<br />

preservation of the environment, and our deep<br />

involvement in strengthening the communities where<br />

we operate give us conviction that we are able to<br />

meet the expectations of our stakeholders based on a<br />

relationship of trust and mutual gains.<br />

At <strong>Gerdau</strong>, one of our values is economic, social,<br />

and environmental sustainability, which is<br />

substantiated by a long-term vision that seeks the<br />

perpetuity of our business. We therefore believe<br />

that the longevity of our Company must involve<br />

a conduct of professionalism and commitment<br />

to deliver value to our customers, shareholders,<br />

employees, communities, and suppliers. The practice<br />

of sustainability makes us more competitive and<br />

reaffirms our respect and our responsibility to future<br />

generations.<br />

More recently we began to reflect on the need to<br />

incorporate into sustainability the concepts related<br />

to culture and politics. When working in different<br />

countries, we believe that cultural sustainability,<br />

ANNUAL REPORT GERDAU 2011 3<br />

which is a full understanding and respect of cultures<br />

in the different regions where we operate, is essential<br />

to the long-term stability of our Company. And with<br />

this comes the increasingly stronger preference of<br />

our customers. Furthermore, we believe that political<br />

sustainability, through the engagement of different<br />

segments of society in building a long-term vision<br />

for the regions where we operate, has an extremely<br />

important role in improving the quality of life as a<br />

whole. With this we can seek to contribute to building<br />

a better future for society.<br />

VISION OF THE FUTURE<br />

The uncertainties of the economic scenario will make<br />

it more challenging to predict steel demand trends.<br />

However, considering the current panorama, the<br />

expectations for 2012 are positive and because of<br />

this we will continue investing to achieve increasing<br />

standards of excellence.<br />

Finally, I would like to thank the Board of Directors and<br />

<strong>Gerdau</strong> Executive Committee for their commitment<br />

and dedication, as well as all our teams that<br />

undoubtedly make <strong>Gerdau</strong> a better company.<br />

“The practice of sustainability makes us more<br />

competitive and reaffirms our respect and our<br />

responsibility to future generations.”<br />

Jorge <strong>Gerdau</strong> Johannpeter<br />

Chairman of the <strong>Gerdau</strong> Board of Directors

4<br />

MESSAGE FROM THE CEO<br />

Record shipments with<br />

higher demand for steel in<br />

the Americas<br />

The year 2011 represented a milestone for <strong>Gerdau</strong>:<br />

while we celebrate 110 years of doing business,<br />

we broke a record in shipments by reaching 19.2<br />

million metric tons – a volume 10% higher than 2010.<br />

This good performance was driven by a greater<br />

demand for long steel on the American continent<br />

despite the adversities caused by the slowdown of<br />

global economy and the European crisis.<br />

Consolidated net revenues, in turn, evolved 13% over<br />

2010, reaching R$ 35.4 billion. Consolidated steel<br />

production on the other hand grew 10% to 19.6 million<br />

metric tons. Consolidated generation of cash from<br />

operation (EBITDA) went to R$ 4.7 billion and net<br />

income of R$ 2.1 billion, both impacted by the strong<br />

pressure of the cost of raw materials, mainly iron ore,<br />

pig iron, coal, and scrap.<br />

Throughout the year, we intensified our work in order<br />

to reduce the cost of raw materials, increase the<br />

productivity of mills, and expand the product<br />

mix. We invested R$ 2 billion in mills and equipment<br />

(CAPEX), especially for entering into the flat steel<br />

sector in Brazil, which is scheduled to start in late<br />

2012, and for expanding our own production of<br />

iron ore. Thus, we continue having the goal of<br />

reaching self-sufficiency of this raw material in Brazil.<br />

Furthermore, studies for the commercial exploitation<br />

of surplus iron ore located in the state of Minas Gerais<br />

are underway.<br />

ANNUAL REPORT GERDAU 2011<br />

With a focus on the automotive industry, we<br />

announced significant investments to increase the<br />

supply of special steels in Brazil and in the United<br />

States, as well as to expand our presence in India<br />

– markets whose demand for vehicles has shown<br />

significant growth.<br />

For the landmark of its 110 years, <strong>Gerdau</strong> revised<br />

and updated its Vision, Mission, Values, and Code<br />

of Ethics at a global level in order to strengthen<br />

our corporate culture. Also as part of the<br />

celebrations we established a unique positioning<br />

of the brand and updated our logo’s design, which<br />

has undergone a subtle revitalization, making it<br />

lighter and more modern. This has strengthened<br />

<strong>Gerdau</strong>’s brand globally.<br />

Following the challenge of being an organization<br />

increasingly integrated, we started the first<br />

phase of deploying the <strong>Gerdau</strong> Template project<br />

in 2011, which will make it possible to use a<br />

single information technology system globally.<br />

At this first moment, the project, which includes<br />

SAP technology, was implemented in Mexico,<br />

Colombia, and Peru. In 2012, the next operations<br />

to receive the deployment are those located in the<br />

United States (not including special steel units), in<br />

Canada, Argentina, Chile, and Uruguay.<br />

The hard work and commitment of our more<br />

than 45,000 employees based on a relationship of<br />

respect and mutual gains were essential to reach<br />

our objectives. One example of this are the results<br />

of the 2011 Opinion Survey that evaluates the<br />

Company’s internal climate globally. For this year,<br />

the favorability index reached 75%, which is a level<br />

considered to be excellent in comparison with the<br />

world’s largest companies.

