FORGING AHEAD - Tradewinds Plantation Berhad

FORGING AHEAD - Tradewinds Plantation Berhad

FORGING AHEAD - Tradewinds Plantation Berhad

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

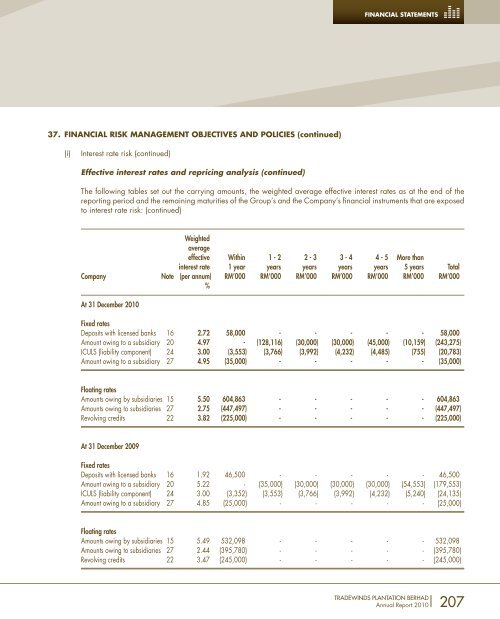

37. FINANCIAL RISk MANAGEMENT OBJECTIVES AND POLICIES (continued)<br />

(i) Interest rate risk (continued)<br />

Effective interest rates and repricing analysis (continued)<br />

The following tables set out the carrying amounts, the weighted average effective interest rates as at the end of the<br />

reporting period and the remaining maturities of the Group’s and the Company’s financial instruments that are exposed<br />

to interest rate risk: (continued)<br />

Weighted<br />

average<br />

effective Within 1 - 2 2 - 3 3 - 4 4 - 5 More than<br />

interest rate 1 year years years years years 5 years Total<br />

Company Note (per annum) RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000<br />

%<br />

At 31 December 2010<br />

Fixed rates<br />

Deposits with licensed banks 16 2.72 58,000 - - - - - 58,000<br />

Amount owing to a subsidiary 20 4.97 - (128,116) (30,000) (30,000) (45,000) (10,159) (243,275)<br />

ICULS (liability component) 24 3.00 (3,553) (3,766) (3,992) (4,232) (4,485) (755) (20,783)<br />

Amount owing to a subsidiary 27 4.95 (35,000) - - - - - (35,000)<br />

Floating rates<br />

Amounts owing by subsidiaries 15 5.50 604,863 - - - - - 604,863<br />

Amounts owing to subsidiaries 27 2.75 (447,497) - - - - - (447,497)<br />

Revolving credits 22 3.82 (225,000) - - - - - (225,000)<br />

At 31 December 2009<br />

FINANCIAL STATEMENTS<br />

Fixed rates<br />

Deposits with licensed banks 16 1.92 46,500 - - - - - 46,500<br />

Amount owing to a subsidiary 20 5.22 - (35,000) (30,000) (30,000) (30,000) (54,553) (179,553)<br />

ICULS (liability component) 24 3.00 (3,352) (3,553) (3,766) (3,992) (4,232) (5,240) (24,135)<br />

Amount owing to a subsidiary 27 4.85 (25,000) - - - - - (25,000)<br />

Floating rates<br />

Amounts owing by subsidiaries 15 5.49 532,098 - - - - - 532,098<br />

Amounts owing to subsidiaries 27 2.44 (395,780) - - - - - (395,780)<br />

Revolving credits 22 3.47 (245,000) - - - - - (245,000)<br />

TRADEWINDS PLANTATION BERHAD<br />

Annual Report 2010<br />

207