- Page 1 and 2:

Level 9, Menara HLA No. 3, Jalan Ki

- Page 3:

CORPORATE GOVERNANCE 56 Statement o

- Page 6 and 7:

4 STATUTORY REPORTING NOTICE OF ANN

- Page 8 and 9:

NOTICE OF ANNUAL GENERAL MEETING AN

- Page 10 and 11:

8 STATUTORY REPORTING STATEMENT ACC

- Page 12 and 13:

GROUP FINANCIAL HIGHLIGHTS 2010 200

- Page 14:

STRATEGIC INVESTMENTS We will remai

- Page 18 and 19:

16 CORPORATE INFORMATION FINANCIAL

- Page 20 and 21:

18 CORPORATE INFORMATION CORPORATE

- Page 22 and 23:

20 CORPORATE INFORMATION BOARD OF D

- Page 24 and 25:

22 CORPORATE INFORMATION BOARD OF D

- Page 26 and 27:

24 CORPORATE INFORMATION BOARD OF D

- Page 28 and 29:

26 CORPORATE INFORMATION TRADEWINDS

- Page 30 and 31:

28 CORPORATE INFORMATION MANAGEMENT

- Page 32 and 33:

30 CORPORATE INFORMATION GROUP CORP

- Page 35:

STRATEGIC DIVERSIFICATIONS Through

- Page 38 and 39:

36 PERFORMANCE REVIEW CHAIRMAN’S

- Page 40 and 41:

38 PERFORMANCE REVIEW CHAIRMAN’S

- Page 42 and 43:

40 PERFORMANCE REVIEW CHAIRMAN’S

- Page 44 and 45:

42 PERFORMANCE REVIEW CHAIRMAN’S

- Page 46 and 47:

44 PERFORMANCE REVIEW BuSINESS REvI

- Page 48 and 49:

BuSINESS REvIEW By CHIEF EXECuTIvE

- Page 50 and 51:

48 PERFORMANCE REVIEW BuSINESS REvI

- Page 52 and 53:

50 PERFORMANCE REVIEW BuSINESS REvI

- Page 54:

STRATEGIC EXPERTISE As our sights a

- Page 58 and 59:

56 CORPORATE GOVERNANCE STATEMENT O

- Page 60 and 61:

58 CORPORATE GOVERNANCE STATEMENT O

- Page 62 and 63:

60 CORPORATE GOVERNANCE STATEMENT O

- Page 64 and 65:

DIRECTORS’ REMUNERATION The remun

- Page 66 and 67:

64 CORPORATE GOVERNANCE STATEMENT O

- Page 68 and 69:

66 CORPORATE GOVERNANCE STATEMENT O

- Page 70 and 71:

68 CORPORATE GOVERNANCE AUDIT COMMI

- Page 72 and 73:

AUTHORITY The Audit Committee shall

- Page 74 and 75:

72 CORPORATE GOVERNANCE ADDITIONAL

- Page 76 and 77:

74 CORPORATE GOVERNANCE ADDITIONAL

- Page 78:

STRATEGIC INNOVATIONS We are commit

- Page 82 and 83:

80 CORPORATE SOCIAL RESPONSIBILITY

- Page 84 and 85:

82 CORPORATE SOCIAL RESPONSIBILITY

- Page 86 and 87:

84 CORPORATE SOCIAL RESPONSIBILITY

- Page 88 and 89:

86 CORPORATE SOCIAL RESPONSIBILITY

- Page 90:

STRATEGIC REACH We are increasing t

- Page 93 and 94:

DIRECTORS’ REPORT The Directors h

- Page 95 and 96:

DIRECTORS’ BENEFITS Since the end

- Page 97 and 98:

SIGNIFICANT EVENTS DURING THE FINAN

- Page 99 and 100:

STATEMENT BY DIRECTORS In the opini

- Page 101 and 102:

REPORT ON OTHER LEGAL AND REGULATOR

- Page 103 and 104:

LIABILITIES Non-current liabilities

- Page 105 and 106:

Group Company 2010 2009 2010 2009 (

- Page 107 and 108:

Equity Share Share component Retain

- Page 109 and 110:

CASH FLOWS FROM INVESTING ACTIVITIE

- Page 111 and 112:

NOTES TO THE FINANCIAL STATEMENTS 3

- Page 113 and 114:

4. SIGNIFICANT ACCOUNTING POLICIES

- Page 115 and 116:

4. SIGNIFICANT ACCOUNTING POLICIES

- Page 117 and 118:

4. SIGNIFICANT ACCOUNTING POLICIES

- Page 119 and 120:

4. SIGNIFICANT ACCOUNTING POLICIES

- Page 121 and 122:

4. SIGNIFICANT ACCOUNTING POLICIES

- Page 123 and 124:

4. SIGNIFICANT ACCOUNTING POLICIES

- Page 125 and 126:

4. SIGNIFICANT ACCOUNTING POLICIES

- Page 127 and 128:

4. SIGNIFICANT ACCOUNTING POLICIES

- Page 129 and 130:

4. SIGNIFICANT ACCOUNTING POLICIES

- Page 131 and 132:

4. SIGNIFICANT ACCOUNTING POLICIES

- Page 133 and 134:

5. ADOPTION OF NEW FRSs AND AMENDME

- Page 135 and 136:

5. ADOPTION OF NEW FRSs AND AMENDME

- Page 137 and 138:

5. ADOPTION OF NEW FRSs AND AMENDME

- Page 139 and 140:

5. ADOPTION OF NEW FRSs AND AMENDME

- Page 141 and 142:

5. ADOPTION OF NEW FRSs AND AMENDME

- Page 143 and 144:

5. ADOPTION OF NEW FRSs AND AMENDME

- Page 145 and 146:

5. ADOPTION OF NEW FRSs AND AMENDME

- Page 147 and 148:

5. ADOPTION OF NEW FRSs AND AMENDME

- Page 149 and 150:

6. SIGNIFICANT ACCOUNTING ESTIMATES

- Page 151 and 152:

6. SIGNIFICANT ACCOUNTING ESTIMATES

- Page 153 and 154:

7. PROPERTY, PLANT AND EQUIPMENT (c

- Page 155 and 156:

7. PROPERTY, PLANT AND EQUIPMENT (c

- Page 157 and 158: 7. PROPERTY, PLANT AND EQUIPMENT (c

- Page 159 and 160: 7. PROPERTY, PLANT AND EQUIPMENT (c

- Page 161 and 162: 9. INVESTMENTS IN SUBSIDIARIES (con

- Page 163 and 164: 9. INVESTMENTS IN SUBSIDIARIES (con

- Page 165 and 166: 9. INVESTMENTS IN SUBSIDIARIES (con

- Page 167 and 168: 11. INVESTMENT IN A JOINTLY CONTROL

- Page 169 and 170: 13. GOODWILL ON CONSOLIDATION At co

- Page 171 and 172: 15. TRADE AND OTHER RECEIVABLES FIN

- Page 173 and 174: 15. TRADE AND OTHER RECEIVABLES (co

- Page 175 and 176: 17. NON-CURRENT ASSETS HELD FOR SAL

- Page 177 and 178: 19. RESERVES (continued) (c) Supple

- Page 179 and 180: 21. BORROWINGS Current liabilities

- Page 181 and 182: 24. IRREDEEMABLE CONVERTIBLE UNSECU

- Page 183 and 184: 25. ISLAMIC DEBT SECURITIES - SECUR

- Page 185 and 186: 26. DEFERRED TAX (continued) Recogn

- Page 187 and 188: 27. TRADE AND OTHER PAYABLES Trade

- Page 189 and 190: 28. REVENUE Group Company 2010 2009

- Page 191 and 192: 30. PROFIT BEFORE TAX (continued) A

- Page 193 and 194: 32. EARNINGS PER ORDINARY SHARE ATT

- Page 195 and 196: 34. ACQUISITION OF SUBSIDIARIES 201

- Page 197 and 198: 34. ACQUISITION OF SUBSIDIARIES (co

- Page 199 and 200: 35. OPERATING SEGMENTS (continued)

- Page 201 and 202: 35. OPERATING SEGMENTS (continued)

- Page 203 and 204: 36. FINANCIAL INSTRUMENTS (continue

- Page 205 and 206: 36. FINANCIAL INSTRUMENTS (continue

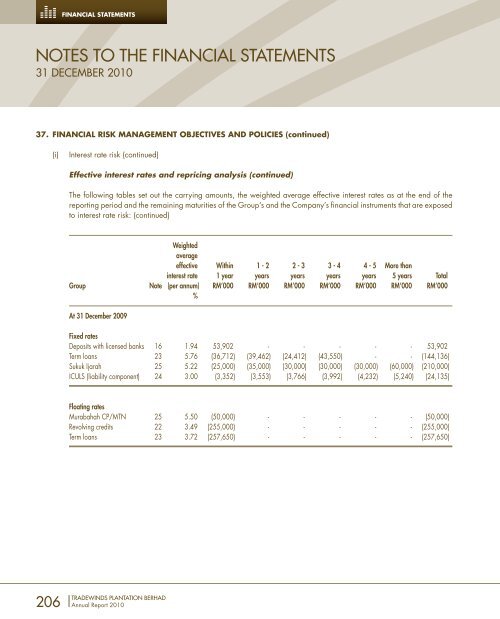

- Page 207: 37. FINANCIAL RISk MANAGEMENT OBJEC

- Page 211 and 212: 37. FINANCIAL RISk MANAGEMENT OBJEC

- Page 213 and 214: 38. RELATED PARTY DISCLOSURES (cont

- Page 215 and 216: 38. RELATED PARTY DISCLOSURES (cont

- Page 217 and 218: 42. SIGNIFICANT EVENTS SUBSEQUENT T

- Page 219 and 220: 44. OPENING STATEMENT OF FINANCIAL

- Page 221 and 222: PLANTATION REvIEW OIL PALM 2010 200

- Page 223 and 224: mATERIAL PROPERTIES Of TRADEWINDS P

- Page 225 and 226: Company/ Location/Address HS(D) 389

- Page 227 and 228: Company/ Location/Address Country L

- Page 229 and 230: Company/ Location/Address Lot No. 0

- Page 231 and 232: ANALySIS Of SHAREHOLDINgS AS AT 25

- Page 233 and 234: LIST OF THIRTY (30) LARGEST SHAREHO

- Page 235 and 236: ANALySIS Of IRREDEEmABLE cONvERTIBL

- Page 237 and 238: SUBSTANTIAL ICULS HOLDER Name Direc

- Page 239 and 240: SOUTHERN PENINSULAR REGION Regional

- Page 241 and 242: MIRI REGION Regional Office c/o Lad

- Page 243 and 244: Proxy Form I / We _________________