During the year we also strengthened our work<br />

with communities, not only through increasing<br />

social investments, but also with the active<br />

participation of approximately 9,500 volunteer<br />

employees who devote part of their time to<br />

transfer knowledge to various social organizations.<br />

As for the environment, <strong>Gerdau</strong> plays a key role<br />

by recycling millions of tons of scrap per year,<br />

removing obsolete materials from the cities and<br />

the countryside and turning them into steel, which<br />

also contributes to the generation of income<br />

for thousands of families. We also operate with<br />

advanced industrial technologies for the protection<br />

of the environment and have tried to widen the<br />

applications of our by-products in the steel industry<br />

and other segments of the economy.<br />

OUTLOOK<br />

The signals from the global steel market point to<br />

a growing demand in 2012 mainly in emerging<br />

countries such as China, Brazil, and India, which<br />

have shown good levels of economic growth.<br />

On the other hand, we will continue monitoring<br />

the situation of the European countries whose<br />

economies are facing a time of severe downturn.<br />

Faced with this scenario, we will keep working<br />

hard to continue <strong>Gerdau</strong>’s path of sustainable<br />

growth and development.<br />

ACKNOWLEDGEMENTS<br />

To conclude, I would like to thank the trust shown<br />

by our customers, shareholders, suppliers and<br />

communities. I would also like to give a special<br />

thanks to our employees for their daily dedication<br />

in overcoming challenges and achieving success.<br />

ANNUAL REPORT GERDAU 2011 5<br />

“In the year that <strong>Gerdau</strong> completed<br />

110 years of business operations, we<br />

saw record of shipments. Even against a<br />

backdrop of global economic uncertainty, we<br />

closed the year with a net revenue growth<br />

and reduction in expenses and debt.”<br />

André B. <strong>Gerdau</strong> Johannpeter<br />

<strong>Gerdau</strong> Chief Executive Officer

6<br />

110 YEARS OF HISTORY<br />

Centennial journey consolidates<br />

operations in the steel industry<br />

In 2011, <strong>Gerdau</strong> celebrated 110 years of existence<br />

consolidating its path of sustainable development<br />

in the steel industry. Ethical values, professional<br />

management, financial austerity, along with industrial<br />

and commercial competitiveness were the basis<br />

for the Company’s solid and consistent growth and<br />

today it is the leader in the segment of long steels<br />

in the Americas and one of the largest special steel<br />

supplier in the world. Celebrations were organized<br />

in all countries where it operates to celebrate this<br />

milestone, bringing together its more than 45,000<br />

employees.<br />

<strong>Gerdau</strong>’s history began in 1901 with the Pontas<br />

de Paris Nail Factory in Porto Alegre. The year of<br />

1948 marked the Company’s entrance into the steel<br />

industry with the acquisition of the Riograndense mill,<br />

also located in Porto Alegre, in order to ensure the<br />

Steel production (1948 - 2011)<br />

(in thousands of metric tons)<br />

3<br />

48<br />

11<br />

53<br />

21<br />

58<br />

62<br />

63<br />

144<br />

68<br />

503<br />

73<br />

950<br />

1,294<br />

ANNUAL REPORT GERDAU 2011<br />

supply of raw material for the production of nails. The<br />

new mill anticipated the minimill concept, a model<br />

based on the use of scrap and regional sales, which<br />

has kept its operating costs more competitive. (see<br />

“Timeline”).<br />

In the following decades, <strong>Gerdau</strong> continued expanding<br />

its operations to produce steel in Brazil through the<br />

construction and purchase of units in the main consumer<br />

centers as well as to expand its distribution network.<br />

The first step in its internationalization process<br />

occurred in Uruguay with the acquisition of Laisa<br />

in 1980. This move was followed with the purchase<br />

2,056<br />

2,878<br />

<strong>Gerdau</strong> has produced steel since 1948 and throughout its history has become the 10th largest producer<br />

78<br />

83<br />

88<br />

93<br />

3,661<br />

98<br />

12,343<br />

03<br />

19,599 19,623<br />

08<br />

11

of Courtice Steel located in the province of Ontario<br />

(Canada) in 1989. Over the following years, the<br />

expansion of business abroad resulted in entering into<br />

different countries, located in the Americas, Europe<br />

and Asia. With this the Company reached in 2011 the<br />

position of 10th largest steel producer in the world<br />

according to studies by the World Steel Association.<br />

Watch the video of the 110 years celebration on<br />

<strong>Gerdau</strong>’s website (www.gerdau.com.br/110years.html).<br />

RENEWED BRAND<br />

As part of the celebrations, <strong>Gerdau</strong> established a single<br />

global brand positioning and updated the design of its<br />

logo, which has undergone a subtle revitalization, and<br />

it has become lighter and more modern. The purpose<br />

of its new “One brand, One logo” positioning is to<br />

strengthen its brand globally. With this, there was a<br />

simplification of the brands in Brazil and the long steel<br />

and special steels operations located in North America,<br />

up until then called <strong>Gerdau</strong> Ameristeel and <strong>Gerdau</strong><br />

Macsteel, began to be called <strong>Gerdau</strong>. Descriptors were<br />

developed to differentiate the two business operations<br />

in North America, and the descriptor for the long steel<br />

operations, previously called <strong>Gerdau</strong> Ameristeel, began<br />

to be called <strong>Gerdau</strong> Long Steel North America. <strong>Gerdau</strong><br />

Special Steel North America is the descriptor of the<br />

company’s special steel operations in the United States<br />

formerly known as <strong>Gerdau</strong> Macsteel.<br />

<strong>Gerdau</strong>’s logo has undergone five changes during its<br />

110 year history. The first graphical representation of<br />

<strong>Gerdau</strong>’s brand was a stamp with a picture of a nail,<br />

ANNUAL REPORT GERDAU 2011 7<br />

which was widely used in promotional materials in<br />

the 40s, 50s, and 60s. Then in 1970, <strong>Gerdau</strong>’s first<br />

institutional logo was created in which the two letter<br />

Gs represented the Company’s spirit of cohesion and<br />

desire to grow. This version of the logo underwent a<br />

minor change in 1976 and, in the 1980s, the Company<br />

again changed its logo, which it had been using until<br />

early 2011.<br />

GERDAU CORPORATE CULTURE AND ETHICS<br />

In order to strengthen its corporate culture, <strong>Gerdau</strong><br />

revised and updated its Vision, Mission, and Values<br />

at a global level. The completion of this work was made<br />

based on interviews with members of the Board of<br />

Directors, <strong>Gerdau</strong>’s Executive Committee, and with the<br />

company’s main leaders. Moreover, another thousand<br />

leaders located in all operations of <strong>Gerdau</strong> around the<br />

world were involved through an online questionnaire,<br />

which established an even greater participatory<br />

process. With these inputs, it was also possible to<br />

develop a book with stories about the experiences that<br />

employees had in their daily work routines that reflect<br />

each one of the Company’s Values. This book entitled<br />

“Our culture unites us – lessons from our history” will be<br />

distributed to all of <strong>Gerdau</strong>’s operations in 2012.<br />

In addition, the Company launched its new Code<br />

of Ethics and promoted the training of more than<br />

45,000 employees in the countries where it operates.<br />

The new code reinforces <strong>Gerdau</strong>’s commitments and<br />

expected behavior with regard to each of the values,<br />

thus becoming an important instrument for maintaining<br />

these concepts and the Company’s longevity.<br />

At <strong>Gerdau</strong>, employees can send or register their<br />

questions and concerns related to ethics by the<br />

Ethics Channel that is available on the intranet or<br />

by an internal extension. All inquiries are treated<br />

confidentially. The new Code of Ethics is public and<br />

can be found on <strong>Gerdau</strong>’s website (www.gerdau.com.<br />

br/sobre-gerdau/governanca-corporativa-diretriz-etica.<br />

aspx). The Company also offers channels that seek to<br />

encourage the free expression of opinions, attitudes,<br />

and concerns of all stakeholders through which it has<br />

relationships by means of its website (www.gerdau/<br />

institucional/contatos.aspx).

