A Value Chain Analysis of the Cashew Sector - AGOA Export Toolkit

A Value Chain Analysis of the Cashew Sector - AGOA Export Toolkit

A Value Chain Analysis of the Cashew Sector - AGOA Export Toolkit

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

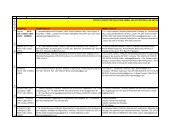

16 Table 1.6 Policies Governing <strong>the</strong> <strong>Cashew</strong> <strong>Value</strong> <strong>Chain</strong> in Ghana<br />

<strong>Cashew</strong> sector policy<br />

Price regulation No price regulation<br />

<strong>Export</strong> tax<br />

Import duties for<br />

cashew products<br />

Investment support<br />

via tax relief<br />

Country label None<br />

Exchange rate policy<br />

Exchange rate<br />

stability<br />

Trade agreements<br />

and preferences<br />

<strong>Cashew</strong> sector policy is a part <strong>of</strong> <strong>the</strong> Food and Agriculture<br />

<strong>Sector</strong> Development Policy (FASDEP).<br />

Objective <strong>of</strong> FASDEP: to promote selected commodities<br />

(tree and industrial crops) and improve access to national<br />

and global markets.<br />

For raw cashews: none<br />

For shelled cashews: none<br />

Import duties for raw cashew nuts: US$ 2.07/80 kg <strong>of</strong> RCN<br />

(equals roughly US$ 26/t; <strong>the</strong> 80kg bag is <strong>the</strong> typical measure<br />

used in <strong>the</strong> cashew industry).<br />

No import duty on kernels, but a quarantine fee <strong>of</strong> US$ 3.5 is<br />

charged on every 2 tonnes <strong>of</strong> imported kernels.<br />

NB: WTO lists applied tariffs for fresh or dried cashew nuts in<br />

shells or shelled at 20%.<br />

The corporate tax on income from non-traditional exports such<br />

as cashew nuts is 8%.<br />

A tax holiday <strong>of</strong> 10 years applies from <strong>the</strong> start <strong>of</strong> tree<br />

cropping operations.<br />

After an initial 5-year tax holiday period, agro-processing<br />

enterprises which primarily use local agricultural raw materials<br />

as inputs have corporate tax rates fi xed according to <strong>the</strong>ir<br />

location, i.e. according to whe<strong>the</strong>r <strong>the</strong>y are based in urban or<br />

rural areas – a 0% tax rate applies to those fi rms outside<br />

regional capitals.<br />

Industrial plant machinery and parts <strong>the</strong>re<strong>of</strong> are exempted from<br />

customs import duty under <strong>the</strong> Customs Harmonized Commodity<br />

and Tariff Code.<br />

Since 1992, Ghana has been using a fl oating exchange rate<br />

regime, a hybrid system <strong>of</strong> inter-bank and retail trading with<br />

minimum interventions.<br />

The US dollar/cedi rate moved up from <strong>the</strong> GH0.0520 per US<br />

dollar registered in 1992 to GH1.2457 per US dollar at <strong>the</strong> end<br />

<strong>of</strong> 2008. It thus increased about 24 times with an average<br />

yearly depreciation <strong>of</strong> 17.04%.<br />

Ghana has been a WTO member since 1 January 1995. The<br />

country is committed to <strong>the</strong> full implementation <strong>of</strong> <strong>the</strong> ECOWAS<br />

protocol for <strong>the</strong> free movement <strong>of</strong> goods and persons in West<br />

Africa. The differential tariff structure between Ghana and <strong>the</strong><br />

West African Economic and Monetary Union may be one <strong>of</strong> <strong>the</strong><br />

barriers that may impact <strong>the</strong> cashew trade in <strong>the</strong> future.<br />

Source <strong>of</strong> Information<br />

Ministry <strong>of</strong> Food and Agriculture (2002)<br />

Personal comments, K. Gallant (2009)<br />

Ghana Investment Promotion Centre<br />

(2007)<br />

Bank <strong>of</strong> Ghana (2008)<br />

Ministry <strong>of</strong> Food and Agriculture<br />

(2002), and WTO (2009)