news round up - Taxmann

news round up - Taxmann

news round up - Taxmann

- TAGS

- news

- round

- taxmann

- taxmann.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

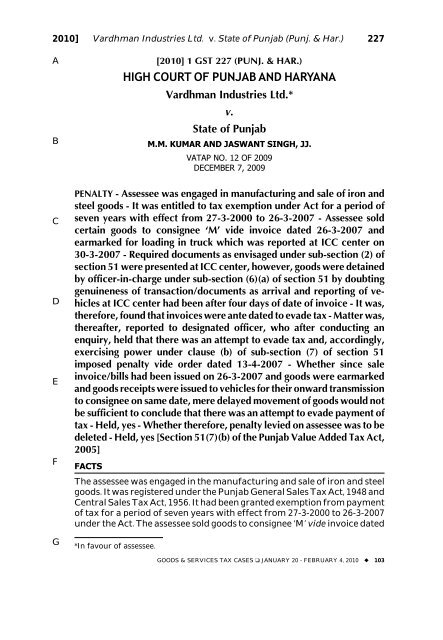

2010] Vardhman Industries Ltd. v. State of Punjab (Punj. & Har.) 227<br />

A<br />

B<br />

C<br />

D<br />

E<br />

F<br />

G<br />

[2010] 1 GST 227 (PUNJ. & HAR.)<br />

HIGH COURT OF PUNJAB AND HARYANA<br />

Vardhman Industries Ltd.*<br />

v.<br />

State of Punjab<br />

M.M. KUMAR AND JASWANT SINGH, JJ.<br />

VATAP NO. 12 OF 2009<br />

DECEMBER 7, 2009<br />

PENALTY - Assessee was engaged in manufacturing and sale of iron and<br />

steel goods - It was entitled to tax exemption under Act for a period of<br />

seven years with effect from 27-3-2000 to 26-3-2007 - Assessee sold<br />

certain goods to consignee ‘M’ vide invoice dated 26-3-2007 and<br />

earmarked for loading in truck which was reported at ICC center on<br />

30-3-2007 - Required documents as envisaged under sub-section (2) of<br />

section 51 were presented at ICC center, however, goods were detained<br />

by officer-in-charge under sub-section (6)(a) of section 51 by doubting<br />

genuineness of transaction/documents as arrival and reporting of vehicles<br />

at ICC center had been after four days of date of invoice - It was,<br />

therefore, found that invoices were ante dated to evade tax - Matter was,<br />

thereafter, reported to designated officer, who after conducting an<br />

enquiry, held that there was an attempt to evade tax and, accordingly,<br />

exercising power under clause (b) of sub-section (7) of section 51<br />

imposed penalty vide order dated 13-4-2007 - Whether since sale<br />

invoice/bills had been issued on 26-3-2007 and goods were earmarked<br />

and goods receipts were issued to vehicles for their onward transmission<br />

to consignee on same date, mere delayed movement of goods would not<br />

be sufficient to conclude that there was an attempt to evade payment of<br />

tax - Held, yes - Whether therefore, penalty levied on assessee was to be<br />

deleted - Held, yes [Section 51(7)(b) of the Punjab Value Added Tax Act,<br />

2005]<br />

FACTS<br />

The assessee was engaged in the manufacturing and sale of iron and steel<br />

goods. It was registered under the Punjab General Sales Tax Act, 1948 and<br />

Central Sales Tax Act, 1956. It had been granted exemption from payment<br />

of tax for a period of seven years with effect from 27-3-2000 to 26-3-2007<br />

under the Act. The assessee sold goods to consignee ‘M’ vide invoice dated<br />

*In favour of assessee.<br />

GOODS & SERVICES TAX CASES ❑ JANUARY 20 - FEBRUARY 4, 2010 ◆ 103

![“FORM NO. 3CEB [See rule 10E] Report from an ... - Taxmann](https://img.yumpu.com/45480232/1/190x245/form-no-3ceb-see-rule-10e-report-from-an-taxmann.jpg?quality=85)