8<br />

CORPORATE<br />

GOVERNANCE<br />

Century-old values and a solid<br />

management structure are the<br />

basis of <strong>Gerdau</strong>’s actions<br />

<strong>Gerdau</strong> follows international standards of<br />

corporate governance and in all its operations<br />

uses the most modern management tools. This<br />

makes it possible to reach increasing levels of<br />

excellence and at the same time have the flexibility<br />

and agility to adapt to the fluctuations in the markets<br />

it operates. With 110 years of history, the Company<br />

guides its conduct by century-old values and strict<br />

ethical principles, fundamental to a relationship of<br />

transparency with its stakeholders and to continue<br />

its path of sustainable development.<br />

It has three publicly listed companies – <strong>Gerdau</strong><br />

S.A., Metalúrgica <strong>Gerdau</strong> S.A., and Empresa<br />

Siderúrgica Del Perú S.A.A. (Siderperu). The<br />

shares of Metalúrgica <strong>Gerdau</strong> S.A. are traded on<br />

BM&FBOVESPA (São Paulo) and those of Siderperu<br />

on the Lima Stock Exchange. <strong>Gerdau</strong> S.A., in turn, is<br />

traded in São Paulo, Madrid and New York. In order<br />

to be able to trade its shares in the United States,<br />

<strong>Gerdau</strong> S.A. has to meet the requirements of the<br />

Sarbanes-Oxley (SOx) Act, which establishes good<br />

corporate governance practices as well as a strict<br />

control over internal processes.<br />

GOVERNANCE STRUCTURE<br />

The long-term strategies of <strong>Gerdau</strong> S.A. are set by<br />

the Board of Directors, which is the body that monitors<br />

the implementation of the policies established by it<br />

and makes decisions about themes relevant to the<br />

ANNUAL REPORT GERDAU 2011<br />

scope of business and operations. It is also up to the<br />

Board of Directors to appoint members of the <strong>Gerdau</strong><br />

Executive Committee (CEG).<br />

The Board of Directors of <strong>Gerdau</strong> S.A. is composed<br />

of nine members including outside members, which<br />

hold between eight and ten meetings a year. The<br />

Board of Directors of Metalúrgica <strong>Gerdau</strong> S.A., in turn,<br />

consists of eleven members and nine of them are also<br />

part of the Board of Directors of <strong>Gerdau</strong> S.A. In both<br />

companies the term of office of each of its members is<br />

one year with the possibility of reelection.<br />

The members of the Board of Directors and<br />

of the Audit Committee are elected annually<br />

at the Ordinary General Meeting (OGM).<br />

The responsibilities of the Board of Directors<br />

include deciding on the accounts submitted by<br />

the administrators, as well as for analyzing,<br />

discussing, and voting on the financial statements,<br />

the allocation of net income, and the dividend<br />

distribution policy, among other items.<br />

Metalúrgica <strong>Gerdau</strong> S.A. and <strong>Gerdau</strong> S.A. have<br />

audit committees responsible for monitoring and<br />

inspecting the actions of the board members. In<br />

addition, these bodies issue opinions and provide<br />

advice on the Board of Directors’ report and the<br />

financial statements.<br />

<strong>Gerdau</strong>’s corporate management is the<br />

responsibility of the Board of Directors and the<br />

<strong>Gerdau</strong> Executive Committee (CEG) coordinates<br />

and oversees the Business Divisions and Functional<br />

Processes. Composed of a CEO, a COO, and five<br />

Executive Vice Presidents, the CEG carries out the<br />

policies determined by the Board of Directors. To<br />

do so, it has the support of committees established<br />

according to criteria of expertise.

INDEPENDENT AUDIT<br />

The financial statements of <strong>Gerdau</strong>’s publicly traded<br />

companies regularly undergo an external audit. The<br />

Company, in accordance with CVM Instruction No.<br />

381/2003, informs that its service provider in this<br />

area did not perform services not related to external<br />

CORPORATE GOVERNANCE STRUCTURE<br />

Support<br />

Committees<br />

Brazil<br />

Special<br />

Steel<br />

Shareholders’<br />

Meeting<br />

Board of<br />

Directors<br />

<strong>Gerdau</strong> Officers<br />

and Executive<br />

Committee<br />

Business<br />

Operations<br />

North<br />

America<br />

Board of<br />

Auditors<br />

ANNUAL REPORT GERDAU 2011 9<br />

auditing during the year 2011. <strong>Gerdau</strong>’s policy for<br />

the contracting of eventual services not related<br />

to external auditing by the independent auditor is<br />

based on the principles that preserve the auditor’s<br />

independence.<br />

Corporate Governance<br />

Committee, Strategy<br />

Committee and Compensation<br />

and Succession Committee<br />

Macroprocesses<br />

Latin<br />

America<br />

Read more about the <strong>Gerdau</strong> governance structure at<br />

www.gerdau.com.br/investidores/governanca-corporativa.aspx

10<br />

SUMMARIZED CORPORATE STRUCTURE<br />

94.2%<br />

<strong>Gerdau</strong><br />

América Latina<br />

Participações<br />

S.A.<br />

9.7% 63.4%<br />

<strong>Gerdau</strong><br />

Internacional<br />

Empreendimentos<br />

Ltda.<br />

49.0% 99.9%<br />

Indústrias<br />

Nacionales<br />

C. por A.<br />

Dominican Rep.<br />

99.2%<br />

Diaco S.A.<br />

Colombia<br />

100.0%<br />

Siderúrgica<br />

Zuliana, C.A.<br />

Venezuela<br />

49.0%<br />

Corsa<br />

Controladora<br />

S.A. de CV<br />

Mexico<br />

Sipar<br />

Aceros S.A.<br />

Argentina<br />

100.0%<br />

<strong>Gerdau</strong><br />

Laisa S.A.<br />

Uruguay<br />

100.0%<br />

<strong>Gerdau</strong><br />

Aza S.A.<br />

Chile<br />

100.0%<br />

Siderúrgica<br />

Tultitlán S.A.<br />

de CV<br />

Mexico<br />

30.0%<br />

86.7%<br />

Empresa<br />

Siderúrgica<br />

del Perú S.A.A.<br />

Peru<br />

Corporación<br />

Centroamericana<br />

del Acero, S.A.<br />

Guatemala<br />

26.9%<br />

94.0%<br />

<strong>Gerdau</strong><br />

Açominas S.A.<br />

Brazil<br />

100.0%<br />

<strong>Gerdau</strong><br />

Macsteel Inc.<br />

USA<br />

6.7%<br />

Metalúrgica<br />

<strong>Gerdau</strong> S.A.<br />

40.6%<br />

<strong>Gerdau</strong> S.A.<br />

93.3%<br />

<strong>Gerdau</strong><br />

Ameristeel Corp.<br />

USA<br />

50.0%<br />

Gallatin<br />

Steel Inc.<br />

USA<br />

94.0%<br />

<strong>Gerdau</strong> Aços<br />

Longos S.A.<br />

Brazil<br />

ANNUAL REPORT GERDAU 2011<br />

95.9%<br />

<strong>Gerdau</strong> Aços<br />

Especiais S.A.<br />

100.0%<br />

Corporación<br />

Sidenor, S.A.<br />

Spain<br />

100.0%<br />

Sidenor<br />

Industrial, S.A.<br />

Spain<br />

80.6%<br />

95.6%<br />

<strong>Gerdau</strong><br />

Comercial<br />

de Aços S.A.<br />

Brazil<br />

Kalyani<br />

<strong>Gerdau</strong> Steel Ltd.<br />

India<br />

Direct and indirect shareholdings on total share capital<br />

December 2011

GERDAU S.A. BOARD OF DIRECTORS<br />

Jorge <strong>Gerdau</strong> Johannpeter<br />

Chairman<br />

Frederico C. <strong>Gerdau</strong><br />

Johannpeter<br />

Vice Chairman<br />

Affonso Celso Pastore<br />

Board Member<br />

Germano H. <strong>Gerdau</strong><br />

Johannpeter<br />

Vice Chairman<br />

André B. <strong>Gerdau</strong><br />

Johannpeter<br />

Board Member<br />

Alfredo Huallem<br />

Board Member<br />

ANNUAL REPORT GERDAU 2011 11<br />

Klaus <strong>Gerdau</strong> Johannpeter<br />

Vice Chairman<br />

Claudio <strong>Gerdau</strong><br />

Johannpeter<br />

Board Member<br />

Oscar de Paula<br />

Bernardes Neto<br />

Board Member

12<br />

GERDAU EXECUTIVE COMMITTEE (CEG)<br />

1 - André B. <strong>Gerdau</strong> Johannpeter<br />

Chief Executive Officer (CEO) and President of the <strong>Gerdau</strong> Executive Committee (CEG)<br />

