Annual general report of the controller and - Parliament of Tanzania

Annual general report of the controller and - Parliament of Tanzania

Annual general report of the controller and - Parliament of Tanzania

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

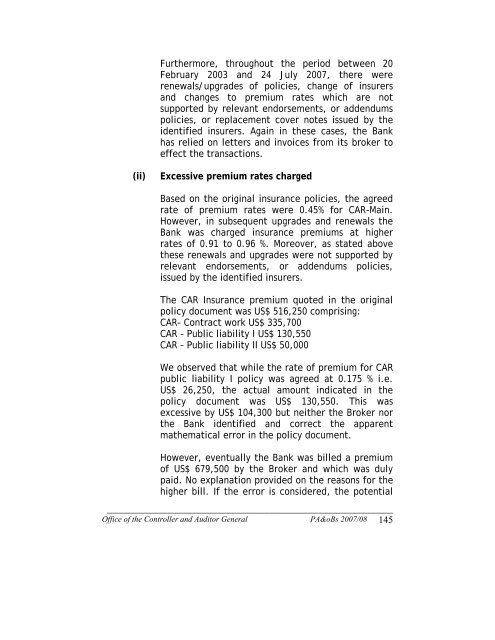

Fur<strong>the</strong>rmore, throughout <strong>the</strong> period between 20<br />

February 2003 <strong>and</strong> 24 July 2007, <strong>the</strong>re were<br />

renewals/upgrades <strong>of</strong> policies, change <strong>of</strong> insurers<br />

<strong>and</strong> changes to premium rates which are not<br />

supported by relevant endorsements, or addendums<br />

policies, or replacement cover notes issued by <strong>the</strong><br />

identified insurers. Again in <strong>the</strong>se cases, <strong>the</strong> Bank<br />

has relied on letters <strong>and</strong> invoices from its broker to<br />

effect <strong>the</strong> transactions.<br />

(ii) Excessive premium rates charged<br />

Based on <strong>the</strong> original insurance policies, <strong>the</strong> agreed<br />

rate <strong>of</strong> premium rates were 0.45% for CAR-Main.<br />

However, in subsequent upgrades <strong>and</strong> renewals <strong>the</strong><br />

Bank was charged insurance premiums at higher<br />

rates <strong>of</strong> 0.91 to 0.96 %. Moreover, as stated above<br />

<strong>the</strong>se renewals <strong>and</strong> upgrades were not supported by<br />

relevant endorsements, or addendums policies,<br />

issued by <strong>the</strong> identified insurers.<br />

The CAR Insurance premium quoted in <strong>the</strong> original<br />

policy document was US$ 516,250 comprising:<br />

CAR- Contract work US$ 335,700<br />

CAR – Public liability I US$ 130,550<br />

CAR – Public liability II US$ 50,000<br />

We observed that while <strong>the</strong> rate <strong>of</strong> premium for CAR<br />

public liability I policy was agreed at 0.175 % i.e.<br />

US$ 26,250, <strong>the</strong> actual amount indicated in <strong>the</strong><br />

policy document was US$ 130,550. This was<br />

excessive by US$ 104,300 but nei<strong>the</strong>r <strong>the</strong> Broker nor<br />

<strong>the</strong> Bank identified <strong>and</strong> correct <strong>the</strong> apparent<br />

ma<strong>the</strong>matical error in <strong>the</strong> policy document.<br />

However, eventually <strong>the</strong> Bank was billed a premium<br />

<strong>of</strong> US$ 679,500 by <strong>the</strong> Broker <strong>and</strong> which was duly<br />

paid. No explanation provided on <strong>the</strong> reasons for <strong>the</strong><br />

higher bill. If <strong>the</strong> error is considered, <strong>the</strong> potential<br />

___________________________________________________________<br />

Office <strong>of</strong> <strong>the</strong> Controller <strong>and</strong> Auditor General PA&oBs 2007/08 145