Annual general report of the controller and - Parliament of Tanzania

Annual general report of the controller and - Parliament of Tanzania Annual general report of the controller and - Parliament of Tanzania

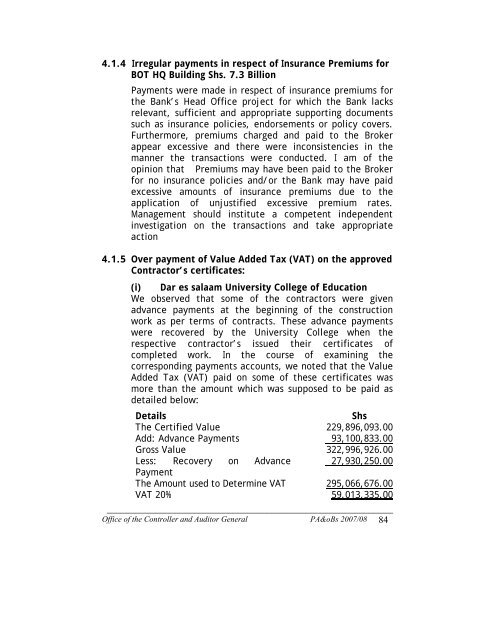

4.1.4 Irregular payments in respect of Insurance Premiums for BOT HQ Building Shs. 7.3 Billion Payments were made in respect of insurance premiums for the Bank’s Head Office project for which the Bank lacks relevant, sufficient and appropriate supporting documents such as insurance policies, endorsements or policy covers. Furthermore, premiums charged and paid to the Broker appear excessive and there were inconsistencies in the manner the transactions were conducted. I am of the opinion that Premiums may have been paid to the Broker for no insurance policies and/or the Bank may have paid excessive amounts of insurance premiums due to the application of unjustified excessive premium rates. Management should institute a competent independent investigation on the transactions and take appropriate action 4.1.5 Over payment of Value Added Tax (VAT) on the approved Contractor’s certificates: (i) Dar es salaam University College of Education We observed that some of the contractors were given advance payments at the beginning of the construction work as per terms of contracts. These advance payments were recovered by the University College when the respective contractor’s issued their certificates of completed work. In the course of examining the corresponding payments accounts, we noted that the Value Added Tax (VAT) paid on some of these certificates was more than the amount which was supposed to be paid as detailed below: Details Shs The Certified Value 229,896,093.00 Add: Advance Payments 93,100,833.00 Gross Value 322,996,926.00 Less: Recovery on Advance 27,930,250.00 Payment The Amount used to Determine VAT 295,066,676.00 VAT 20% 59,013,335.00 ___________________________________________________________ Office of the Controller and Auditor General PA&oBs 2007/08 84

The above certificate was in favour of ESTIM Construction (T) Ltd. The correct value of Value Added Tax (VAT) should have been determined as follows: Details Shs The Certified Value 229,896,093.00 VAT 20% 45,979,218.00 The excess amount paid is Shs. (59,013,335 – 45,979,218) = 13,034,116. No plausible explanation was advanced by management for this anomaly. 4.1.6 Compensation to Usangu villagers not fully accounted for TZS 5.9 billion by TANAPA Tanzania National Parks (TANAPA) included in the land development, land development costs of Shs.5.9 billion being compensation to Usangu villagers that has not been fully accounted for. There was no any evidence or audit trail to suggest that the funds were received by the intended beneficiaries. Furthermore, the Ministers Council instructed TANAPA through the Ministry of Natural Resources and Tourism to pay Usangu villagers an amount of Shs.4.28 Billion as compensation following the inclusion of Usangu wet lands into Ruaha National Park and thus payments were to be made in accordance with the Village Land Act, 1999. TANAPA however had released a total of 5.9 billion as compensation to the villagers by 30 th June 2008. There was no evidence whether the extra funds amounting to Shs.1.62 billion was approved by the Cabinet and TANAPA’s Board of Trustees. In the absence of accountability, compensation may not have reached the targeted Beneficiaries. 4.2 Revenue management 4.2.1 Cash management Pursuant to Reg. 78 of the Public Finance Regulations 2001(Revised 2004) all collections of revenue or public ___________________________________________________________ Office of the Controller and Auditor General PA&oBs 2007/08 85

- Page 53 and 54: 4 Tanzania Standard Newspaper (TSN)