2 - Claudio <strong>Gerdau</strong> Johannpeter<br />

Chief Operating Officer (COO)<br />

3 - Expedito Luz<br />

Executive Vice President of Legal Affairs and Compliance<br />

4 - Manoel Vitor de Mendonça Filho<br />

Executive Vice President, Brazil Business Operation - Açominas and Long Steel Brazil<br />

5 - Ricardo Giuzeppe Mascheroni<br />

Executive Vice President, North America and Latin America Business Operation - North<br />

6 - Osvaldo Burgos Schirmer<br />

Executive Vice President, Finance, Auditing, and Investor Relations<br />

7 - Francisco Deppermann Fortes<br />

Executive Vice President of Human Resources,<br />

Management, and Organizational Development<br />

ANNUAL REPORT GERDAU 2011<br />

5 4 2<br />

1 6 7 3

CORPORATE MANAGEMENT*<br />

CORPORATE MANAGEMENT<br />

André Araujo Hofmeister | Director, Planning and Business Development<br />

Antonio José Bacelar Teixeira | Director, Logistics<br />

Antônio Marques de Almeida | Director, Brazil Shared Services<br />

Denise Casagrande da Rocha | Director, Personnel Development<br />

Dirceu Tarcisio Togni | Director, Industry and Engineering<br />

Enio Viterbo Junior | Director, Health, Safety and Environment<br />

Fernando Jimenez Boldrini | Director, <strong>Gerdau</strong> Shared Services<br />

Fladimir Batista Lopes Gauto | Director, Procurement<br />

Geraldo Toffanello | Director, Accounting<br />

Glen Anderson Beeby | Director, Information Technology<br />

Harley Lorentz Scardoelli | Director, Finance<br />

Hildo Alberto Baldasso | Director, Technical Engineering<br />

José Paulo Soares Martins | Director, <strong>Gerdau</strong> Institute<br />

Marcos Eduardo Faraco Wahrhaftig | Director, <strong>Gerdau</strong> Template Project<br />

Paulo Perlott Ramos | Director, Marketing, Sales and Metallics<br />

Paulo Augusto de Lima Torres | Director, Operational Planning<br />

Renato Gasparetto Jr. | Director, Corporate Communications and Public Affairs<br />

BUSINESS DIVISIONS MANAGEMENT<br />

BRAZIL<br />

Heitor L. Beninca Bergamini | Executive Director - Long Steel Brazil<br />

Rodrigo Belloc Soares | Executive Director - <strong>Gerdau</strong> Açominas<br />

Marcus Rocha Duarte | Director, Solid Fuels of Brazil Business Operation<br />

Paulo José Barros Rabelo | Director, Iron Ore of Brazil Business Operation<br />

Aloysio Antonio P. de Carvalho | Director, Planning & Management Technology - <strong>Gerdau</strong> Açominas<br />

Antônio Pinto Segreto | Industrial Director - <strong>Gerdau</strong> Açominas<br />

Carmine Sarao Neto | Director, Human Resources - <strong>Gerdau</strong> Açominas<br />

Daniel Antonio M. de Mesquita | Engineering Director - <strong>Gerdau</strong> Açominas<br />

Fernando José Dutra Parreira | Executive Director, Southern Brazil Business Operation - Long Steel Brazil<br />

José Carlos de Matos Silva | Sales Director - <strong>Gerdau</strong> Açominas<br />

José Eustaquio de Lima | Executive Director, Comercial <strong>Gerdau</strong> - Long Steel Brazil<br />

José Falcão Filho | Director, Metallics - Long Steel Brazil<br />

José Walnei G. de Almeida | Director, Direct Sales - Long Steel Brazil<br />

Luciana Domagala | Director, Human Resources - Long Steel Brazil & Special Steel Brazil<br />

Luiz Augusto Polacchini | Director, Logistics of Brazil Business Operation<br />

Marcelo Costa Nasser | Executive Director, Fabricated Reinforcing Steel Facilities - Long Steel Brazil<br />

Mario Sant’Anna Junior | Executive Director, Brazil Forestry Operation - Long Steel Brazil<br />

Nestor Mundstock | Executive Director, Cosigua mill - Long Steel Brazil<br />

Paulo Ricardo Tomazelli | Commercial Director - Long Steel Brazil<br />

ANNUAL REPORT GERDAU 2011 13<br />

* Updated in February, 2012

14<br />

CORPORATE MANAGEMENT*<br />

SPECIAL STEEL<br />

Mark Anthony Marcucci | Executive Director, Special Steel Business Division<br />

André Beaudry | Executive Director, Business Development (India)<br />

A.S. Mathur | Executive Director, Kalyani <strong>Gerdau</strong> (India)<br />

T. Mohan Babu | Chief Operating Officer, Kalyani <strong>Gerdau</strong> (India)<br />

Roberto de Barros Bezerra | Industrial Director, Kalyani <strong>Gerdau</strong> (India)<br />

Cesar Arroyo Garcia | Director, Human Resources, <strong>Gerdau</strong> Sidenor (Spain)<br />

Francisco Javier F. Retana | Industrial Director, <strong>Gerdau</strong> Sidenor (Spain)<br />

Gregorio Iparraguirre Campos | Commercial Director, <strong>Gerdau</strong> Sidenor (Spain)<br />

Hermenio Pinto Gonçalves | Industrial Director, Special Steel Brazil<br />

Joaquim Guilherme Bauer | Executive Director, Special Steel Brazil<br />

Jack Finlayson | President, <strong>Gerdau</strong> Special Steel North America (USA)<br />

John Kelleher | Vice President, Operations <strong>Gerdau</strong> Special Steel North America (USA)<br />

José Jainaga Gomez | General Director, <strong>Gerdau</strong> Sidenor (Spain)<br />

Ricardo Sendim Fioramonte | Commercial Director, Special Steel Brazil<br />

Robert Jeffrey Karmol | Controller, <strong>Gerdau</strong> Special Steel North America (USA)<br />

Rodrigo Ferreira de Souza | Financial Director, <strong>Gerdau</strong> Sidenor (Spain)<br />

Richard Mark Szink | Director, Sales & Marketing, <strong>Gerdau</strong> Special Steel North America (USA)<br />

LATIN AMERICA<br />

André Felipe Gueiros Reinaux | Executive Director, Latin America - North<br />

Hermann Von Mühlenbrock Soto | Executive Director, Latin America - South<br />

Renato Silva Bernardes | Executive Director, <strong>Gerdau</strong> Mexico<br />

Carlos Hamilton de O. Pimenta | Executive Director, Diaco (Colombia)<br />

José Padilla Bello | Executive Director, Sizuca (Venezuela)<br />

José Pedro Sintas | Executive Director, <strong>Gerdau</strong> Laisa (Uruguay)<br />

Luís Daniel Pécora Nova | Executive Director, Sipar <strong>Gerdau</strong> (Argentina)<br />

Samuel Nanes Venguer | Administrative, Financial and Institutional Relations Director, <strong>Gerdau</strong> Mexico<br />

NORTH AMERICA<br />

Guilherme <strong>Gerdau</strong> Johannpeter | President, <strong>Gerdau</strong> Long Steel North America<br />

