Economics of Kautiliya Shukra and Brihaspati.pmd

Economics of Kautiliya Shukra and Brihaspati.pmd

Economics of Kautiliya Shukra and Brihaspati.pmd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

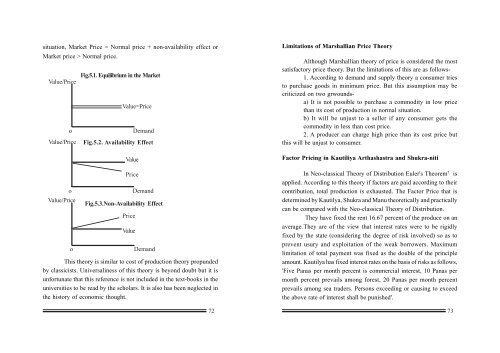

situation, Market Price = Normal price + non-availability effect or<br />

Market price > Normal price.<br />

Value/Price<br />

Value/Price<br />

Value/Price<br />

Fig.5.1. Equilibrium in the Market<br />

Value=Price<br />

o Dem<strong>and</strong><br />

Fig.5.2. Availability Effect<br />

Value<br />

Price<br />

o Dem<strong>and</strong><br />

Fig.5.3.Non-Availability Effect<br />

Price<br />

Value<br />

o Dem<strong>and</strong><br />

This theory is similar to cost <strong>of</strong> production theory propunded<br />

by classicists. Universaliness <strong>of</strong> this theory is beyond doubt but it is<br />

unfortunate that this reference is not included in the text-books in the<br />

universities to be read by the scholars. It is also has been neglected in<br />

the history <strong>of</strong> economic thought.<br />

72<br />

Limitations <strong>of</strong> Marshallian Price Theory<br />

Although Marshallian theory <strong>of</strong> price is considered the most<br />

satisfactory price theory. But the limitations <strong>of</strong> this are as follows-<br />

1. According to dem<strong>and</strong> <strong>and</strong> supply theory a consumer tries<br />

to purchase goods in minimum price. But this assumption may be<br />

criticized on two grwoundsa)<br />

It is not possible to purchase a commodity in low price<br />

than its cost <strong>of</strong> production in normal situation.<br />

b) It will be unjust to a seller if any consumer gets the<br />

commodity in less than cost price.<br />

2. A producer can charge high price than its cost price but<br />

this will be unjust to consumer.<br />

Factor Pricing in <strong>Kautiliya</strong> Arthashastra <strong>and</strong> <strong>Shukra</strong>-niti<br />

In Neo-classical Theory <strong>of</strong> Distribution Euler's Theorem 7 is<br />

applied. According to this theory if factors are paid according to their<br />

contribution, total production is exhausted. The Factor Price that is<br />

determined by Kautilya, <strong>Shukra</strong> <strong>and</strong> Manu theoretically <strong>and</strong> practically<br />

can be compared with the Neo-classical Theory <strong>of</strong> Distribution.<br />

They have fixed the rent 16.67 percent <strong>of</strong> the produce on an<br />

average.They are <strong>of</strong> the view that interest rates were to be rigidly<br />

fixed by the state (considering the degree <strong>of</strong> risk involved) so as to<br />

prevent usury <strong>and</strong> exploitation <strong>of</strong> the weak borrowers. Maximum<br />

limitation <strong>of</strong> total payment was fixed as the double <strong>of</strong> the principle<br />

amount. Kautilya has fixed interest rates on the basis <strong>of</strong> risks as follows,<br />

'Five Panas per month percent is commercial interest, 10 Panas per<br />

month percent prevails among forest, 20 Panas per month percent<br />

prevails among sea traders. Persons exceeding or causing to exceed<br />

the above rate <strong>of</strong> interest shall be punished'.<br />

73