- Page 55 and 56: summary total of invoices issued to

- Page 57 and 58: 6. Tanzania Communi cation Regulato

- Page 59 and 60: monthly reports as required by sect

- Page 61 and 62: independently as required by sectio

- Page 63 and 64: TANAPA obtained from the Exim Bank

- Page 65 and 66: 8. Tanzania Post Corporation 9. Ins

- Page 67 and 68: Procurement Notice as required by R

- Page 69 and 70: 11 Muhimbili University of Health a

- Page 71 and 72: Water Supply and Sewarage Authority

- Page 73 and 74: elating to prior years interest cha

- Page 75 and 76: CHAPTER THREE SUMMARY OF THE PREVIO

- Page 77 and 78: 2. 10.2 Weak Information Technology

- Page 79 and 80: eporting directly to the Chief Exec

- Page 81 and 82: Concern Problems Some public corpor

- Page 83 and 84: customers resulting into over or un

- Page 85 and 86: overstatement of the assets; nonrev

- Page 87 and 88: y the liabilities imposed by variou

- Page 89 and 90: Tanzania International Container Te

- Page 91 and 92: while the Board of External Trade f

- Page 93 and 94: 3.2.2 National Insurance Corporatio

- Page 95 and 96: Kagera Sugar Company Ltd General Ty

- Page 97 and 98: Emunio Tanzania Limited Kiwira Coal

- Page 99 and 100: guaranteed 75% by the government an

- Page 101 and 102: 4.0 Introduction CHAPTER FOUR EXPEN

- Page 103: 4.1.3 Questionable payments (i) Nat

- Page 107 and 108: (iii) Tanzania Engineering and Mech

- Page 109 and 110: ensure that this regulation is full

- Page 111 and 112: Customer Meter No. Date connected F

- Page 113 and 114: Date Number of visitors per TANAPA

- Page 115 and 116: Loss of Potential Revenues from Pri

- Page 117 and 118: CHAPTER FIVE INTERNAL CONTROL SYSTE

- Page 119 and 120: prepared (NBC A/C No. 022103000156

- Page 121 and 122: 5.6 Lack of segregation of duties.

- Page 123 and 124: monthly basis to do a reconciliatio

- Page 125 and 126: CHAPTER SIX PERFORMANCE REVIEW 6.0

- Page 127 and 128: From the table above, the operation

- Page 129 and 130: - IPTL and Songas accounted for abo

- Page 131 and 132: Key performance targets not achieve

- Page 133 and 134: failing to effectively and efficien

- Page 135 and 136: SN Donor Year of deposit Amount 1.

- Page 137 and 138: anger post 10 TANESCO Electricity c

- Page 139 and 140: aired without raising Broadcasting

- Page 141 and 142: 6.13.2 National Development Corpora

- Page 143 and 144: CHAPTER SEVEN COMPLIANCE WITH PROCU

- Page 145 and 146: of appropriate procurement methods

- Page 147 and 148: evaluation committee to the tender

- Page 149 and 150: A review of the tendering procedure

- Page 151 and 152: Dodoma (2 sites ) 10 Singida (2 sit

- Page 153 and 154: TANAPA. Furthermore, there was no e

4.1.4 Irregular payments in respect <strong>of</strong> Insurance Premiums for<br />

BOT HQ Building Shs. 7.3 Billion<br />

Payments were made in respect <strong>of</strong> insurance premiums for<br />

<strong>the</strong> Bank’s Head Office project for which <strong>the</strong> Bank lacks<br />

relevant, sufficient <strong>and</strong> appropriate supporting documents<br />

such as insurance policies, endorsements or policy covers.<br />

Fur<strong>the</strong>rmore, premiums charged <strong>and</strong> paid to <strong>the</strong> Broker<br />

appear excessive <strong>and</strong> <strong>the</strong>re were inconsistencies in <strong>the</strong><br />

manner <strong>the</strong> transactions were conducted. I am <strong>of</strong> <strong>the</strong><br />

opinion that Premiums may have been paid to <strong>the</strong> Broker<br />

for no insurance policies <strong>and</strong>/or <strong>the</strong> Bank may have paid<br />

excessive amounts <strong>of</strong> insurance premiums due to <strong>the</strong><br />

application <strong>of</strong> unjustified excessive premium rates.<br />

Management should institute a competent independent<br />

investigation on <strong>the</strong> transactions <strong>and</strong> take appropriate<br />

action<br />

4.1.5 Over payment <strong>of</strong> Value Added Tax (VAT) on <strong>the</strong> approved<br />

Contractor’s certificates:<br />

(i) Dar es salaam University College <strong>of</strong> Education<br />

We observed that some <strong>of</strong> <strong>the</strong> contractors were given<br />

advance payments at <strong>the</strong> beginning <strong>of</strong> <strong>the</strong> construction<br />

work as per terms <strong>of</strong> contracts. These advance payments<br />

were recovered by <strong>the</strong> University College when <strong>the</strong><br />

respective contractor’s issued <strong>the</strong>ir certificates <strong>of</strong><br />

completed work. In <strong>the</strong> course <strong>of</strong> examining <strong>the</strong><br />

corresponding payments accounts, we noted that <strong>the</strong> Value<br />

Added Tax (VAT) paid on some <strong>of</strong> <strong>the</strong>se certificates was<br />

more than <strong>the</strong> amount which was supposed to be paid as<br />

detailed below:<br />

Details Shs<br />

The Certified Value 229,896,093.00<br />

Add: Advance Payments 93,100,833.00<br />

Gross Value 322,996,926.00<br />

Less: Recovery on Advance 27,930,250.00<br />

Payment<br />

The Amount used to Determine VAT 295,066,676.00<br />

VAT 20% 59,013,335.00<br />

___________________________________________________________<br />

Office <strong>of</strong> <strong>the</strong> Controller <strong>and</strong> Auditor General PA&oBs 2007/08 84