André Pires de Oliveira Dias | Vice President of Finance, <strong>Gerdau</strong> Long Steel North America<br />

Carl Czarnik | Vice President of Human Resources, <strong>Gerdau</strong> Long Steel North America<br />

James Kerkvliet | Vice President of Sales and Marketing, <strong>Gerdau</strong> Long Steel North America<br />

Matthew C. Yeatman | Vice President of Metallics Raw Materials, <strong>Gerdau</strong> Long Steel North America<br />

Peter Campo | Vice President of Downstream Operations, <strong>Gerdau</strong> Long Steel North America<br />

Wang Chia Yuan | Vice President of Mill Operations, <strong>Gerdau</strong> Long Steel North America<br />

ANNUAL REPORT GERDAU 2011<br />

* Updated in February, 2012

RISK MANAGEMENT<br />

Strict internal control of<br />

processes ensures appropriate<br />

risk management<br />

<strong>Gerdau</strong> monitors in a structured manner all the possible<br />

risks of its business and its operations. This is done<br />

using a rigorous risk management system that is<br />

continually improved, which contributes to efficient<br />

management and generation of sustainable value for<br />

shareholders.<br />

MANAGING OPERATIONAL RISKS<br />

<strong>Gerdau</strong>’s internal audit is responsible for mapping<br />

operational risks and respective internal controls of<br />

the processes. Operational risks arise from failures,<br />

deficiencies, or inadequacy of internal processes,<br />

people, or technology environments. These risks<br />

can be related to the industrial process or to the<br />

management of the Company’s different areas,<br />

including the supply of raw materials and inputs,<br />

marketing & sales, information technology, logistics,<br />

and personnel management.<br />

These risks are assessed annually from the results<br />

of the audit work and Sarbanes-Oxley Certification<br />

tests, as well as interviews with senior management<br />

and information received from the managers of the<br />

processes. Based on this data, the Audit Plan is<br />

carried out for the following year, which involves<br />

identifying gaps in the processes as well as<br />

opportunities for improvements in controls and other<br />

mitigation measures.<br />

MANAGING BUSINESS RISKS<br />

<strong>Gerdau</strong> also rigorously monitors the business risks,<br />

which include issues related to competitiveness<br />

and the Company’s positioning in the steel market.<br />

ANNUAL REPORT GERDAU 2011 15<br />

The management of business risks is carried out by<br />

different decision-making forums that consider the<br />

benefits and risks linked to it. Furthermore, the various<br />

business indicators monitor not only results, but also<br />

factors that can impact the Company, many of which<br />

are flags of strategic and operational risks.<br />

The <strong>Gerdau</strong> Executive Committee (CEG) and<br />

its committees have the responsibility to identify,<br />

evaluate, and determine actions in relation to business<br />

risks that arise. The CEG, for example, manages<br />

strategic risks that involve the evaluation of credit<br />

availability in the international market, the emergence<br />

of new competitors, launching of new products,<br />

<strong>Gerdau</strong>’s reputation with its various stakeholders, and<br />

the needs of future investments. The compliance team<br />

in turn is responsible for staying continuously up-todate<br />

with the laws in each country where <strong>Gerdau</strong><br />

operates and to comply with all the current regulations<br />

and legal norms.<br />

RISK MANAGEMENT COMMITTEE<br />

The Risk Management Committee oversees<br />

managing the most relevant risks in a direct or<br />

indirect way.<br />

The themes supervised directly by the committee<br />

include the status of assessments on the controls<br />

under the Sarbanes-Oxley Act, the audit work on<br />

operational risks, the progress of complaints made<br />

through the ethics channel (respecting anonymity<br />

and confidentiality), compliance, and others. The<br />

approval of the Annual Audit Plan is also part of its<br />

responsibility.<br />

Indirect supervision is given to risks that are already<br />

regularly monitored by other decision-making forums.<br />

Periodically the body requests presentations on<br />

risk management from other processes as a way<br />

to assess the adequacy of risk control in different<br />

areas, trying to prove whether the risks that <strong>Gerdau</strong> is<br />

subject are being properly identified and managed.

