news round up - Taxmann

news round up - Taxmann

news round up - Taxmann

- TAGS

- news

- round

- taxmann

- taxmann.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

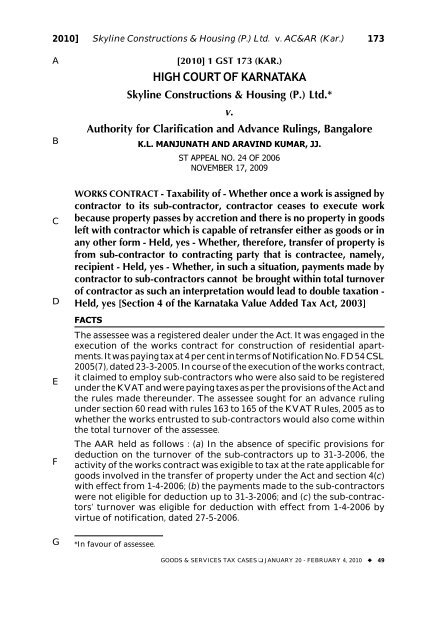

2010] Skyline Constructions & Housing (P.) Ltd. v. AC&AR (Kar.) 173<br />

A<br />

B<br />

C<br />

D<br />

E<br />

F<br />

G<br />

[2010] 1 GST 173 (KAR.)<br />

HIGH COURT OF KARNATAKA<br />

Skyline Constructions & Housing (P.) Ltd.*<br />

v.<br />

Authority for Clarification and Advance Rulings, Bangalore<br />

K.L. MANJUNATH AND ARAVIND KUMAR, JJ.<br />

ST APPEAL NO. 24 OF 2006<br />

NOVEMBER 17, 2009<br />

WORKS CONTRACT - Taxability of - Whether once a work is assigned by<br />

contractor to its sub-contractor, contractor ceases to execute work<br />

because property passes by accretion and there is no property in goods<br />

left with contractor which is capable of retransfer either as goods or in<br />

any other form - Held, yes - Whether, therefore, transfer of property is<br />

from sub-contractor to contracting party that is contractee, namely,<br />

recipient - Held, yes - Whether, in such a situation, payments made by<br />

contractor to sub-contractors cannot be brought within total turnover<br />

of contractor as such an interpretation would lead to double taxation -<br />

Held, yes [Section 4 of the Karnataka Value Added Tax Act, 2003]<br />

FACTS<br />

The assessee was a registered dealer under the Act. It was engaged in the<br />

execution of the works contract for construction of residential apartments.<br />

It was paying tax at 4 per cent in terms of Notification No. FD 54 CSL<br />

2005(7), dated 23-3-2005. In course of the execution of the works contract,<br />

it claimed to employ sub-contractors who were also said to be registered<br />

under the KVAT and were paying taxes as per the provisions of the Act and<br />

the rules made thereunder. The assessee sought for an advance ruling<br />

under section 60 read with rules 163 to 165 of the KVAT Rules, 2005 as to<br />

whether the works entrusted to sub-contractors would also come within<br />

the total turnover of the assessee.<br />

The AAR held as follows : (a) In the absence of specific provisions for<br />

deduction on the turnover of the sub-contractors <strong>up</strong> to 31-3-2006, the<br />

activity of the works contract was exigible to tax at the rate applicable for<br />

goods involved in the transfer of property under the Act and section 4(c)<br />

with effect from 1-4-2006; (b) the payments made to the sub-contractors<br />

were not eligible for deduction <strong>up</strong> to 31-3-2006; and (c) the sub-contractors’<br />

turnover was eligible for deduction with effect from 1-4-2006 by<br />

virtue of notification, dated 27-5-2006.<br />

*In favour of assessee.<br />

GOODS & SERVICES TAX CASES ❑ JANUARY 20 - FEBRUARY 4, 2010 ◆ 49

![“FORM NO. 3CEB [See rule 10E] Report from an ... - Taxmann](https://img.yumpu.com/45480232/1/190x245/form-no-3ceb-see-rule-10e-report-from-an-taxmann.jpg?quality=85)