REC- 1-51.p65 - Rural Electrification Corporation Ltd.

REC- 1-51.p65 - Rural Electrification Corporation Ltd.

REC- 1-51.p65 - Rural Electrification Corporation Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

to Ministry Of Power for onward submission/approval of<br />

RBI, it has sought exemption from compliance with the<br />

regulations governing NBFCs till the period of the 12th Five<br />

Year Plan (FY2017).<br />

Further, on December 13, 2006 and February 21, 2009, our<br />

Board of Directors approved our adoption of prudential<br />

norms. Our prudential norms limit our exposure, separately,<br />

for private and state sector borrowers. For private sector<br />

borrowers, our exposure is restricted to any single borrower<br />

for up to 25% of our <strong>Corporation</strong>’s owned funds and to a<br />

single group of companies for up to 50% of our <strong>Corporation</strong>’s<br />

owned funds. In respect of loans to state sector borrowers,<br />

our maximum credit exposure varies from 100% to 250% of<br />

our <strong>Corporation</strong>’s net worth, depending on entity appraisal<br />

and status of on bundling of the respective state utilities.<br />

7. There has been shortfall in creation of Special Fund by some<br />

of the RE Cooperative Societies amounting to Rs. 301.45 lacs<br />

(Previous year Rs.500.89 lacs) and the societies are pursued<br />

to create the required Special Fund.<br />

8. Balance confirmation has been received from most of the<br />

borrowers.<br />

9. Income Tax as applicable in respect of Interest Accrued on<br />

bonds is deducted at source at the time of actual payment of<br />

interest to the bond holders since such bonds are transferable.<br />

10. The formalities regarding registration of conveyance deeds<br />

etc. in respect of some of the Land & Building acquired by<br />

the <strong>Corporation</strong> amounting to Rs. 3,630.58 lacs (Previous<br />

year Rs. 3,996.51 lacs) are in the process of completion.<br />

11. In terms of Accounting Policy No. 10.2, the balances in<br />

respect of Interest Warrants Accounts (both for institutional<br />

and 54EC & Infra bonds) as on 31.03.2010 held in specified<br />

banks are Rs. 3,431.32 lacs (previous year Rs.5,025.32 lacs).<br />

12. In the opinion of the management, the current assets, loans<br />

and advances appearing in the balance sheet have a value<br />

equivalent to the amount stated therein if realized during<br />

the ordinary course of business and all known liabilities have<br />

been provided.<br />

13. Provision for impairment loss as required under Accounting<br />

Standard-28 on impairment of Assets is not necessary as in<br />

the opinion of management there is no impairment of the<br />

<strong>Corporation</strong>’s Assets in terms of AS-28.<br />

14. The company has no outstanding liability towards Micro,<br />

Small and Medium undertakings.<br />

15. Bond Redemption Reserve (BRR) has been created since in<br />

terms of clarification issued by the Department of Company<br />

Affairs, Govt. of India vide no.6/3/2001-CL.V dated<br />

18.4.2002, BRR is not required to be created in the case of<br />

privately placed debentures issued by NBFC’s registered with<br />

the RBI under section 45-IA of the RBI (Amendment) Act,<br />

1997.<br />

16. During the year, the <strong>Corporation</strong> has reduced cost of<br />

borrowing to the extent of Rs.765.69 lacs (Previous year<br />

Rs.420.16lacs) on account of swap (coupon only) transaction<br />

linked to rupee borrowing.<br />

The <strong>Corporation</strong> had entered into various coupons only swap<br />

transactions and cross currency swap transactions. The Net<br />

Mark to Market position in respect of the above swap<br />

transactions as on 31.03.2010 is of Rs. 16,544.12 lacs<br />

(favourable) (Previous year Rs.24, 271.25 lacs favourable).<br />

CONSOLIDATED<br />

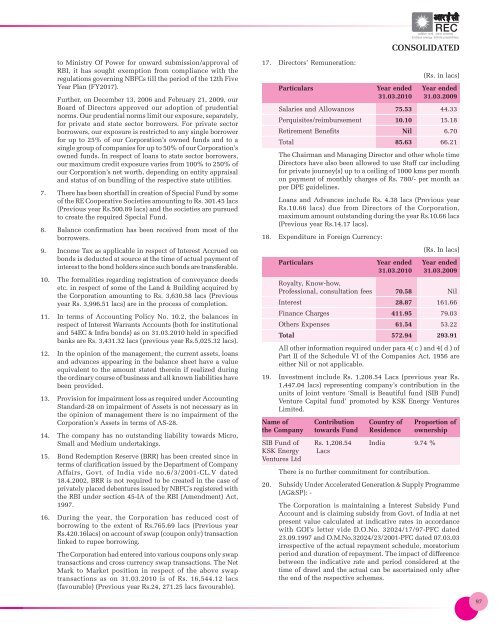

17. Directors’ Remuneration:<br />

Particulars Year ended<br />

(Rs. in lacs)<br />

Year ended<br />

31.03.2010 31.03.2009<br />

Salaries and Allowances 75.53 44.33<br />

Perquisites/reimbursement 10.10 15.18<br />

Retirement Benefits Nil 6.70<br />

Total 85.63 66.21<br />

18.<br />

The Chairman and Managing Director and other whole time<br />

Directors have also been allowed to use Staff car including<br />

for private journey(s) up to a ceiling of 1000 kms per month<br />

on payment of monthly charges of Rs. 780/- per month as<br />

per DPE guidelines.<br />

Loans and Advances include Rs. 4.38 lacs (Previous year<br />

Rs.10.66 lacs) due from Directors of the <strong>Corporation</strong>,<br />

maximum amount outstanding during the year Rs.10.66 lacs<br />

(Previous year Rs.14.17 lacs).<br />

Expenditure in Foreign Currency:<br />

(Rs. In lacs)<br />

Particulars Year ended Year ended<br />

Royalty, Know-how,<br />

31.03.2010 31.03.2009<br />

Professional, consultation fees 70.58 Nil<br />

Interest 28.87 161.66<br />

Finance Charges 411.95 79.03<br />

Others Expenses 61.54 53.22<br />

Total 572.94 293.91<br />

19.<br />

All other information required under para 4( c ) and 4( d ) of<br />

Part II of the Schedule VI of the Companies Act, 1956 are<br />

either Nil or not applicable.<br />

Investment include Rs. 1,208.54 Lacs (previous year Rs.<br />

1,447.04 lacs) representing company’s contribution in the<br />

units of Joint venture ‘Small is Beautiful fund (SIB Fund)<br />

Venture Capital fund’ promoted by KSK Energy Ventures<br />

Limited.<br />

Name of Contribution Country of Proportion of<br />

the Company towards Fund Residence ownership<br />

SIB Fund of Rs. 1,208.54 India 9.74 %<br />

KSK Energy<br />

Ventures <strong>Ltd</strong><br />

Lacs<br />

20.<br />

There is no further commitment for contribution.<br />

Subsidy Under Accelerated Generation & Supply Programme<br />

(AG&SP): -<br />

The <strong>Corporation</strong> is maintaining a Interest Subsidy Fund<br />

Account and is claiming subsidy from Govt. of India at net<br />

present value calculated at indicative rates in accordance<br />

with GOI’s letter vide D.O.No. 32024/17/97-PFC dated<br />

23.09.1997 and O.M.No.32024/23/2001-PFC dated 07.03.03<br />

irrespective of the actual repayment schedule, moratorium<br />

period and duration of repayment. The impact of difference<br />

between the indicative rate and period considered at the<br />

time of drawl and the actual can be ascertained only after<br />

the end of the respective schemes.<br />

97