16<br />

STRATEGY AND<br />

COMPETITIVE<br />

ADVANTAGE<br />

Continuous search for new<br />

levels of profitability and<br />

sustainable growth<br />

<strong>Gerdau</strong> in 2011 continued working to extend the levels<br />

of efficiency of its operations driven by the strategy<br />

of striving to reach higher levels of profitability<br />

and growth with sustainability. To increase the<br />

competitiveness of the business, one of the pillars<br />

of its strategy has been efforts to reduce costs and<br />

increase our own supply of iron ore and coal, which<br />

are key raw materials in the steelmaking process.<br />

Furthermore, studies for the commercial exploitation<br />

of surplus iron ore located in Minas Gerais are<br />

underway.<br />

To be relevant in markets where it operates is another<br />

of <strong>Gerdau</strong>’s strategic pillars. The Company also<br />

believes that geographic diversification is fundamental<br />

for its continual growth process. In this sense, its<br />

presence in India, where in 2012 it will start up a<br />

rolling mill for special steels and rebars and a sintering<br />

facility, consists of one of its biggest challenges. In an<br />

GERDAU STRATEGY<br />

Relevance<br />

in the markets<br />

Profitability<br />

and<br />

Growth with Sustainability<br />

Business<br />

competitiveness<br />

Integrated Organization<br />

ANNUAL REPORT GERDAU 2011<br />

effort to consolidate itself as a player in all segments<br />

of the steel industry, <strong>Gerdau</strong> has been investing to<br />

start up production of flat steel in Brazil by the end<br />

of 2012 with the manufacturing of hot rolled coils at<br />

<strong>Gerdau</strong> Açominas (MG).<br />

UNIQUE FEATURES OF GERDAU MANAGEMENT<br />

<strong>Gerdau</strong> Business System<br />

One of <strong>Gerdau</strong>’s main competitive advantages<br />

is its ability to enhance and disseminate its best<br />

practices in a way that is standardize and fast to their<br />

teams in the different countries where it operates.<br />

This work, which covers all areas of the Company, is<br />

accomplished through the <strong>Gerdau</strong> Business System<br />

(GBS), a system that consolidates different practices<br />

developed in-house or as benchmarks outside the<br />

Company.<br />

Because it is an open system and is constantly being<br />

improved, GBS identifies, evaluates, and incorporates<br />

new practices that have shown significant results<br />

in operations. It also facilitates spreading <strong>Gerdau</strong>’s<br />

corporate culture, contributing to the Company’s<br />

complete integration.<br />

In 2011, an experiment was conducted to simplify<br />

the system in order to accelerate the deployment of<br />

priorities practices and to make it increasingly focused<br />

on business needs.<br />

Player<br />

in all segments<br />

Geographic<br />

diversification

Shared Services <strong>Gerdau</strong><br />

Since 2006, the Company has had the Shared<br />

Services <strong>Gerdau</strong> (SSG), which is a service center<br />

that brings together all the operational processes<br />

common to the <strong>Gerdau</strong> units in Brazil such as<br />

Accounting Services, Indirect Taxes Management,<br />

Financial Services, Planning and Management<br />

of Services, Management of Registrations, and<br />

Employee Support and Services. The role of the<br />

SSG is to make it possible to streamline resources<br />

and services as well as to simplify and standardize<br />

processes, reducing costs and providing more agility<br />

and operational productivity.<br />

In 2011, Shared Services <strong>Gerdau</strong> was recognized by<br />

the Group for the Study of Shared Services Centers<br />

(GESC) as a reference services center in Brazil. As<br />

a result of successful experience in Brazil, <strong>Gerdau</strong><br />

will expand the service to its other operations in 2012<br />

through three centers located in Brazil, Mexico, and<br />

the United States. The center in Brazil will continue<br />

giving support to the operations in the country, the one<br />

in Mexico will focus on operations in Latin America<br />

and Spain, and the one in the United States will meet<br />

the demands of operations of long and special steels<br />

in North America.<br />

ANNUAL REPORT GERDAU 2011 17<br />

<strong>Gerdau</strong> Template<br />

Following the challenge of being an organization<br />

increasingly integrated, <strong>Gerdau</strong> started the first<br />

phase of deploying the <strong>Gerdau</strong> Template in 2011,<br />

which will make it possible to apply a single<br />

information technology system in the countries<br />

where it operates, using SAP technology. This<br />

will enable greater efficiency, security, and agility in<br />

the collection and sharing of information and in the<br />

integration of new units.<br />

The initiative includes the participation of a permanent<br />

team consisting of about 250 employees and the<br />

support of several specialized consultants. The first<br />

phase of the project was completed in 2011 with the<br />

deployment of the system in Mexico, Colombia, and<br />

Peru. During this process, 151,000 data related to<br />

suppliers, customers, products, and materials were<br />

reviewed and uploaded into the new system. In<br />

addition to this, about 50,000 tests were performed.<br />

Two thousand people received training and of those,<br />

135 have become multipliers, which means that they<br />

are responsible for training and supporting employees<br />

who use the system in their respective countries. In<br />

2012 the operations located in the United States (not<br />

including special steel units), Canada, Argentina,<br />

Chile, and Uruguay will have the new system.<br />

The <strong>Gerdau</strong> Template deployed in Mexico, Colombia (photo), and Peru will enable greater efficiency in collecting and sharing information

Business<br />

<strong>Gerdau</strong> continues to invest to increase its own production<br />

of iron ore from its mines located in Miguel Burnier<br />

(photo), Várzea do Lopes, and Gongo Soco (MG)

PERFORMANCE OF<br />

OPERATIONS<br />

Greater global demand drives<br />

record shipments in 2011<br />

The expansion of world demand for steel and<br />

<strong>Gerdau</strong>’s commercial efforts allowed the company to<br />

break the record in shipments in 2011. It sold 19.2<br />

million metric tons during the year, representing a<br />

growth of 10% compared to the previous year. This<br />

good performance was driven by increased demand<br />

from the automotive and energy industry in the United<br />

States and Canada, and by the construction in Brazil<br />

and other Latin American countries.<br />

Consolidated steel production also broke a record.<br />

It progressed 10% over 2010, totaling 19.6 million<br />

metric tons with expansion in volumes produced in<br />

all regions where the Company operates. Important<br />

investments were made during the year for the<br />

expansion of installed capacity and modernization<br />

of industrial mills totaling R$ 2 billion in 2011. The<br />

biggest investments have been for the production of<br />

flat steel in Brazil, scheduled to start by the end of<br />

2012, to increase our own production of iron ore.<br />

Shipments per Business Division<br />

19.2 million metric tons<br />

Latin America<br />

15.3%<br />

Does not include<br />

operations<br />

in Brazil<br />

Special Steel<br />

13.8%<br />

Includes special steel<br />

operations in Brazil,<br />

Spain and the US<br />

Note: The above information does not include data from<br />

affiliated companies and jointly-owned subsidiaries.<br />

Brazil<br />

36.9%<br />

Does not include<br />

special steel<br />

operations in Brazil<br />

North America<br />

34.0%<br />

Does not include<br />

Mexico and special<br />

steel mills in the<br />

United States<br />

ANNUAL REPORT GERDAU 2011<br />

“In the year that <strong>Gerdau</strong> completed 110<br />

years, we continue investing in order to<br />

ensure excellence in all operations. We<br />

have also worked with a focus on reducing<br />

costs and achieving new synergies<br />

between the units. Over the next five<br />

years, we will invest R$ 10.3 billion with a<br />

special focus on entering into the flat steel<br />

production market in Brazil, expanding the<br />

special steel installed capacity in Brazil<br />

and the United States, and increasing our<br />

presence in India. We will also continue<br />

our project to sell the surplus of iron ore<br />

with the goal of achieving self-sufficiency<br />

of this important raw material in Brazil.”<br />

Claudio <strong>Gerdau</strong> Johannpeter<br />

<strong>Gerdau</strong> Chief Operating Officer (COO)<br />

19

20 ANNUAL REPORT GERDAU 2011<br />

OUTLOOK | WORLD<br />

▪ The World Steel Association estimates<br />

indicate that global steel consumption is<br />

expected to grow 5.4% in 2012 driven<br />

mainly by demand from emerging markets<br />

(BRIC, Middle East, and North Africa). The<br />

Company also believes that the United<br />

States will continue in its recovery period<br />

and is following carefully the evolution of the<br />

economic crisis in Europe.<br />

▪ About 70% of consumption for 2012 should<br />

occur in developing economies where<br />

<strong>Gerdau</strong> has a large portion of its operations.<br />

▪ According to this scenario, <strong>Gerdau</strong> is fully<br />

prepared to meet the future needs of steel<br />

in countries where it operates. In 2012, the<br />

Company will continue investing to add value<br />

to its products, increase the installed capacity<br />

in relevant markets, improve operational<br />

excellence of its units, reduce costs, and<br />

achieve new synergies between operations.<br />

▪ Investments of R$ 10.3 billion are scheduled<br />

for the next five years (2012 - 2016).<br />

BRAZIL (except special steel mills)<br />

<strong>Gerdau</strong> reported a good shipments performance<br />

in 2011 in Brazil especially in the area of construction.<br />

The shipments volume reached 7.1 million metric<br />

tons, a 6% growth over 2010, and steel production<br />

in turn reached 7.6 million metric tons, up 9% from a<br />

year earlier.<br />

Despite increases in the levels of production volume<br />

and shipments, the level of business profitability<br />

was impacted by the pressure of raw material costs,<br />

unfavorable exchange rates, and expansion of direct<br />

and indirect imports of steel.<br />

Under “Brazil”, <strong>Gerdau</strong> reports all its activities in the<br />

country except for the special steel segment, whose<br />

information is provided separately. In the Brazilian<br />

market, the Company operates with 11 steel mills, 4<br />

downstream operations, 40 fabricated reinforcing steel<br />

facilities, 4 flat steel service centers, 7 scrap collection<br />

and processing facilities, and 4 iron ore extraction<br />

areas. In each state of the country, the Company<br />

has at least one Comercial <strong>Gerdau</strong> unit, which is a<br />

distributor of flat and long steel. In total there are 82<br />

distribution branches.<br />

<strong>Gerdau</strong> steel was used for the construction of the Rio Negro bridge,<br />

the second largest cable-stayed bridge in the world over river water

During the year, <strong>Gerdau</strong> intensified its work to<br />

reduce the cost of raw materials, increase the<br />

productivity of its mills, and expand its product<br />

mix. In relation to our own production of iron ore, the<br />

Company continues with the goal of achieving selfsufficiency<br />

of this raw material in Brazil. Furthermore,<br />

studies for the commercial exploitation of surplus iron<br />

ore located in Minas Gerais are underway.<br />

In 2011, <strong>Gerdau</strong> continued with its investments for<br />

the start of production of flat steel in Brazil, especially<br />

the installation of a hot rolled coil mill at <strong>Gerdau</strong><br />

Açominas (see table “<strong>Gerdau</strong> will start production of<br />

flat steel in Brazil”).<br />

GERDAU WILL START PRODUCTION OF FLAT STEEL IN BRAZIL<br />

In late 2012, <strong>Gerdau</strong> will begin producing flat<br />

steel products in Brazil, expanding the product<br />

range offered to its customers. In the first stage<br />

of the investment, a new rolling mill for hot rolled<br />

coils will start up operations aimed to meet<br />

the needs of the construction industry (steel<br />

The new rolling mill for hot rolled coils will start its operations by the end of 2012<br />

ANNUAL REPORT GERDAU 2011<br />

To meet the needs of the civil construction consumer<br />

market, the Company expanded the installed capacity<br />

of the structural shapes rolling mill in 2011, which is<br />

also located in <strong>Gerdau</strong> Açominas, to 700,000 metric<br />

tons per year. Considering the prospect of continued<br />

growth in demand, the Company has already initiated<br />

studies to expand to 1 million metric tons the annual<br />

production capacity of structural shapes, which are<br />

used in construction, the oil industry, as well as for<br />

machinery and equipment.<br />

Throughout the year, <strong>Gerdau</strong> also provided steel<br />

for the construction of soccer stadiums for the 2014<br />

World Cup and major infrastructure building projects<br />

construction), oil, shipbuilding, machinery, and<br />

implements. In the second stage, a heavy plate<br />

rolling mill will begin its operations. Both pieces of<br />

equipment will be located at <strong>Gerdau</strong> Açominas in<br />

Ouro Branco (MG).<br />

21

22 ANNUAL REPORT GERDAU 2011<br />

for the country such as railways, wind power mills,<br />

bridges, ports, and highways, as well as the Federal<br />

Government’s My House, My Life program stimulating<br />

home ownership. In addition, it continued investing<br />

to add value to its clients in the civil construction<br />

sector. An example of this was the increase in the<br />

rebar fabricating capacity with the expansion and<br />

opening of new units. The fabricated reinforcing steel<br />

facilities system provides greater cost savings, quality,<br />

and speed in the execution of building projects.<br />

The Company has also announced investments in<br />

improvements to the Araçariguama (SP) rolling mill<br />

with the installation of a new line of <strong>Gerdau</strong> GG 50<br />

rebar in coils, which will start up operation in 2012.<br />

OUTLOOK | BRAZIL<br />

▪ The perspective for 2012 is for continued<br />

growth of the internal market where steel<br />

consumption is expected to reach 26.7<br />

million metric tons, which is an increase of<br />

7% over 2011 according to the Brazil Steel<br />

Institute.<br />

▪ <strong>Gerdau</strong> will continue to provide steel for<br />

the construction of soccer stadiums as well<br />

as infrastructure building projects such as<br />

Bus Rapid Transit (BRT), railways, wind<br />

power mills, ports, and highways. In 2012,<br />

the civil construction sector should be<br />

driven by the acceleration of the building<br />

projects for the World Cup in 2014 and by<br />

the continuity of Federal Government’s My<br />

House, My Life program.<br />

▪ Given these prospects, the Company is<br />

fully prepared to meet the demand for steel<br />

in Brazil considering its current installed<br />

capacity and planned investments.<br />

In addition, a new rolling mill for wire rod and rolled<br />

rebar will be installed at the Cosigua (RJ) mill, which<br />

will begin operations in 2013, initially with an installed<br />

capacity of 600,000 metric tons per year, a volume<br />

that will be increased to 1.1 million metric tons a<br />

year in a second stage. The expansion project also<br />

includes the installation in Rio de Janeiro of a new<br />

rebar fabricated reinforcing steel facility for civil<br />

construction and another subsidiary of Comercial<br />

<strong>Gerdau</strong> focused on selling steel products.<br />

LATIN AMERICA (does not include operations in Brazil)<br />

<strong>Gerdau</strong> ended the year with increased shipments<br />

and production in Latin America, which is a market<br />

that showed a significant recovery in 2011 despite<br />

the high level of imports and high pressure from<br />

costs. The consolidated volume of shipments in Latin<br />

America was 2.6 million metric tons in 2011, 19%<br />

more than the previous year with the highest growth<br />

taking place in Colombia, Argentina, and Chile. In<br />

the same period, steel production reached 1.7 million<br />

metric tons, an increase of 15% compared to 2010.<br />

<strong>Gerdau</strong> made several investments in order to<br />

keep up with the growing demand for steel in the<br />

region. A new fabricated reinforcing steel facility<br />

was inaugurated in Mexico, and it is <strong>Gerdau</strong>’s first<br />

in the country. The unit is geared to meet the civil<br />

construction industry in the region.<br />

A new welded wire mesh factory was installed<br />

in Guatemala, which is also dedicated to civil<br />

construction. Also, a new drawing mill and rolling mill<br />

for rebars and light merchant bars is scheduled to<br />

start up operations in 2012, strengthening our service<br />

capacity in the domestic market and neighboring<br />

countries. The new mill will have an annual installed<br />

capacity of 200,000 metric tons.

<strong>Gerdau</strong> opened its first fabricated reinforcing steel facility in Mexico, geared to meet the demand of civil construction of the region<br />

In the Dominican Republic, the Company opened<br />

a new rolling mill with a capacity of 400,000 metric<br />

tons for rebars and light merchant bars in 2011. As a<br />

result, <strong>Gerdau</strong> became the sole producer of structural<br />

shapes in the Caribbean region.<br />

In Venezuela, several operational improvements<br />

were made as well as technical and managerial<br />

training of employees. As a result, there was an<br />

increase of 50% in production with the expansion of<br />

service capacity and volume of deliveries for the civil<br />

construction market.<br />

In Colombia, <strong>Gerdau</strong> took up its activities again at<br />

its Duitama unit that has a rebar rolling mill with an<br />

annual production capacity of 90,000 metric tons.<br />

It also made several investments for technological<br />

upgrading of the Yumbo mill, which resumed<br />

operations in early 2012 to better meet the growing<br />

demand for long steel in the country. The mill, whose<br />

production is geared to meet the civil construction<br />

industry, has an annual installed capacity of 240<br />

metric tons.<br />

OUTLOOK | LATIN AMERICA<br />

ANNUAL REPORT GERDAU 2011<br />

Investments are also planned to increase the capacity<br />

of the mills and plants of Tocancipá and Tuta in 2012,<br />

adding 80,000 metric tons to their annual installed<br />

capacity in Colombia. Furthermore, a port terminal<br />

will be inaugurated in the country for shipment of coal<br />

and coke, which are important raw materials for steel<br />

production. The port will serve mainly the markets of<br />

Brazil, Mexico, and the United States.<br />

▪ A strong recovery in the civil construction<br />

and infrastructure sectors should keep<br />

demand for steel strong in 2012.<br />

▪ According to the World Steel Association,<br />

the countries of Latin America (except Brazil)<br />

should reach a steel consumption of 41.7<br />

million metric tons in 2012, which is an<br />

increase of 5% over the previous year.<br />

23

24 ANNUAL REPORT GERDAU 2011<br />

In Peru, a project is being studied to expand the<br />

capacity of the rolling mill Siderperu. The improvement<br />

of the port logistics structure and of the mill’s<br />

environmental protection technologies are also<br />

scheduled for 2012. This year completed the fiveyear<br />

period of commitments made by <strong>Gerdau</strong> in the<br />

purchase of Siderperu with the Peruvian State. The<br />

fulfillment of this commitment was endorsed by audit<br />

firms of recognized prestige and has been supervised<br />

and approved by the Agency for Promoting Private<br />

Investments (ProInversión).<br />

In Chile, investments were made in a new dust removal<br />

system in the Colina mill. In addition, studies are<br />

underway to expand the Company’s installed capacity.<br />

NORTH AMERICA (does not include Mexico and<br />

special steel mills in the United States)<br />

The growing recovery in the economy of the United<br />

States and Canada has had a positive impact on<br />

the performance of <strong>Gerdau</strong>’s shipments in the<br />

region. Moreover, the constant work of management<br />

to increase productivity and reduce costs, along with<br />

investments in modernization of units has increased the<br />

Company’s competitiveness.<br />

During the year, 6.5 million metric tons of steel were<br />

sold, which is 14% more compared to 2010 mostly due<br />

to the increase in demand for long steel products from<br />

the manufacturing and oil & gas industries in the region,<br />

as well as due to the increase of exports from the United<br />

States. Steel production reached 7 million metric tons –<br />

12% higher from a year earlier.<br />

<strong>Gerdau</strong> has a large industrial presence in North America with 20 steel mills, 12 downstream operations, 48 fabricated reinforcing steel facilities,<br />

and 22 scrap collection and processing facilities

<strong>Gerdau</strong> has a large industrial presence in the region:<br />

20 mills, 12 downstream operations, 48 fabricated<br />

reinforcing steel facilities, and 22 scrap collection<br />

and processing units. This makes it possible for us to<br />

serve our customers with unique advantages such as<br />

agility and a broad product mix.<br />

In the coming years, the Company will continue<br />

investing to increase the competitiveness of its<br />

units. The annual installed capacity of the Midlothian<br />

mill in Texas, <strong>Gerdau</strong>’s main unit in North America, will<br />

evolve to 1.8 million metric tons of steel. The installed<br />

capacity of rebars will also be expanded in the same<br />

unit to 550,000 metric tons per year. Both initiatives<br />

will start operations in 2014. Furthermore, a new<br />

reheating furnace will be commissioned at the Calvert<br />

City (Kentucky) mill at the end of 2012.<br />

In 2012, the Company will also initiate the deployment<br />

of the <strong>Gerdau</strong> Template, a project to ensure the use<br />

of a single information technology system through<br />

the SAP platform in all of <strong>Gerdau</strong>’s operations (see<br />

“Strategy and Competitive Advantage” section).<br />

OUTLOOK | NORTH AMERICA<br />

▪ The perspective for 2012 is a recovery<br />

of the economies of North America driven<br />

primarily by the continued recovery in the<br />

manufacturing industry and of the oil & gas,<br />

energy, and agriculture sectors.<br />

▪ The World Steel Association predicts that<br />

steel consumption in the United States is<br />

expected to grow 5% in 2012, reaching 93.8<br />

million metric tons. In Canada, the growth<br />

forecast is 5% in steel consumption, reaching<br />

14.7 million metric tons.<br />

ANNUAL REPORT GERDAU 2011<br />

<strong>Gerdau</strong> provided steel for the construction of the Freedom Towers<br />

(USA), a project to rebuild the World Trade Center<br />

SPECIAL STEEL (includes mills in Brazil, Spain, the<br />

United States and India)<br />

In 2011, the growing demand from the automotive<br />

sector in Brazil and the United States brought<br />

about a 6% increase in shipments of special steel<br />

at <strong>Gerdau</strong> in comparison with the previous year,<br />

reaching 2.9 million metric tons. In the same period,<br />

steel production reached 3.4 million metric tons, an<br />

increase of 5%. Against this backdrop of growth in<br />

shipments, <strong>Gerdau</strong> announced new investments in<br />

its special steel units in Brazil and the United States<br />

(see table “<strong>Gerdau</strong> invests to increase its production<br />

capacity of special steel”).<br />

In Brazil, the Brazilian automotive sector posted<br />

shipments of 3.4 million vehicles in the period,<br />

keeping in line with the 2010 volume according to<br />

the National Association of Vehicle Manufacturers<br />

(Anfavea). Thus, the Brazilian market remained the<br />

4th largest in the world in vehicles sold. Due to the<br />

anticipated growth in coming years, new vehicle mills<br />

will be installed in the country and existing companies<br />

in this market will expand, thus creating an increased<br />

demand for special steels.<br />

25

26 ANNUAL REPORT GERDAU 2011<br />

In the markets of the United States, Canada, and<br />

Mexico, the production of vehicles (passenger and<br />

light commercial vehicles) recorded 13 million units,<br />

which increased 10% compared to 2010. Motivated<br />

by the good performance of the market, new car<br />

manufacturers are also coming to the United States,<br />

and the level of nationalization of the automotive<br />

components also continues to expand.<br />

The production of <strong>Gerdau</strong>’s special steel is directed to the<br />

segment of special bar quality (SBQ), which primarily serves<br />

the automotive supply chain<br />

As for Europe, the number of light, medium, and<br />

heavy commercial vehicles evolved to 1.9 million<br />

units, which is 10% higher than in 2010 according to<br />

the European Automobile Manufacturers’ Association<br />

(ACEA). To cope with the economic instability of<br />

the region, the Company continued its efforts to<br />

reduce costs, increase productivity, and diversify the<br />

markets served.<br />

OUTLOOK | SPECIAL STEEL<br />

▪ The prospects for 2012 are positive for the<br />

special steel market in Brazil, the United States,<br />

and India.<br />

▪ In Brazil, according to the National Association<br />

of Vehicle Manufacturers (Anfavea), it is<br />

estimated that vehicle production will grow 2%<br />

in 2012, thus keeping the high demand levels<br />

already recorded in the last years.<br />

▪ In the United States, demand for steel should<br />

also remain at high levels mainly due to the<br />

need to renew the fleet of vehicles and the good<br />

moment being experienced by the oil & gas<br />

industry. For the market of medium and heavy<br />

commercial vehicles, which carry more steel<br />

in their composition, the estimates indicate a<br />

growth of 10% in production in 2012. In relation<br />

to the market for light vehicles (light commercial<br />

and passenger vehicles), the estimate is an 8%<br />

growth in production.<br />

▪ As regards to Europe, the prospects for<br />

the production of light, medium, and heavy<br />

commercial vehicles are of decreasing in 2012.<br />

▪ In India, the prospects for production of vehicles<br />

(passenger, light and medium commercial<br />

vehicles, motorcycles, and tricycles) point to a<br />

growth of up to 13% in 2012 compared with 2011<br />

according to the Society of Indian Automobile<br />

Manufacturers (SIAM).

<strong>Gerdau</strong>, one of the largest suppliers of<br />

special steel in the world, is making significant<br />

investments to expand the supply of special<br />

steels in Brazil and the United States, as well<br />

as expand its presence in India. Its production<br />

is aimed at the segment of special bar quality<br />

(SBQ), which is sold primarily to the automotive<br />